This version of the form is not currently in use and is provided for reference only. Download this version of

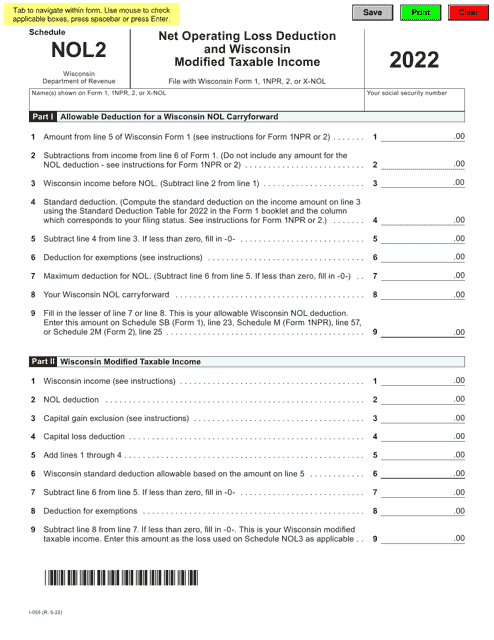

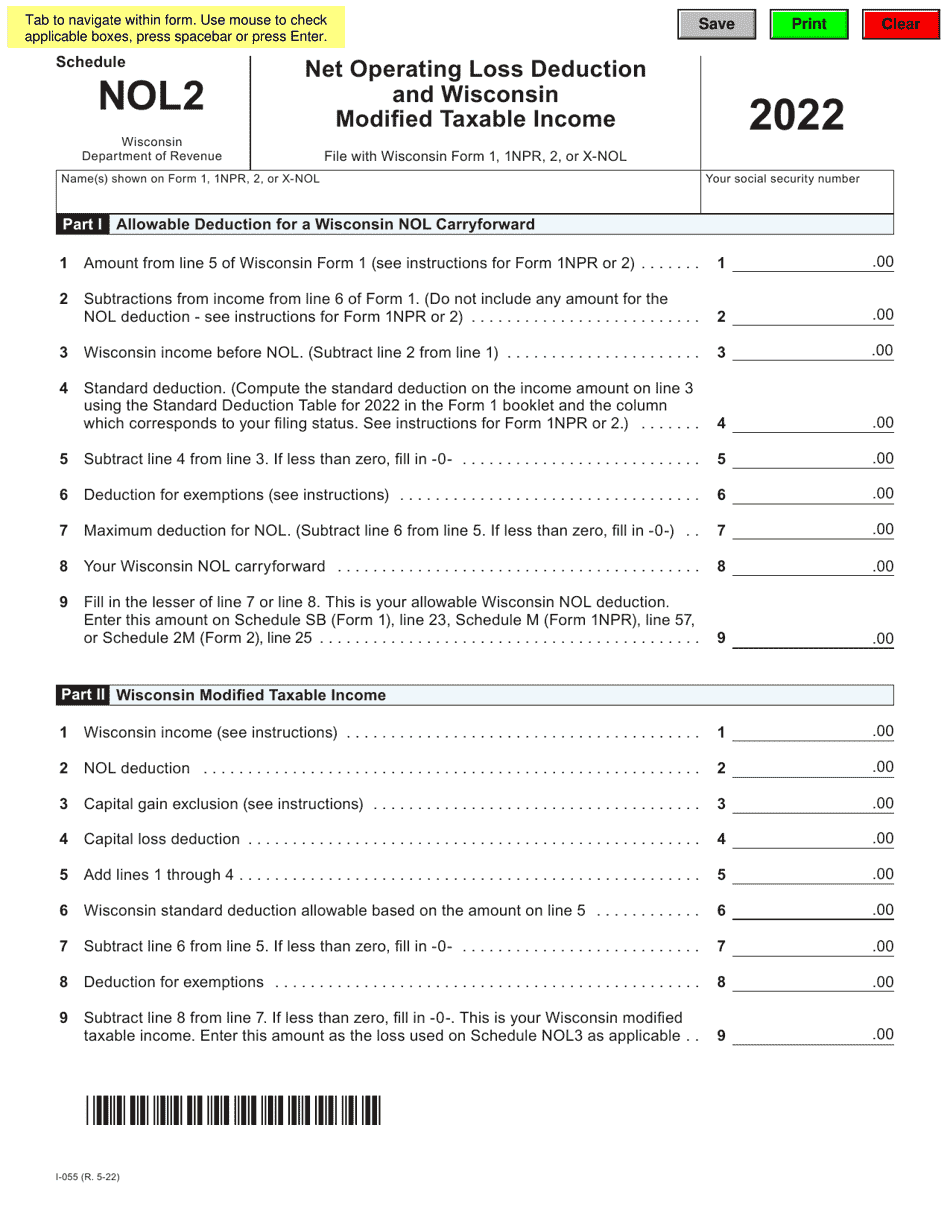

Form I-055 Schedule NOL2

for the current year.

Form I-055 Schedule NOL2 Net Operating Loss Deduction and Wisconsin Modified Taxable Income - Wisconsin

What Is Form I-055 Schedule NOL2?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-055?

A: Form I-055 is a schedule used for reporting the net operating loss deduction and Wisconsin modified taxable income in Wisconsin.

Q: What is the net operating loss deduction?

A: The net operating loss deduction allows businesses to offset their taxable income by deducting losses from previous years.

Q: What is Wisconsin modified taxable income?

A: Wisconsin modified taxable income is the amount of income that is subject to taxation in the state of Wisconsin after certain modifications.

Q: Why is Form I-055 used?

A: Form I-055 is used to calculate and report the net operating loss deduction and Wisconsin modified taxable income on the Wisconsin tax return.

Q: Who is required to file Form I-055?

A: Businesses operating in Wisconsin that have incurred net operating losses and need to claim the net operating loss deduction.

Q: Are there any specific instructions for filling out Form I-055?

A: Yes, detailed instructions are provided with the form to guide taxpayers through the process of completing the schedule.

Q: Is the net operating loss deduction available for individuals?

A: No, the net operating loss deduction is only available for businesses.

Q: What modifications are made to taxable income for Wisconsin?

A: Modifications may include additions or subtractions for items such as federal deductions or exemptions that are not allowed under Wisconsin law.

Q: Can I use Form I-055 for federal tax purposes?

A: No, Form I-055 is specifically designed for reporting net operating loss deduction and Wisconsin modified taxable income for Wisconsin state taxes only.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-055 Schedule NOL2 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.