This version of the form is not currently in use and is provided for reference only. Download this version of

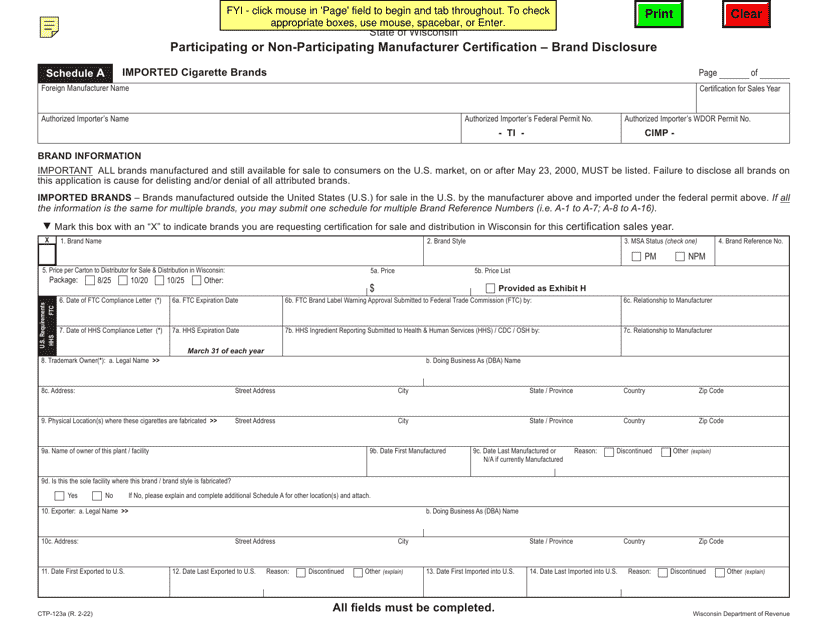

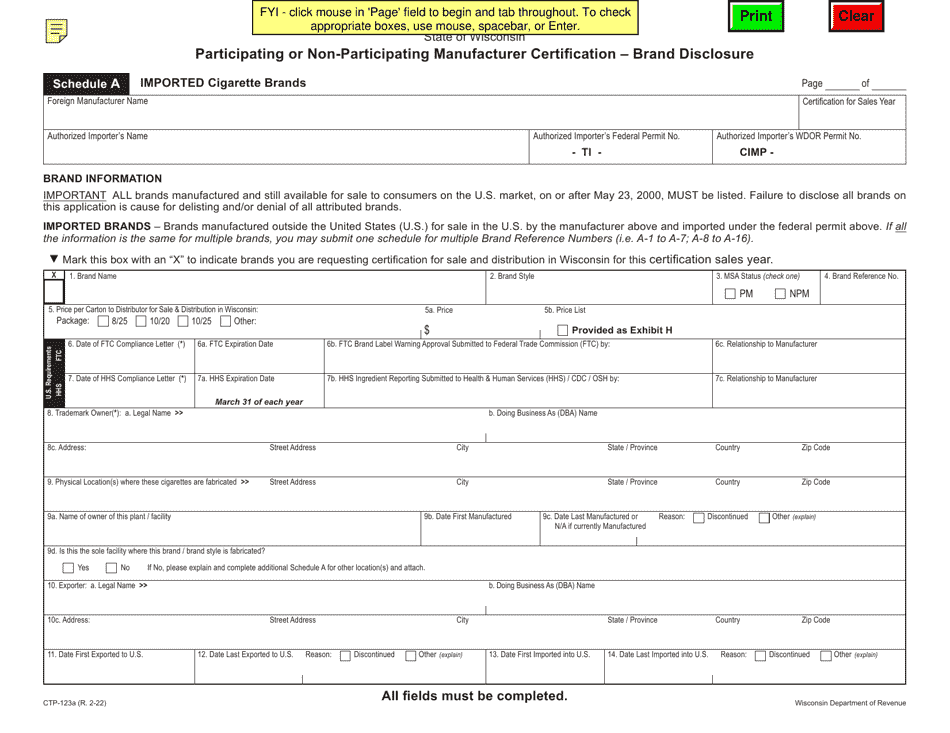

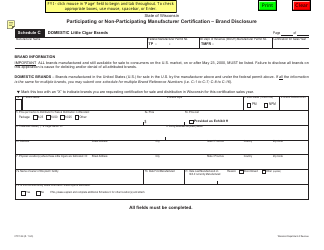

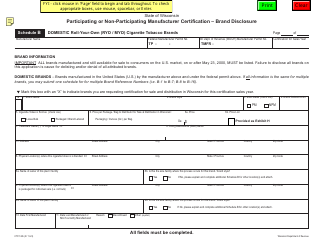

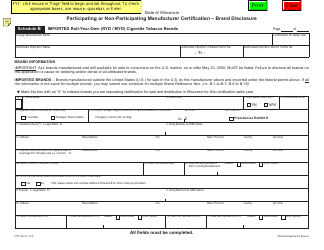

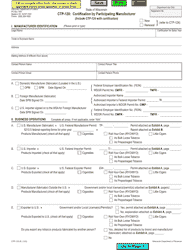

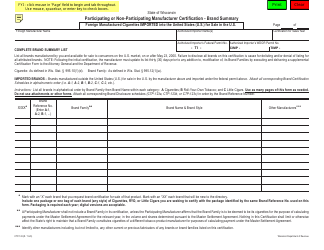

Form CTP-123A Schedule A

for the current year.

Form CTP-123A Schedule A Participating or Non-participating Manufacturer Certification - Brand Disclosure - Imported Cigarette Brands - Wisconsin

What Is Form CTP-123A Schedule A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTP-123A?

A: Form CTP-123A is a Schedule A Participating or Non-participating Manufacturer Certification - Brand Disclosure form specifically for imported cigarette brands in the state of Wisconsin.

Q: What is the purpose of Form CTP-123A?

A: The purpose of Form CTP-123A is to certify whether a manufacturer of imported cigarette brands in Wisconsin is a participating or non-participating manufacturer.

Q: What does it mean to be a participating manufacturer?

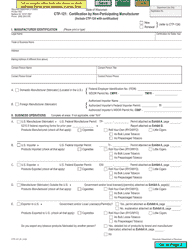

A: A participating manufacturer is a manufacturer that has signed the Master Settlement Agreement (MSA) and is compliant with its requirements.

Q: What does it mean to be a non-participating manufacturer?

A: A non-participating manufacturer is a manufacturer that has not signed the Master Settlement Agreement (MSA) or is not compliant with its requirements.

Q: Who needs to fill out Form CTP-123A?

A: Manufacturers of imported cigarette brands in Wisconsin need to fill out Form CTP-123A to certify their participation or non-participation.

Q: What information is required in Form CTP-123A?

A: Form CTP-123A requires manufacturers to disclose information about their imported cigarette brands, including brand names, associated trademarks, and whether they are participating or non-participating manufacturers.

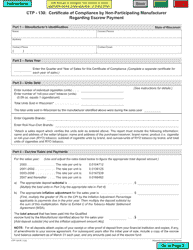

Q: Are there any penalties for not submitting Form CTP-123A?

A: Failure to submit Form CTP-123A or providing false information may result in penalties and legal consequences.

Q: Can a non-participating manufacturer sell their imported cigarette brands in Wisconsin?

A: Yes, a non-participating manufacturer can sell their imported cigarette brands in Wisconsin, but they need to comply with specific requirements and pay into an escrow fund based on their sales volume.

Q: Is Form CTP-123A specific to the state of Wisconsin?

A: Yes, Form CTP-123A is specific to the state of Wisconsin and is used to comply with the state's regulations for imported cigarette brands.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTP-123A Schedule A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.