This version of the form is not currently in use and is provided for reference only. Download this version of

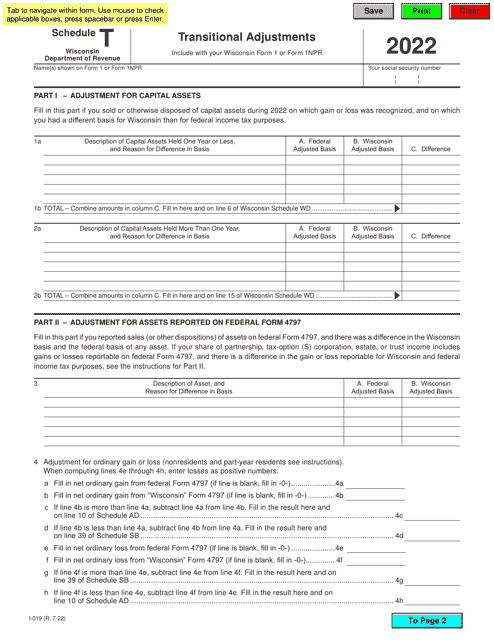

Form I-019 Schedule T

for the current year.

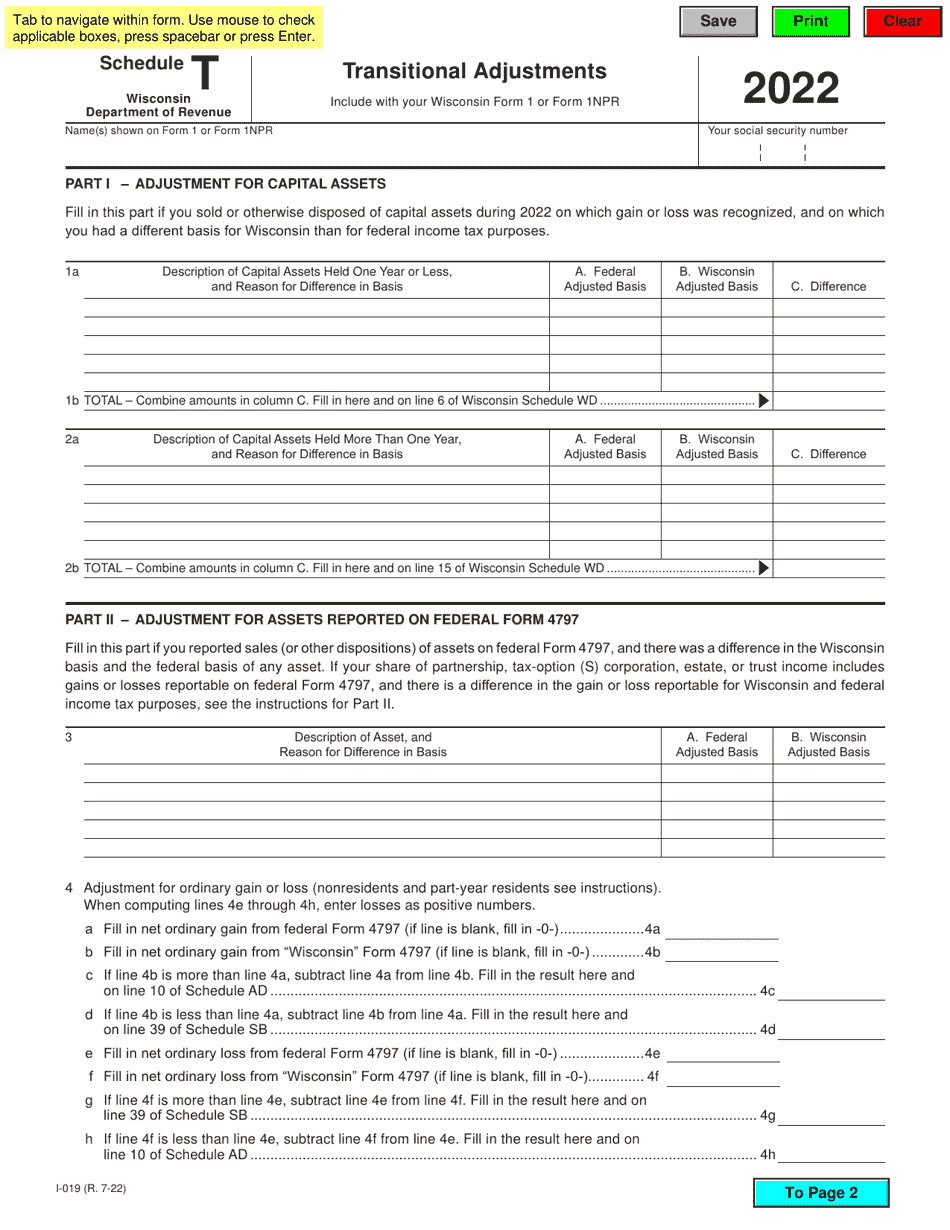

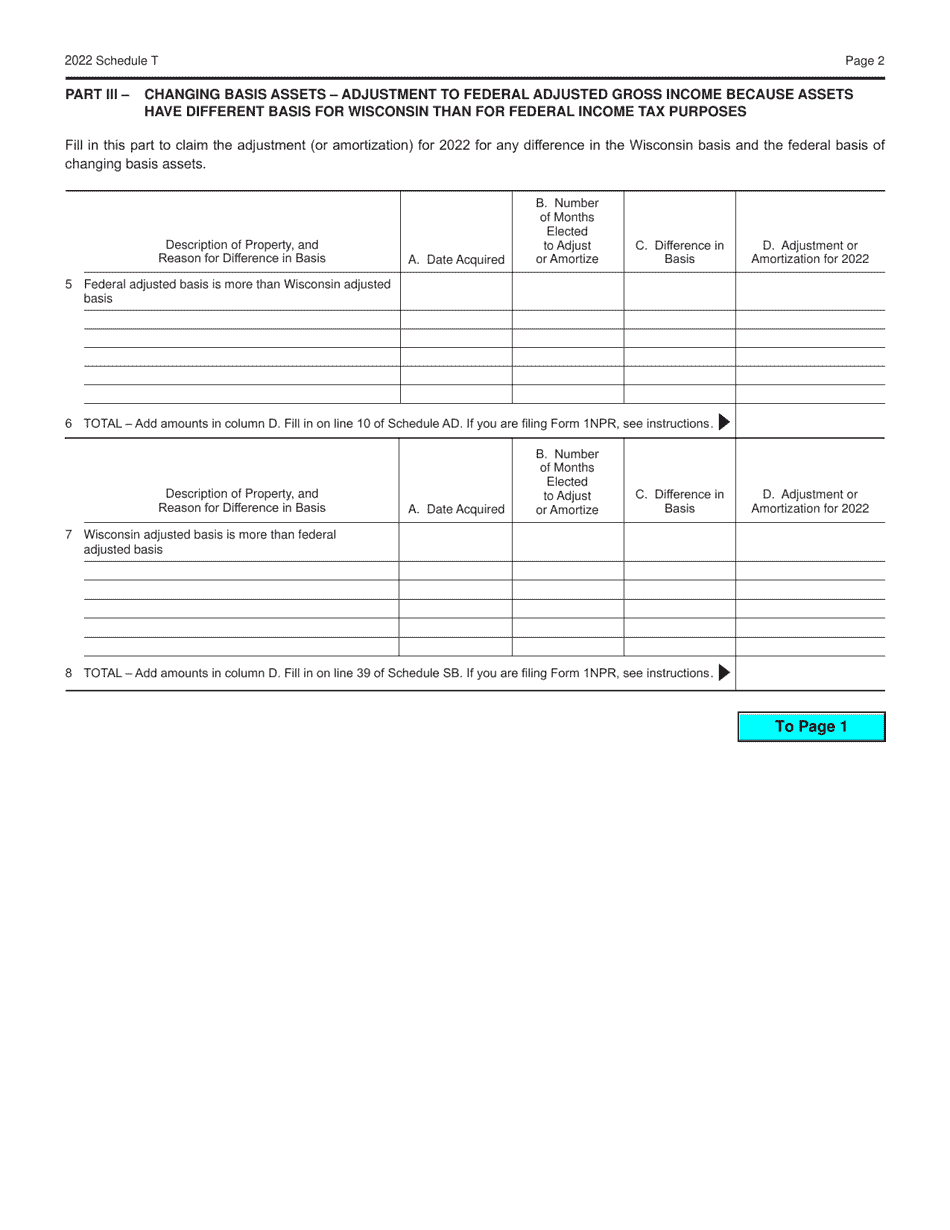

Form I-019 Schedule T Transitional Adjustments - Wisconsin

What Is Form I-019 Schedule T?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-019 Schedule T?

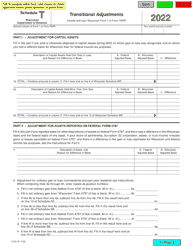

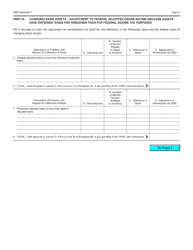

A: Form I-019 Schedule T is a form used for reporting transitional adjustments in Wisconsin.

Q: What are transitional adjustments?

A: Transitional adjustments are changes made to the tax base of a jurisdiction as a result of a change in tax rates or tax rules.

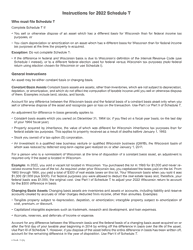

Q: Who needs to file Form I-019 Schedule T?

A: Taxpayers in Wisconsin who have transitional adjustments need to file Form I-019 Schedule T.

Q: When should Form I-019 Schedule T be filed?

A: Form I-019 Schedule T should be filed along with the taxpayer's annual tax return.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-019 Schedule T by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.