This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-053I Schedule M

for the current year.

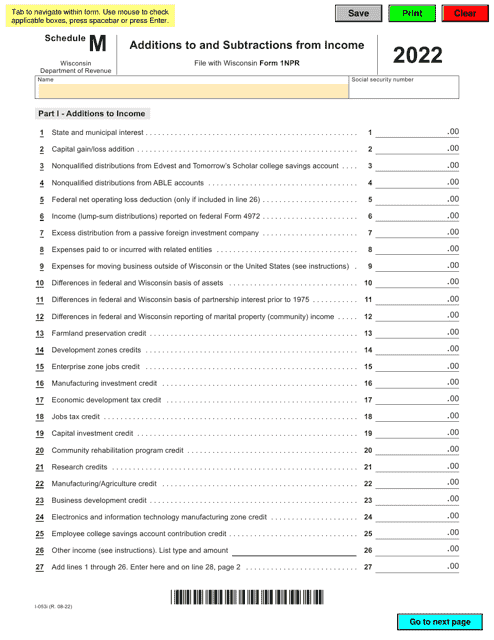

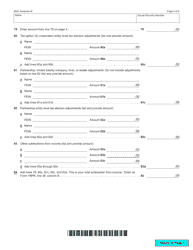

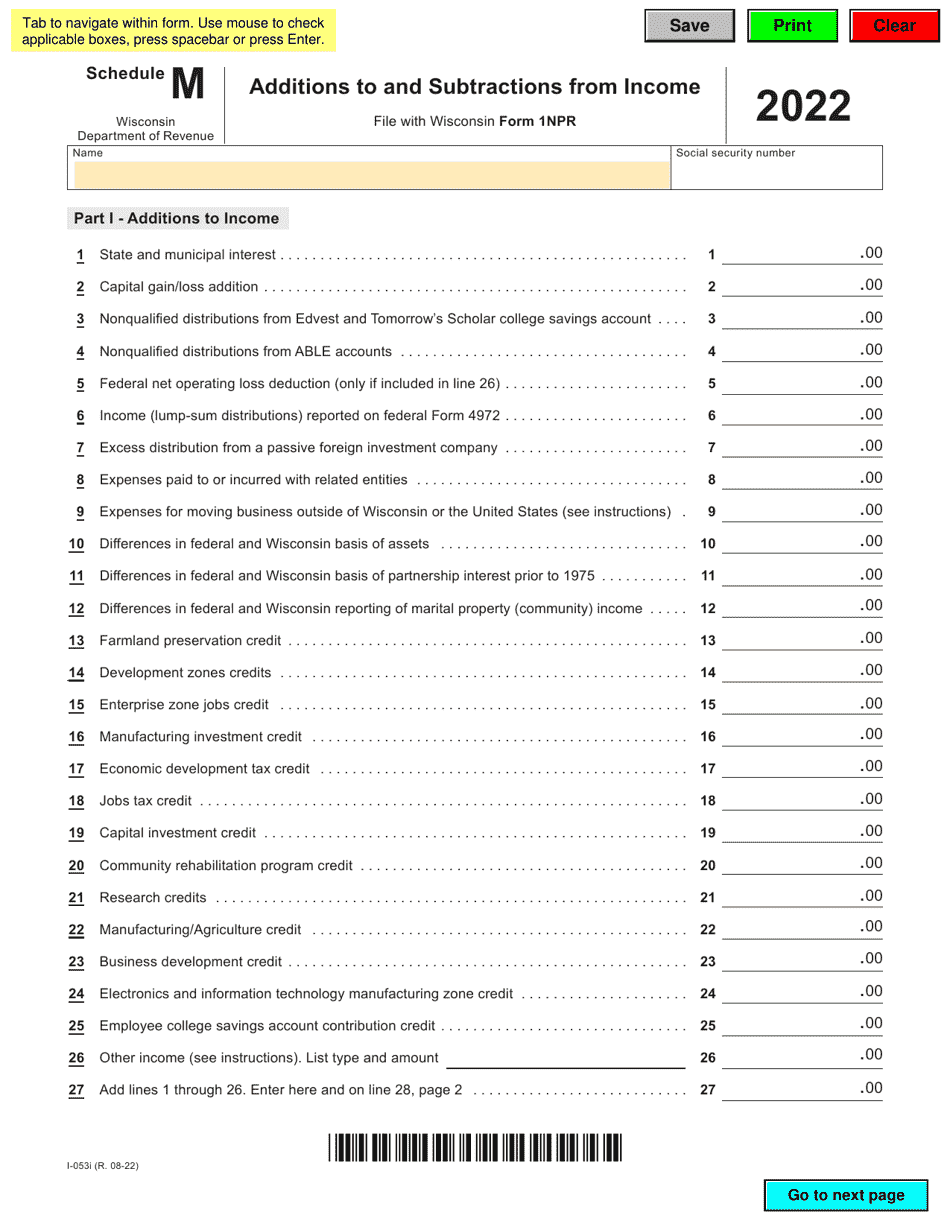

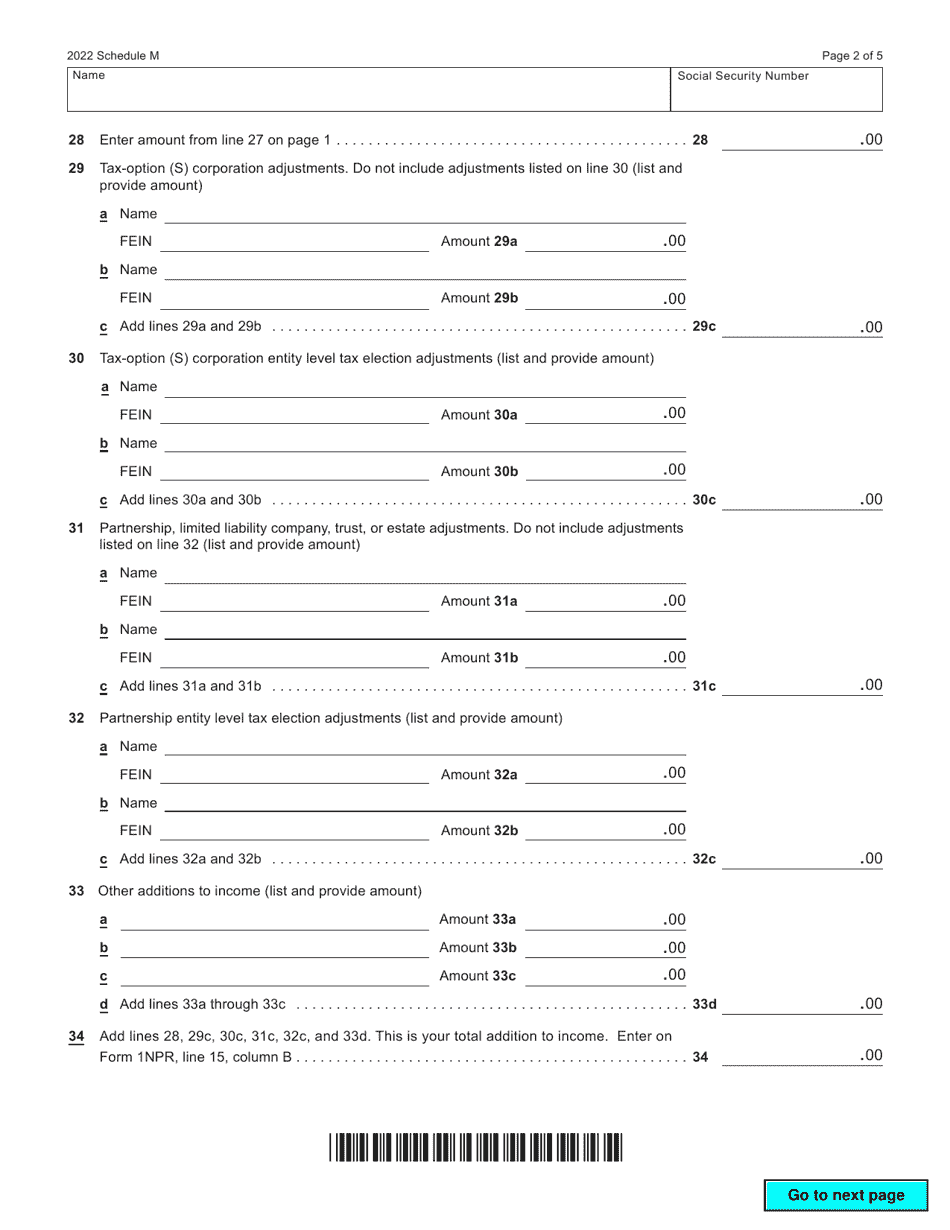

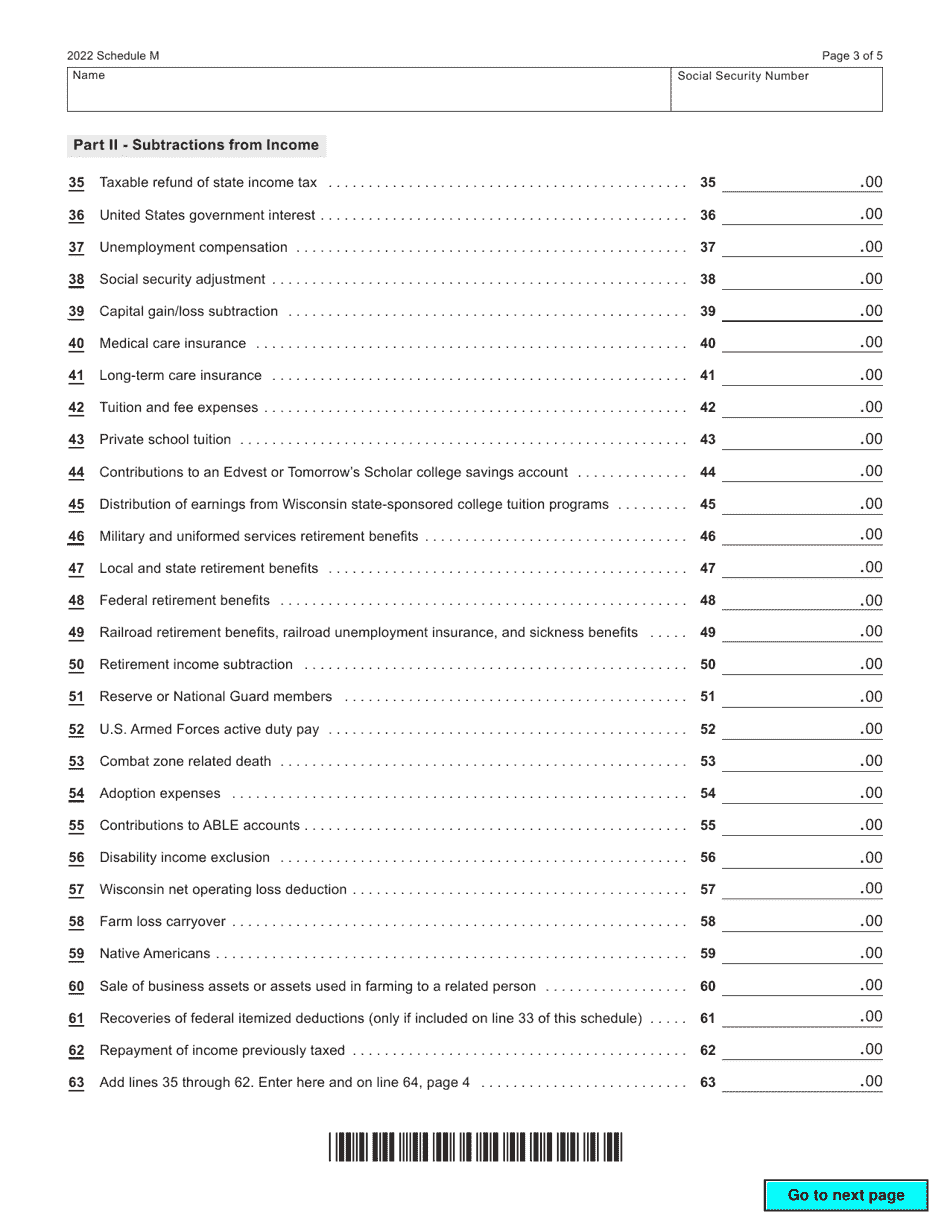

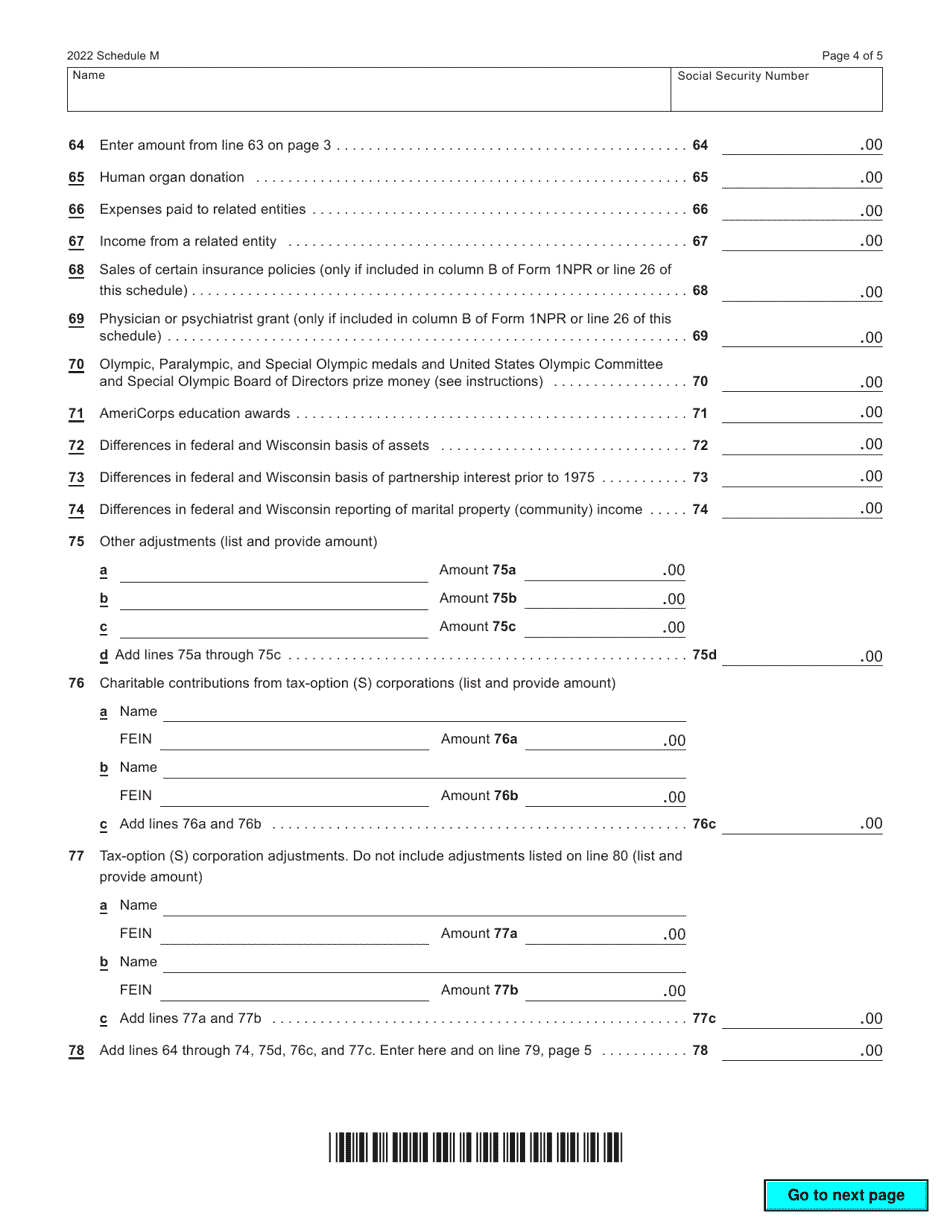

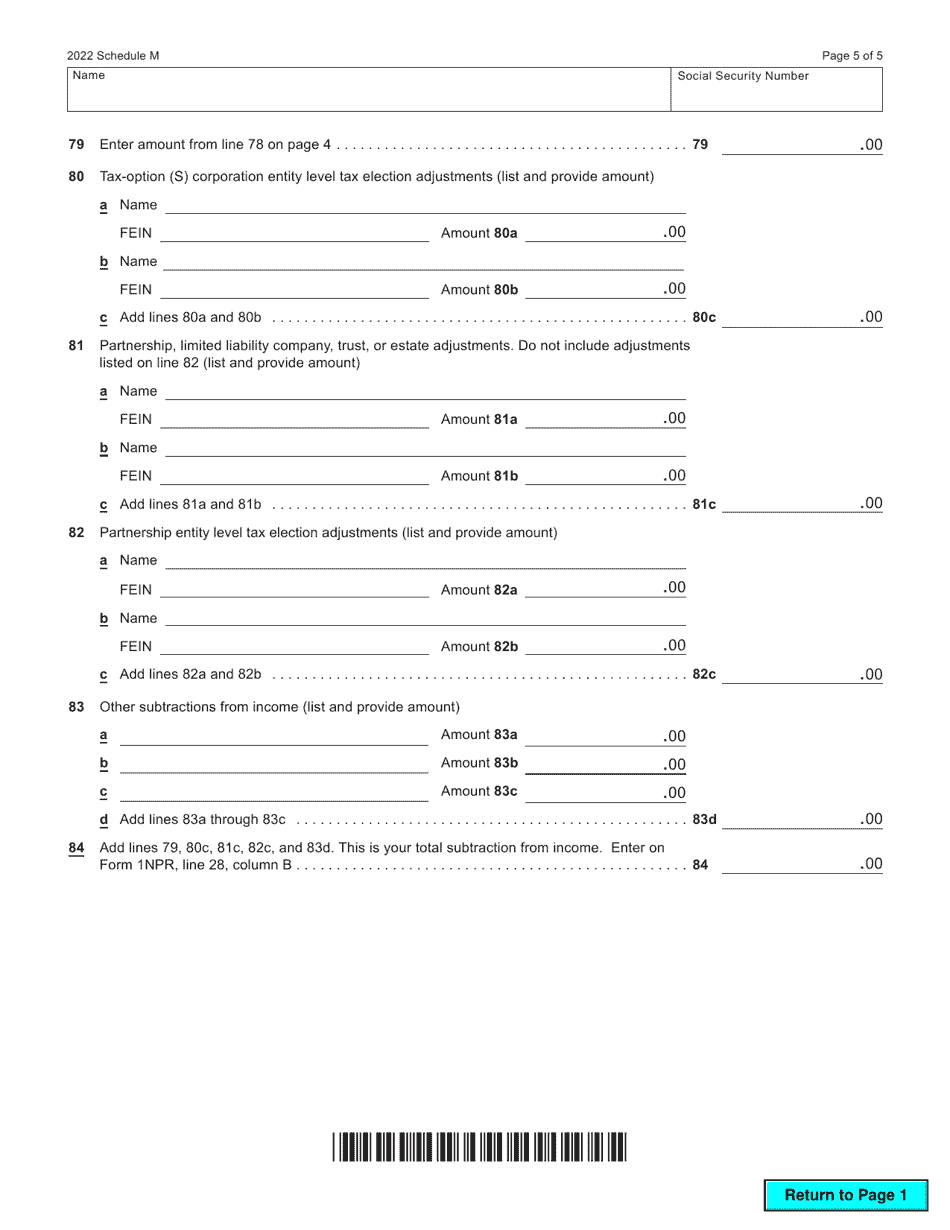

Form I-053I Schedule M Additions to and Subtractions From Income - Wisconsin

What Is Form I-053I Schedule M?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-053I?

A: Form I-053I is a schedule used to report additions to and subtractions from income in Wisconsin.

Q: What is Schedule M?

A: Schedule M is a part of Form I-053I that specifically deals with additions to and subtractions from income.

Q: What are additions to income?

A: Additions to income are items that need to be added to your total income.

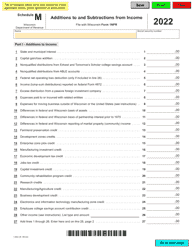

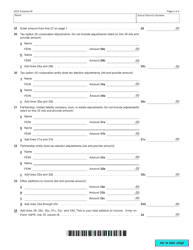

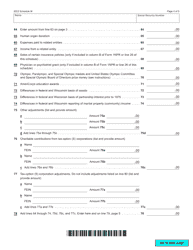

Q: What are subtractions from income?

A: Subtractions from income are items that can be subtracted from your total income.

Q: Why do I need to complete Schedule M?

A: You need to complete Schedule M to accurately report any additions or subtractions to your income in Wisconsin.

Q: Is Schedule M specific to Wisconsin?

A: Yes, Schedule M is specific to Wisconsin and is used to report income additions and subtractions for Wisconsin tax purposes.

Q: What types of items are typically reported as additions to income?

A: Common examples of additions to income include interest income, rental income, and capital gains.

Q: What types of items are typically reported as subtractions from income?

A: Common examples of subtractions from income include deductions for student loan interest, contributions to retirement accounts, and business losses.

Q: Do I need to file Schedule M if I don't have any additions or subtractions to my income?

A: If you don't have any additions or subtractions to your income, you may not need to file Schedule M. However, you should consult the instructions or a tax professional to confirm.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-053I Schedule M by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.