This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4466W (IC-831)

for the current year.

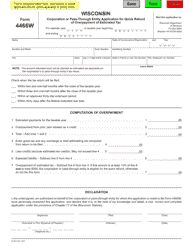

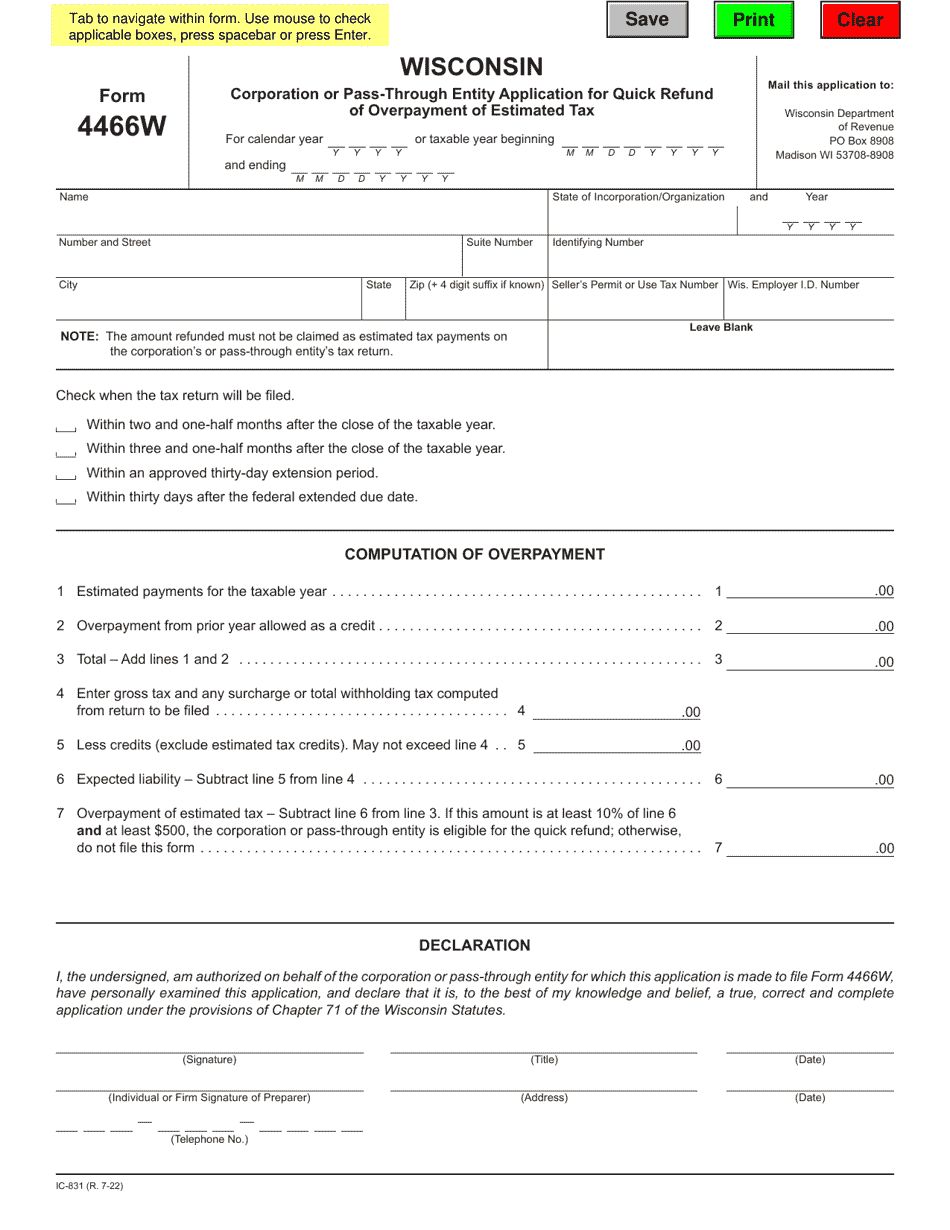

Form 4466W (IC-831) Wisconsin Corporation or Pass-Through Entity Application for Quick Refund of Overpayment of Estimated Tax - Wisconsin

What Is Form 4466W (IC-831)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4466W?

A: Form 4466W is the Wisconsin Corporation or Pass-Through Entity Application for Quick Refund of Overpayment of Estimated Tax.

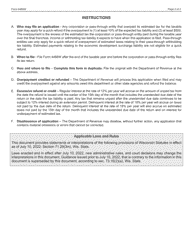

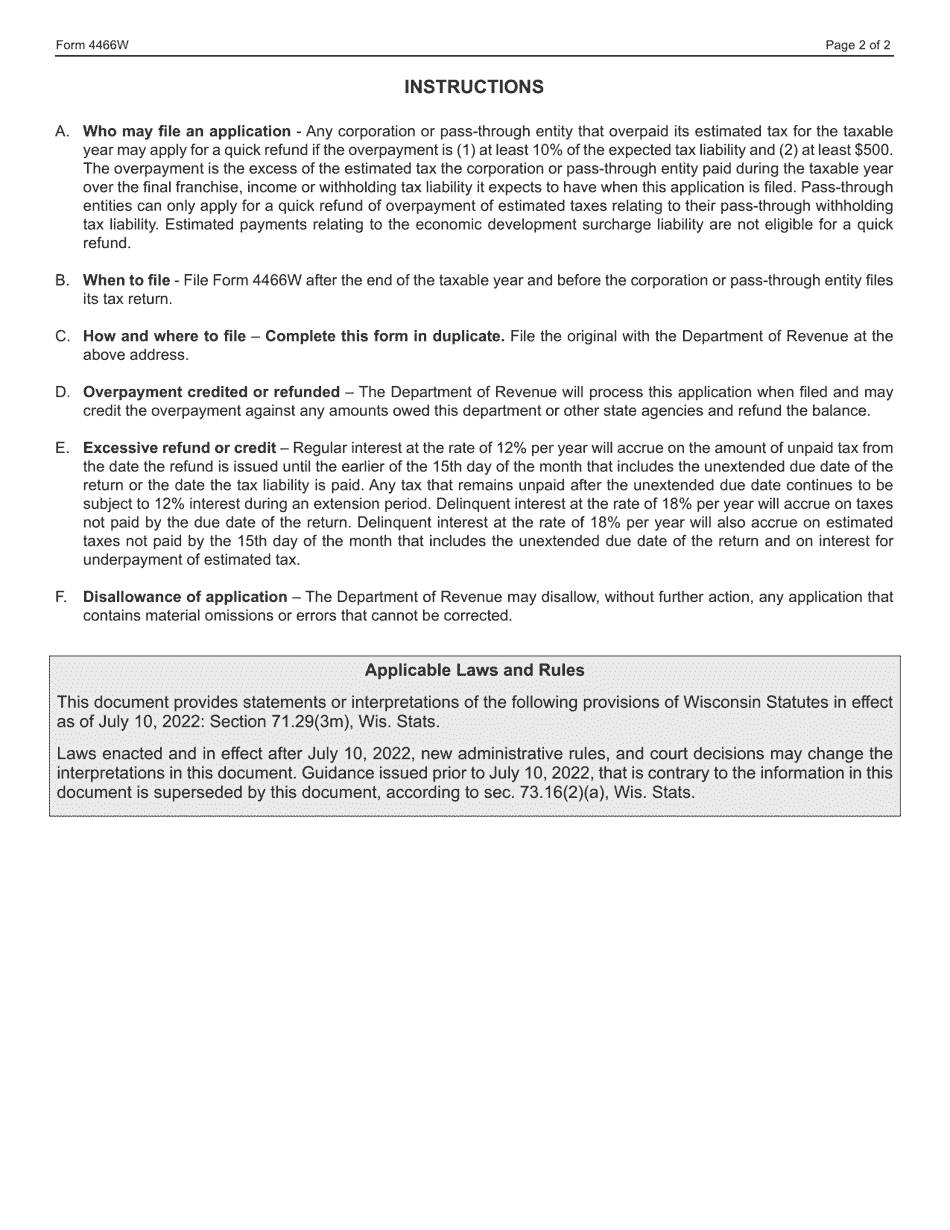

Q: Who can use Form 4466W?

A: The form is used by Wisconsin corporations or pass-through entities to apply for a quick refund of overpaid estimated tax.

Q: What is the purpose of Form 4466W?

A: The purpose of Form 4466W is to request a quick refund of overpaid estimated tax by Wisconsin corporations or pass-through entities.

Q: Is there a specific deadline to submit Form 4466W?

A: Yes, the form must be filed within 12 months from the original due date of the return or the date of overpayment, whichever is later.

Q: Are there any fees associated with filing Form 4466W?

A: No, there are no fees associated with filing Form 4466W.

Q: What documentation is required when filing Form 4466W?

A: You must include supporting documentation, such as federal Form 4466 or federal Schedule A.

Q: How long does it take to process Form 4466W?

A: The Wisconsin Department of Revenue typically processes refund requests within 90 days.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4466W (IC-831) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.