This version of the form is not currently in use and is provided for reference only. Download this version of

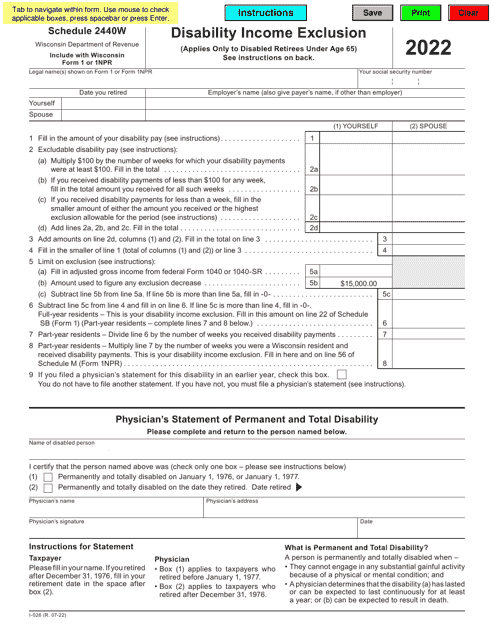

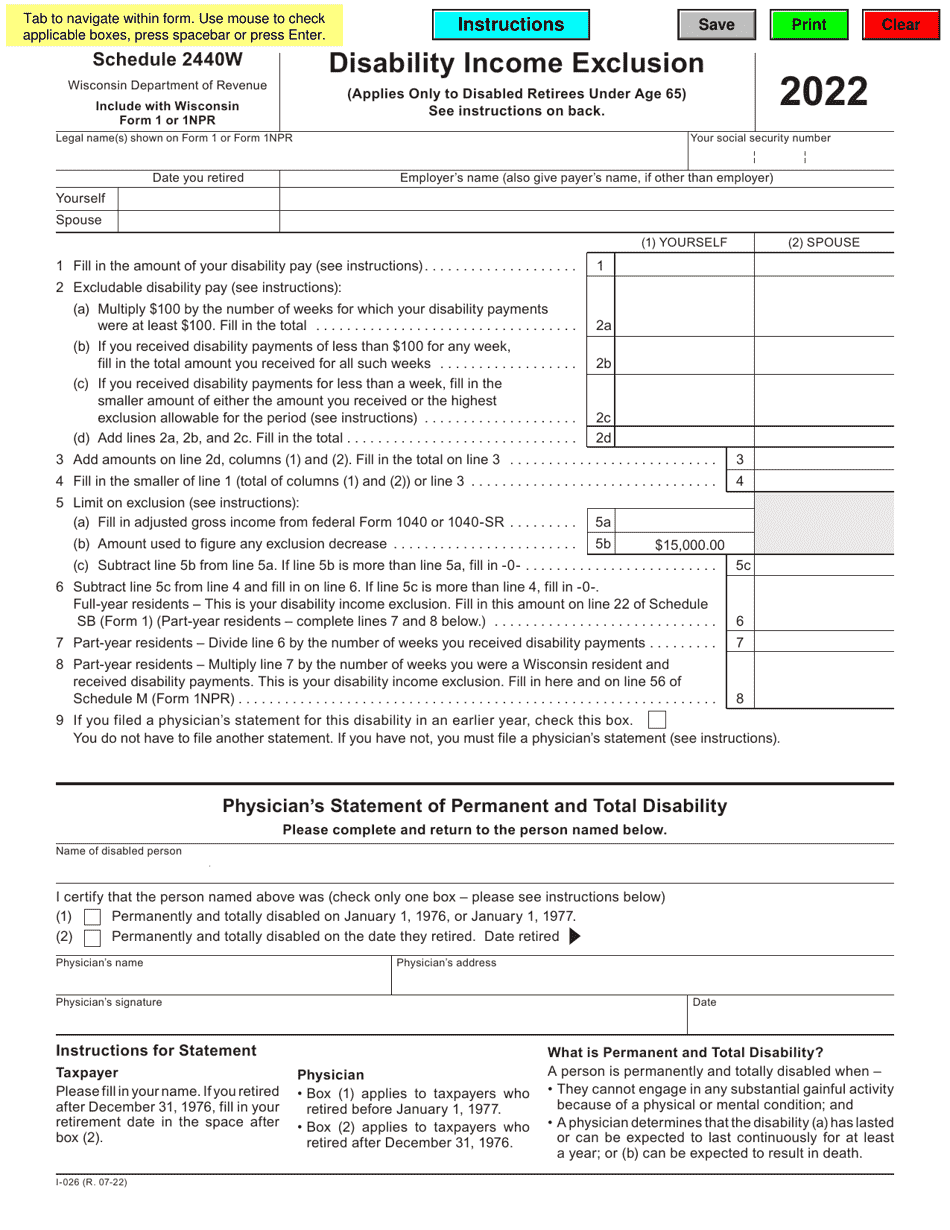

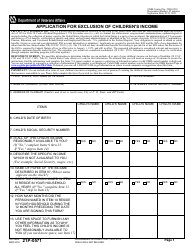

Form I-026 Schedule 2440W

for the current year.

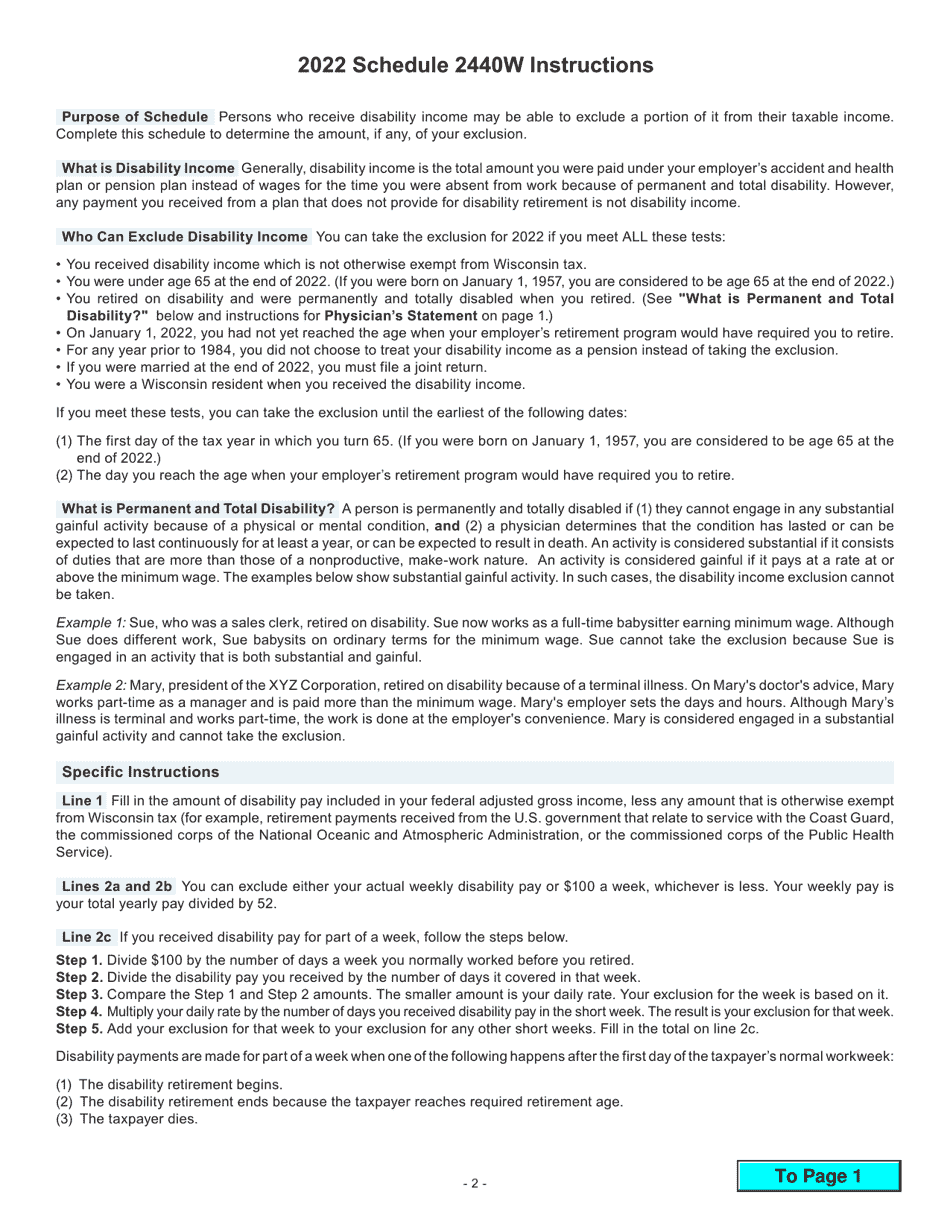

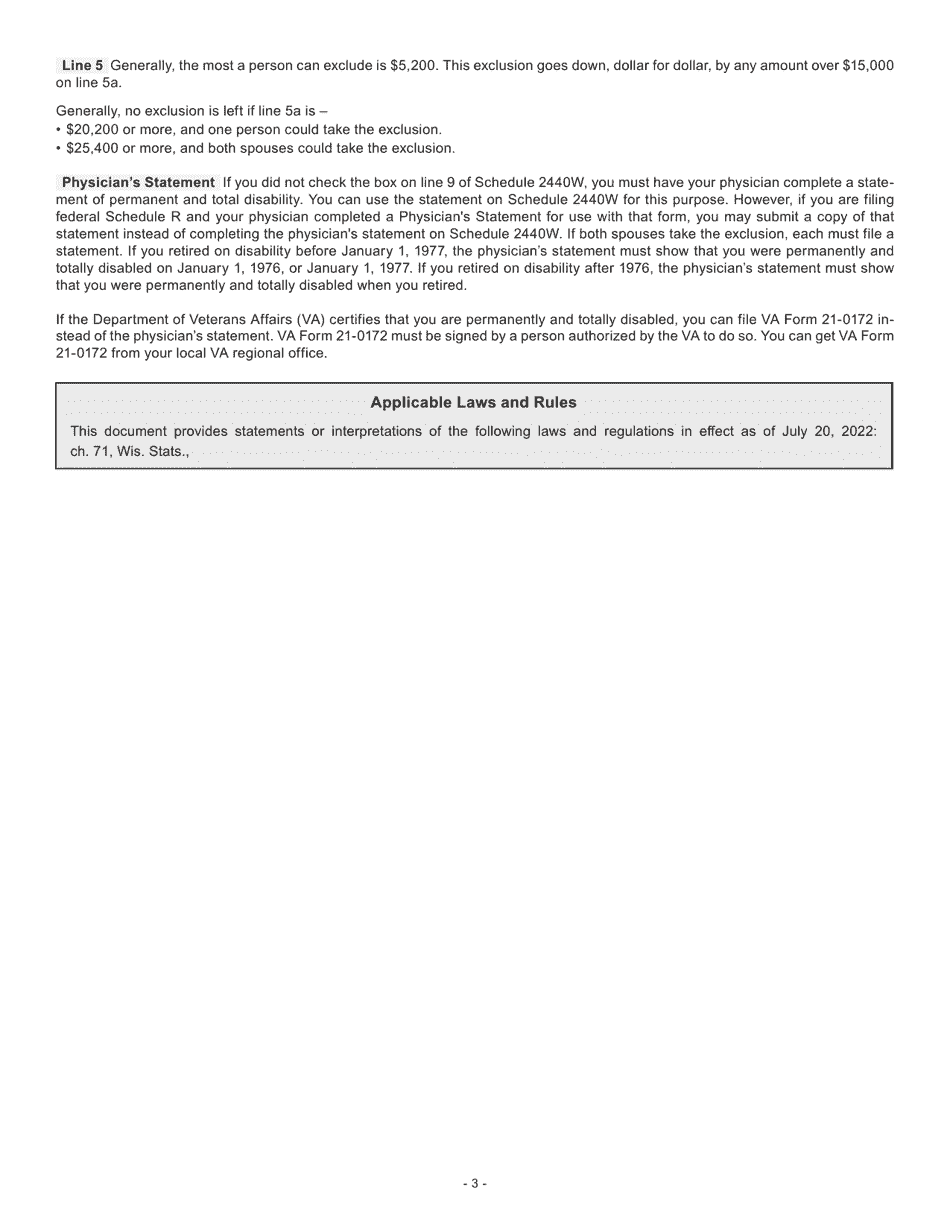

Form I-026 Schedule 2440W Disability Income Exclusion - Wisconsin

What Is Form I-026 Schedule 2440W?

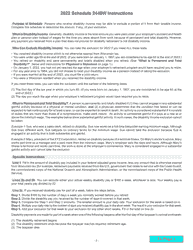

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-026 Schedule 2440W?

A: Form I-026 Schedule 2440W is a tax form used in Wisconsin to claim a disability income exclusion.

Q: What is disability income exclusion?

A: Disability income exclusion is a tax benefit that allows individuals with disabilities to exclude a portion of their income from their taxable income.

Q: Who is eligible for disability income exclusion in Wisconsin?

A: In Wisconsin, individuals who have a qualifying disability and meet certain income requirements may be eligible for disability income exclusion.

Q: What is the purpose of Form I-026 Schedule 2440W?

A: The purpose of this form is to calculate and claim the disability income exclusion on your Wisconsin state tax return.

Q: Do I need to file Form I-026 Schedule 2440W?

A: You should file this form if you are claiming the disability income exclusion on your Wisconsin state tax return.

Q: What other documents do I need to include with Form I-026 Schedule 2440W?

A: You may need to include copies of your federal tax return and any documentation related to your disability with this form.

Q: Is there a deadline to file Form I-026 Schedule 2440W?

A: The deadline to file this form is usually the same as the deadline for filing your Wisconsin state tax return.

Q: Can I e-file Form I-026 Schedule 2440W?

A: Yes, you can e-file this form using approved tax preparation software or through a tax professional.

Q: Can I claim disability income exclusion if I live in a state other than Wisconsin?

A: No, Form I-026 Schedule 2440W is specific to Wisconsin residents and can only be used for claiming the disability income exclusion in Wisconsin.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-026 Schedule 2440W by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.