This version of the form is not currently in use and is provided for reference only. Download this version of

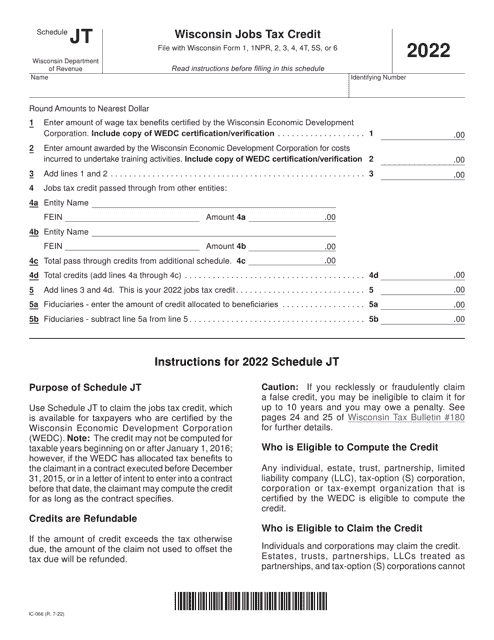

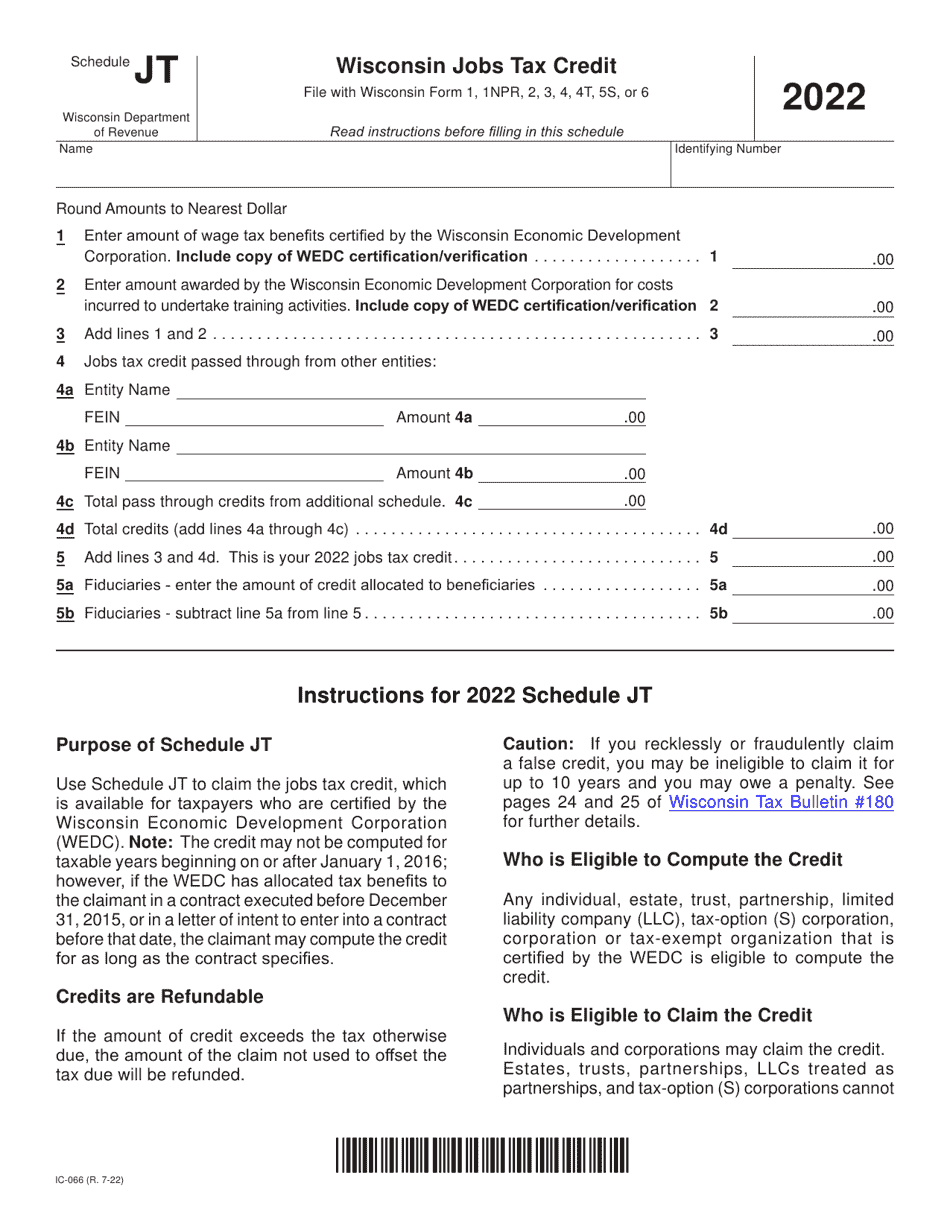

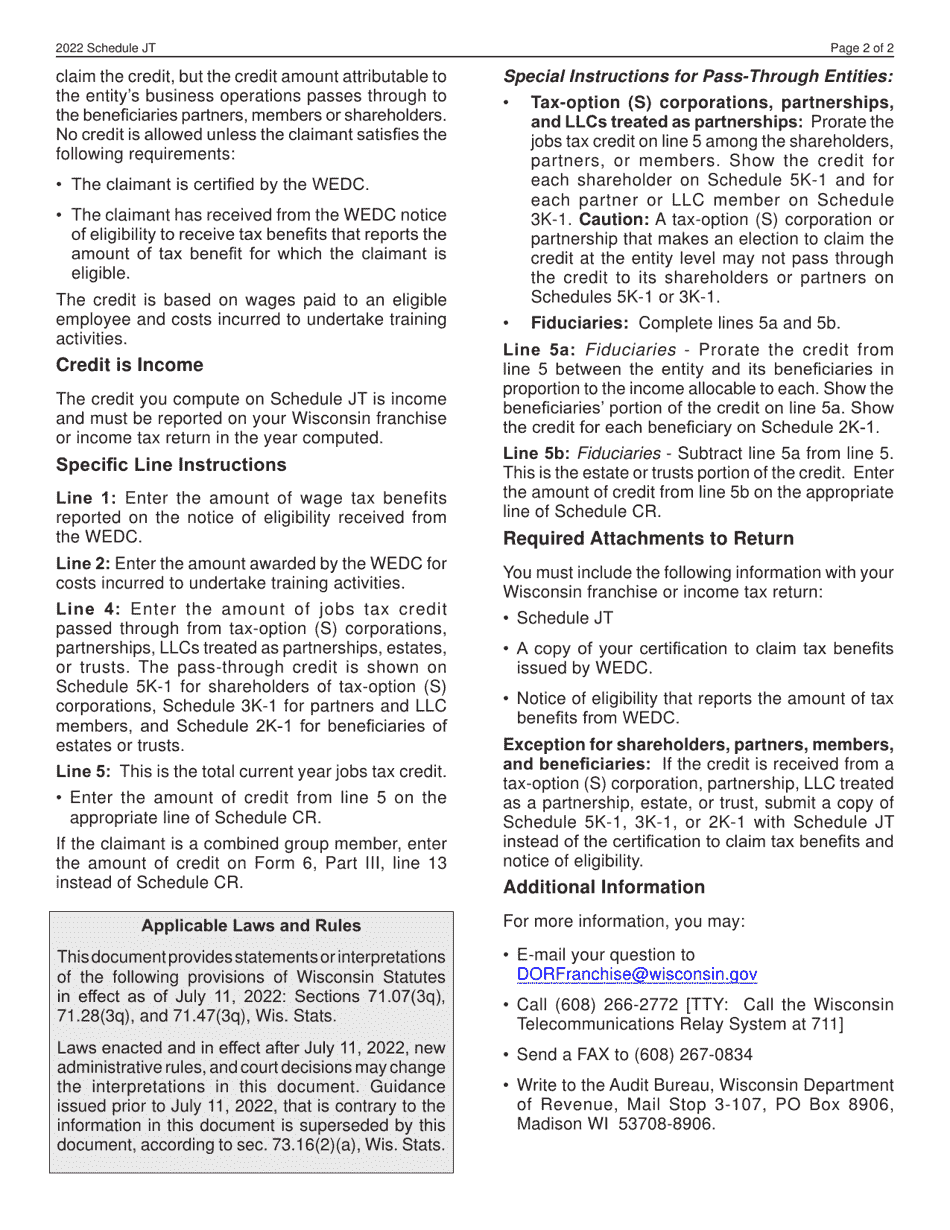

Form IC-066 Schedule JT

for the current year.

Form IC-066 Schedule JT Wisconsin Jobs Tax Credit - Wisconsin

What Is Form IC-066 Schedule JT?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IC-066 Schedule JT?

A: Form IC-066 Schedule JT is a tax form used in Wisconsin for claiming the Jobs Tax Credit.

Q: What is the Wisconsin Jobs Tax Credit?

A: The Wisconsin Jobs Tax Credit is a tax credit available to businesses that create jobs in Wisconsin.

Q: Who is eligible to claim the Wisconsin Jobs Tax Credit?

A: Businesses that create jobs in Wisconsin and meet certain criteria are eligible to claim the Wisconsin Jobs Tax Credit.

Q: What information is required to complete Form IC-066 Schedule JT?

A: To complete Form IC-066 Schedule JT, you will need information about the number of qualifying jobs created and wages paid to qualifying employees.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IC-066 Schedule JT by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.