This version of the form is not currently in use and is provided for reference only. Download this version of

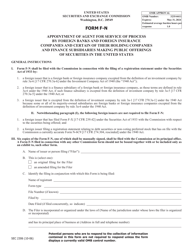

Form 6I (IC-402)

for the current year.

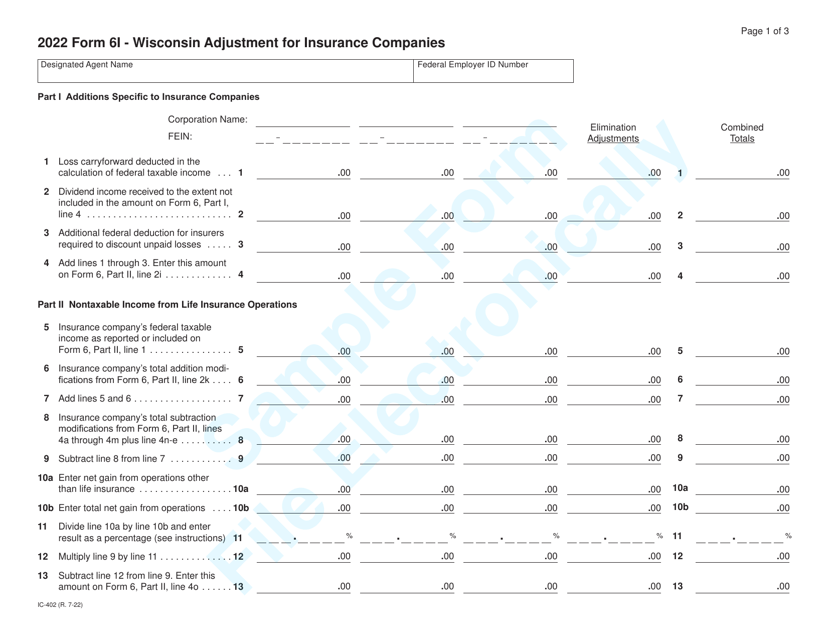

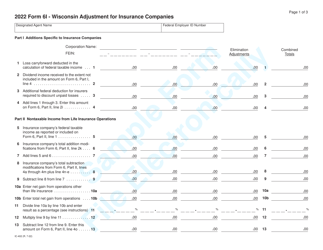

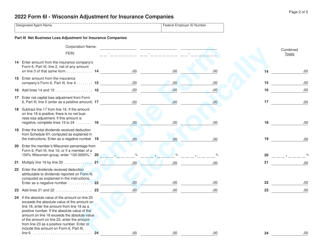

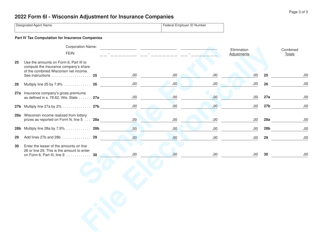

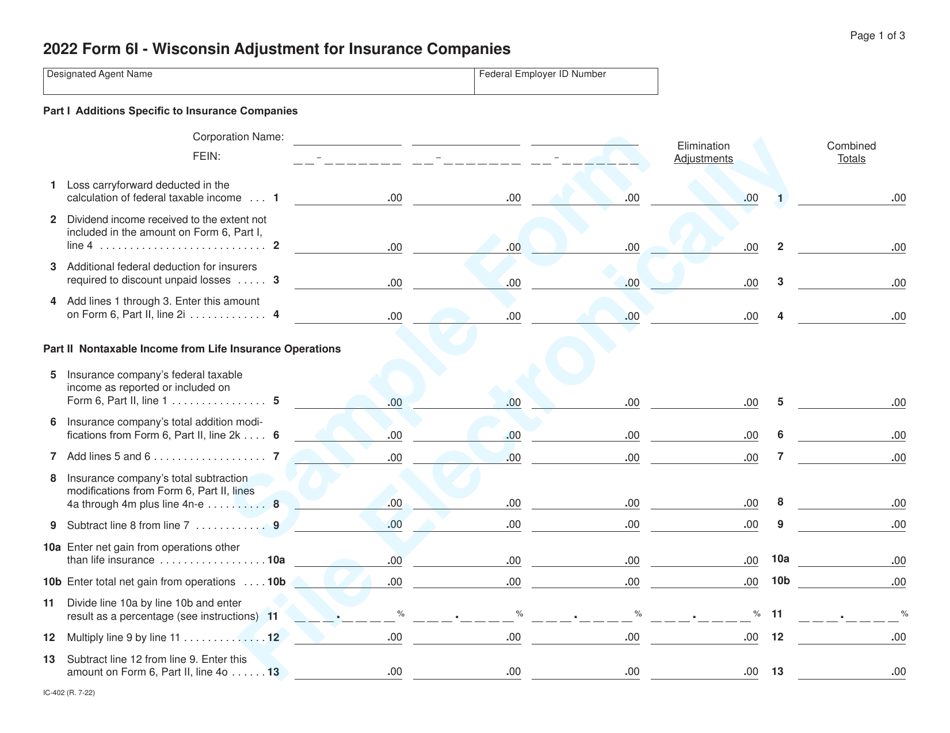

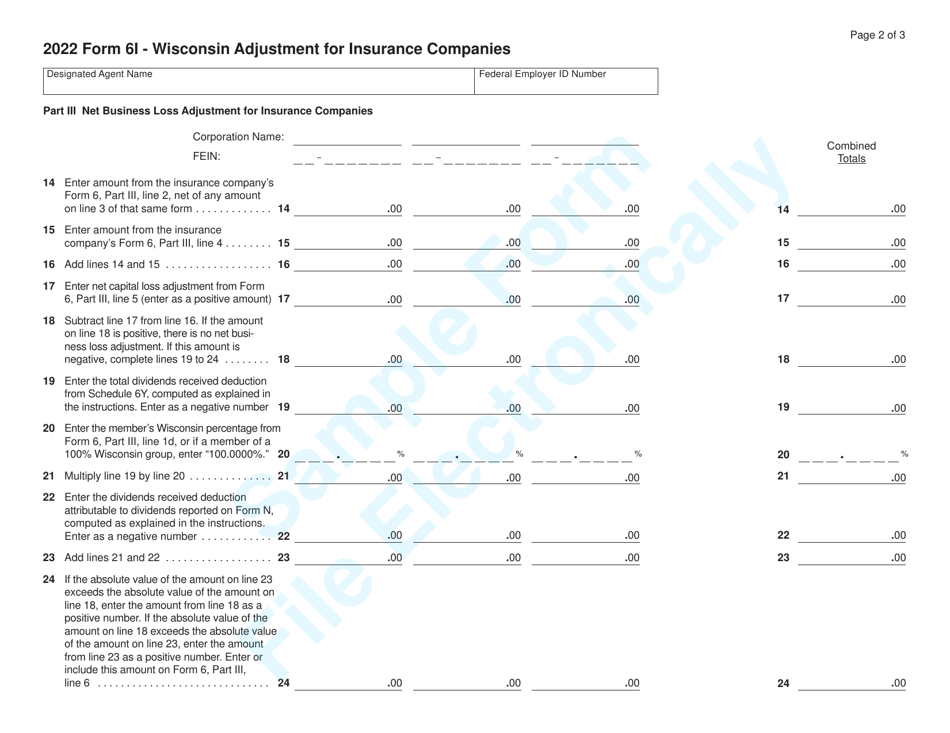

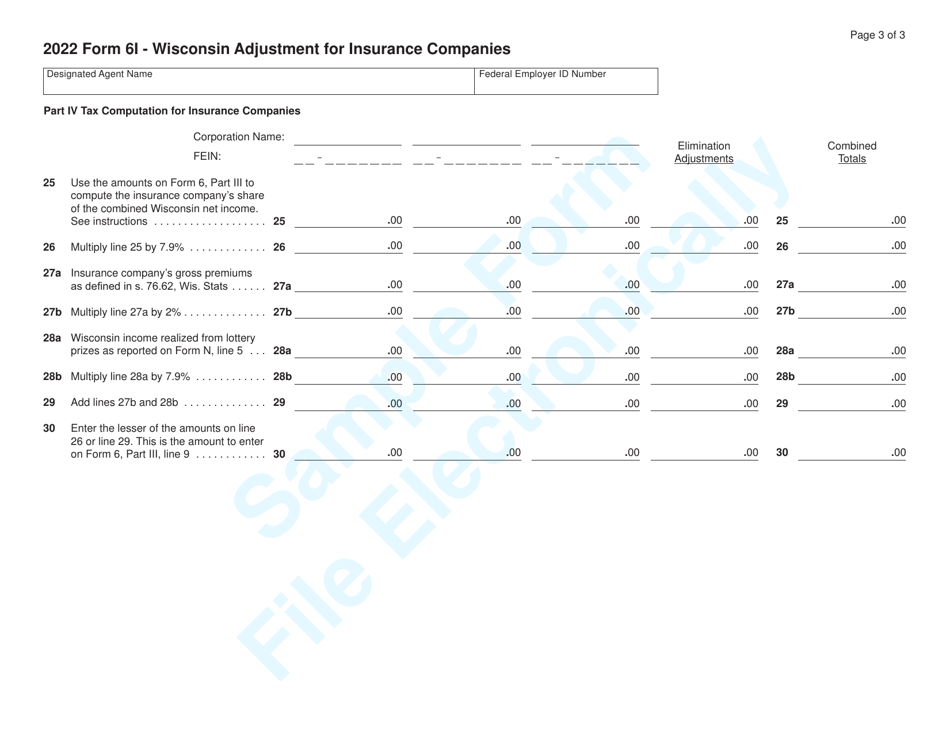

Form 6I (IC-402) Wisconsin Adjustment for Insurance Companies - Sample - Wisconsin

What Is Form 6I (IC-402)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 6I (IC-402)?

A: Form 6I (IC-402) is a tax form used by insurance companies in Wisconsin.

Q: Who needs to file Form 6I (IC-402)?

A: Insurance companies operating in Wisconsin need to file Form 6I (IC-402).

Q: What is the purpose of Form 6I (IC-402)?

A: Form 6I (IC-402) is used to calculate and report adjustments to income for insurance companies in Wisconsin.

Q: When is the deadline for filing Form 6I (IC-402)?

A: The deadline for filing Form 6I (IC-402) is generally March 15th of the following tax year.

Q: What happens if I don't file Form 6I (IC-402) on time?

A: Failure to file Form 6I (IC-402) on time may result in penalties and interest charges.

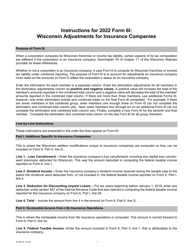

Q: Are there any specific instructions for completing Form 6I (IC-402)?

A: Yes, the Wisconsin Department of Revenue provides detailed instructions for completing Form 6I (IC-402). It is important to carefully read and follow these instructions.

Q: Can Form 6I (IC-402) be filed electronically?

A: Yes, insurance companies in Wisconsin can file Form 6I (IC-402) electronically through the Wisconsin Department of Revenue's eFile system.

Q: What supporting documents should I include with Form 6I (IC-402)?

A: You should include any necessary schedules or attachments that are required based on the instructions provided with Form 6I (IC-402).

Q: What if I have questions or need assistance with Form 6I (IC-402)?

A: If you have questions or need assistance with Form 6I (IC-402), you can contact the Wisconsin Department of Revenue for guidance.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6I (IC-402) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.