This version of the form is not currently in use and is provided for reference only. Download this version of

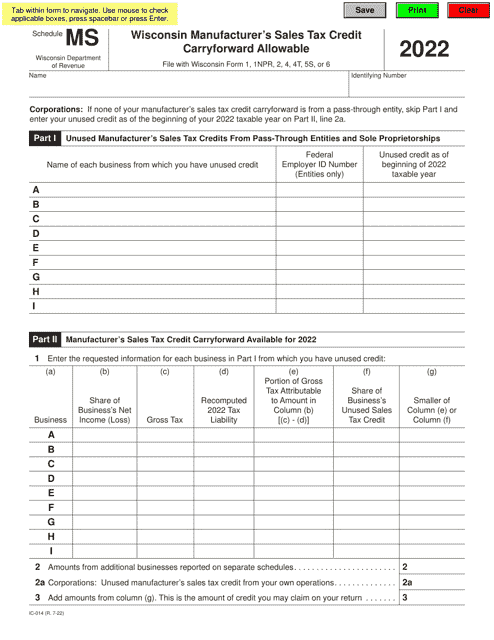

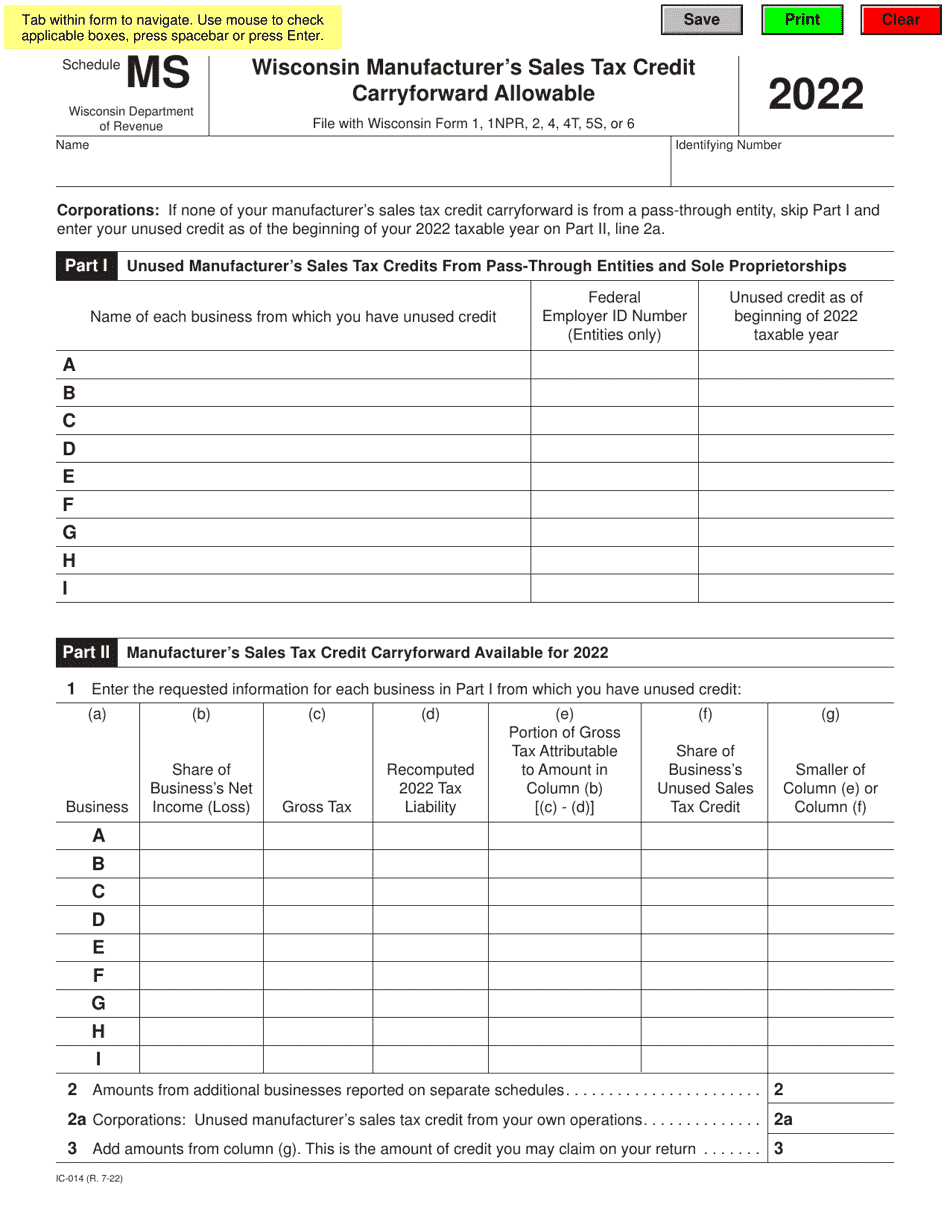

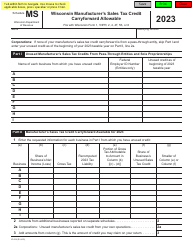

Form IC-014 Schedule MS

for the current year.

Form IC-014 Schedule MS Wisconsin Manufacturer's Sales Tax Credit Carryforward Allowable - Wisconsin

What Is Form IC-014 Schedule MS?

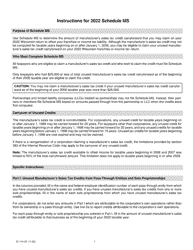

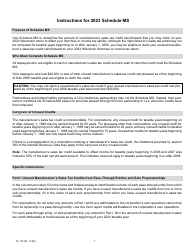

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-014 Schedule MS?

A: Form IC-014 Schedule MS is a tax form used in Wisconsin.

Q: What does the form calculate?

A: The form calculates the Wisconsin Manufacturer's Sales Tax Credit Carryforward Allowable.

Q: Who is eligible for the Wisconsin Manufacturer's Sales Tax Credit?

A: Manufacturers in Wisconsin are eligible for the credit.

Q: What does the credit carryforward allowable mean?

A: The credit carryforward allowable is the amount of the credit that can be carried forward to future tax years.

Q: Why would a manufacturer need to file Form IC-014 Schedule MS?

A: A manufacturer would file this form to claim the Wisconsin Manufacturer's Sales Tax Credit and determine the carryforward amount.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-014 Schedule MS by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.