This version of the form is not currently in use and is provided for reference only. Download this version of

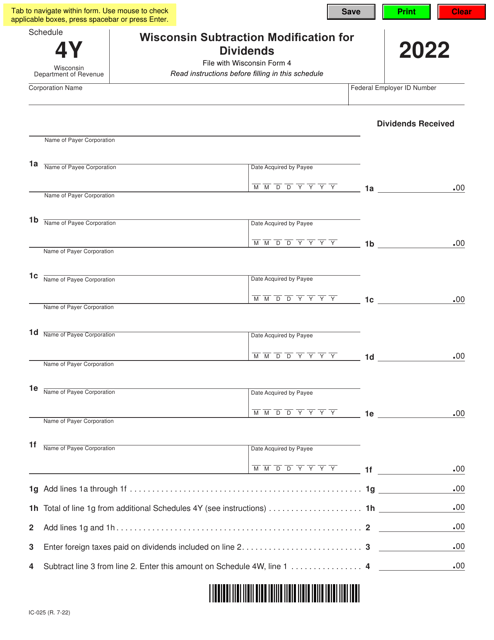

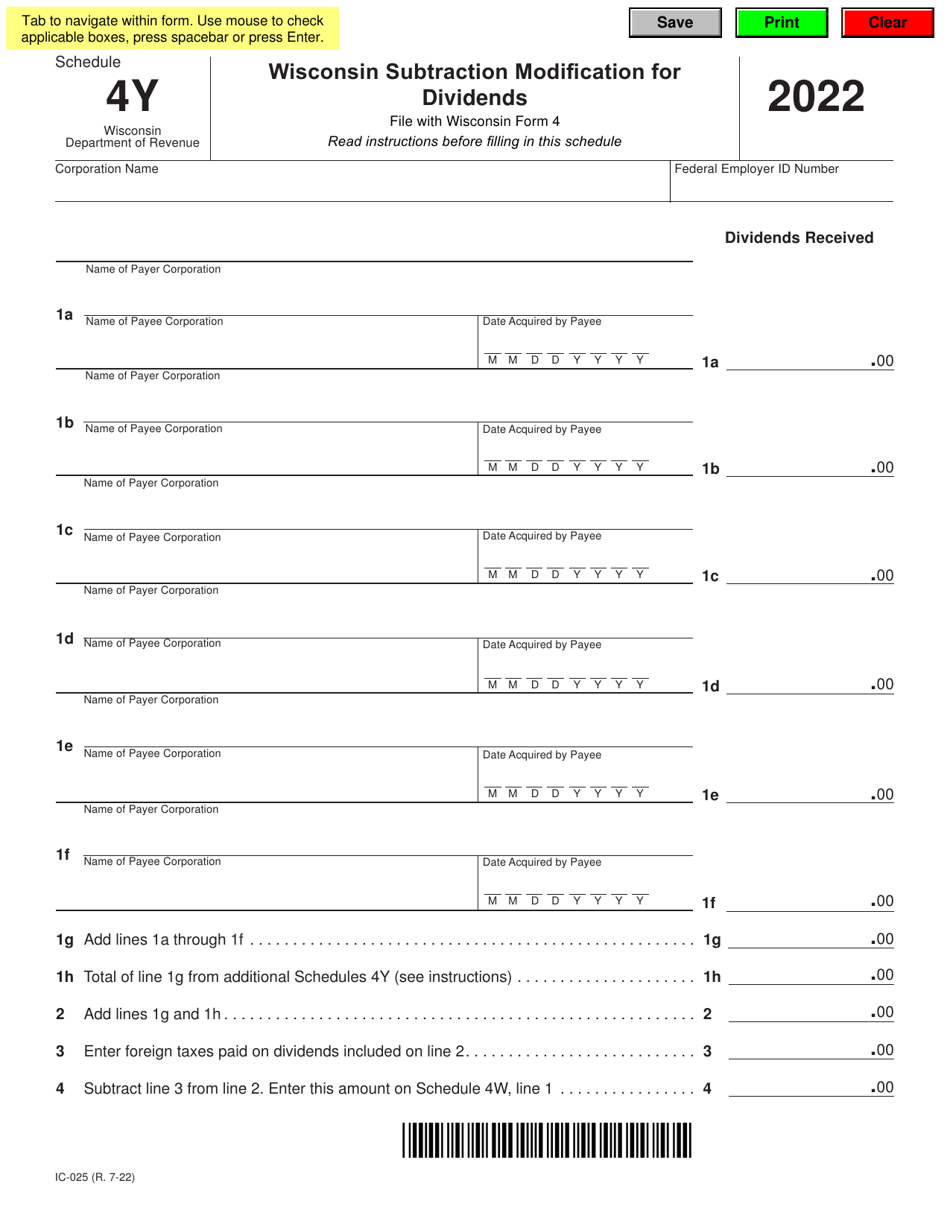

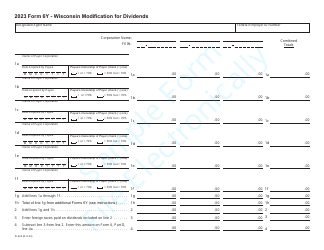

Form IC-025 Schedule 4Y

for the current year.

Form IC-025 Schedule 4Y Wisconsin Subtraction Modification for Dividends - Wisconsin

What Is Form IC-025 Schedule 4Y?

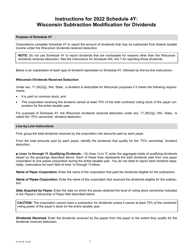

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-025?

A: Form IC-025 is the Schedule 4Y Wisconsin Subtraction Modification for Dividends.

Q: What is the purpose of Form IC-025?

A: The purpose of Form IC-025 is to report and calculate the Wisconsin Subtraction Modification for Dividends.

Q: What is the Wisconsin Subtraction Modification for Dividends?

A: The Wisconsin Subtraction Modification for Dividends is a deduction that allows taxpayers to reduce their Wisconsin taxable income by the amount of qualifying dividends received.

Q: Who needs to file Form IC-025?

A: Taxpayers who received qualifying dividends and are required to file a Wisconsin state tax return need to file Form IC-025.

Q: Do I have to fill out Form IC-025 if I didn't receive any qualifying dividends?

A: No, if you didn't receive any qualifying dividends, then you don't need to fill out Form IC-025.

Q: Is Form IC-025 the only form I need to report my dividends in Wisconsin?

A: No, in addition to Form IC-025, you may also need to report your dividends on other forms, such as Schedule 1 or Schedule WD.

Q: When is the deadline to file Form IC-025?

A: The deadline to file Form IC-025 is the same as the deadline to file your Wisconsin state tax return, which is usually April 15th.

Q: What happens if I don't file Form IC-025?

A: If you are required to file Form IC-025 and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I file Form IC-025 electronically?

A: Yes, you can file Form IC-025 electronically through the Wisconsin Department of Revenue's e-file system.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-025 Schedule 4Y by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.