This version of the form is not currently in use and is provided for reference only. Download this version of

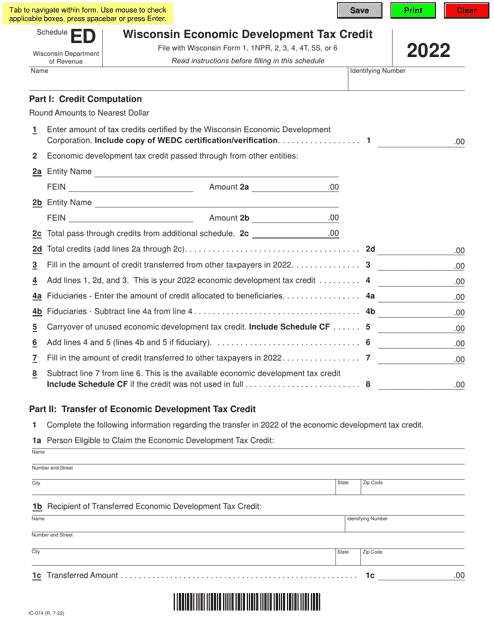

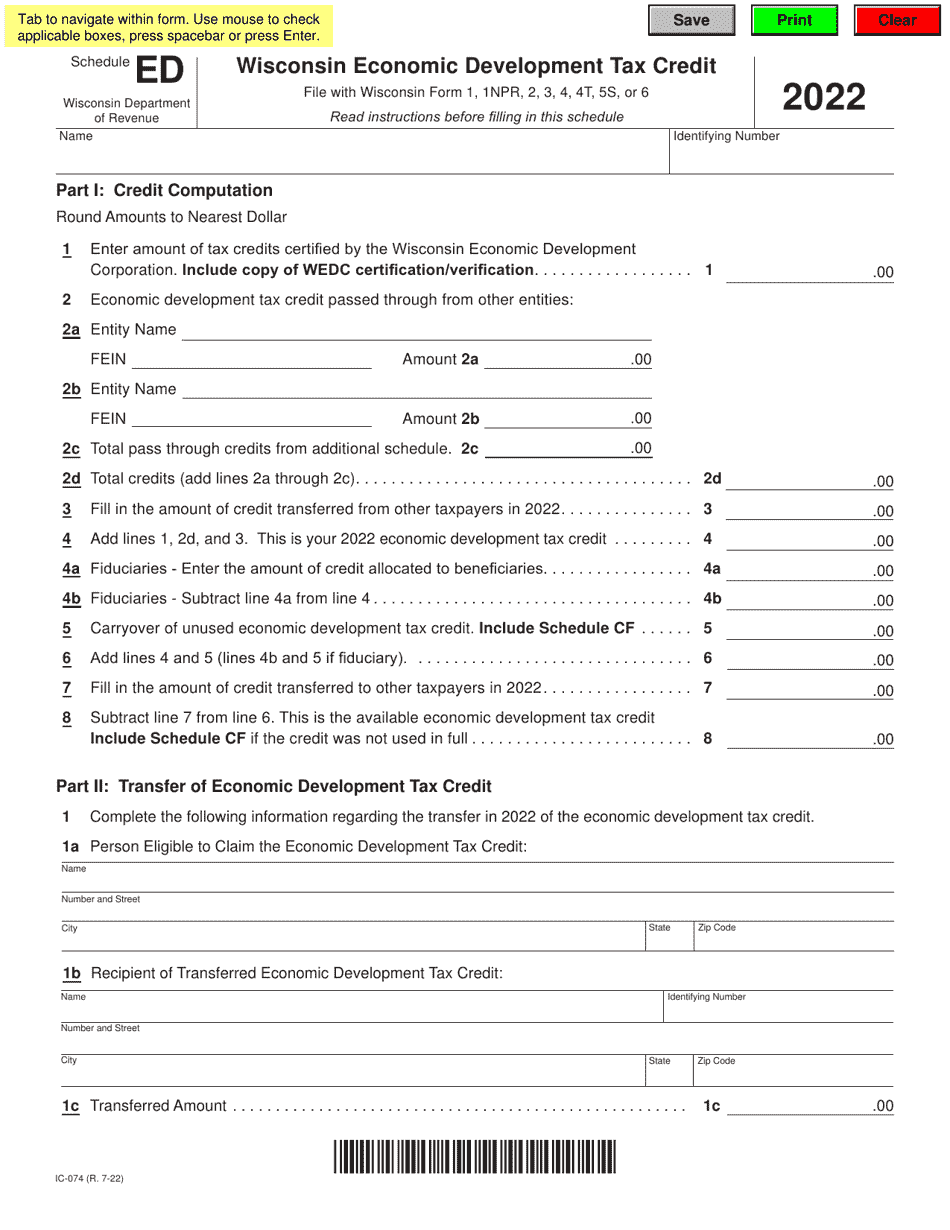

Form IC-074 Schedule ED

for the current year.

Form IC-074 Schedule ED Wisconsin Economic Development Tax Credit - Wisconsin

What Is Form IC-074 Schedule ED?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-074 Schedule ED?

A: Form IC-074 Schedule ED is a tax form used in Wisconsin for claiming the Economic Development Tax Credit.

Q: What is the Wisconsin Economic Development Tax Credit?

A: The Wisconsin Economic Development Tax Credit is a tax credit available to businesses that make qualified investments in certain economic development projects in Wisconsin.

Q: Who can claim the Wisconsin Economic Development Tax Credit?

A: Businesses that meet the eligibility requirements and make qualified investments in Wisconsin can claim the Wisconsin Economic Development Tax Credit.

Q: What are qualified investments for the Wisconsin Economic Development Tax Credit?

A: Qualified investments for the Wisconsin Economic Development Tax Credit include expenditures for eligible activities such as job creation, capital investment, research and development, and workforce training.

Q: How do I claim the Wisconsin Economic Development Tax Credit?

A: To claim the Wisconsin Economic Development Tax Credit, you need to complete and submit Form IC-074 Schedule ED along with your Wisconsin income tax return.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-074 Schedule ED by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.