This version of the form is not currently in use and is provided for reference only. Download this version of

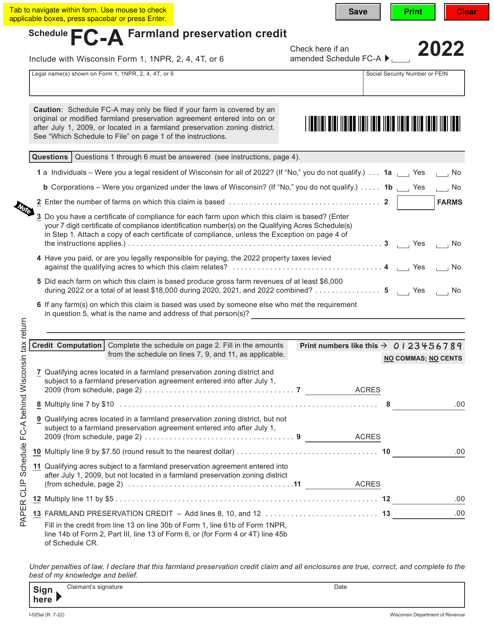

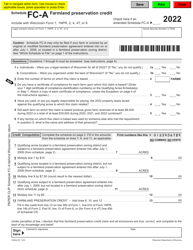

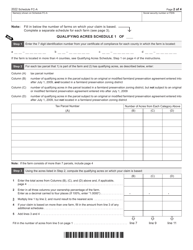

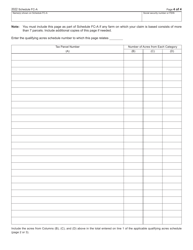

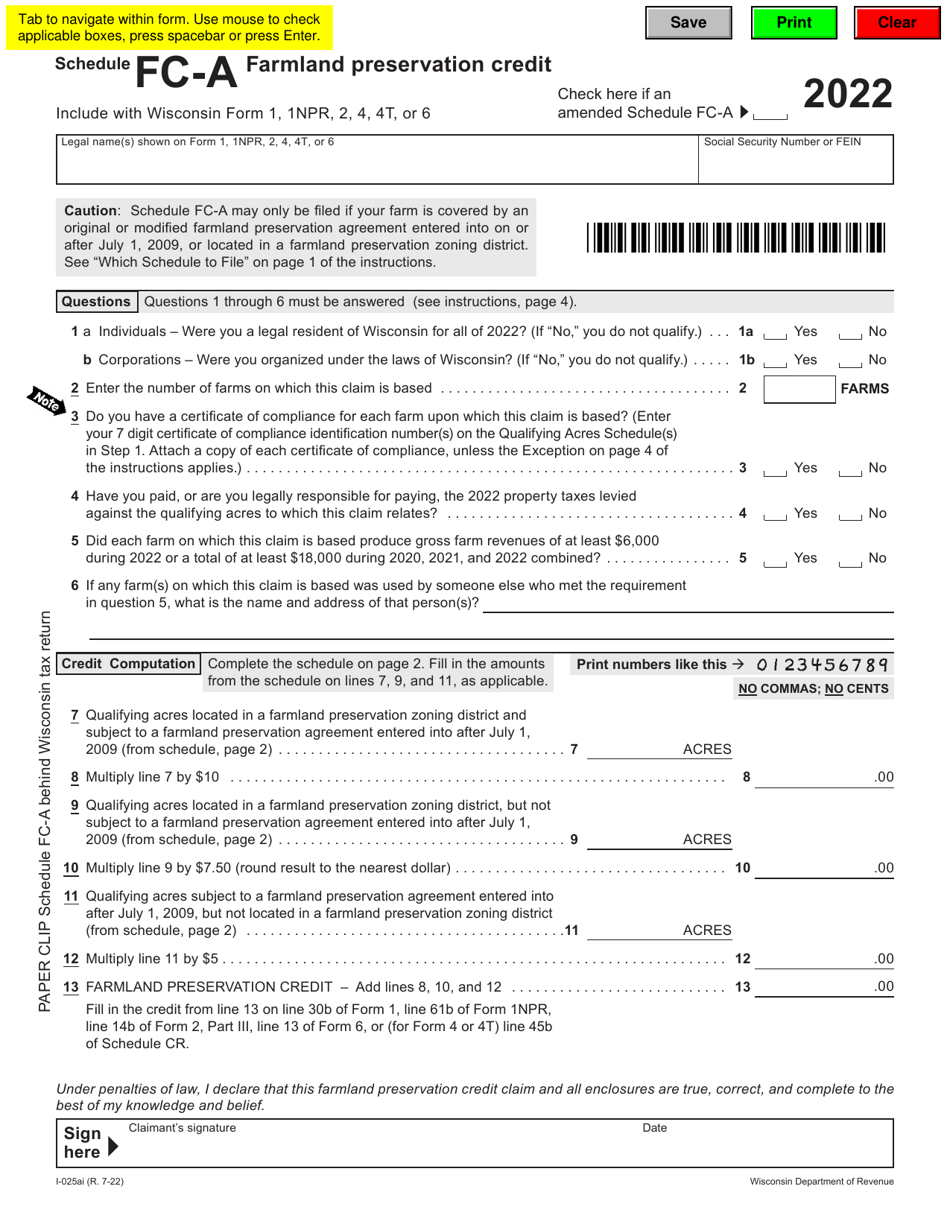

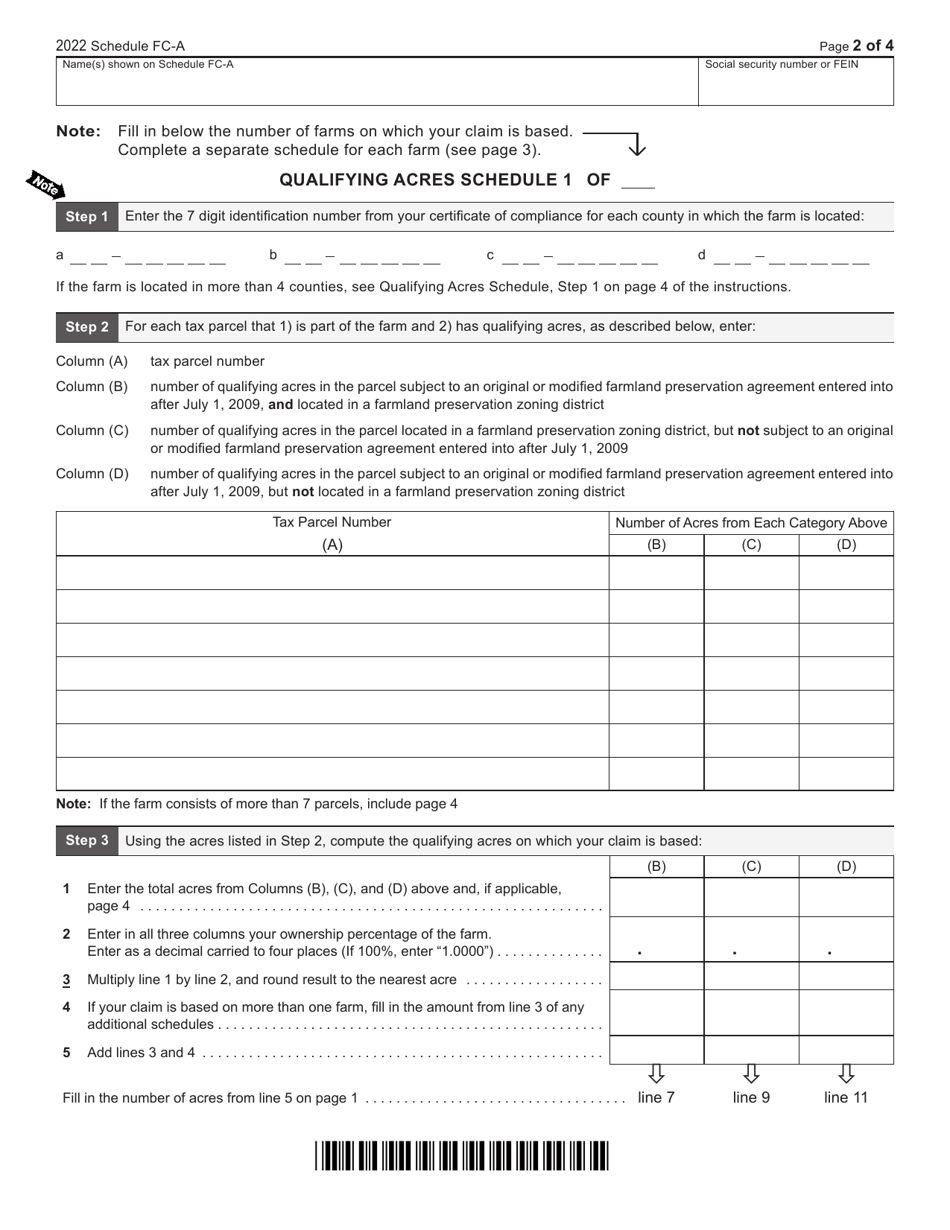

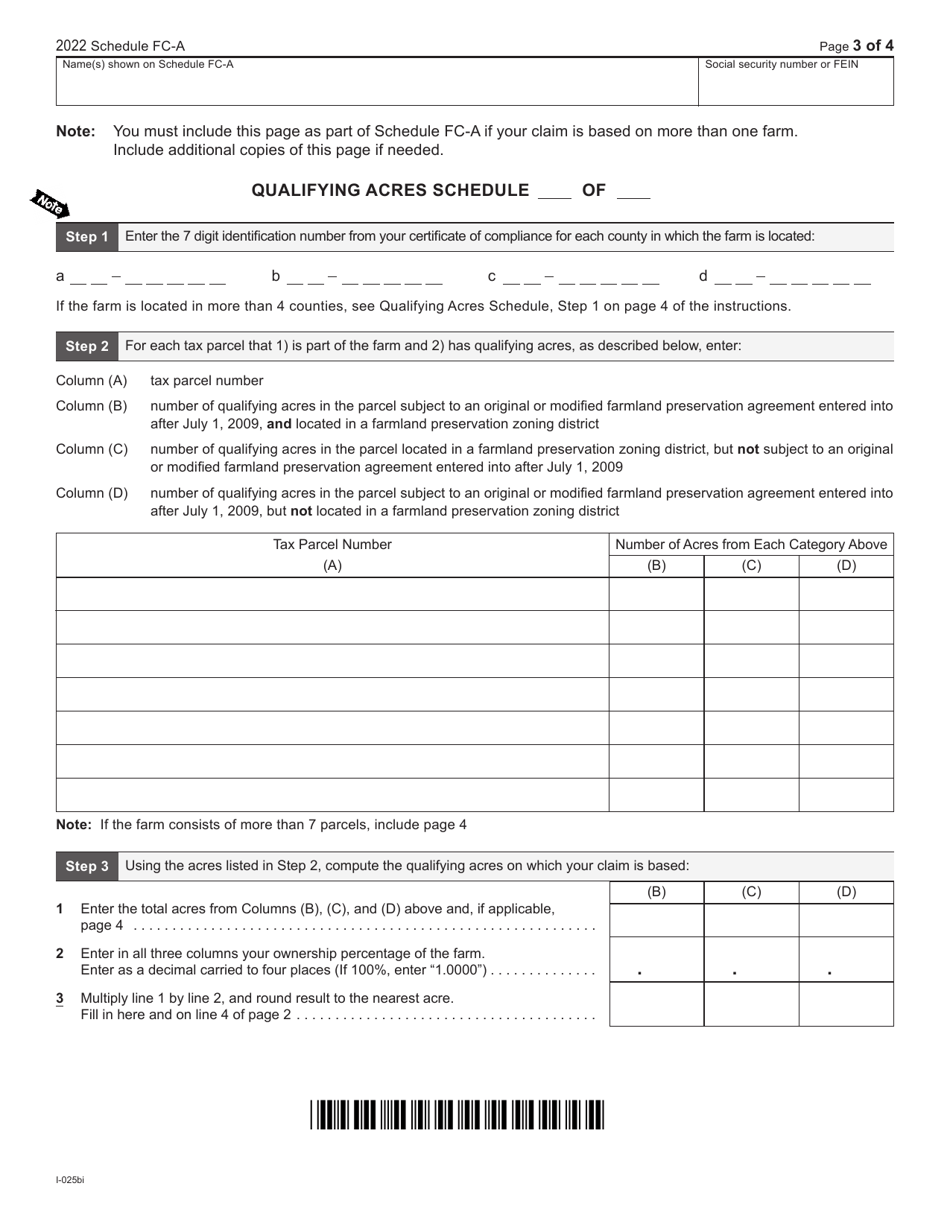

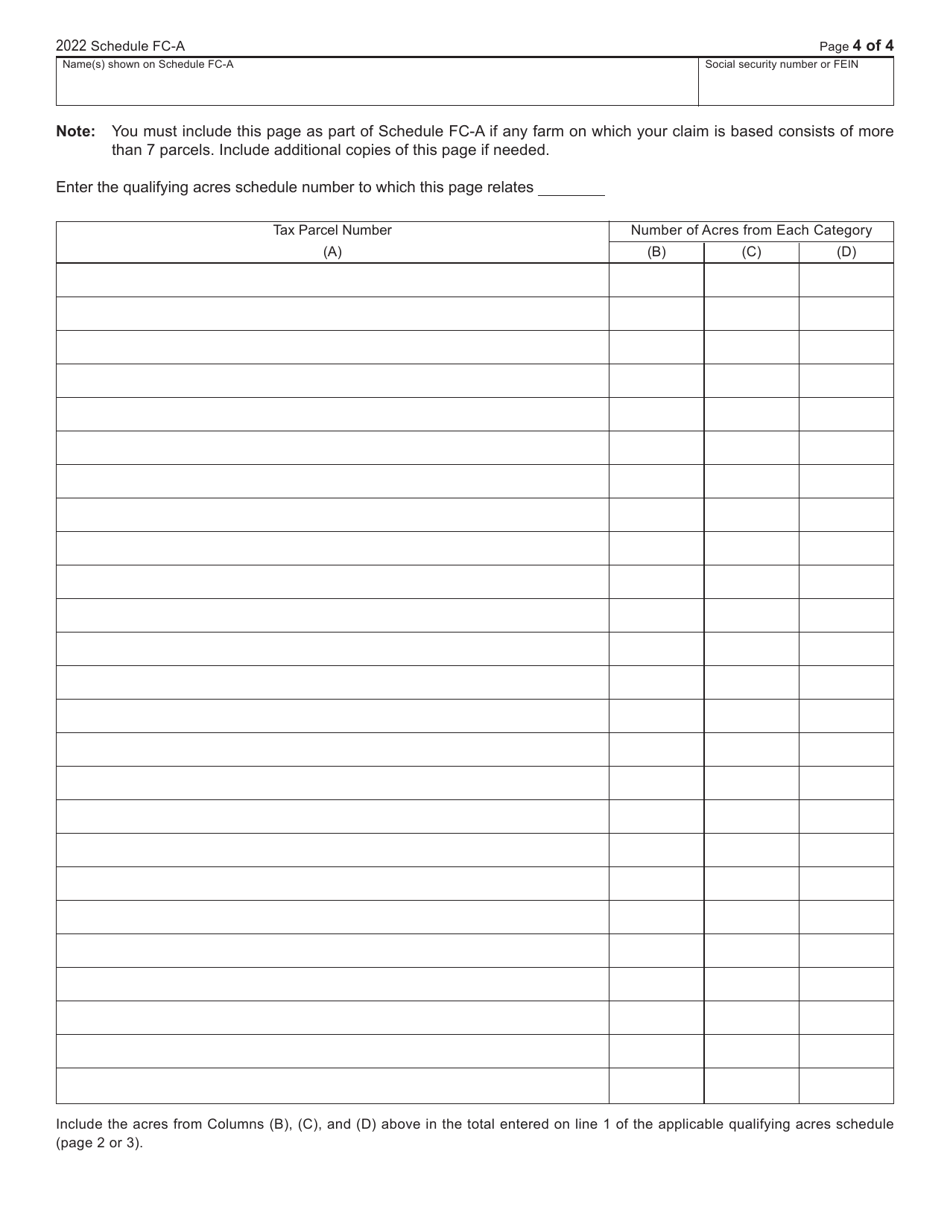

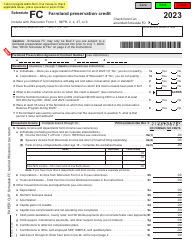

Form I-025AI Schedule FC-A

for the current year.

Form I-025AI Schedule FC-A Farmland Preservation Credit - Wisconsin

What Is Form I-025AI Schedule FC-A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-025AI?

A: Form I-025AI is the Schedule FC-A Farmland Preservation Credit form used in Wisconsin.

Q: What is the purpose of the Farmland Preservation Credit?

A: The Farmland Preservation Credit is designed to provide tax relief to farmers in Wisconsin who qualify for farmland preservation.

Q: Who is eligible to claim the Farmland Preservation Credit?

A: To be eligible, you must be an owner of farmland in Wisconsin that is subject to a farmland preservation agreement.

Q: How do I claim the Farmland Preservation Credit?

A: You need to complete and submit Form I-025AI, the Schedule FC-A Farmland Preservation Credit form, along with your Wisconsin income tax return.

Q: Are there any requirements or restrictions to claim the Farmland Preservation Credit?

A: Yes, there are certain criteria you must meet, including having a certified farmland preservation agreement and meeting certain income limits.

Q: Is there a deadline to file the Farmland Preservation Credit?

A: Yes, the deadline to file the Farmland Preservation Credit is the same as the deadline for filing your Wisconsin income tax return.

Q: Can I claim the Farmland Preservation Credit if I don't live in Wisconsin?

A: No, the Farmland Preservation Credit is only available to Wisconsin residents who own farmland in the state.

Q: What happens if I claim the Farmland Preservation Credit incorrectly?

A: If you claim the credit incorrectly, you may have to pay back any excess credit you received, and you may also face penalties and interest.

Q: Is the Farmland Preservation Credit refundable?

A: No, the Farmland Preservation Credit is not refundable. It can only be used to offset your Wisconsin income tax liability.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-025AI Schedule FC-A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.