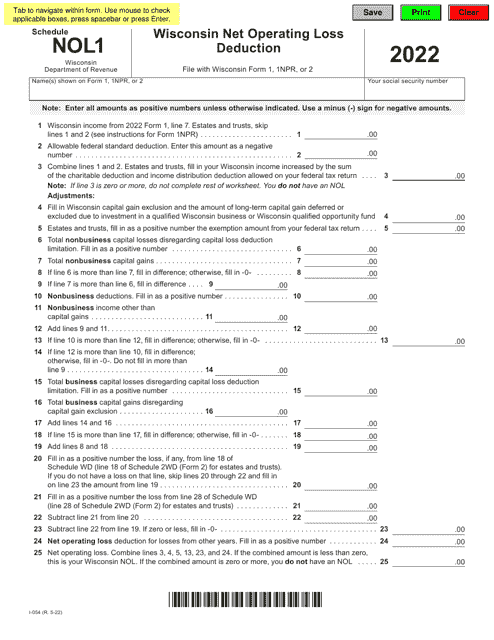

This version of the form is not currently in use and is provided for reference only. Download this version of

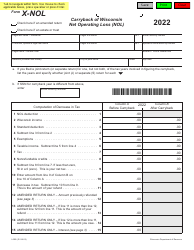

Form I-054 Schedule NOL1

for the current year.

Form I-054 Schedule NOL1 Wisconsin Net Operating Loss Deduction - Wisconsin

What Is Form I-054 Schedule NOL1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-054?

A: Form I-054 is the Schedule NOL1 used in Wisconsin to claim the Net Operating Loss Deduction.

Q: What is the Wisconsin Net Operating Loss Deduction?

A: The Wisconsin Net Operating Loss Deduction allows individuals and businesses to deduct their net operating losses from their Wisconsin taxable income.

Q: Who can use Form I-054?

A: Form I-054 can be used by individuals and businesses who have a net operating loss in Wisconsin and want to claim the corresponding deduction.

Q: How do I claim the Wisconsin Net Operating Loss Deduction?

A: To claim the Wisconsin Net Operating Loss Deduction, you need to complete Form I-054 and attach it to your Wisconsin income tax return.

Q: Are there any specific requirements for claiming the Wisconsin Net Operating Loss Deduction?

A: Yes, there are specific requirements for claiming the Wisconsin Net Operating Loss Deduction. These requirements are detailed in the instructions accompanying Form I-054.

Q: Can I carry forward unused net operating losses in Wisconsin?

A: Yes, you can carry forward unused net operating losses in Wisconsin for up to 15 years.

Q: Is there a limit to the amount I can deduct as a net operating loss in Wisconsin?

A: No, there is no limit to the amount you can deduct as a net operating loss in Wisconsin. However, the deduction is subject to certain limitations and calculations, as explained in the instructions accompanying Form I-054.

Q: Do I need to keep any documentation to support my net operating loss deduction in Wisconsin?

A: Yes, you should keep documentation to support your net operating loss deduction in Wisconsin. This documentation may be requested by the Wisconsin Department of Revenue during an audit or review.

Q: Can I use Form I-054 to claim a net operating loss deduction in states other than Wisconsin?

A: No, Form I-054 is specific to claiming the net operating loss deduction in Wisconsin only. If you have a net operating loss in another state, you should consult that state's tax forms and instructions.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-054 Schedule NOL1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.