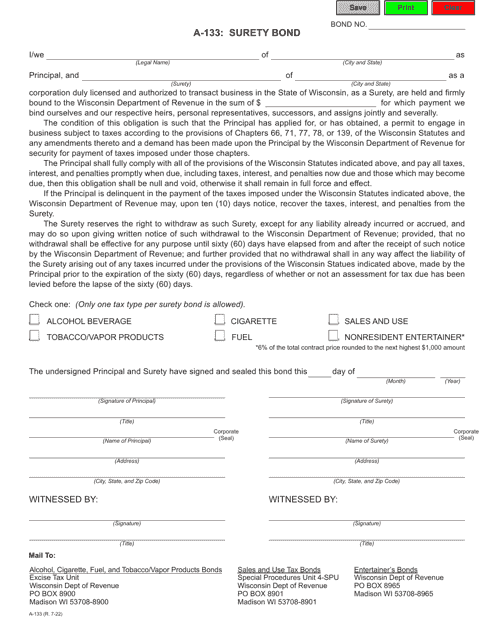

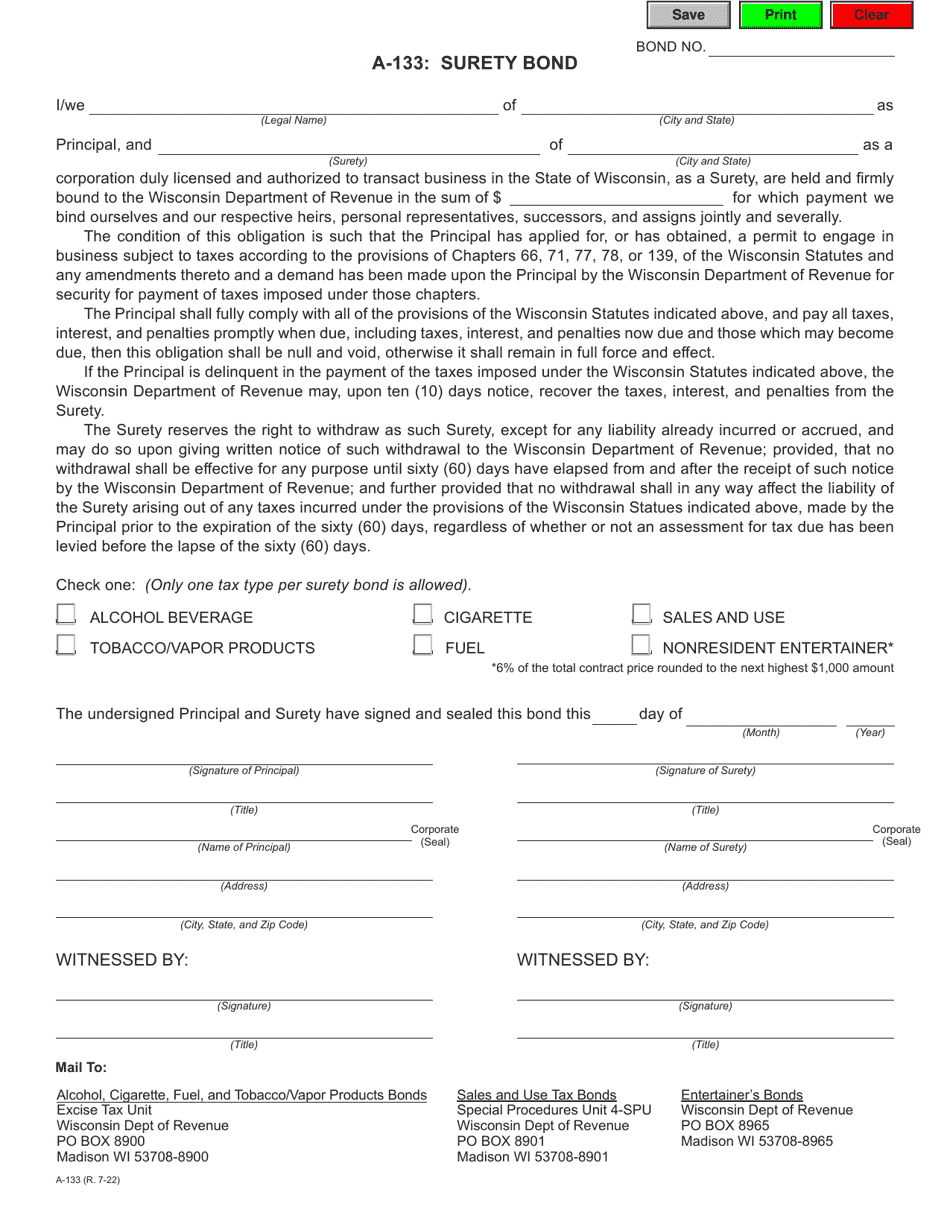

Form A-133 Surety Bond - Wisconsin

What Is Form A-133?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-133 Surety Bond?

A: Form A-133 Surety Bond is a document required by the state of Wisconsin for certain types of businesses, such as contractors, to provide financial assurance that they will fulfill their obligations.

Q: Who needs to file Form A-133 Surety Bond?

A: Certain types of businesses in Wisconsin, such as contractors and construction companies, are required to file Form A-133 Surety Bond.

Q: What is the purpose of Form A-133 Surety Bond?

A: The purpose of Form A-133 Surety Bond is to protect consumers and ensure that businesses fulfill their contractual obligations, particularly in the construction industry.

Q: How does Form A-133 Surety Bond work?

A: Form A-133 Surety Bond serves as a guarantee that if a business fails to fulfill its contractual obligations, the bond amount can be used to compensate the aggrieved party.

Q: Are there any fees or costs associated with Form A-133 Surety Bond?

A: Yes, businesses are required to pay a fee to obtain Form A-133 Surety Bond. The specific amount may vary depending on factors such as the bond amount and the business's creditworthiness.

Q: How long is Form A-133 Surety Bond valid for?

A: Form A-133 Surety Bond is typically valid for a specific period, such as one year. After the bond expires, it may need to be renewed.

Q: What happens if a business fails to file Form A-133 Surety Bond?

A: Failure to file Form A-133 Surety Bond when required may result in penalties and legal consequences for the business, such as fines or suspension of business operations.

Q: Can the bond amount be returned to the business after the completion of a project?

A: The bond amount is generally not returned to the business after the completion of a project. It serves as a protection for the aggrieved party in case the business fails to fulfill its obligations.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-133 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.