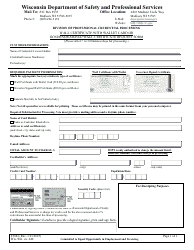

This version of the form is not currently in use and is provided for reference only. Download this version of

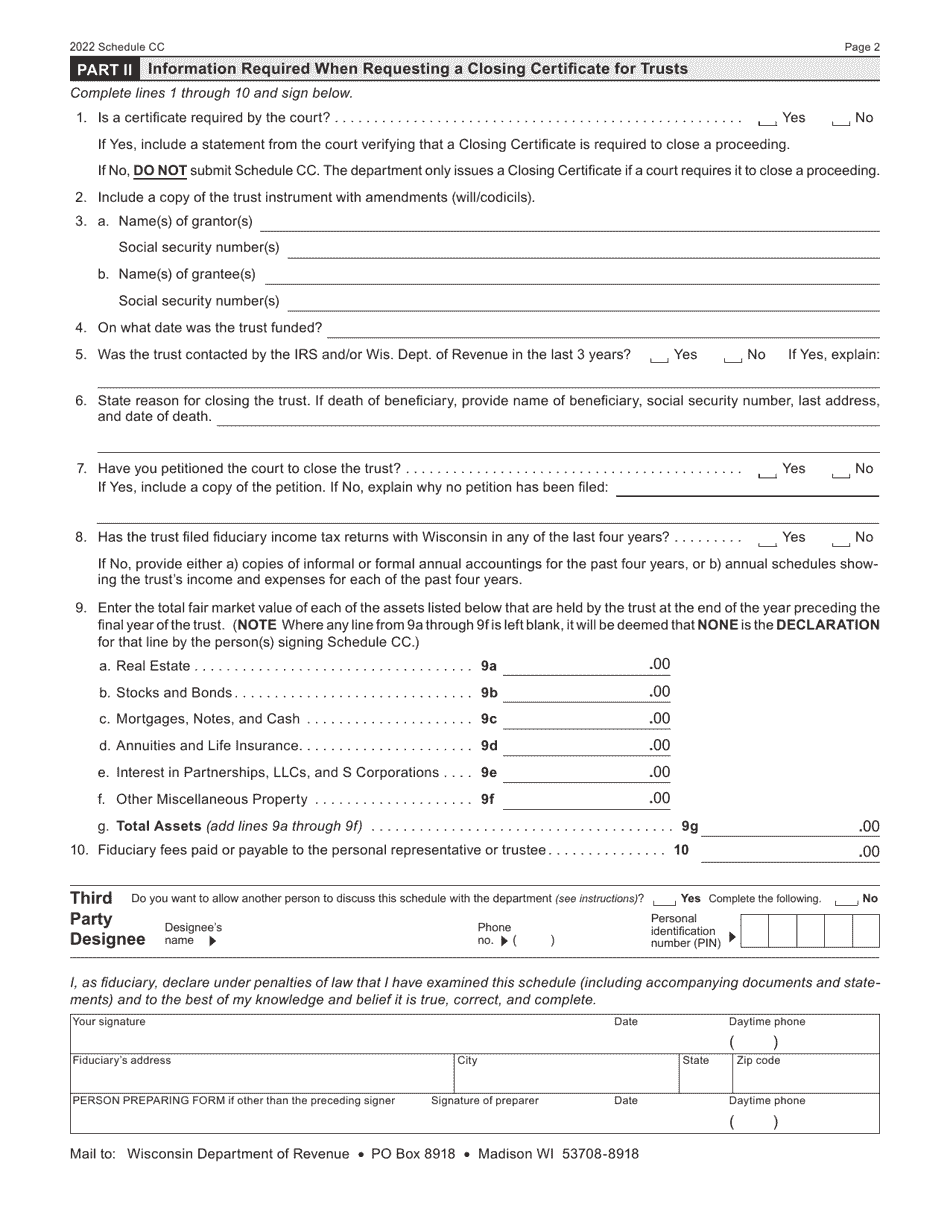

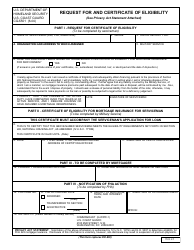

Form I-030 Schedule CC

for the current year.

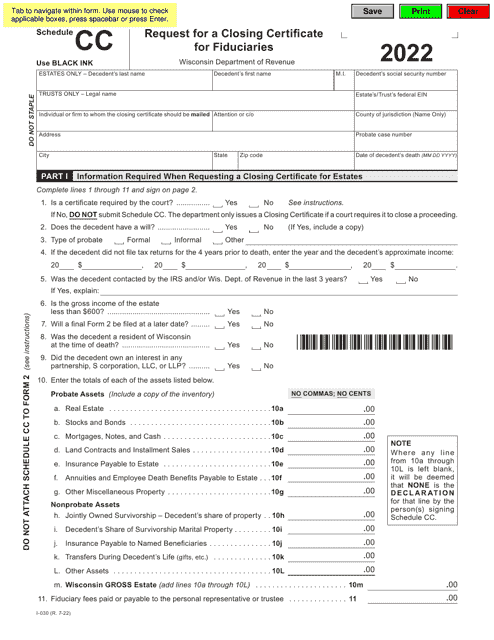

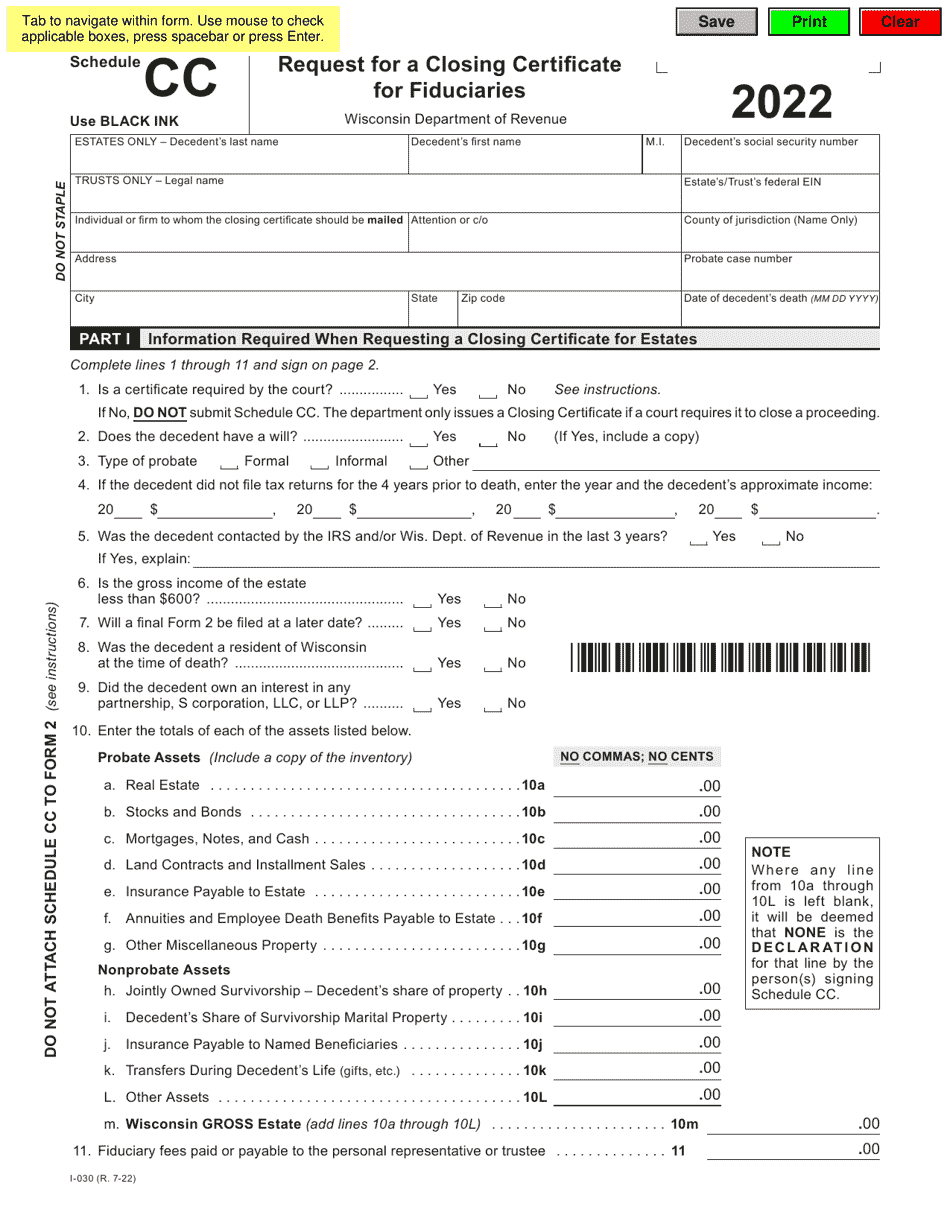

Form I-030 Schedule CC Request for a Closing Certificate for Fiduciaries - Wisconsin

What Is Form I-030 Schedule CC?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-030 Schedule CC?

A: Form I-030 Schedule CC is a request for a closing certificate for fiduciaries in Wisconsin.

Q: Who can use Form I-030 Schedule CC?

A: Form I-030 Schedule CC can be used by fiduciaries in Wisconsin who need a closing certificate.

Q: What is a closing certificate for fiduciaries?

A: A closing certificate for fiduciaries is a document that certifies the final tax responsibilities of a deceased person's estate.

Q: Why would a fiduciary need a closing certificate?

A: A fiduciary may need a closing certificate to provide proof that the deceased person's estate has satisfied its tax obligations.

Q: Are there any filing fees for Form I-030 Schedule CC?

A: No, there are no filing fees for Form I-030 Schedule CC.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-030 Schedule CC by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.