This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5R (IC-042)

for the current year.

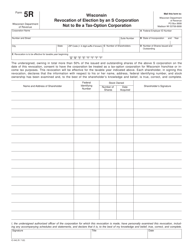

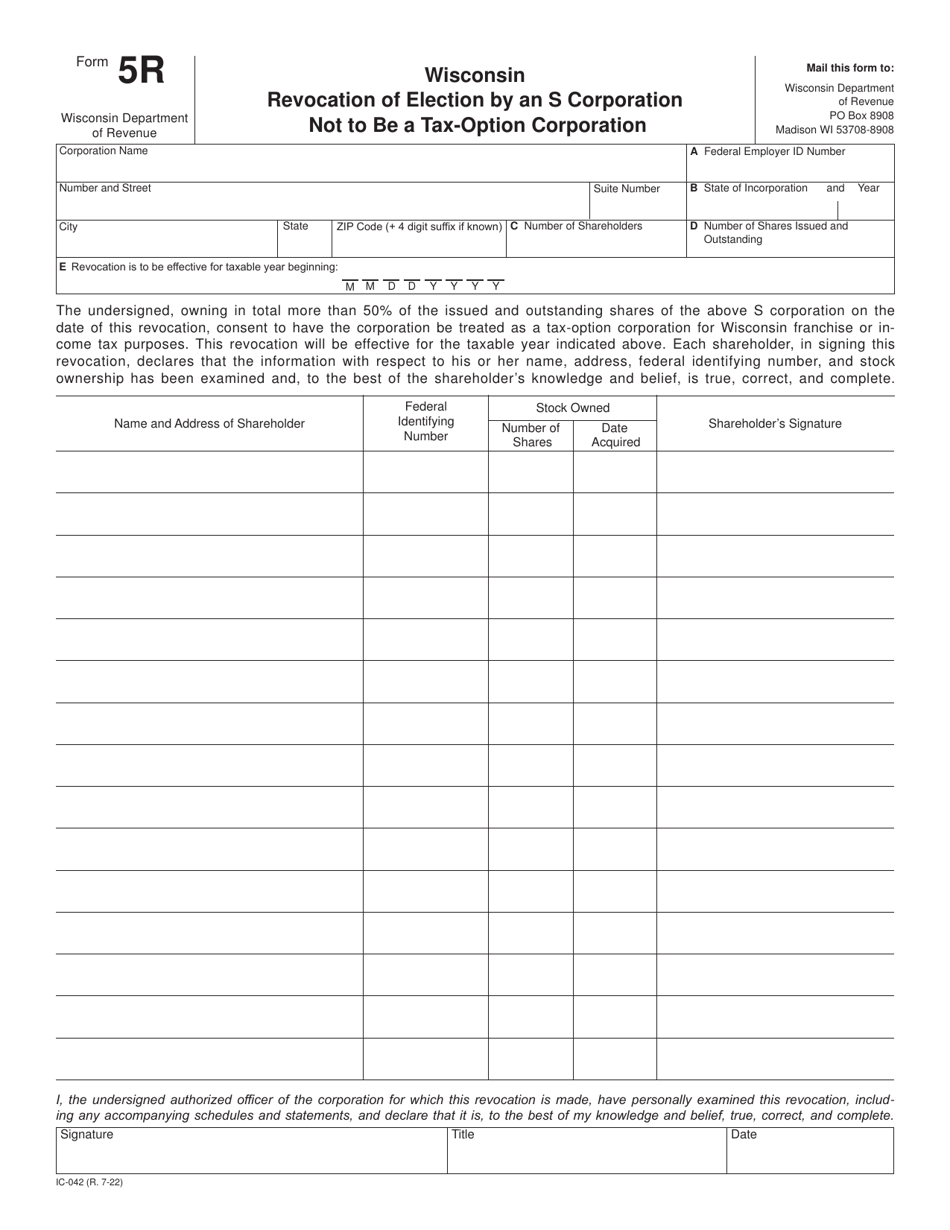

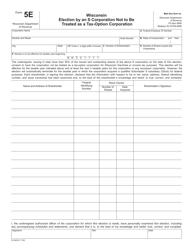

Form 5R (IC-042) Wisconsin Revocation of Election by an S Corporation Not to Be a Tax-Option Corporation - Wisconsin

What Is Form 5R (IC-042)?

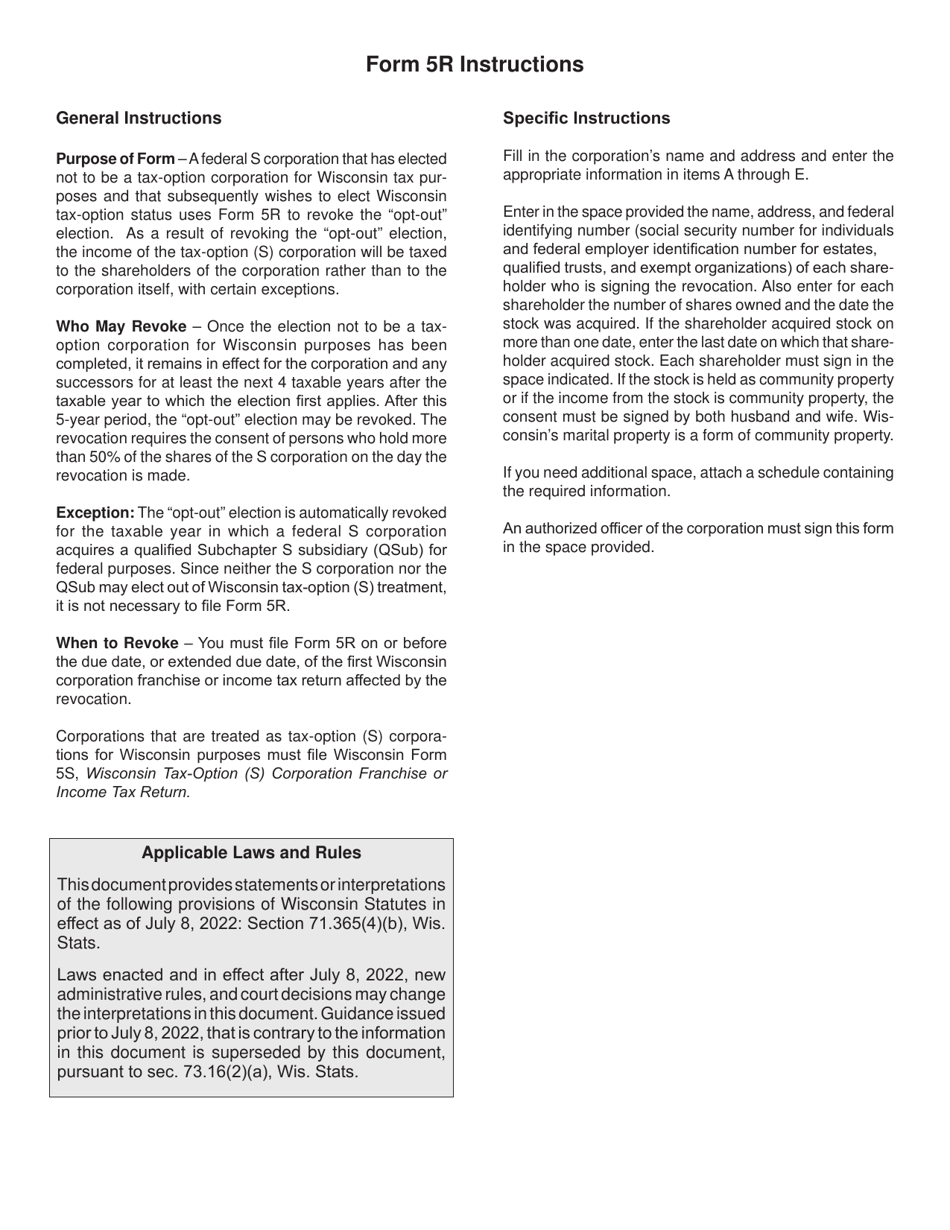

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5R (IC-042)?

A: Form 5R (IC-042) is a Wisconsin Revocation of Election by an S Corporation Not to Be a Tax-Option Corporation.

Q: Who can use Form 5R (IC-042)?

A: S Corporations in Wisconsin that want to revoke their election to be treated as a tax-option corporation.

Q: What is a tax-option corporation?

A: A tax-option corporation is an S Corporation that elects to be treated as a C Corporation for Wisconsin tax purposes.

Q: Why would an S Corporation want to revoke its election to be a tax-option corporation?

A: There may be various reasons, such as changes in ownership or business structure.

Q: Are there any fees associated with filing Form 5R (IC-042)?

A: No, there are no fees for filing Form 5R (IC-042).

Q: When should Form 5R (IC-042) be filed?

A: Form 5R (IC-042) should be filed within 90 days of the revocation of the S Corporation's tax-option election.

Q: What happens after filing Form 5R (IC-042)?

A: The Wisconsin Department of Revenue will process the revocation and update the S Corporation's tax status.

Q: Is Form 5R (IC-042) used for federal tax purposes?

A: No, Form 5R (IC-042) is only for Wisconsin tax purposes.

Q: Can I use Form 5R (IC-042) to revoke the tax-option election for multiple tax years?

A: No, Form 5R (IC-042) can only be used to revoke the tax-option election for the current tax year.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5R (IC-042) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.