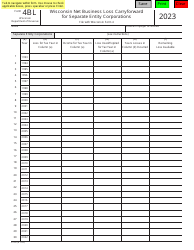

This version of the form is not currently in use and is provided for reference only. Download this version of

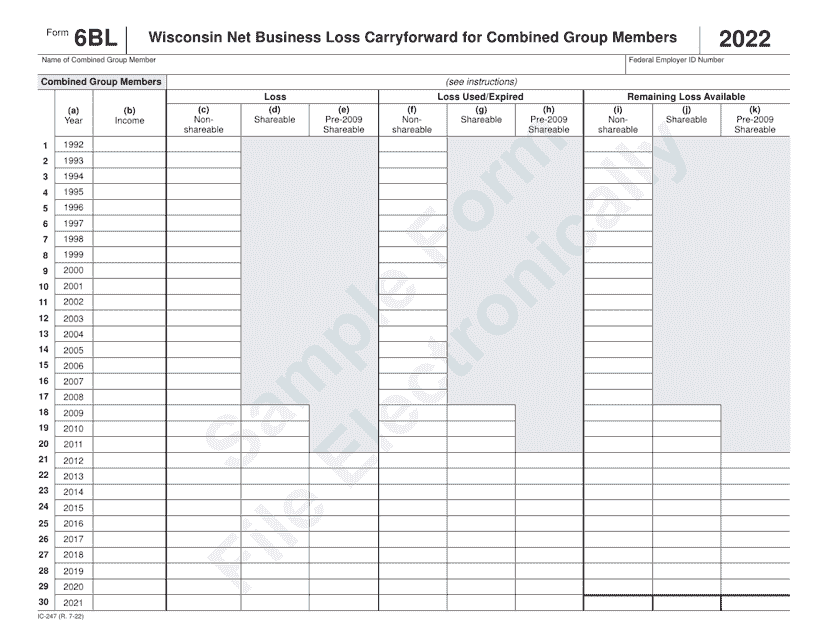

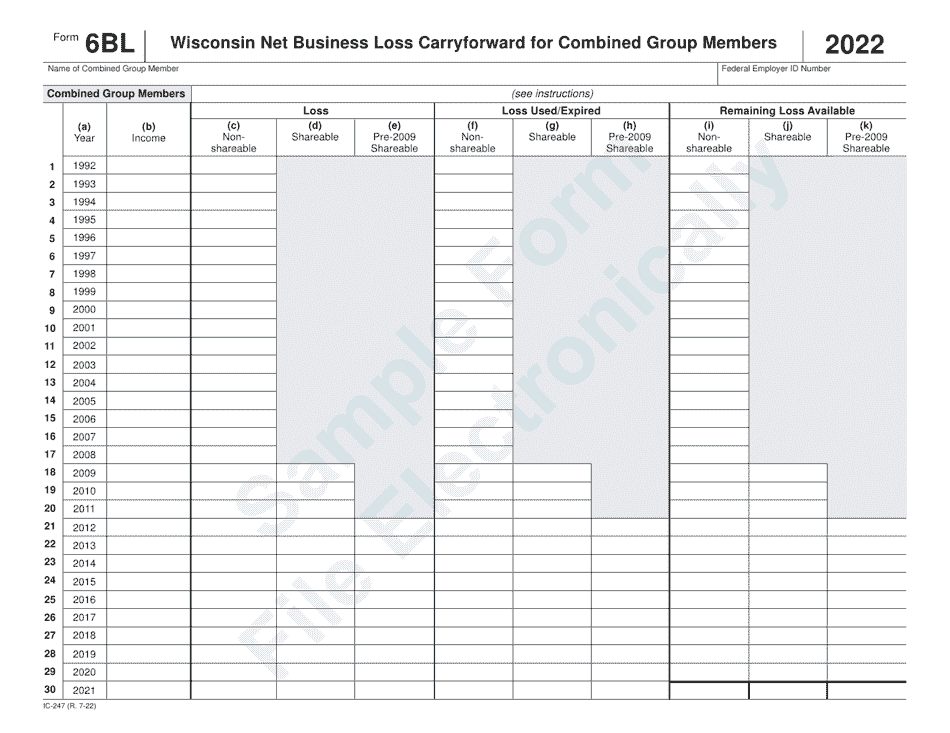

Form 6BL (IC-247)

for the current year.

Form 6BL (IC-247) Wisconsin Net Business Loss Carryforward for Combined Group Members - Sample - Wisconsin

What Is Form 6BL (IC-247)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 6BL (IC-247)?

A: Form 6BL (IC-247) is a tax form used in Wisconsin for reporting net business loss carryforwards for combined group members.

Q: Who is required to file Form 6BL (IC-247)?

A: Combined group members in Wisconsin who have net business loss carryforwards are required to file this form.

Q: What is a net business loss carryforward?

A: A net business loss carryforward is a tax deduction that allows businesses to offset future taxable income with past losses.

Q: What is a combined group?

A: A combined group refers to a group of corporations that elect to file a combined tax return in Wisconsin.

Q: Why would a combined group member need to report net business loss carryforwards?

A: Reporting net business loss carryforwards allows combined group members to utilize past losses to reduce their future tax liability.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6BL (IC-247) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.