This version of the form is not currently in use and is provided for reference only. Download this version of

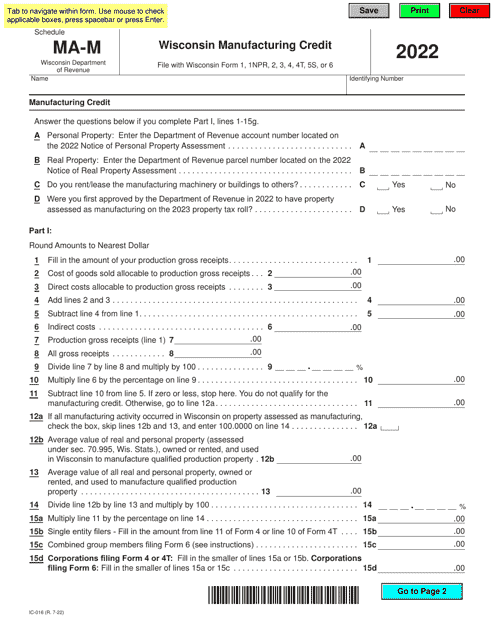

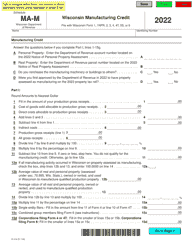

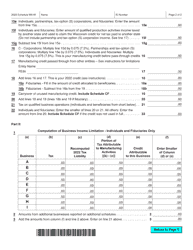

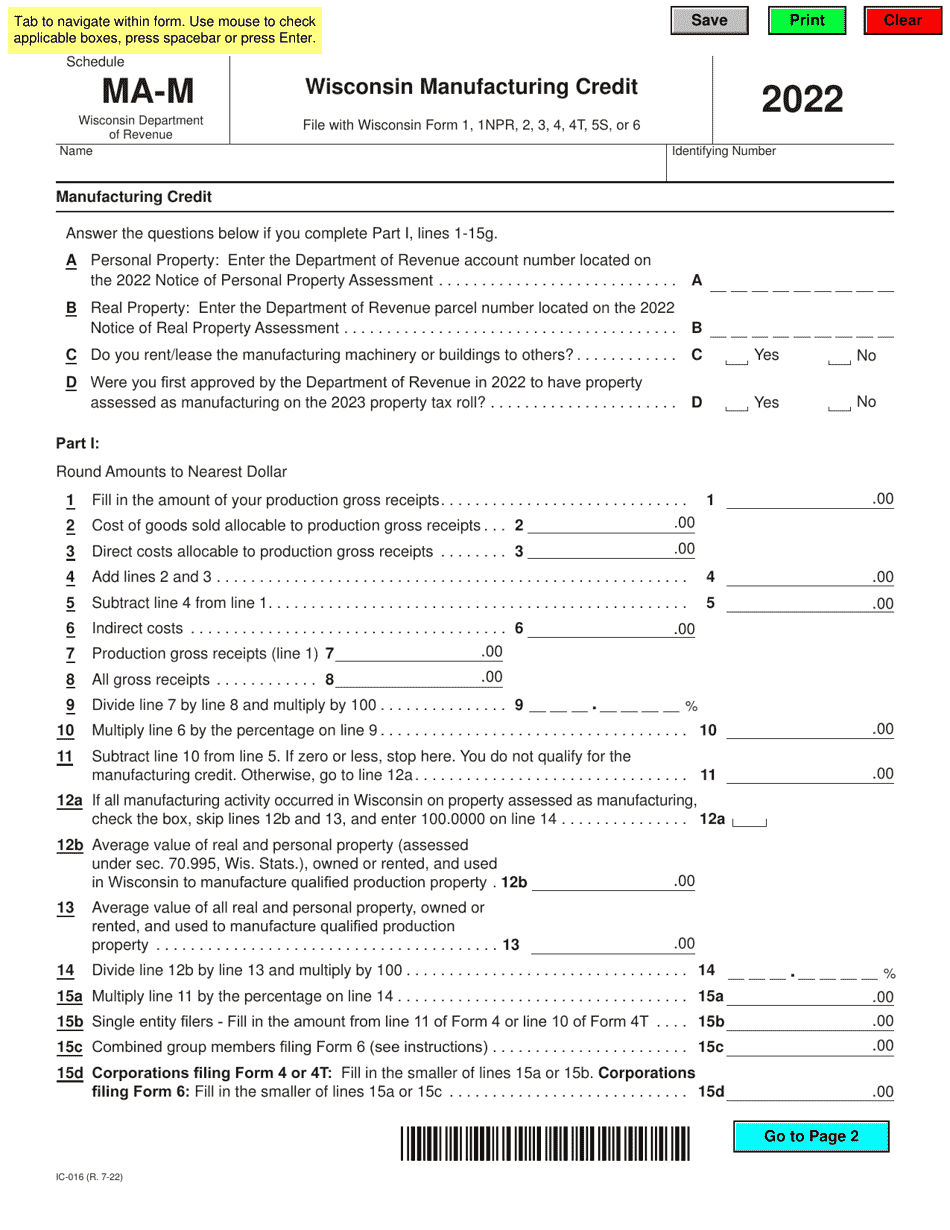

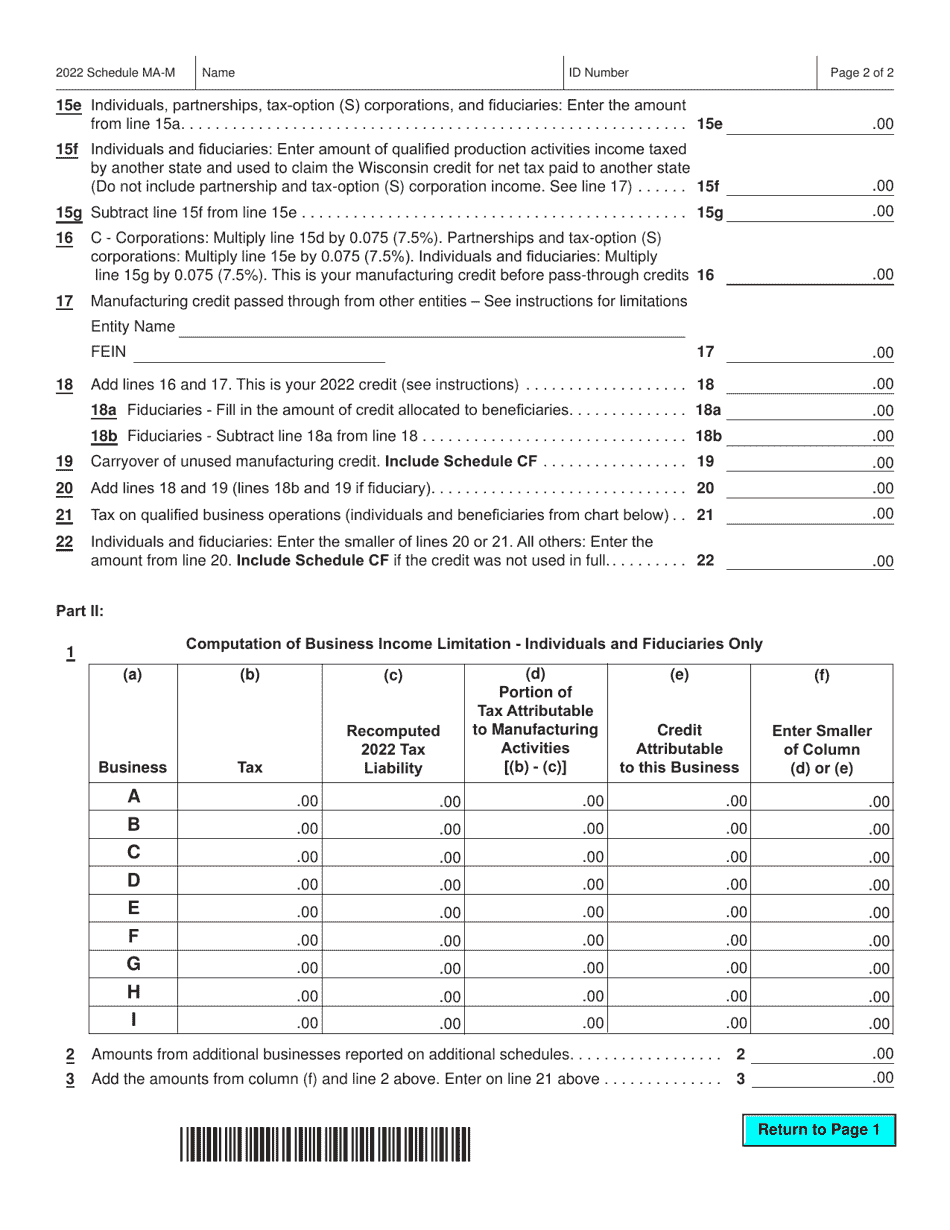

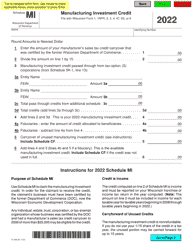

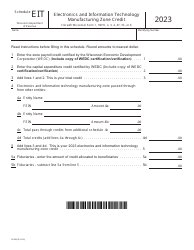

Form IC-016 Schedule MA-M

for the current year.

Form IC-016 Schedule MA-M Wisconsin Manufacturing Credit - Wisconsin

What Is Form IC-016 Schedule MA-M?

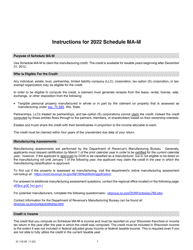

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-016 Schedule MA-M?

A: Form IC-016 Schedule MA-M is a schedule used to calculate the Wisconsin Manufacturing Credit in Wisconsin.

Q: What is the Wisconsin Manufacturing Credit?

A: The Wisconsin Manufacturing Credit is a tax credit available to businesses engaged in manufacturing activities in Wisconsin.

Q: Who is eligible for the Wisconsin Manufacturing Credit?

A: Businesses engaged in manufacturing activities in Wisconsin are eligible for the Wisconsin Manufacturing Credit.

Q: What is the purpose of Form IC-016 Schedule MA-M?

A: The purpose of Form IC-016 Schedule MA-M is to calculate the amount of Wisconsin Manufacturing Credit that a business is eligible for.

Q: What information do I need to complete Form IC-016 Schedule MA-M?

A: To complete Form IC-016 Schedule MA-M, you will need information about your business's manufacturing activities in Wisconsin, including income and expenses related to manufacturing.

Q: When is Form IC-016 Schedule MA-M due?

A: Form IC-016 Schedule MA-M is typically due at the same time as your Wisconsin tax return, which is generally April 15th of each year.

Q: Can I claim the Wisconsin Manufacturing Credit if I am not engaged in manufacturing activities?

A: No, the Wisconsin Manufacturing Credit is only available to businesses engaged in manufacturing activities in Wisconsin.

Q: Are there any limitations or restrictions on the Wisconsin Manufacturing Credit?

A: Yes, there are limitations and restrictions on the Wisconsin Manufacturing Credit, including income thresholds and phase-outs based on the business's income.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-016 Schedule MA-M by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.