This version of the form is not currently in use and is provided for reference only. Download this version of

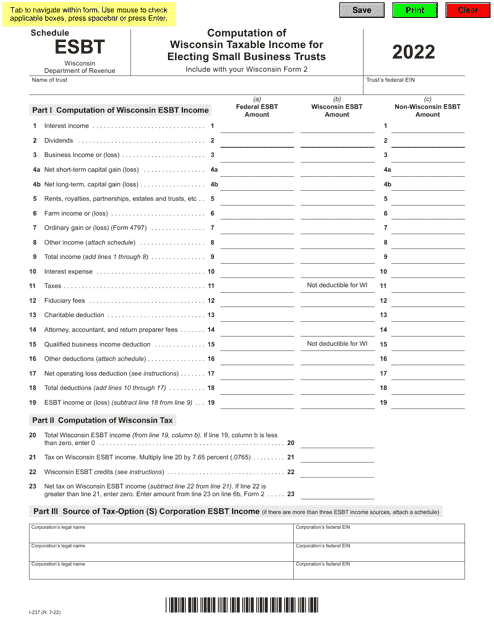

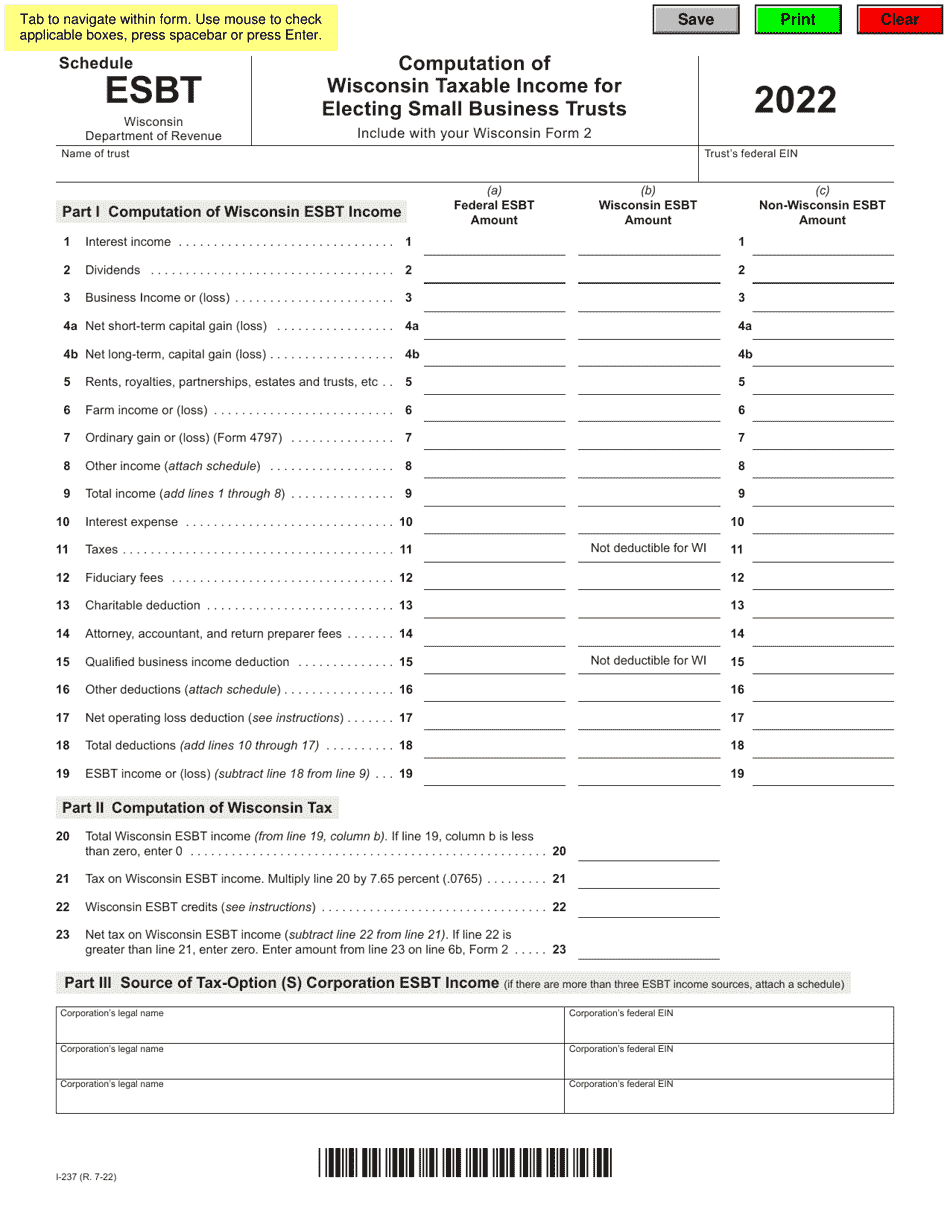

Form I-237 Schedule ESBT

for the current year.

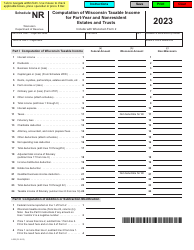

Form I-237 Schedule ESBT Computation of Wisconsin Taxable Income for Electing Small Business Trusts - Wisconsin

What Is Form I-237 Schedule ESBT?

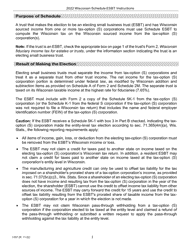

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-237?

A: Form I-237 is a document used to compute the Wisconsin taxable income for Electing Small Business Trusts (ESBT) in Wisconsin.

Q: What does ESBT stand for?

A: ESBT stands for Electing Small Business Trust.

Q: Who is required to file Form I-237?

A: Electing Small Business Trusts in Wisconsin are required to file Form I-237 to compute their taxable income.

Q: What is the purpose of Form I-237?

A: The purpose of Form I-237 is to calculate the Wisconsin taxable income for Electing Small Business Trusts.

Q: Is Form I-237 specific to Wisconsin?

A: Yes, Form I-237 is specific to the state of Wisconsin.

Q: What information is needed to complete Form I-237?

A: To complete Form I-237, you will need information about the trust's income, deductions, and credits.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-237 Schedule ESBT by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.