This version of the form is not currently in use and is provided for reference only. Download this version of

Form 6CL (IC-444)

for the current year.

Form 6CL (IC-444) Wisconsin Capital Loss Adjustment - Sample - Wisconsin

What Is Form 6CL (IC-444)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

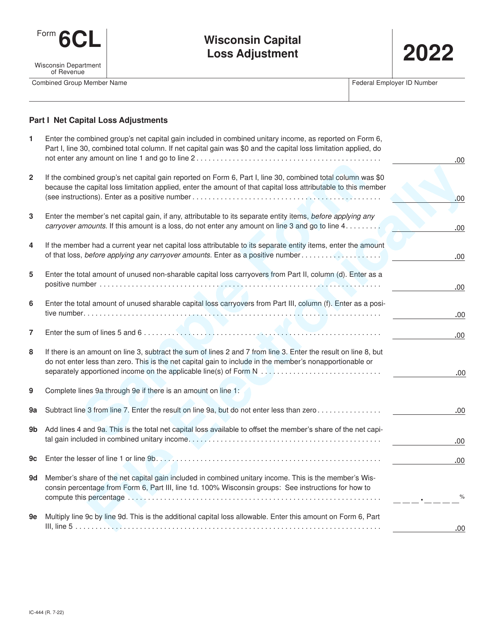

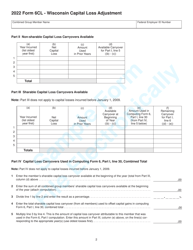

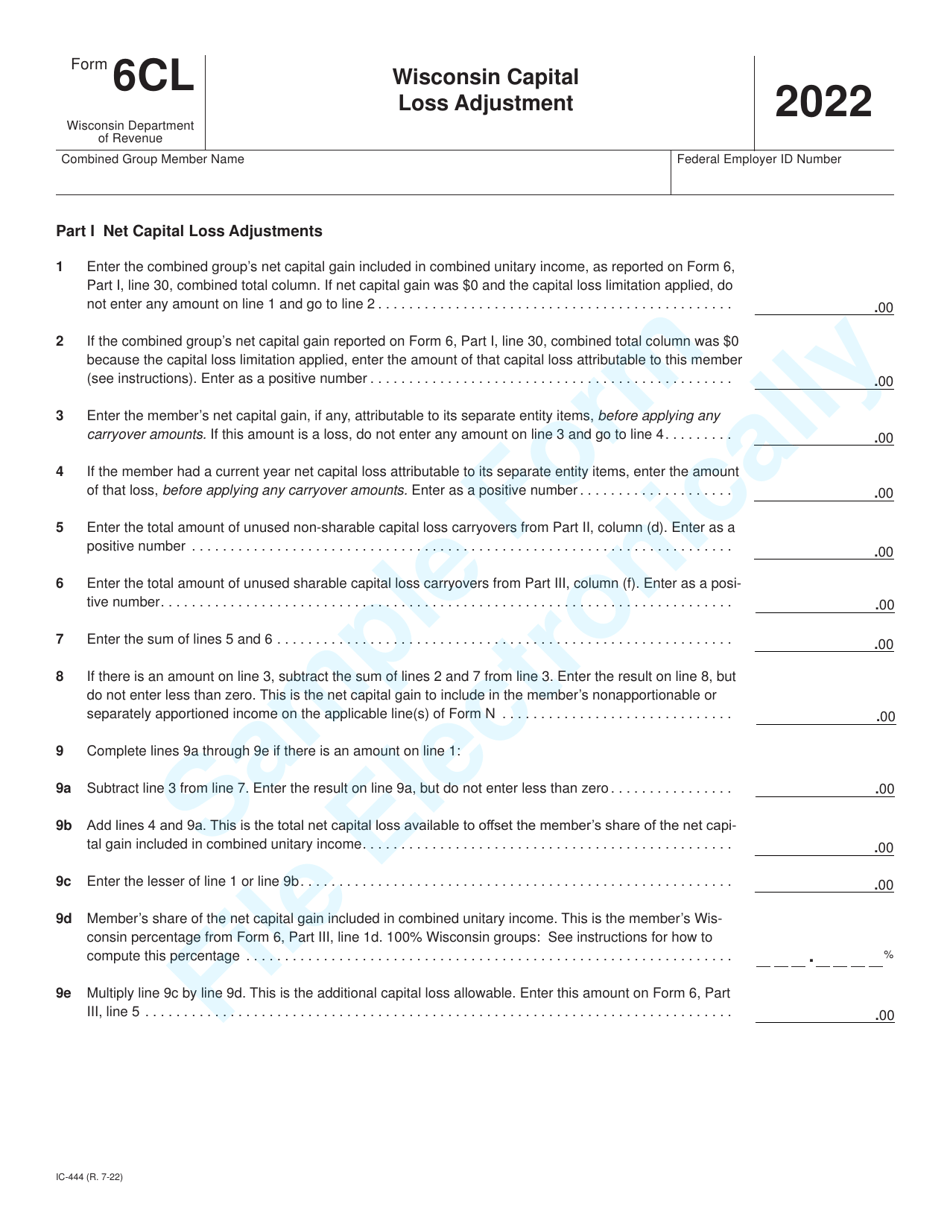

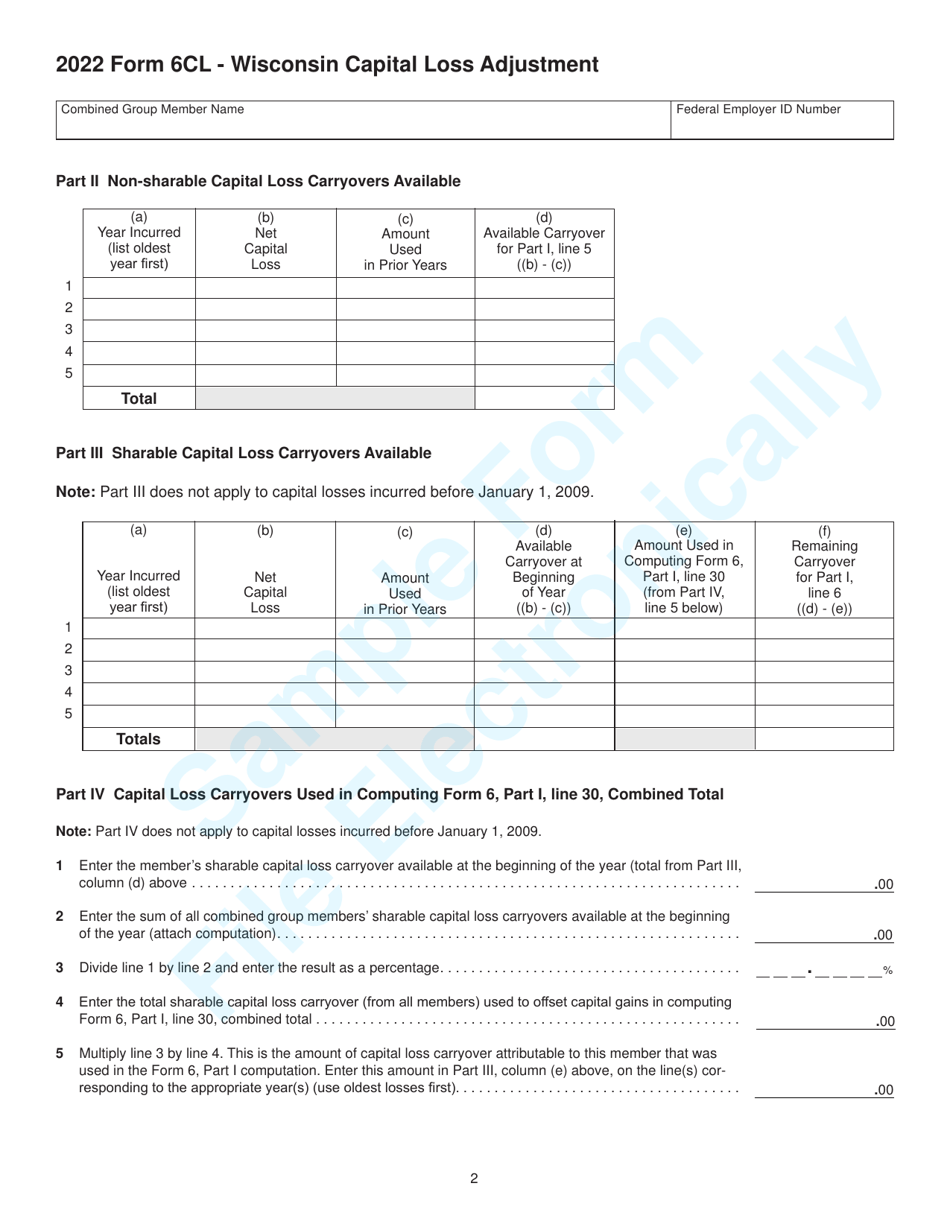

Q: What is Form 6CL (IC-444)?

A: Form 6CL (IC-444) is a Wisconsin tax form used for the Capital Loss Adjustment.

Q: What is the purpose of Form 6CL?

A: The purpose of Form 6CL is to calculate and report the capital loss adjustment on your Wisconsin income tax return.

Q: Who needs to file Form 6CL?

A: You need to file Form 6CL if you had a capital loss from the sale or exchange of property in a previous tax year.

Q: What is a capital loss?

A: A capital loss occurs when you sell or exchange property for less than its adjusted basis.

Q: How do I calculate the capital loss adjustment?

A: To calculate the capital loss adjustment, you need to determine your Wisconsin capital loss and adjust it for any federal tax benefits.

Q: When is Form 6CL due?

A: Form 6CL is due on the same date as your Wisconsin income tax return, which is typically April 15th.

Q: Can I file Form 6CL electronically?

A: Yes, you can file Form 6CL electronically if you are e-filing your Wisconsin income tax return.

Q: What should I do if I have questions about Form 6CL?

A: If you have questions about Form 6CL, you should contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6CL (IC-444) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.