This version of the form is not currently in use and is provided for reference only. Download this version of

Form 1 (I-0101) Schedule AD

for the current year.

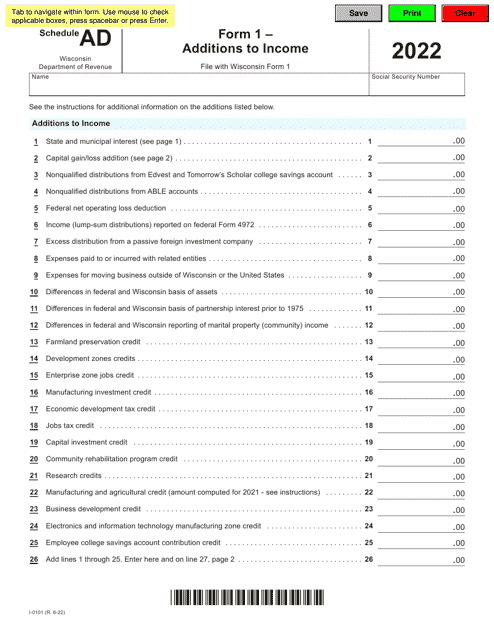

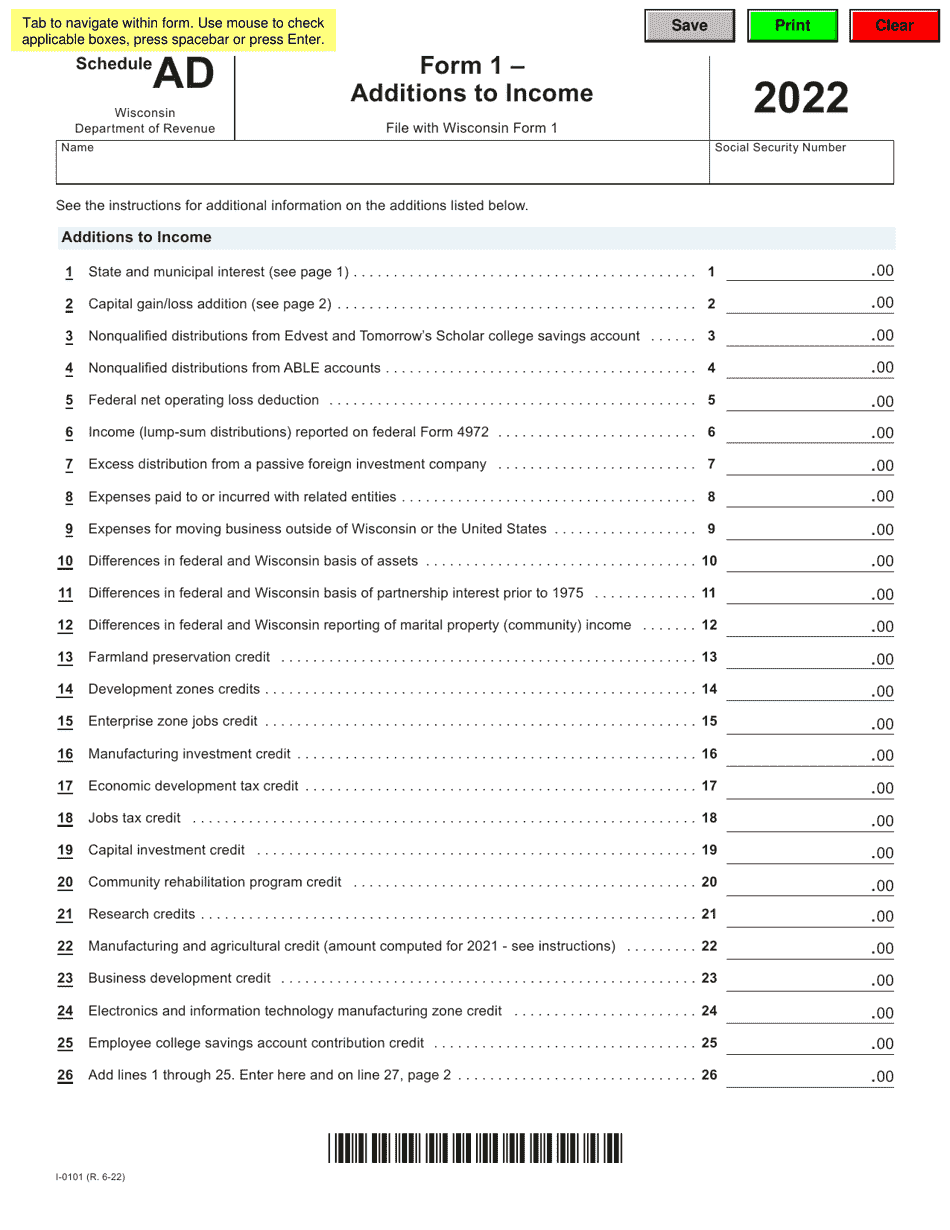

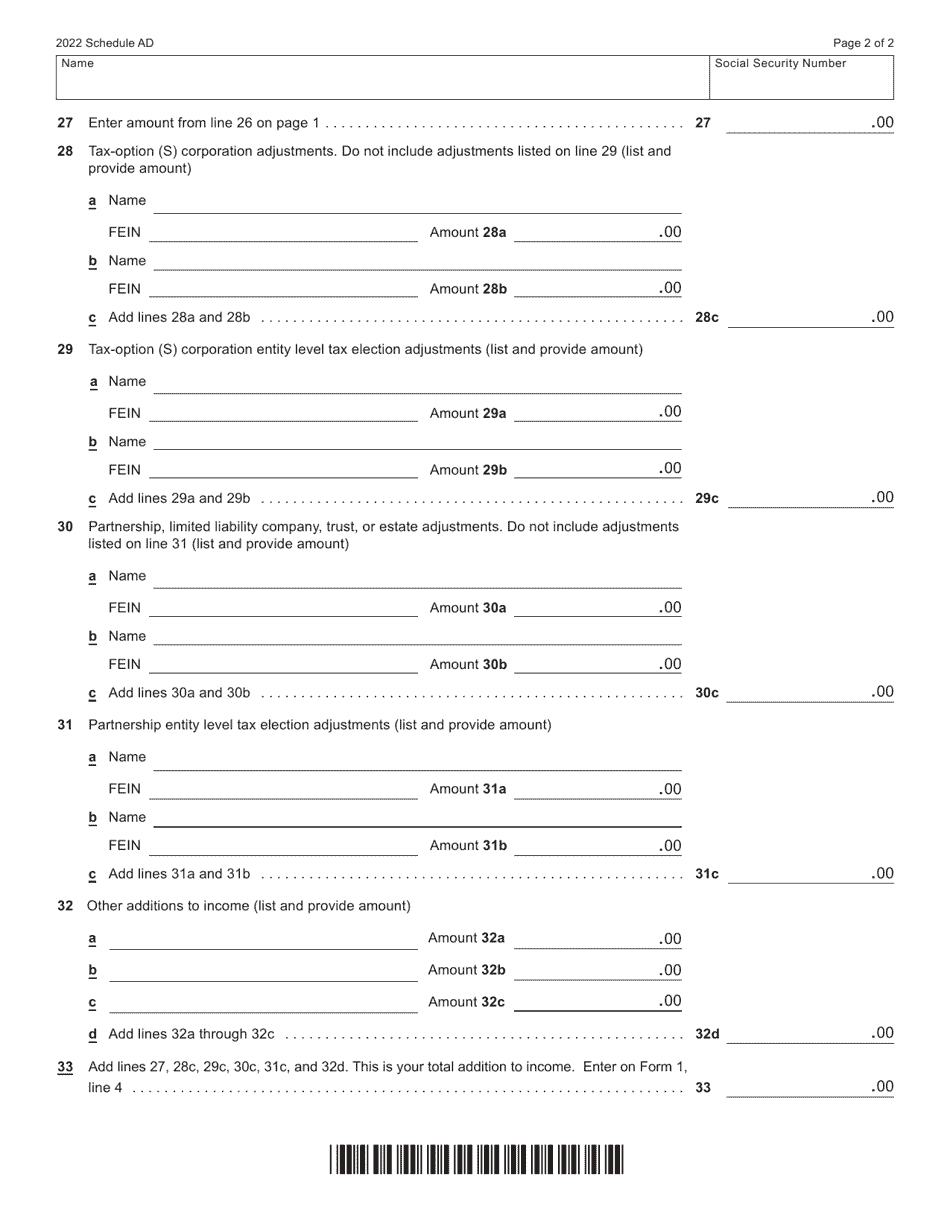

Form 1 (I-0101) Schedule AD Additions to Income - Wisconsin

What Is Form 1 (I-0101) Schedule AD?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1 (I-0101) Schedule AD?

A: Form 1 (I-0101) Schedule AD is a tax form used in Wisconsin to report additions to income.

Q: What are additions to income?

A: Additions to income are additional sources of income that need to be reported for tax purposes.

Q: Who needs to file Form 1 (I-0101) Schedule AD?

A: Wisconsin residents who have additional sources of income that need to be reported for tax purposes.

Q: What types of income should be reported on Form 1 (I-0101) Schedule AD?

A: Examples of income that should be reported on this form include taxable interest, dividends, unemployment compensation, and rental income.

Q: When is the deadline to file Form 1 (I-0101) Schedule AD?

A: The deadline to file Form 1 (I-0101) Schedule AD is generally the same as the deadline to file your Wisconsin state tax return, which is usually April 15th.

Q: What happens if I don't file Form 1 (I-0101) Schedule AD?

A: Failing to file Form 1 (I-0101) Schedule AD or reporting all required additions to income may result in penalties or interest charges from the Wisconsin Department of Revenue.

Q: Can I e-file Form 1 (I-0101) Schedule AD?

A: Yes, you can e-file Form 1 (I-0101) Schedule AD using approved tax software or through a certified tax professional.

Q: Do I need to include any supporting documentation with Form 1 (I-0101) Schedule AD?

A: You may need to attach supporting documentation for certain additions to income. Review the instructions provided with the form for specific requirements.

Q: Can I amend Form 1 (I-0101) Schedule AD if I make a mistake?

A: Yes, you can amend Form 1 (I-0101) Schedule AD if you need to correct any errors or report additional income. Use Form 1X (Amended Wisconsin Individual Income Tax Return) to make changes.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 (I-0101) Schedule AD by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.