This version of the form is not currently in use and is provided for reference only. Download this version of

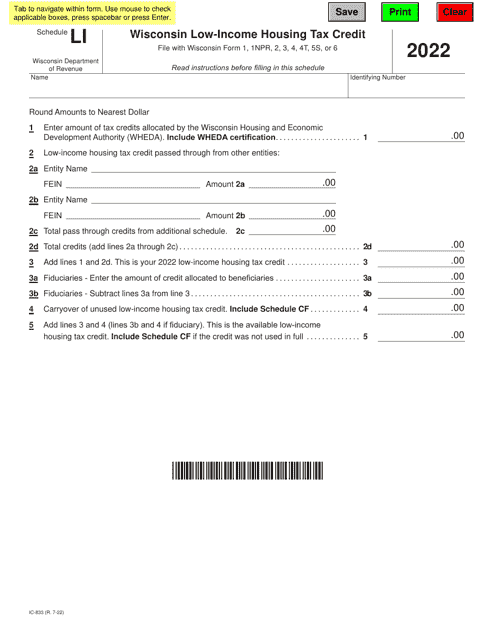

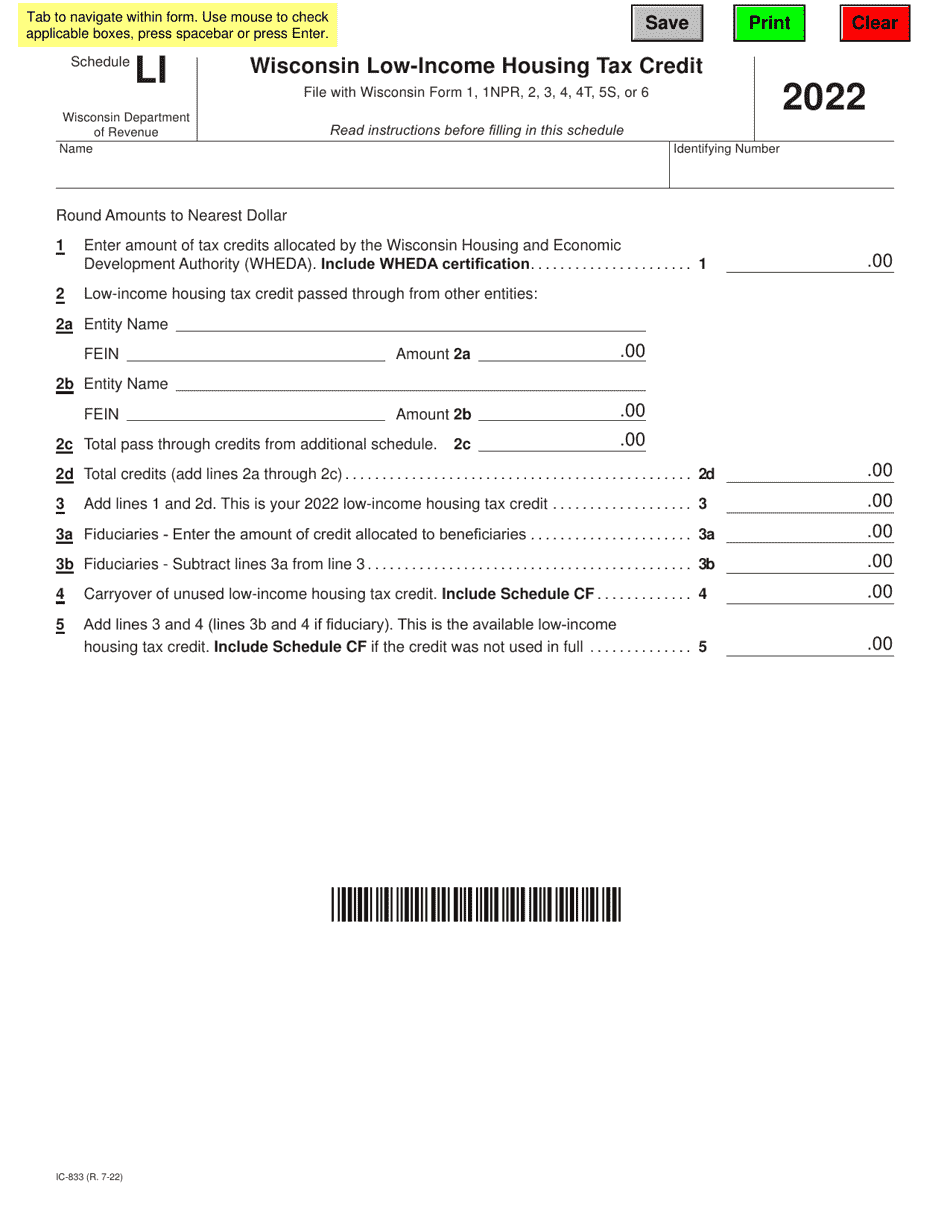

Form IC-833 Schedule LI

for the current year.

Form IC-833 Schedule LI Wisconsin Low-Income Housing Tax Credit - Wisconsin

What Is Form IC-833 Schedule LI?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-833 Schedule LI?

A: Form IC-833 Schedule LI is a form used in Wisconsin to claim the Low-Income Housing Tax Credit.

Q: What is the Wisconsin Low-Income Housing Tax Credit?

A: The Wisconsin Low-Income Housing Tax Credit is a tax credit available to individuals or organizations that invest in low-income housing properties in Wisconsin.

Q: Who can use Form IC-833 Schedule LI?

A: Individuals or organizations that have invested in low-income housing properties in Wisconsin and are eligible for the tax credit can use this form.

Q: What information is required on Form IC-833 Schedule LI?

A: This form requires the taxpayer to provide information about the low-income housing property, including the property identification number, the number of low-income units, and the amount of eligible basis.

Q: When is Form IC-833 Schedule LI due?

A: Form IC-833 Schedule LI is typically due on the same date as the Wisconsin income tax return, which is usually April 15th.

Q: Are there any other supporting documents that need to be submitted with Form IC-833 Schedule LI?

A: Yes, taxpayers may need to submit additional documentation, such as certification of the low-income housing property and other related forms.

Q: Can I claim the Wisconsin Low-Income Housing Tax Credit if I don't live in Wisconsin?

A: No, the tax credit is specifically for individuals or organizations that invest in low-income housing properties in Wisconsin.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-833 Schedule LI by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.