This version of the form is not currently in use and is provided for reference only. Download this version of

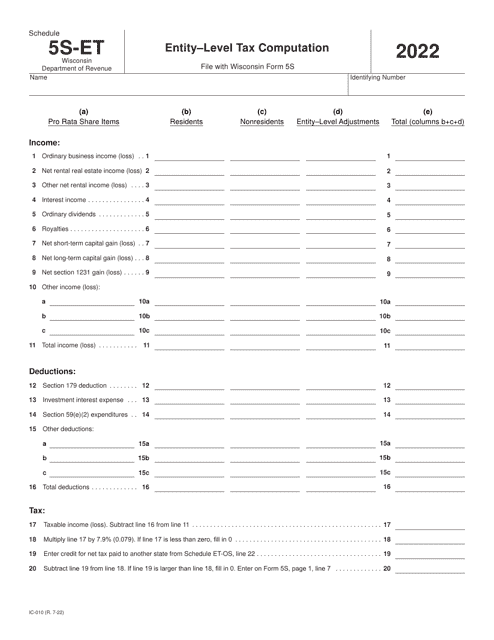

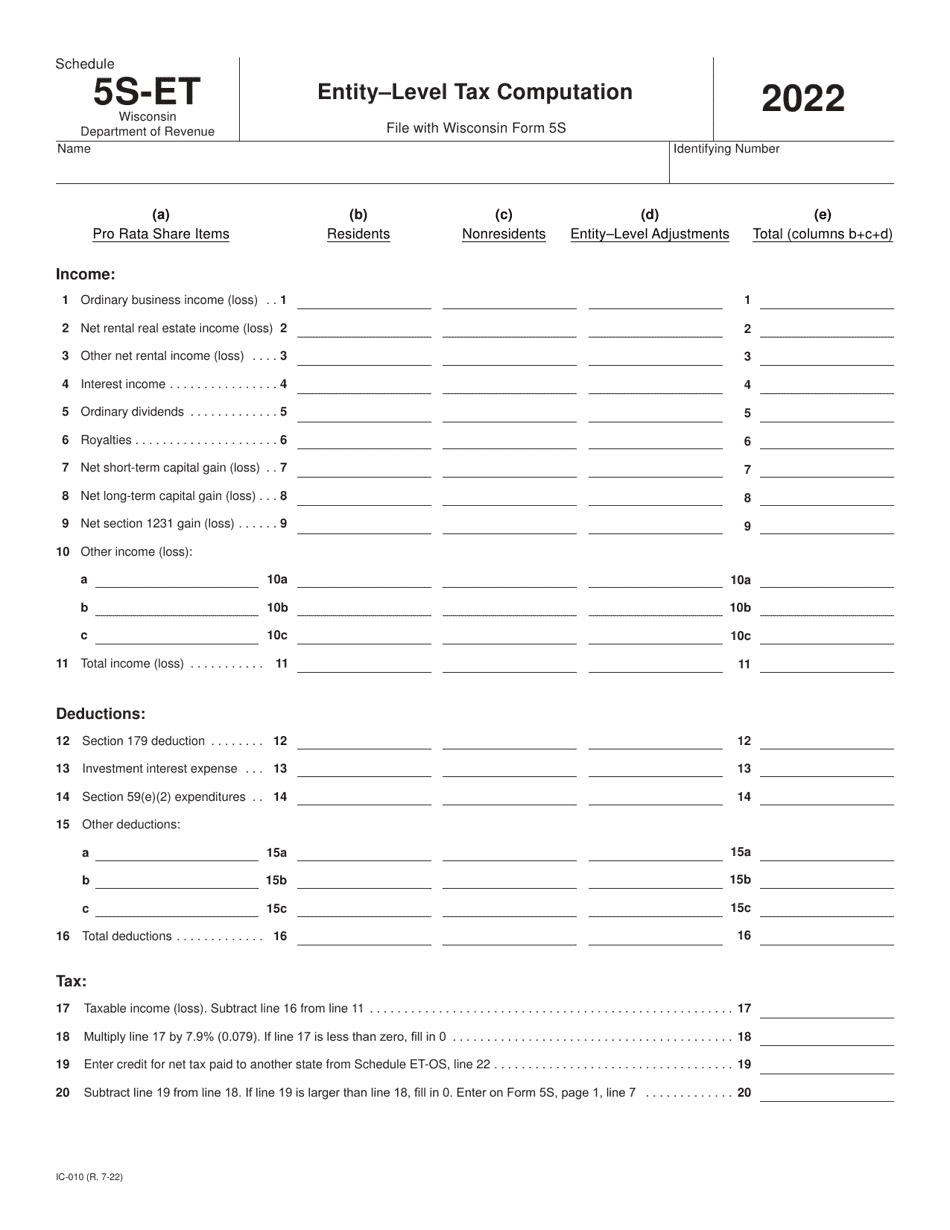

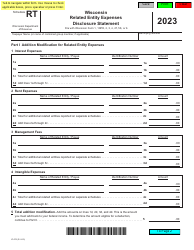

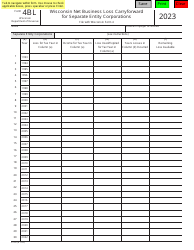

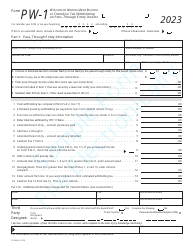

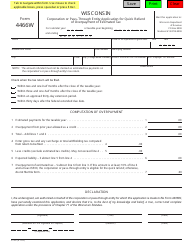

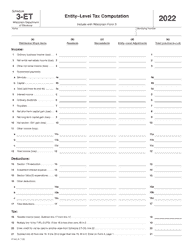

Form IC-010 Schedule 5S-ET

for the current year.

Form IC-010 Schedule 5S-ET Entity-Level Tax Computation - Wisconsin

What Is Form IC-010 Schedule 5S-ET?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-010?

A: Form IC-010 is the Schedule 5S-ET Entity-Level Tax Computation form used in Wisconsin.

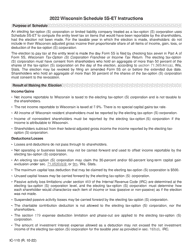

Q: What is Schedule 5S-ET?

A: Schedule 5S-ET is a tax computation schedule for entity-level taxes in Wisconsin.

Q: What is entity-level tax?

A: Entity-level tax is a tax levied directly on the business entity rather than the owners or shareholders.

Q: Who needs to file Form IC-010?

A: Business entities in Wisconsin that are subject to entity-level taxes need to file Form IC-010.

Q: What information do I need to complete Form IC-010?

A: You will need information about your business entity's income, expenses, credits, and other relevant tax details.

Q: Are there any filing deadlines for Form IC-010?

A: Yes, Form IC-010 must be filed by the due date specified by the Wisconsin Department of Revenue.

Q: Can I e-file Form IC-010?

A: Yes, Wisconsin allows electronic filing of Form IC-010.

Q: What happens if I don't file Form IC-010?

A: Failure to file Form IC-010 or filing it late can result in penalties and interest charges.

Q: Can I request an extension to file Form IC-010?

A: Yes, you may request an extension to file Form IC-010 by contacting the Wisconsin Department of Revenue.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IC-010 Schedule 5S-ET by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.