This version of the form is not currently in use and is provided for reference only. Download this version of

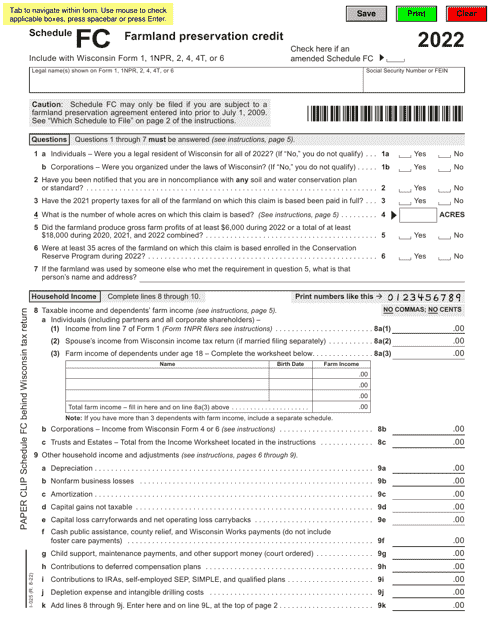

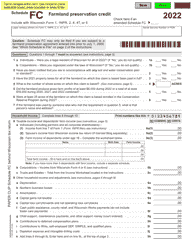

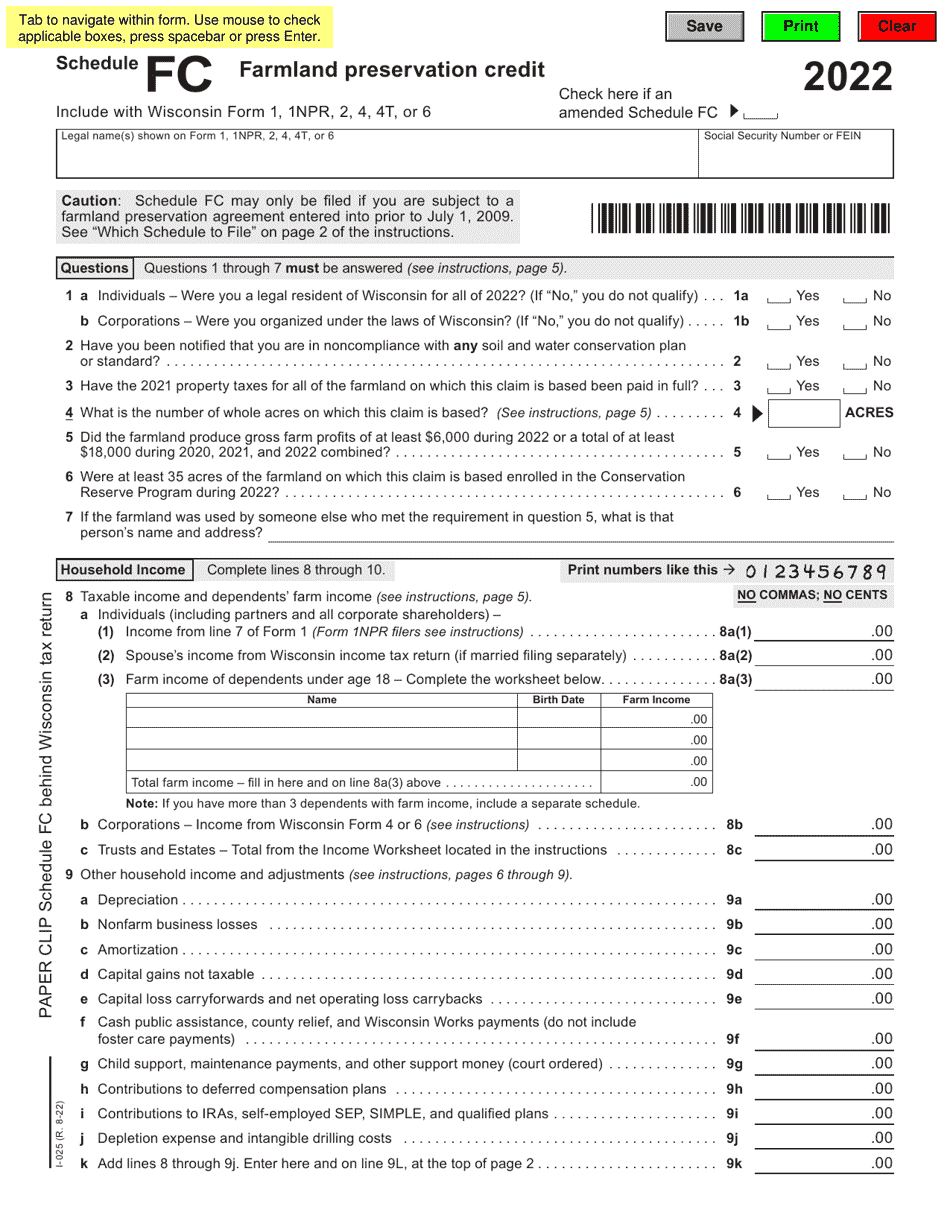

Form I-025 Schedule FC

for the current year.

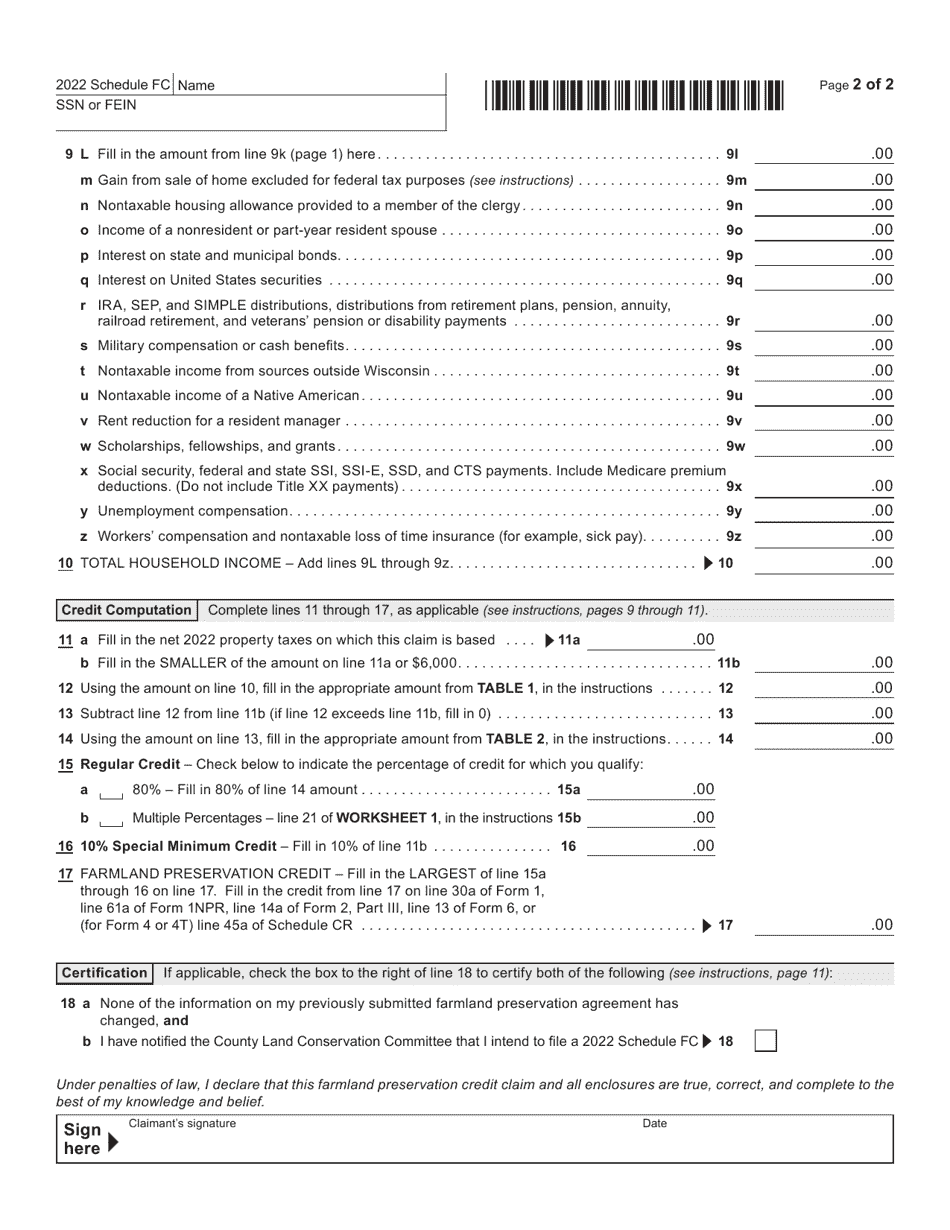

Form I-025 Schedule FC Farmland Preservation Credit - Wisconsin

What Is Form I-025 Schedule FC?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-025 Schedule FC?

A: Form I-025 Schedule FC is a tax form used in Wisconsin to claim the Farmland Preservation Credit.

Q: What is the Farmland Preservation Credit?

A: The Farmland Preservation Credit is a tax credit available to eligible farmers in Wisconsin who agree to preserve their land for agricultural purposes.

Q: How do I qualify for the Farmland Preservation Credit?

A: To qualify for the Farmland Preservation Credit, you must meet certain criteria set by the Wisconsin Department of Revenue. This includes owning or leasing eligible agricultural land and following specific farming practices.

Q: What farming practices are required to qualify for the Farmland Preservation Credit?

A: To qualify for the Farmland Preservation Credit, you must follow specific farming practices, such as having a qualifying agricultural use for the land, maintaining minimum acreage requirements, and complying with nutrient management requirements.

Q: How do I fill out Form I-025 Schedule FC?

A: To fill out Form I-025 Schedule FC, you will need to provide information about your agricultural activities, land ownership or lease agreement details, and any other required documentation. You may also need to calculate the credit amount using the instructions provided.

Q: When is the deadline to file Form I-025 Schedule FC?

A: The deadline to file Form I-025 Schedule FC is typically the same as the deadline for filing your Wisconsin income tax return, which is usually April 15th, unless it falls on a weekend or holiday.

Q: Can I file Form I-025 Schedule FC electronically?

A: Yes, you can file Form I-025 Schedule FC electronically if you are filing your Wisconsin income tax return electronically. However, if you are filing a paper return, you will need to include the completed Schedule FC with your return.

Q: What should I do if I have questions or need assistance with Form I-025 Schedule FC?

A: If you have questions or need assistance with Form I-025 Schedule FC, you can contact the Wisconsin Department of Revenue for guidance and support.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-025 Schedule FC by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.