This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form I-056 Schedule NOL3

for the current year.

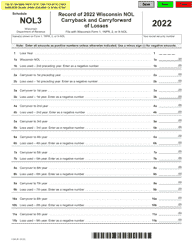

Instructions for Form I-056 Schedule NOL3 Record of Wisconsin Nol Carryback and Carryforward of Losses - Wisconsin

This document contains official instructions for Form I-056 Schedule NOL3, Record of Wisconsin Nol Carryback and Carryforward of Losses - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-056 Schedule NOL3 is available for download through this link.

FAQ

Q: What is Form I-056 Schedule NOL3?

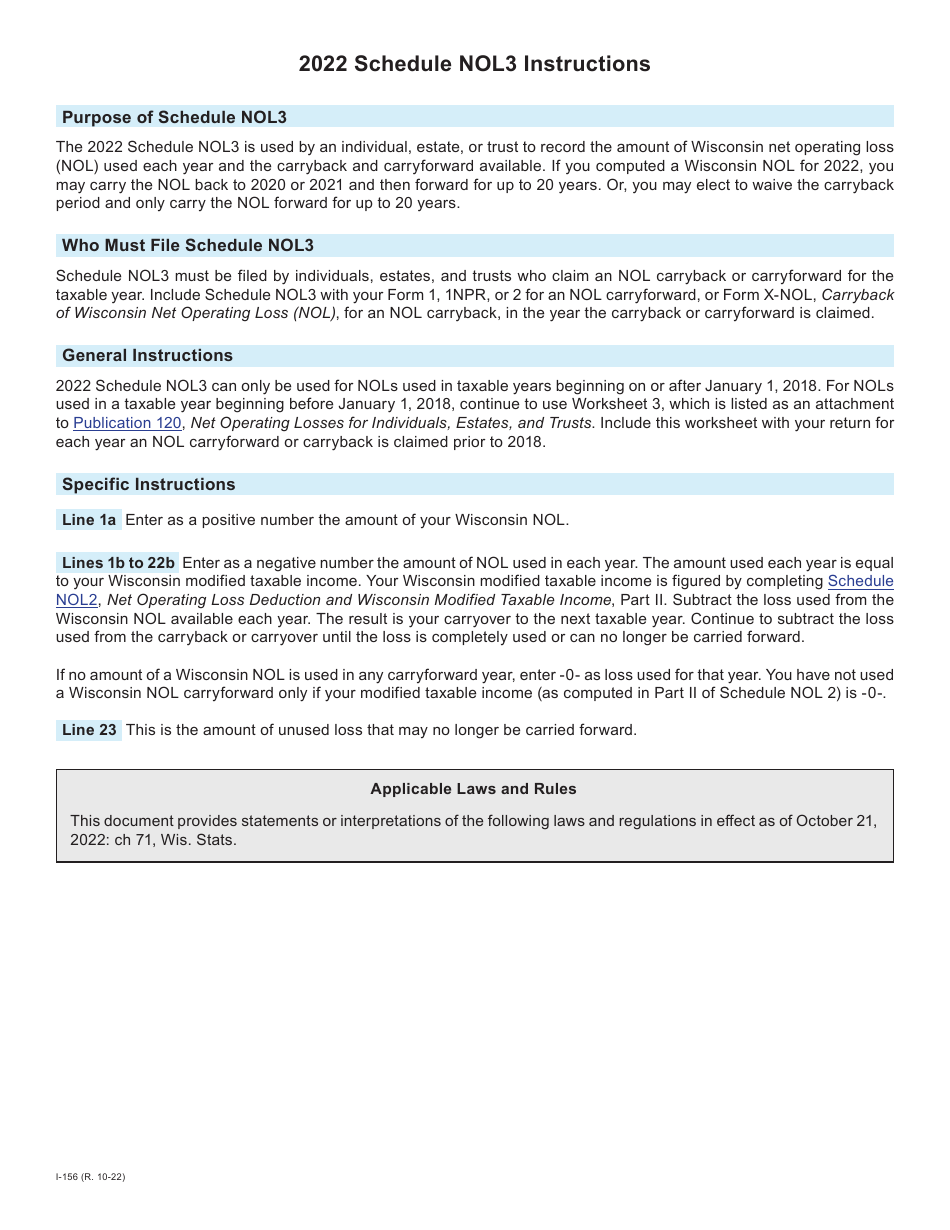

A: Form I-056 Schedule NOL3 is a form used for recording the Wisconsin NOL carryback and carryforward of losses.

Q: What is NOL?

A: NOL stands for Net Operating Loss.

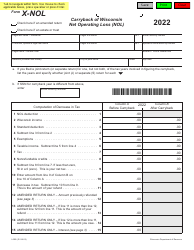

Q: What is a NOL carryback?

A: A NOL carryback is when a business applies its current year's losses to prior years' tax returns to get a refund.

Q: What is a NOL carryforward?

A: A NOL carryforward is when a business applies its current year's losses to future years' tax returns to reduce taxable income.

Q: Who needs to file Form I-056 Schedule NOL3?

A: Taxpayers in Wisconsin who have net operating losses and want to carry back or carry forward those losses must file Form I-056 Schedule NOL3.

Q: When is the deadline for filing Form I-056 Schedule NOL3?

A: The deadline for filing Form I-056 Schedule NOL3 is generally the same as the deadline for filing your Wisconsin income tax return.

Q: What information is required on Form I-056 Schedule NOL3?

A: Form I-056 Schedule NOL3 requires information about the taxpayer's net operating losses, including the amount of the loss and the tax year to which it applies.

Q: Can I carry back my NOL to another state?

A: No, Form I-056 Schedule NOL3 is specific to Wisconsin and cannot be used to carry back NOLs to another state.

Q: Can I amend my Wisconsin NOL carryback or carryforward?

A: Yes, if you need to make changes to your NOL carryback or carryforward, you can file an amended Form I-056 Schedule NOL3.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.