This version of the form is not currently in use and is provided for reference only. Download this version of

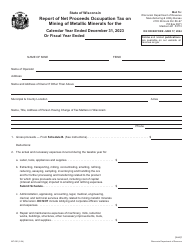

Form MT-001

for the current year.

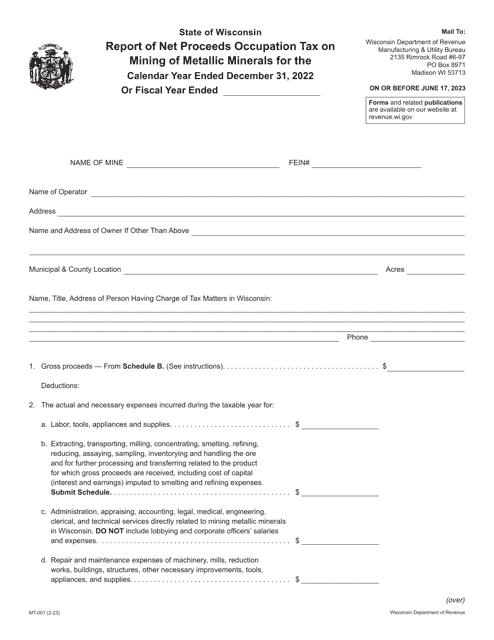

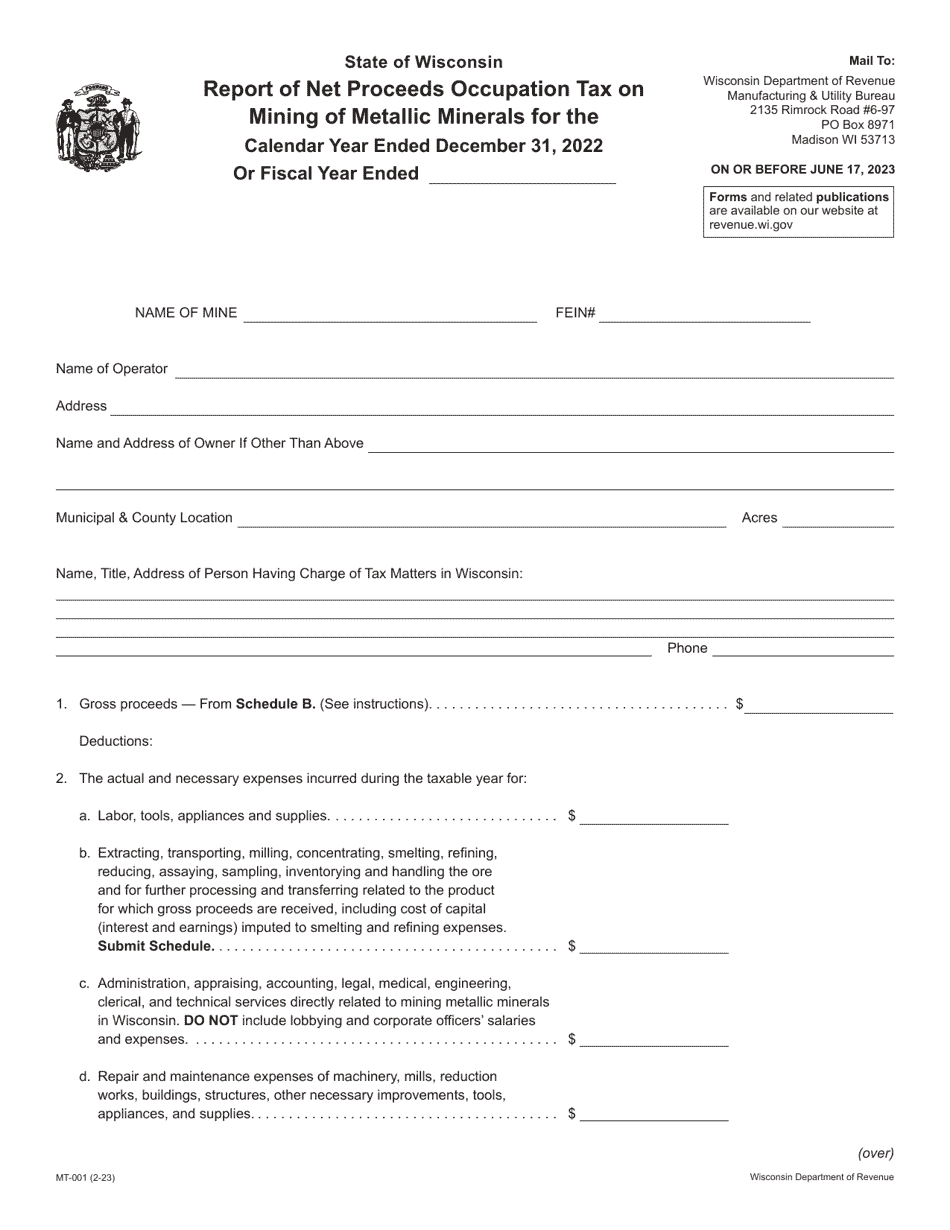

Form MT-001 Report of Net Proceeds Occupation Tax on Mining of Metallic Minerals - Wisconsin

What Is Form MT-001?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-001?

A: Form MT-001 is the Report of Net Proceeds Occupation Tax on Mining of Metallic Minerals in Wisconsin.

Q: Who needs to file Form MT-001?

A: Mining companies engaged in the mining of metallic minerals in Wisconsin need to file Form MT-001.

Q: What is the purpose of Form MT-001?

A: The purpose of Form MT-001 is to report and pay the occupation tax on the net proceeds from mining metallic minerals in Wisconsin.

Q: How often do you need to file Form MT-001?

A: Form MT-001 is filed annually and is due by March 1st of the following year.

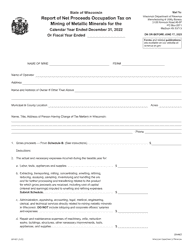

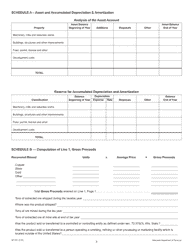

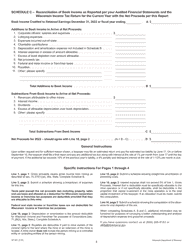

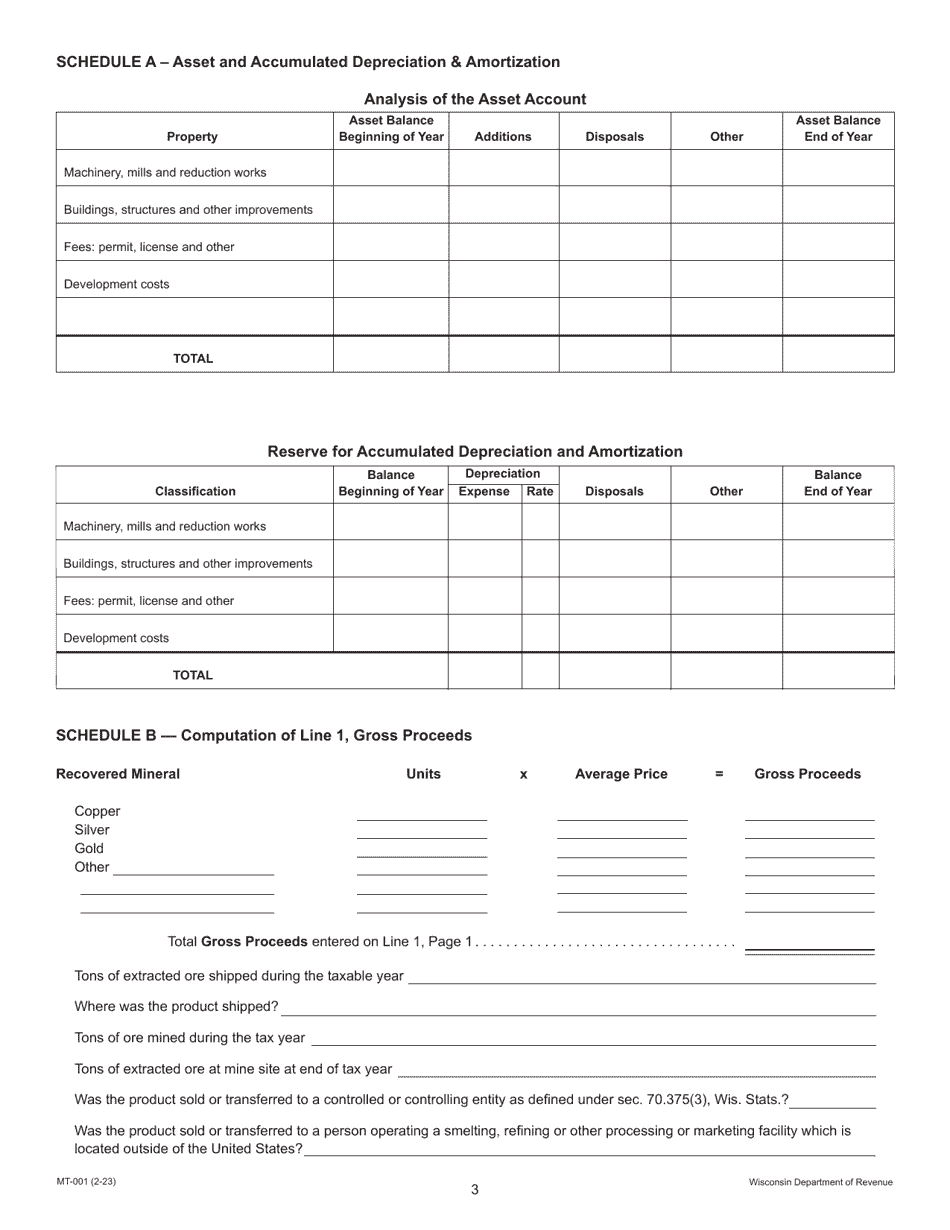

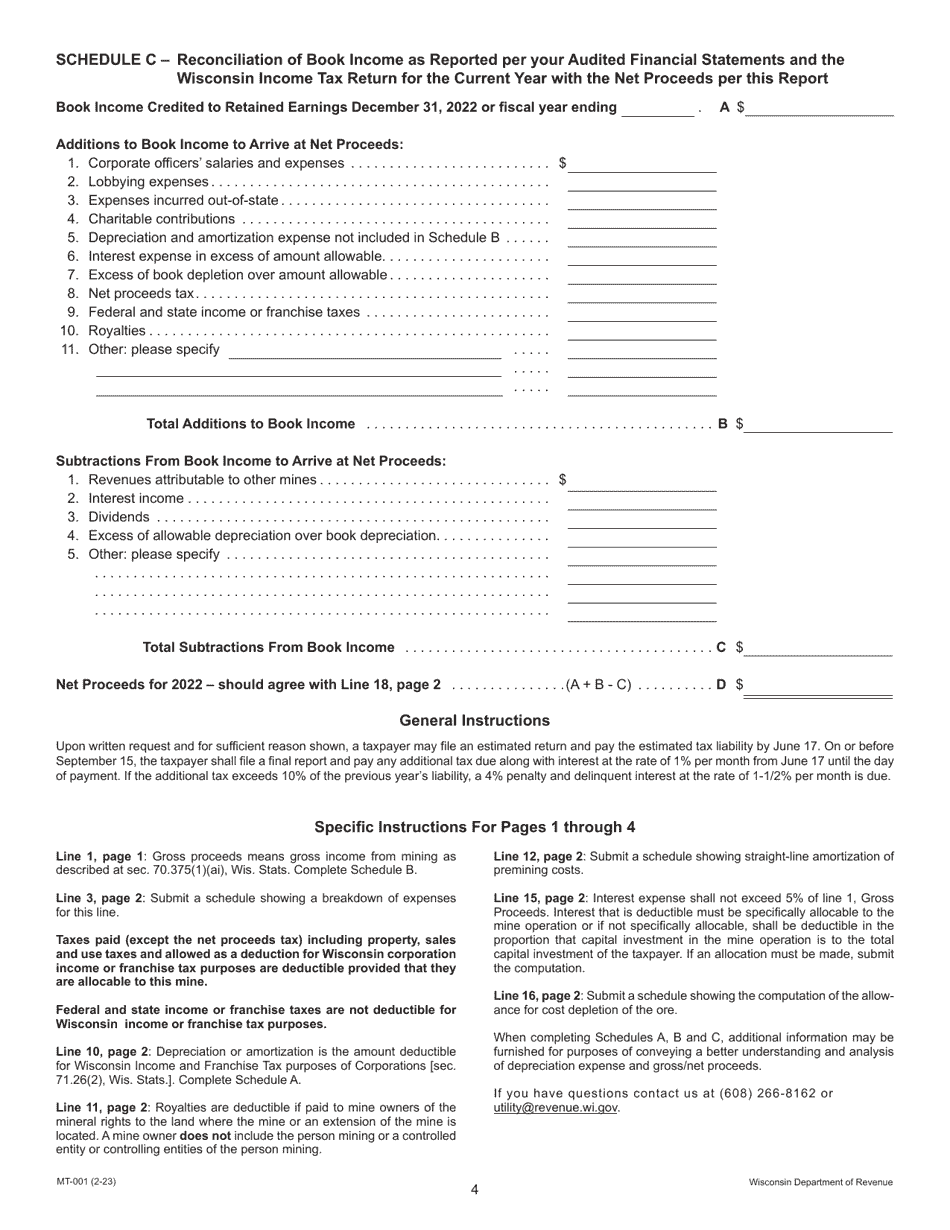

Q: What information is required on Form MT-001?

A: Form MT-001 requires information such as the name and address of the mining company, details of the mining operation, and the net proceeds from mining.

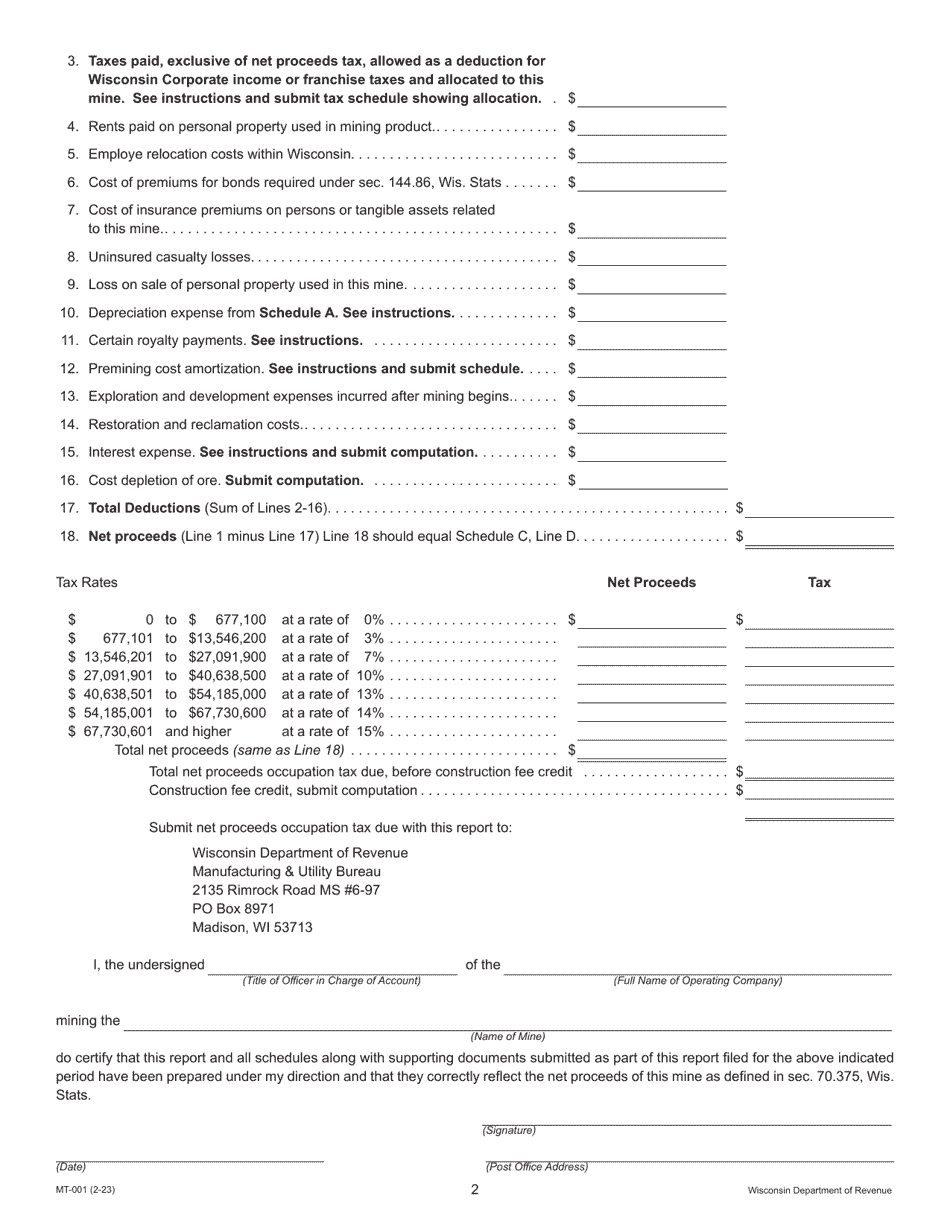

Q: Are there any exemptions or deductions available on Form MT-001?

A: Yes, there are certain exemptions and deductions available on Form MT-001. These include exemptions for small miners and deductions for exploration expenses.

Q: What are the consequences of not filing Form MT-001?

A: Failure to file Form MT-001 or paying the occupation tax can result in penalties, interest, and potential legal action by the Wisconsin Department of Revenue.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.