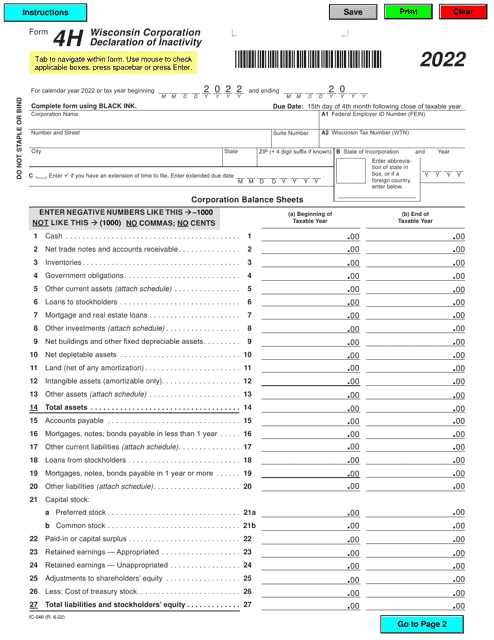

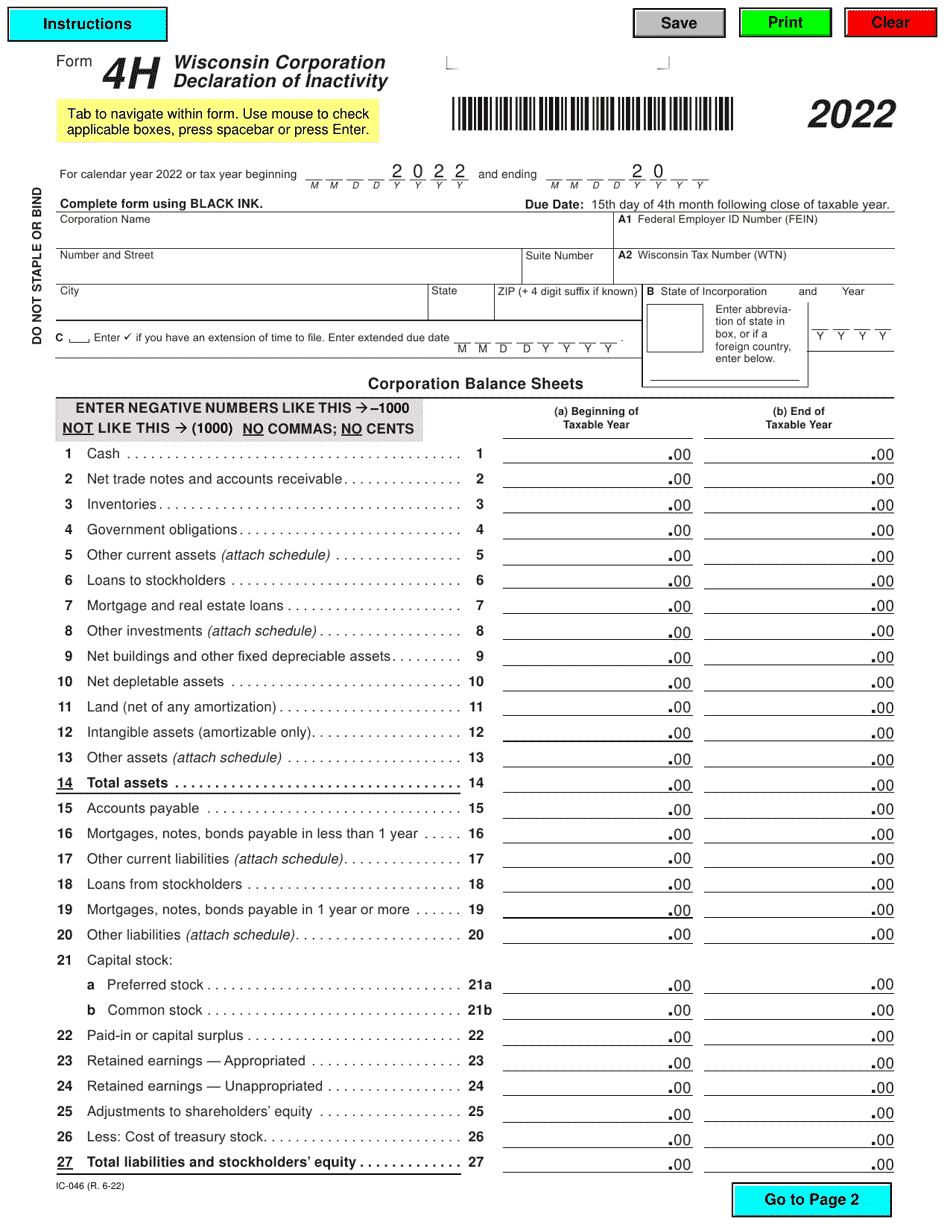

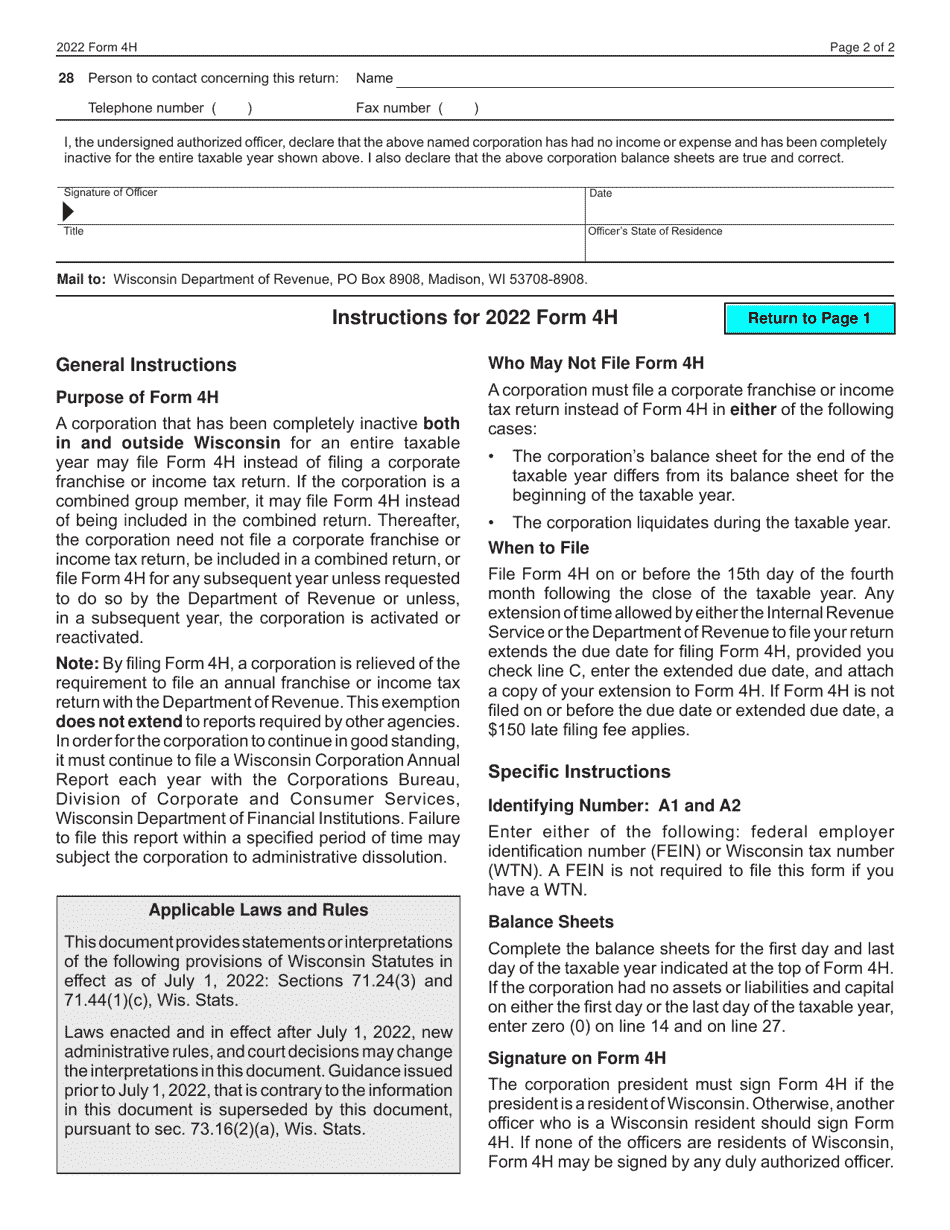

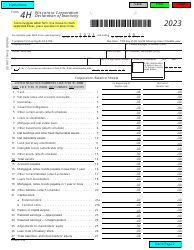

Form 4H Wisconsin Corporation Declaration of Inactivity - Wisconsin

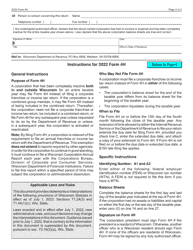

What Is Form 4H?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4H Wisconsin Corporation Declaration of Inactivity?

A: Form 4H Wisconsin Corporation Declaration of Inactivity is a document that corporations in Wisconsin use to declare their inactivity and request to be exempt from certain filing requirements.

Q: When should I use Form 4H Wisconsin Corporation Declaration of Inactivity?

A: You should use Form 4H Wisconsin Corporation Declaration of Inactivity if your corporation is inactive and you want to be exempt from filing certain documents with the state of Wisconsin.

Q: What does it mean for a corporation to be inactive?

A: An inactive corporation is one that is not engaged in any business operations or transactions, and has no assets or liabilities.

Q: What are the benefits of filing Form 4H Wisconsin Corporation Declaration of Inactivity?

A: The main benefit of filing this form is that it exempts your corporation from filing certain annual reports and fees with the state of Wisconsin.

Q: Are there any fees associated with filing Form 4H Wisconsin Corporation Declaration of Inactivity?

A: No, there are no fees associated with filing this form.

Q: How long is the validity of Form 4H Wisconsin Corporation Declaration of Inactivity?

A: Once filed, the declaration of inactivity remains valid until the corporation resumes conducting business operations.

Q: Can an inactive corporation become active again?

A: Yes, an inactive corporation can become active again by filing the necessary documents and fees with the state of Wisconsin.

Q: Can I dissolve my corporation instead of filing Form 4H Wisconsin Corporation Declaration of Inactivity?

A: Yes, if you no longer wish to maintain your corporation, you can choose to dissolve it instead of filing Form 4H Wisconsin Corporation Declaration of Inactivity.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4H by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.