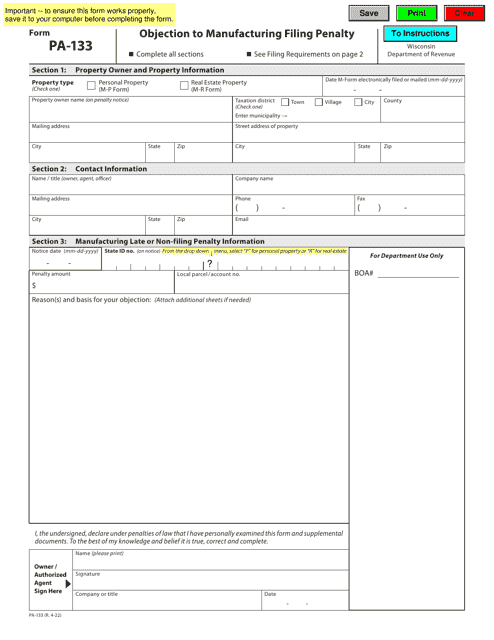

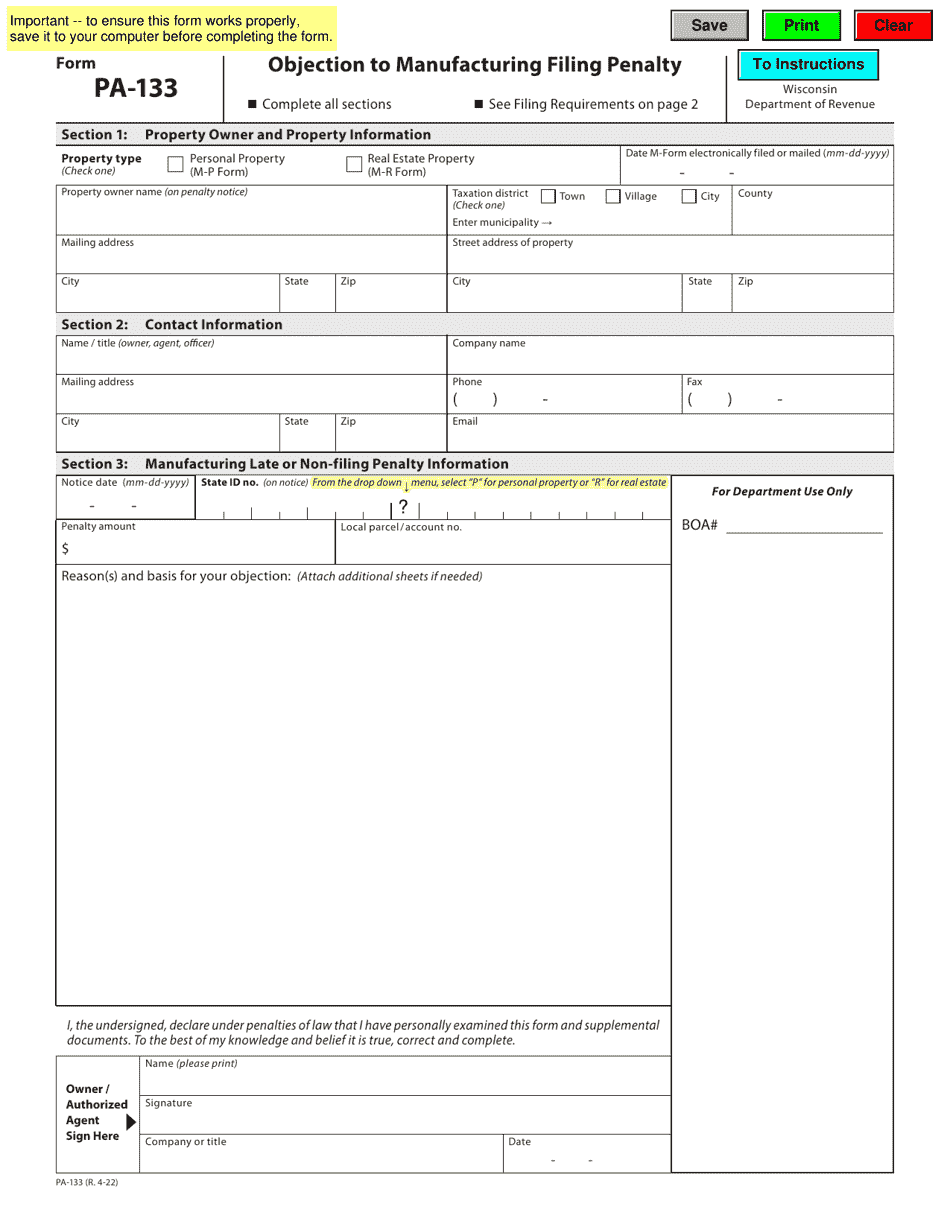

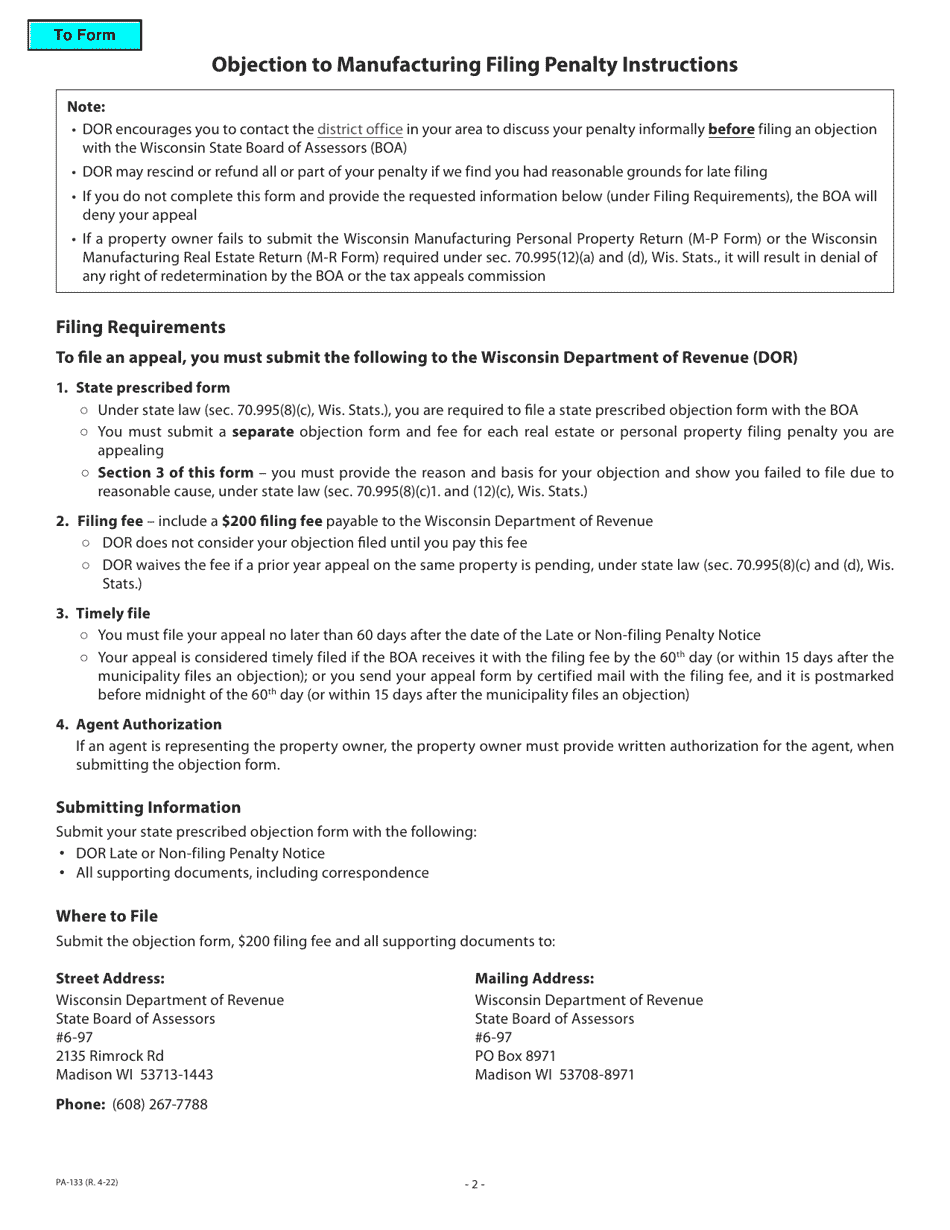

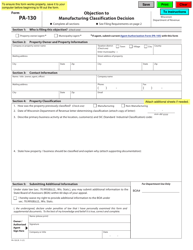

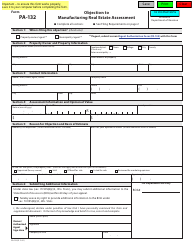

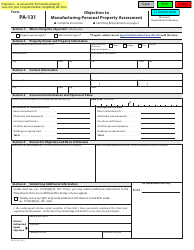

Form PA-133 Objection to Manufacturing Filing Penalty - Wisconsin

What Is Form PA-133?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PA-133?

A: Form PA-133 is an objection form to a manufacturing filing penalty in Wisconsin.

Q: What is a manufacturing filing penalty?

A: A manufacturing filing penalty is a penalty imposed for not filing required manufacturing reports or documents.

Q: Who uses form PA-133?

A: Form PA-133 is used by individuals or businesses in Wisconsin who want to object to a manufacturing filing penalty.

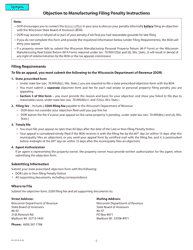

Q: What should I include with form PA-133?

A: When filing form PA-133, you should include any supporting documentation or evidence that supports your objection to the manufacturing filing penalty.

Q: What happens after I file form PA-133?

A: After you file form PA-133, the Wisconsin Department of Revenue will review your objection and make a decision regarding the manufacturing filing penalty.

Q: Can I appeal the decision made on my form PA-133?

A: Yes, if you disagree with the decision made on your form PA-133, you can appeal the decision through the appropriate channels within the Wisconsin Department of Revenue.

Q: Is there a deadline for filing form PA-133?

A: Yes, there is a deadline for filing form PA-133. The specific deadline will be stated on the notice or assessment that you received regarding the manufacturing filing penalty.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-133 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.