This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-094 Schedule PS

for the current year.

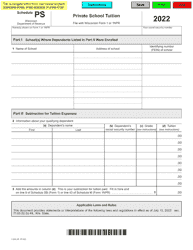

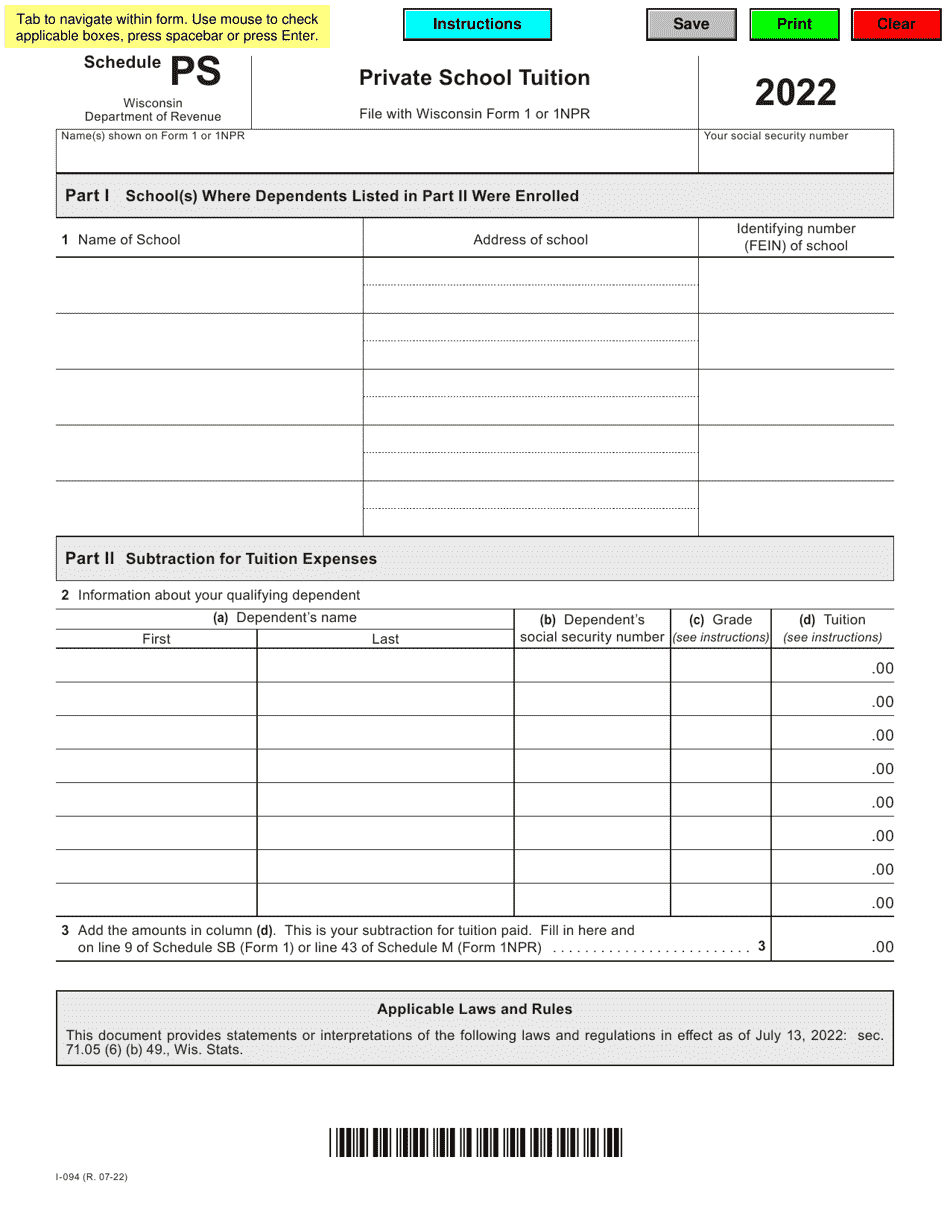

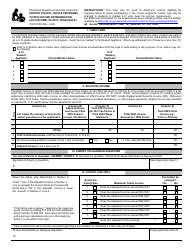

Form I-094 Schedule PS Private School Tuition - Wisconsin

What Is Form I-094 Schedule PS?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-094 Schedule PS?

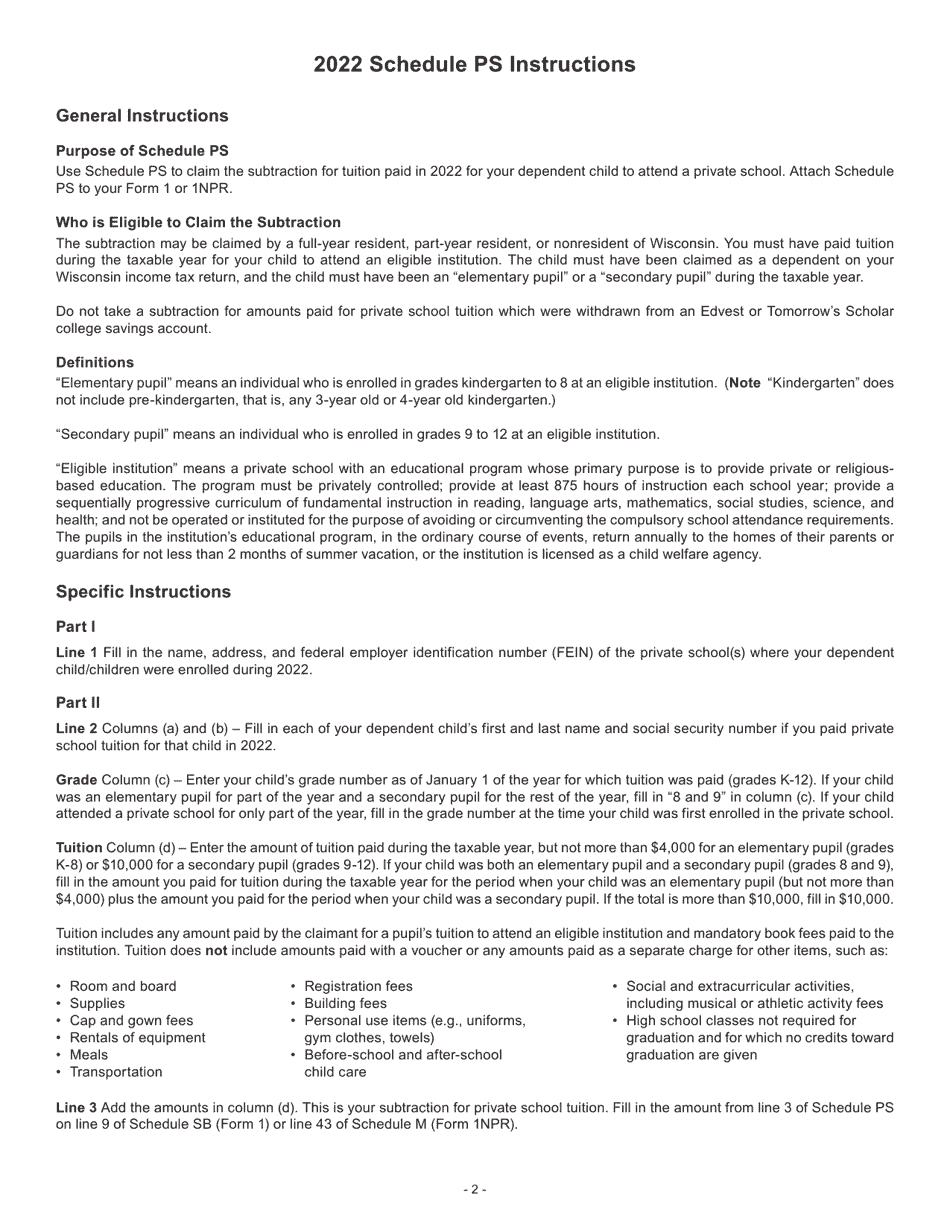

A: Form I-094 Schedule PS is a tax form used in the state of Wisconsin to report private school tuition expenses.

Q: Who needs to use Form I-094 Schedule PS?

A: Residents of Wisconsin who paid private school tuition expenses can use Form I-094 Schedule PS to claim a tax deduction.

Q: What can be deducted on Form I-094 Schedule PS?

A: Private school tuition expenses can be deducted on Form I-094 Schedule PS.

Q: When is the deadline to file Form I-094 Schedule PS?

A: The deadline to file Form I-094 Schedule PS is generally the same as the deadline for filing your Wisconsin state tax return, which is April 15th.

Q: Can Form I-094 Schedule PS be filed electronically?

A: Yes, Form I-094 Schedule PS can be filed electronically if you are e-filing your Wisconsin state tax return.

Q: Can I claim private school tuition expenses on my federal tax return?

A: No, private school tuition expenses cannot be claimed as a deduction on your federal tax return. They can only be claimed on your Wisconsin state tax return using Form I-094 Schedule PS.

Q: Are there any income limits for claiming the private school tuition deduction?

A: No, there are no income limits for claiming the private school tuition deduction on Form I-094 Schedule PS.

Q: What supporting documentation do I need to include with Form I-094 Schedule PS?

A: You may be required to provide documentation such as receipts or invoices showing the amount of private school tuition expenses paid.

Q: Can I claim tuition expenses for more than one student on Form I-094 Schedule PS?

A: Yes, you can claim tuition expenses for multiple students on Form I-094 Schedule PS as long as you paid the expenses for each student.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-094 Schedule PS by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.