This version of the form is not currently in use and is provided for reference only. Download this version of

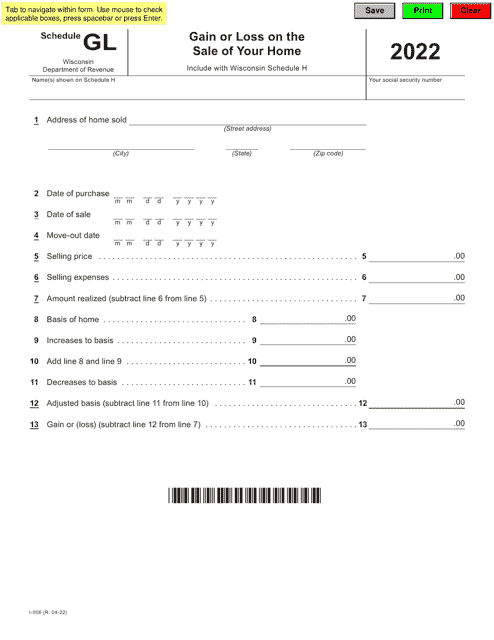

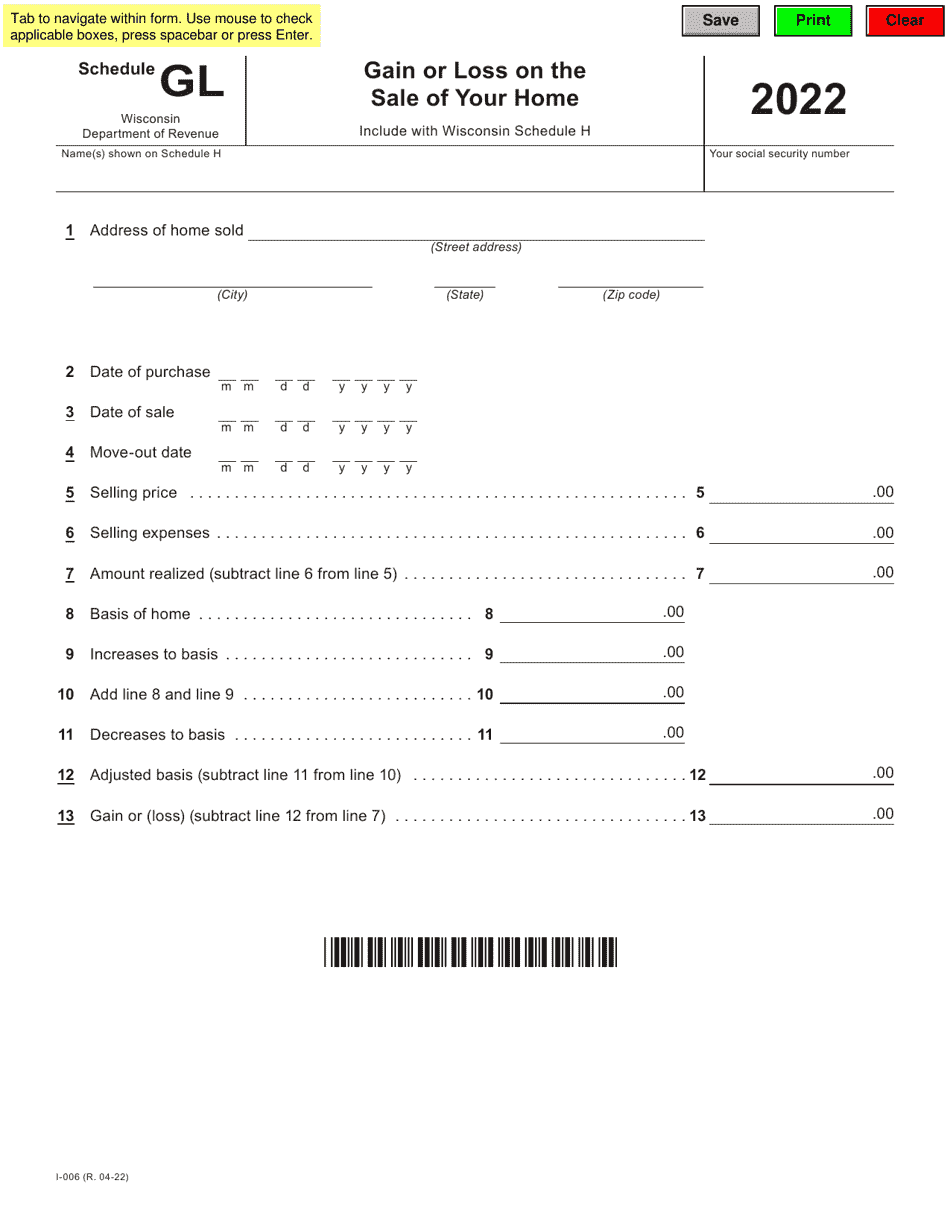

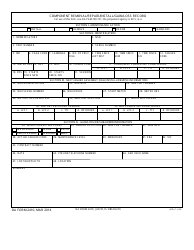

Form I-006 Schedule GL

for the current year.

Form I-006 Schedule GL Gain or Loss on the Sale of Your Home - Wisconsin

What Is Form I-006 Schedule GL?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-006 Schedule GL?

A: Form I-006 Schedule GL is a tax form used in Wisconsin to report the gain or loss on the sale of your home.

Q: Who needs to file Form I-006 Schedule GL?

A: You need to file Form I-006 Schedule GL if you have sold your home in Wisconsin and need to report the gain or loss.

Q: What information do I need to complete Form I-006 Schedule GL?

A: To complete Form I-006 Schedule GL, you will need information about the sale of your home, including the sale price and any expenses related to the sale.

Q: When is the deadline to file Form I-006 Schedule GL?

A: The deadline to file Form I-006 Schedule GL in Wisconsin is usually April 15th of the following year.

Q: Can I e-file Form I-006 Schedule GL?

A: No, Form I-006 Schedule GL cannot be e-filed. It must be filed by mail.

Q: Are there any special rules or requirements for reporting gain or loss on the sale of a home in Wisconsin?

A: Yes, there may be special rules or requirements for reporting gain or loss on the sale of a home in Wisconsin. It is recommended to consult with a tax professional or refer to the instructions for Form I-006 Schedule GL.

Q: What should I do if I have questions or need assistance with Form I-006 Schedule GL?

A: If you have questions or need assistance with Form I-006 Schedule GL, you can contact the Wisconsin Department of Revenue or seek help from a tax professional.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-006 Schedule GL by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.