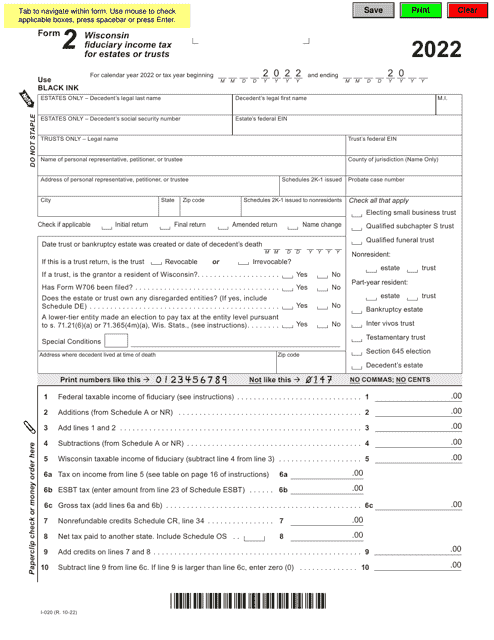

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2 (I-020)

for the current year.

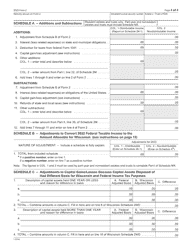

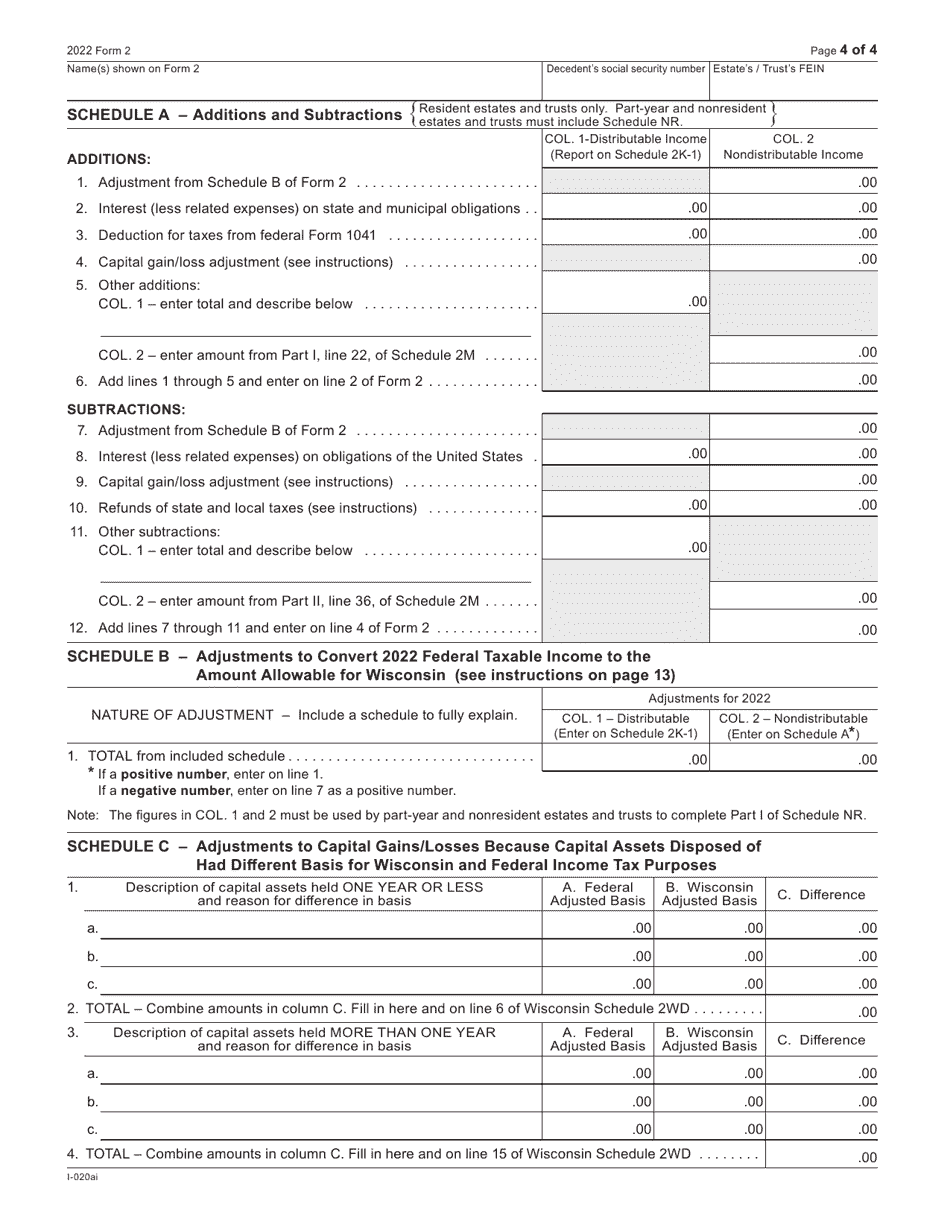

Form 2 (I-020) Wisconsin Fiduciary Income Tax for Estates and Trusts - Wisconsin

What Is Form 2 (I-020)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 2 (I-020)?

A: Form 2 (I-020) is the Wisconsin Fiduciary Income Tax form for Estates and Trusts.

Q: Who needs to file Form 2 (I-020)?

A: Estates and trusts in Wisconsin need to file Form 2 (I-020) for their fiduciary income tax.

Q: What is fiduciary income tax?

A: Fiduciary income tax is the tax paid on income earned by an estate or trust.

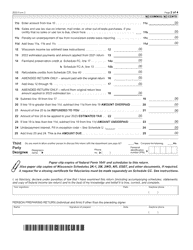

Q: When is Form 2 (I-020) due?

A: Form 2 (I-020) is due on or before April 15th, or the 15th day of the fourth month following the close of the taxable year.

Q: Are there any extensions available for filing Form 2 (I-020)?

A: Yes, Wisconsin allows for an automatic 5-month extension to file Form 2 (I-020).

Q: Is there a minimum income threshold for filing Form 2 (I-020)?

A: Yes, estates and trusts with Wisconsin income of $600 or more must file Form 2 (I-020).

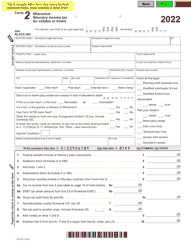

Q: What types of income should be reported on Form 2 (I-020)?

A: All income earned by the estate or trust, including interest, dividends, and capital gains, should be reported on Form 2 (I-020).

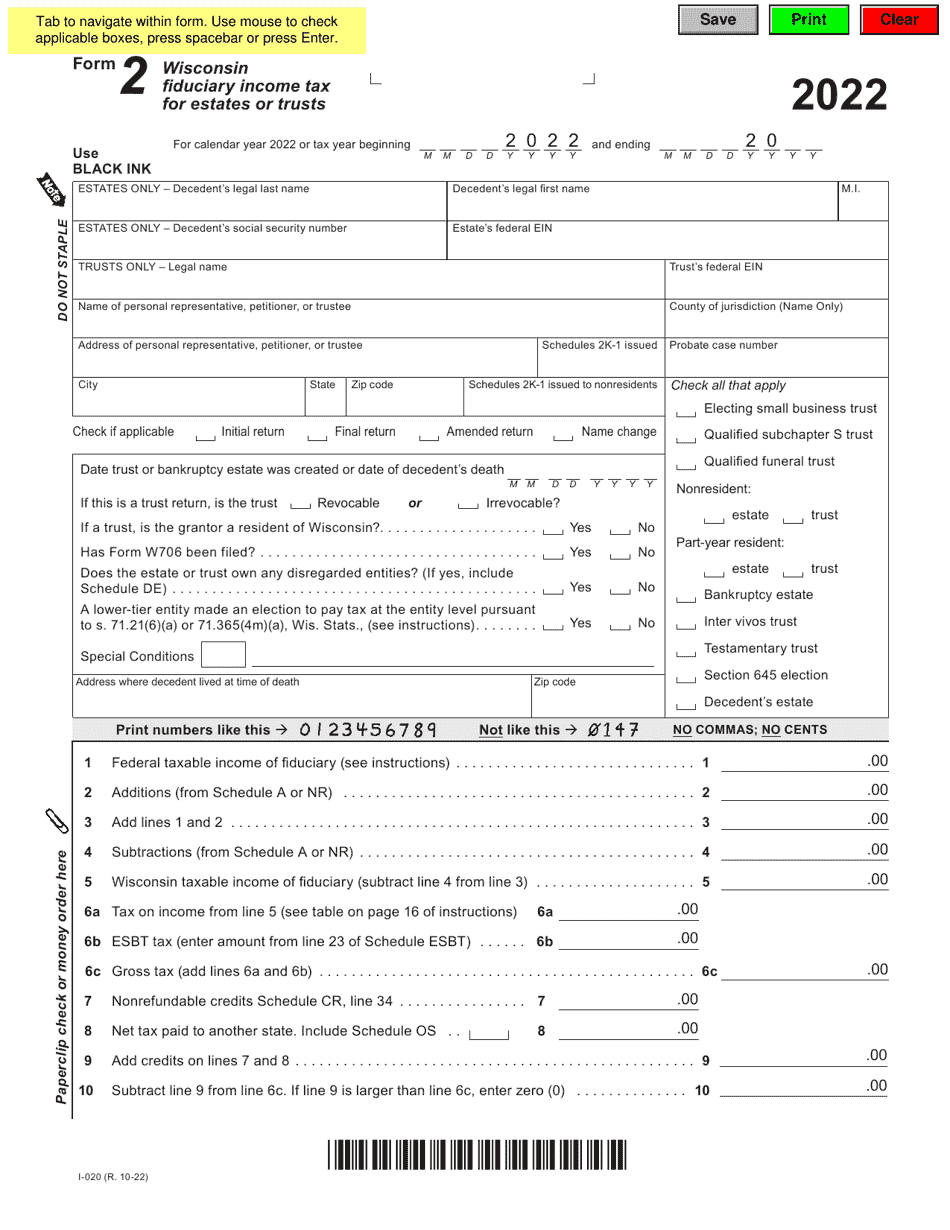

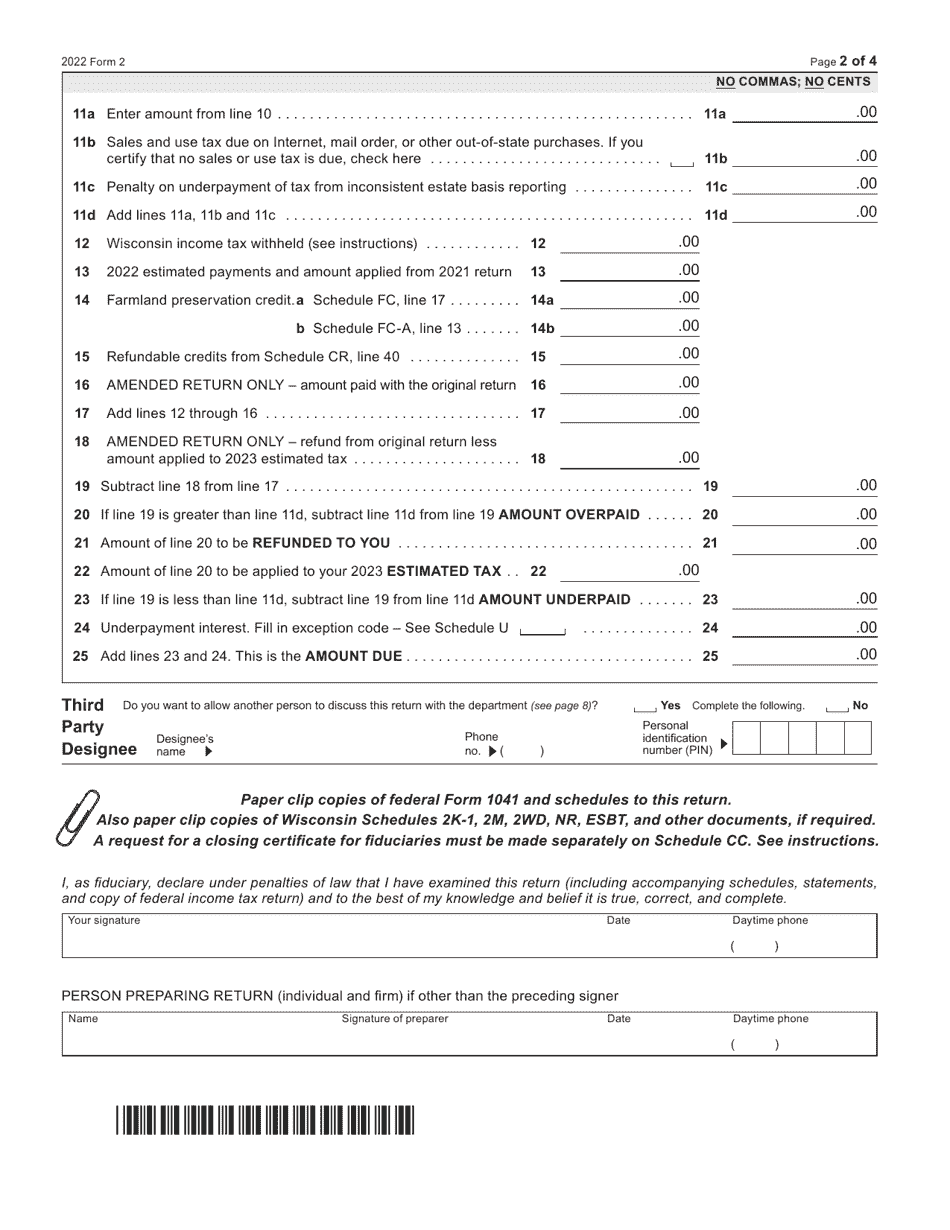

Q: Are there any deductions or credits available for estates and trusts on Form 2 (I-020)?

A: Yes, there are various deductions and credits available for estates and trusts on Form 2 (I-020). Consult the instructions for the form for more information.

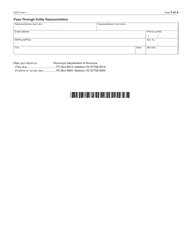

Q: Can Form 2 (I-020) be filed electronically?

A: Yes, Form 2 (I-020) can be filed electronically through the Wisconsin Department of Revenue's e-file system.

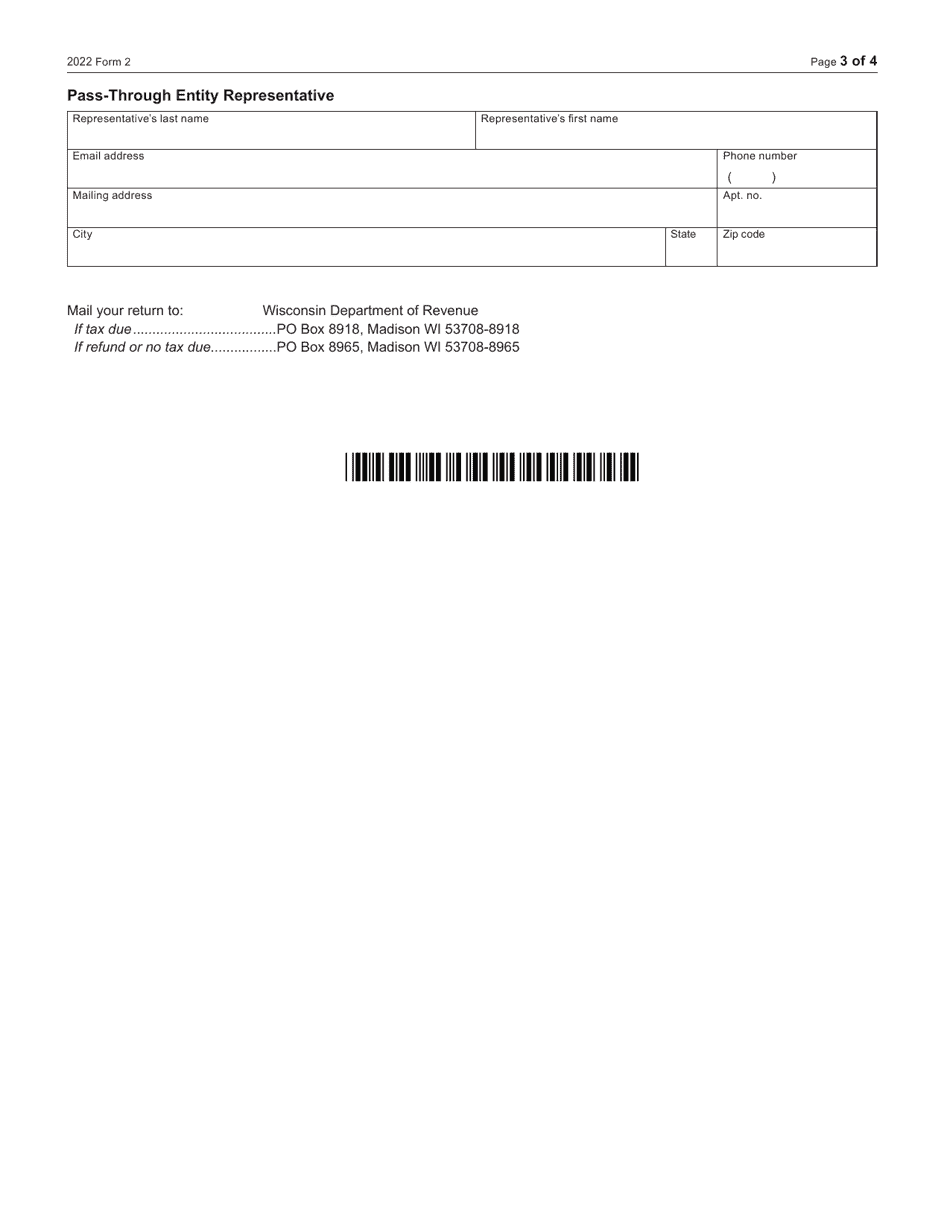

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 (I-020) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.