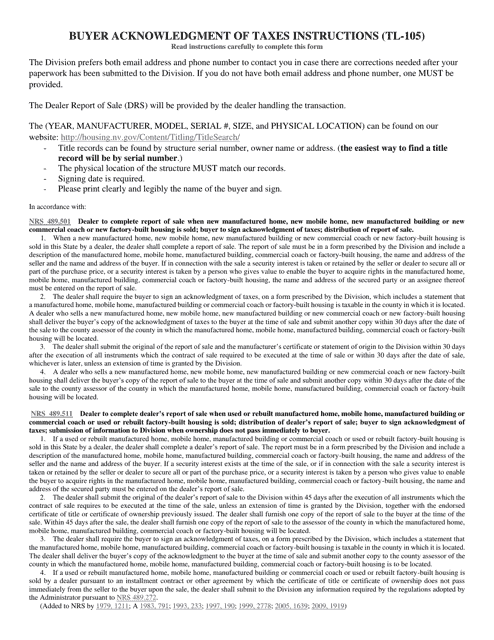

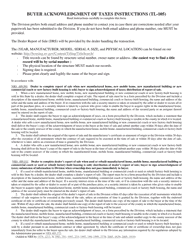

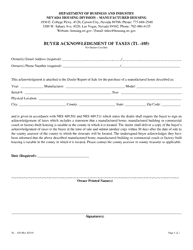

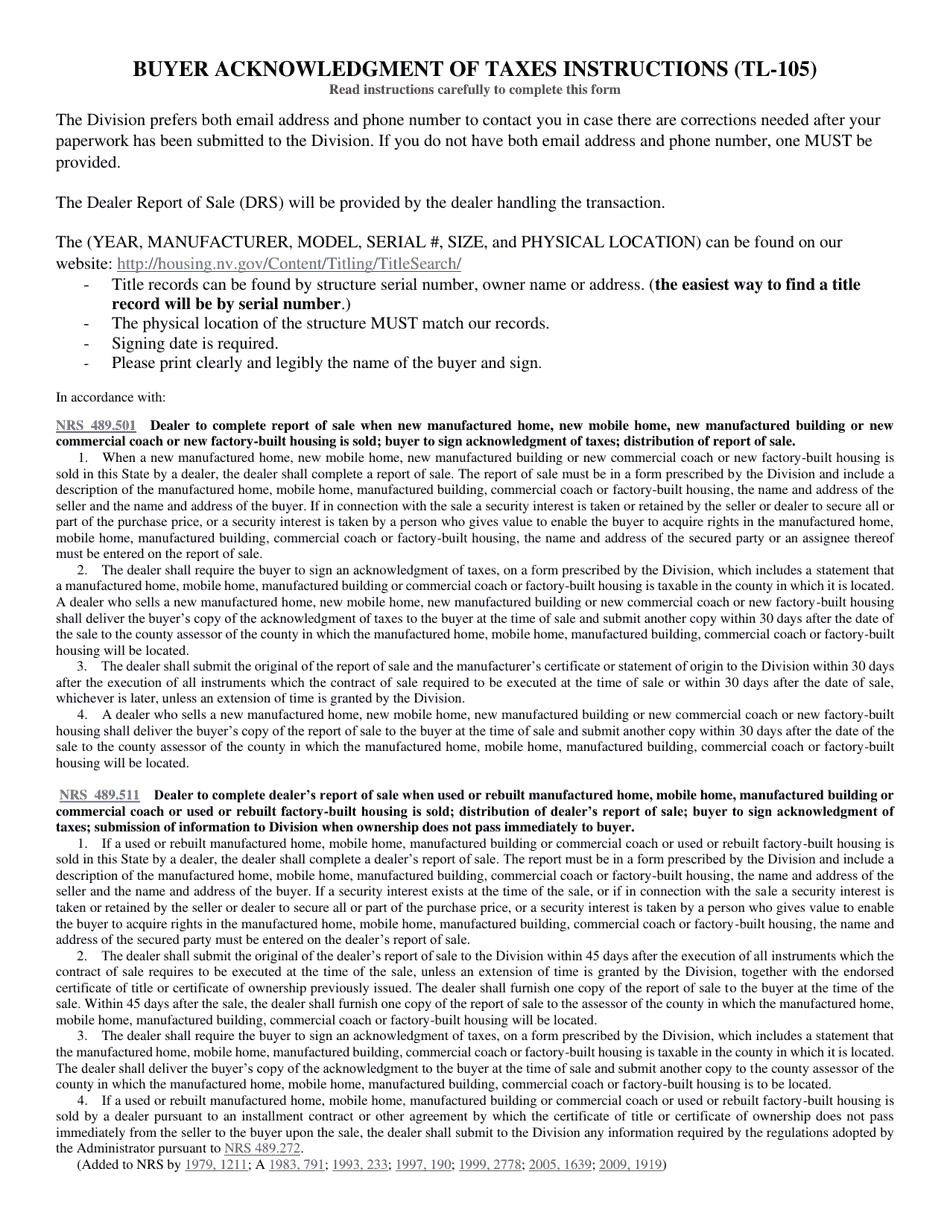

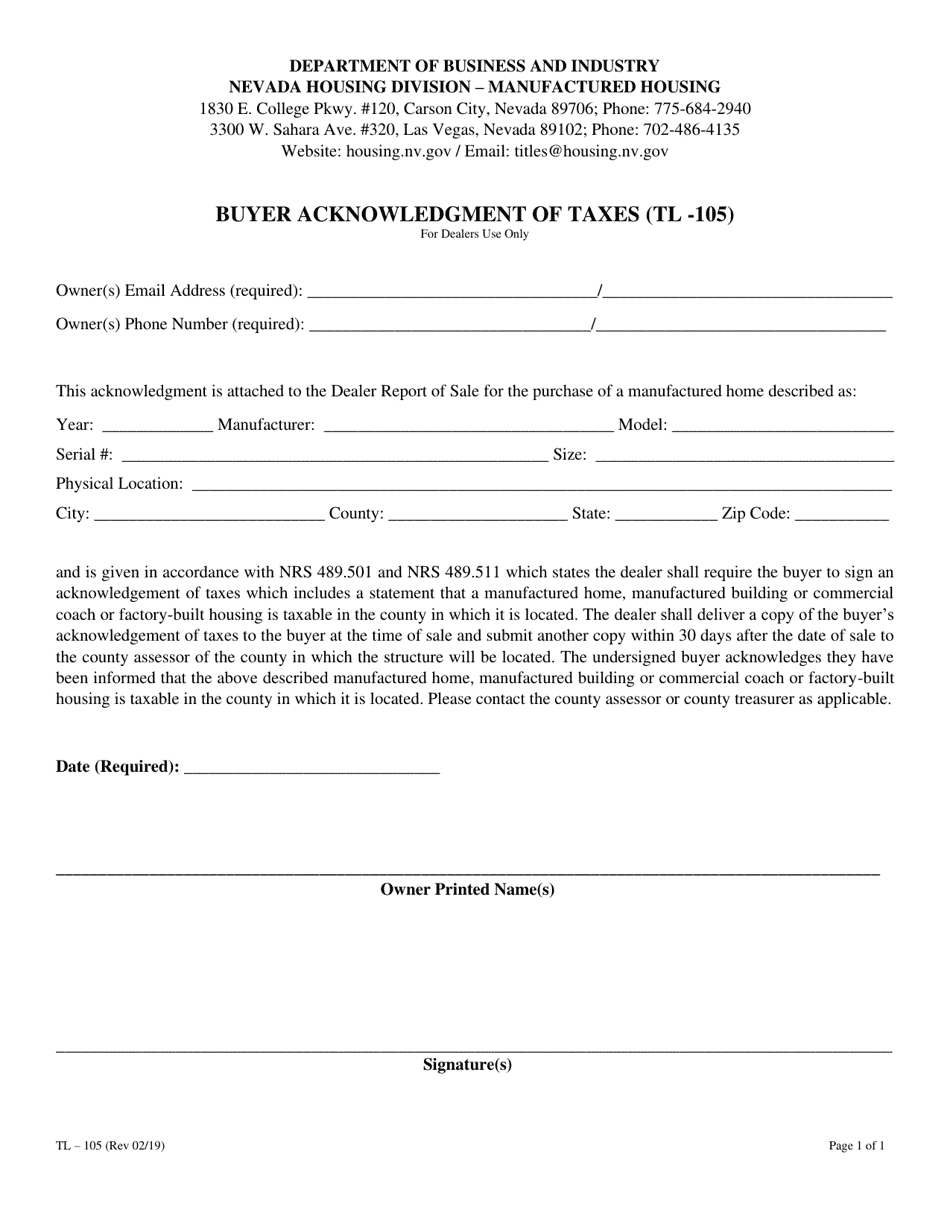

Form TL-105 Buyer Acknowledgment of Taxes - Nevada

What Is Form TL-105?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TL-105?

A: Form TL-105 is the Buyer Acknowledgment of Taxes form in Nevada.

Q: Who needs to fill out Form TL-105?

A: Buyers in Nevada may need to fill out Form TL-105.

Q: What is the purpose of Form TL-105?

A: The purpose of Form TL-105 is to acknowledge the taxes associated with a transaction.

Q: When should Form TL-105 be filled out?

A: Form TL-105 should be filled out at the time of the transaction.

Q: Is Form TL-105 mandatory?

A: The requirement to fill out Form TL-105 may vary depending on the specific transaction and circumstances.

Q: What information is required on Form TL-105?

A: Form TL-105 typically requires the buyer's name, address, and other details of the transaction.

Q: Are there any fees associated with Form TL-105?

A: There are no fees associated with filling out Form TL-105.

Q: What should I do with Form TL-105 once I have filled it out?

A: You should keep a copy of the completed Form TL-105 for your records and provide a copy to the seller or other relevant parties as required.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TL-105 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.