This version of the form is not currently in use and is provided for reference only. Download this version of

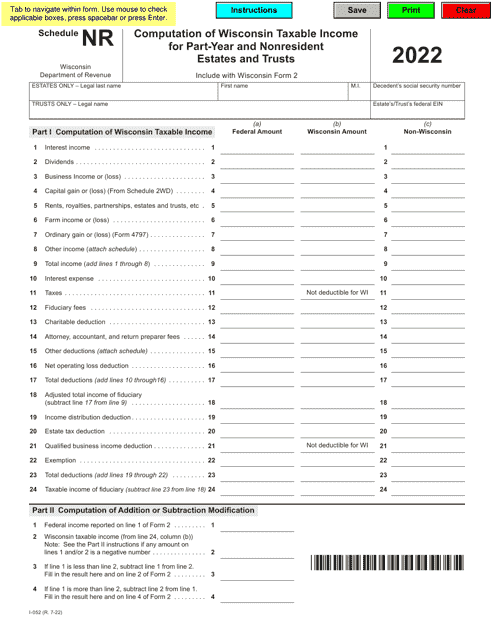

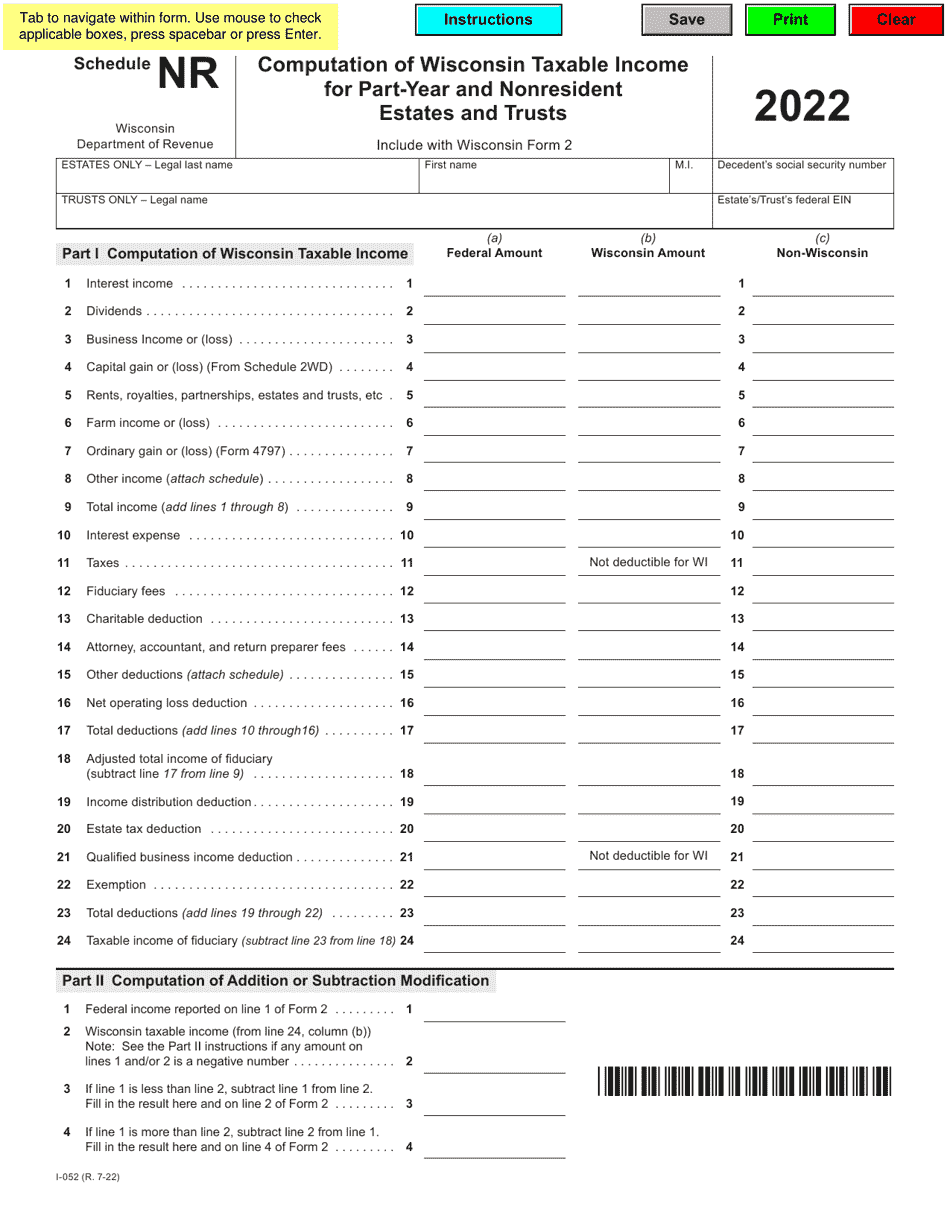

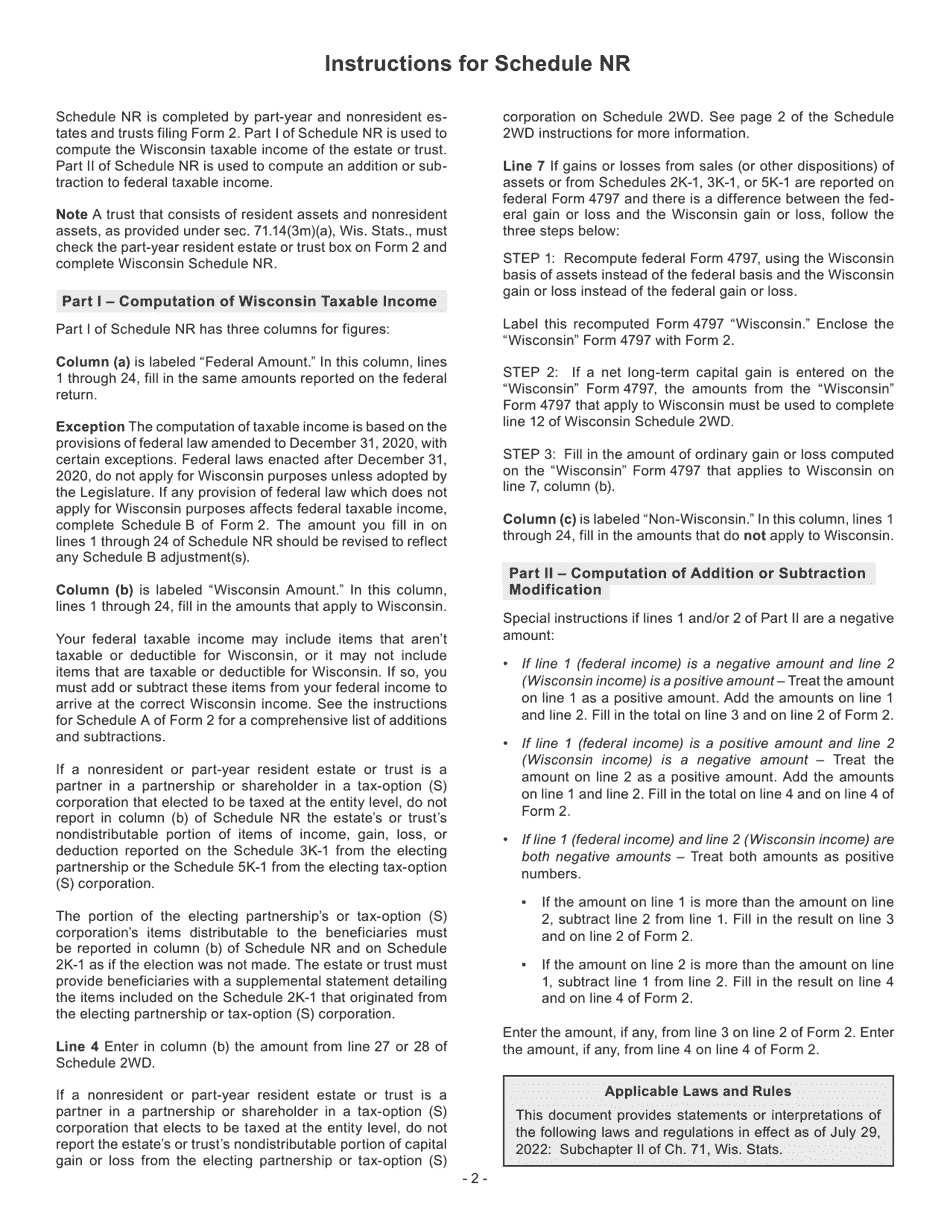

Form I-052 Schedule NR

for the current year.

Form I-052 Schedule NR Computation of Wisconsin Taxable Income for Part-Year and Nonresident Estates and Trusts - Wisconsin

What Is Form I-052 Schedule NR?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-052?

A: Form I-052 is the Schedule NR for calculating Wisconsin taxable income for part-year and nonresident estates and trusts in Wisconsin.

Q: Who needs to file Form I-052?

A: Form I-052 must be filed by part-year and nonresident estates and trusts who have income from Wisconsin sources.

Q: What is Wisconsin taxable income?

A: Wisconsin taxable income is the portion of income that is subject to Wisconsin state taxes.

Q: What is the purpose of Schedule NR?

A: The purpose of Schedule NR is to determine the correct amount of Wisconsin taxable income for part-year and nonresident estates and trusts.

Q: How do you calculate Wisconsin taxable income?

A: Wisconsin taxable income is calculated by determining the income from Wisconsin sources and subtracting any adjustments, exemptions, and credits.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-052 Schedule NR by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.