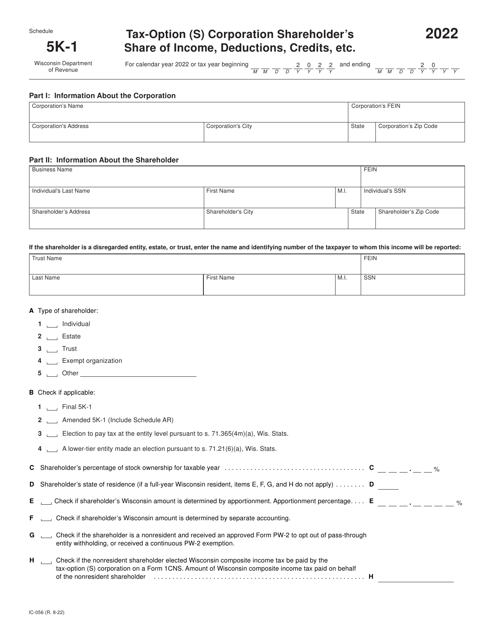

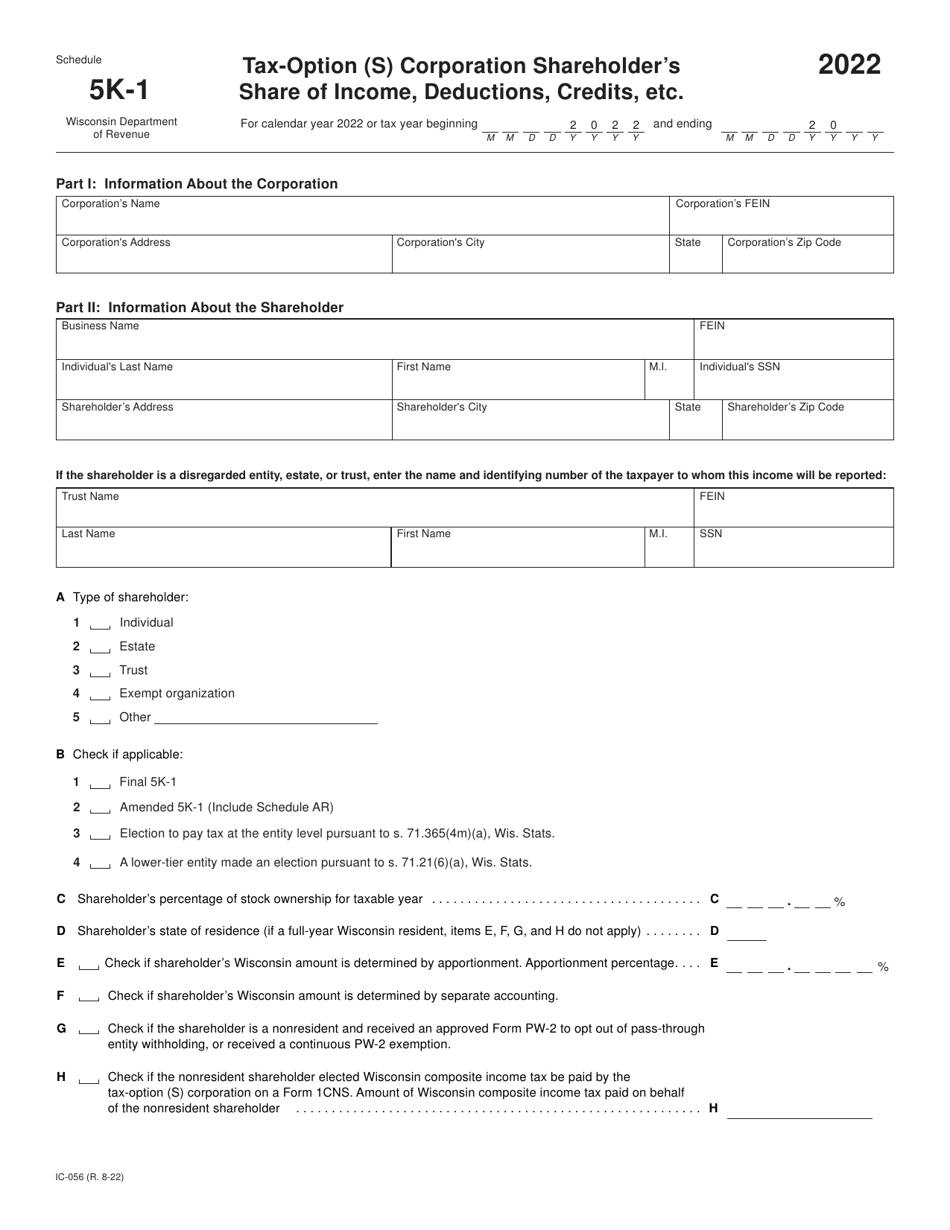

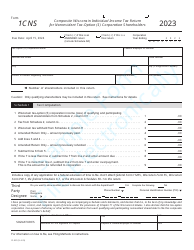

Form 5K-1 (IC-056) Tax-Option (S) Corporation Shareholder's Share of Income, Deductions, Credits, Etc. - Wisconsin

What Is Form 5K-1 (IC-056)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 5K-1?

A: Form 5K-1 is a tax form used by tax-option (S) corporations in Wisconsin.

Q: Who should file Form 5K-1?

A: Tax-option (S) corporations in Wisconsin should file Form 5K-1.

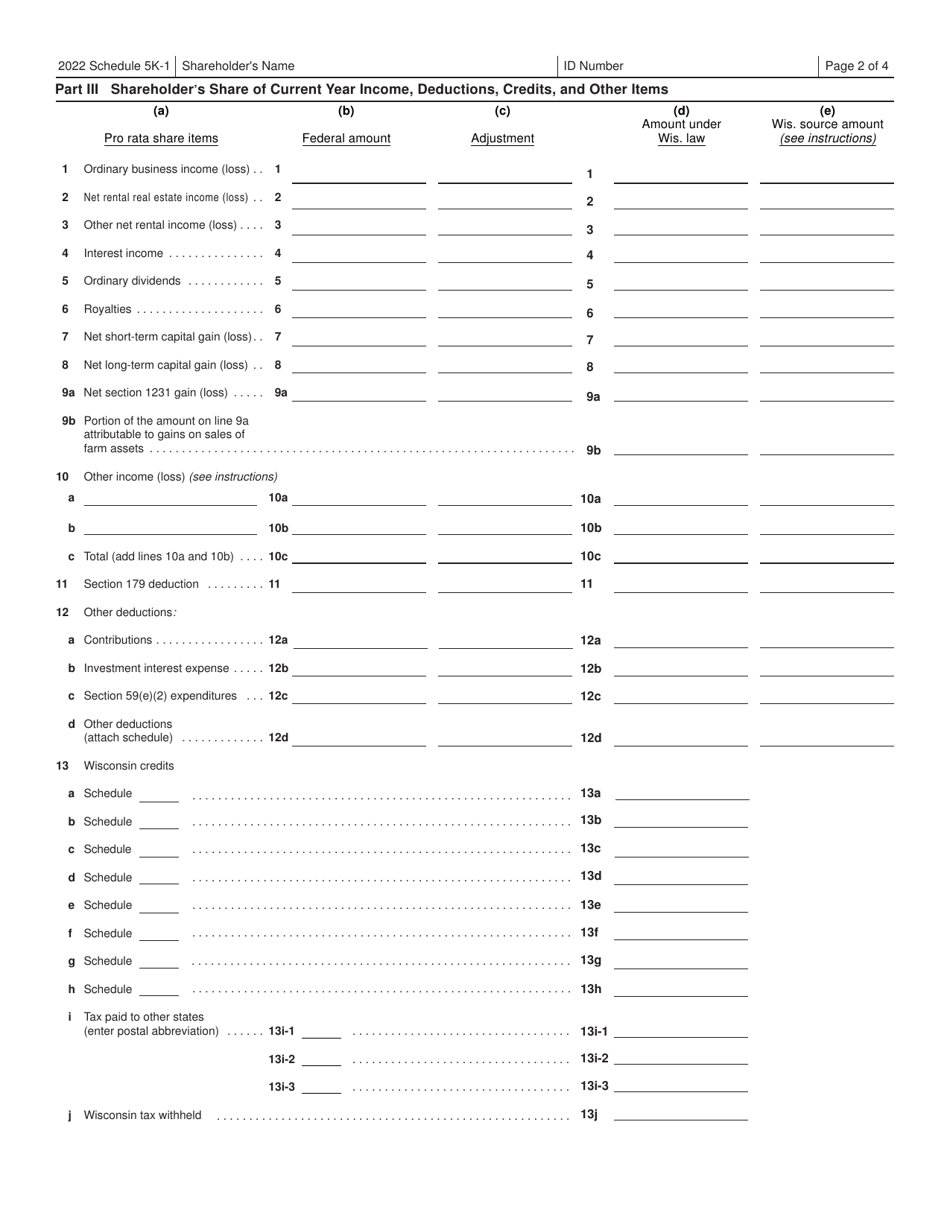

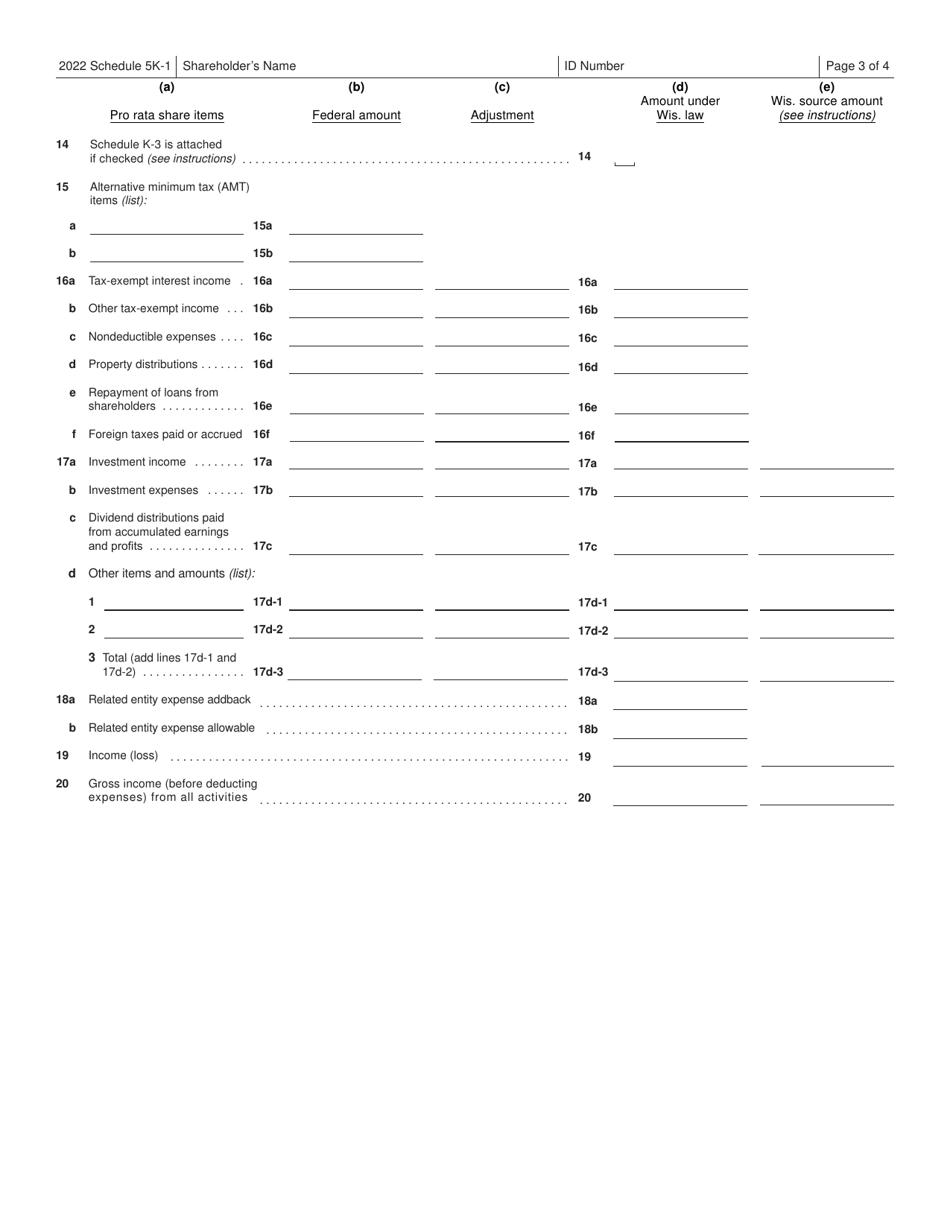

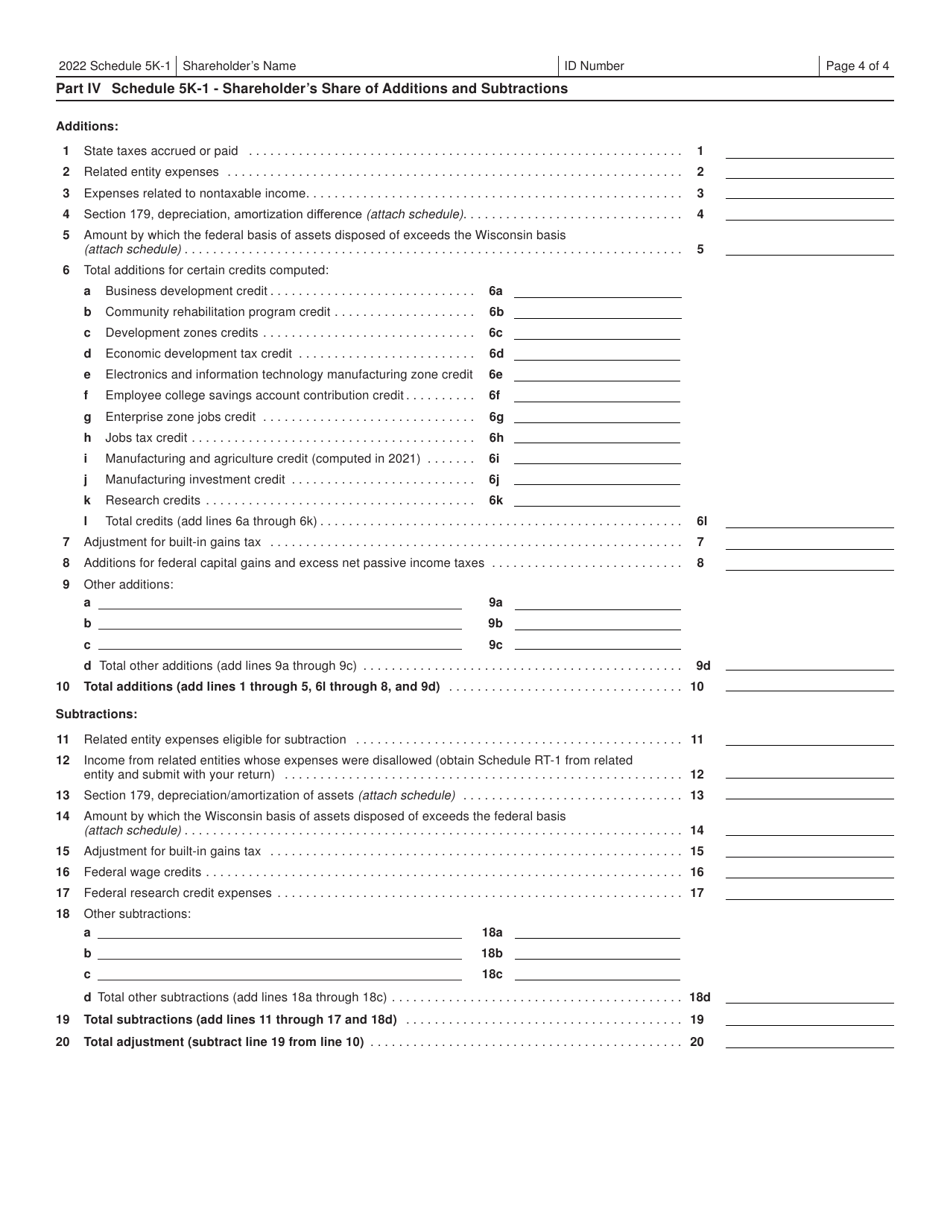

Q: What is the purpose of Form 5K-1?

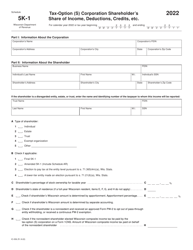

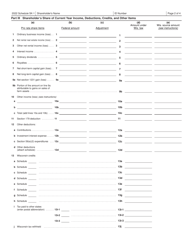

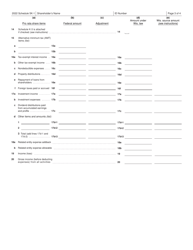

A: Form 5K-1 is used to report a tax-option (S) corporation shareholder's share of income, deductions, credits, etc. in Wisconsin.

Q: When is Form 5K-1 due?

A: Form 5K-1 is due on the same date as the tax-option (S) corporation's Wisconsin income tax return.

Q: Are there any penalties for not filing Form 5K-1?

A: Yes, failure to file Form 5K-1 may result in penalties imposed by the Wisconsin Department of Revenue.

Q: Can Form 5K-1 be filed electronically?

A: Yes, Form 5K-1 can be filed electronically through the Wisconsin Department of Revenue's e-file system.

Q: What should I do with Form 5K-1 after filing it?

A: You should keep a copy of Form 5K-1 for your records and submit it to the Wisconsin Department of Revenue along with your tax return.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5K-1 (IC-056) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.