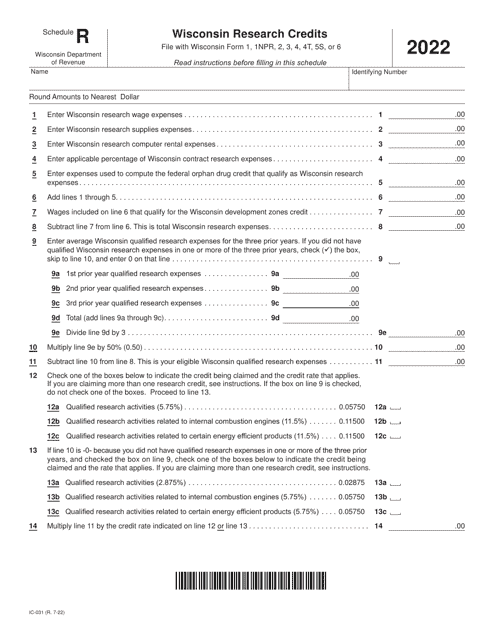

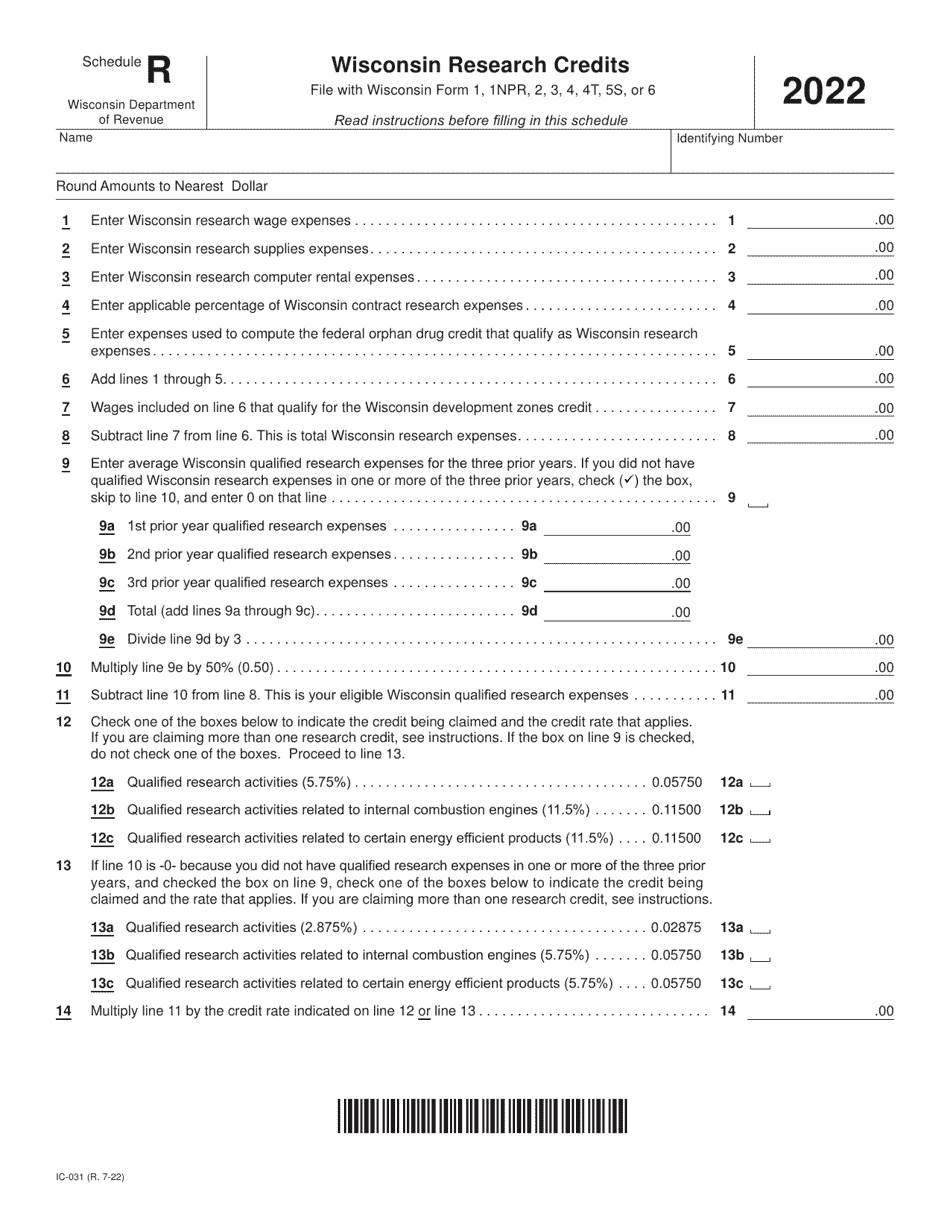

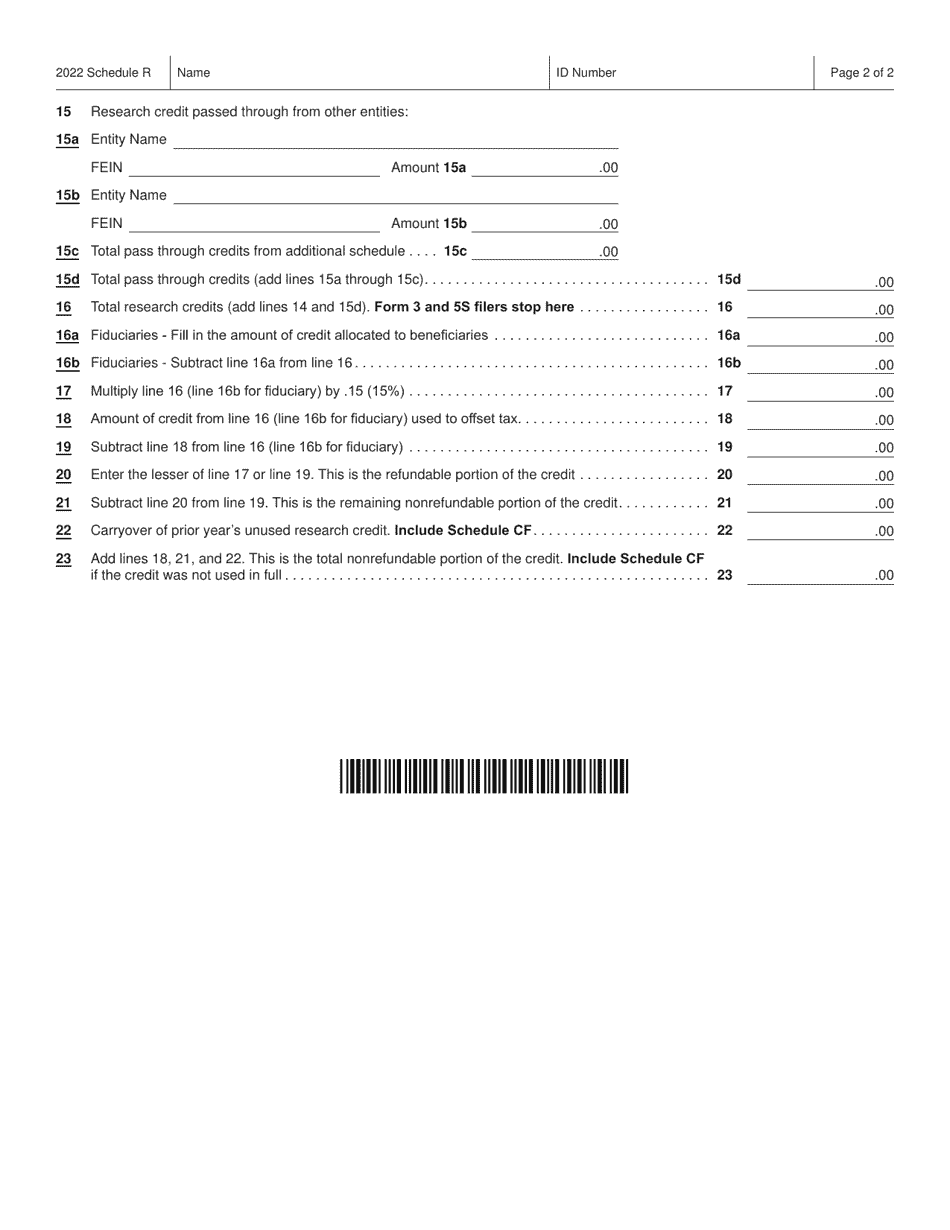

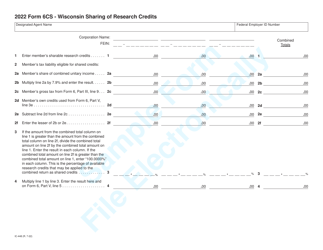

Form IC-031 Wisconsin Research Credits - Wisconsin

What Is Form IC-031?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-031?

A: Form IC-031 is the Wisconsin Research Credits form.

Q: What are Wisconsin Research Credits?

A: Wisconsin Research Credits are tax credits available to businesses in Wisconsin that engage in qualified research and development activities.

Q: Who is eligible to claim Wisconsin Research Credits?

A: Businesses in Wisconsin that incur qualified research expenses are eligible to claim Wisconsin Research Credits.

Q: What are qualified research expenses?

A: Qualified research expenses include wages, supplies, and contract research costs related to qualified research activities.

Q: How do I claim Wisconsin Research Credits?

A: To claim Wisconsin Research Credits, you must complete Form IC-031 and include it with your Wisconsin tax return.

Q: Are there any limitations on the amount of Wisconsin Research Credits that can be claimed?

A: Yes, there are limitations on the amount of Wisconsin Research Credits that can be claimed. The maximum credit that can be claimed in a tax year is 10% of the excess qualified research expenses over the base amount.

Q: When is Form IC-031 due?

A: Form IC-031 is due at the same time as your Wisconsin tax return, which is usually April 15th.

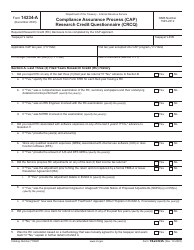

Q: Are there any additional requirements or documentation needed to claim Wisconsin Research Credits?

A: Yes, additional documentation may be required to support your claim for Wisconsin Research Credits, including records of qualified research expenses and documentation of the activities conducted.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IC-031 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.