This version of the form is not currently in use and is provided for reference only. Download this version of

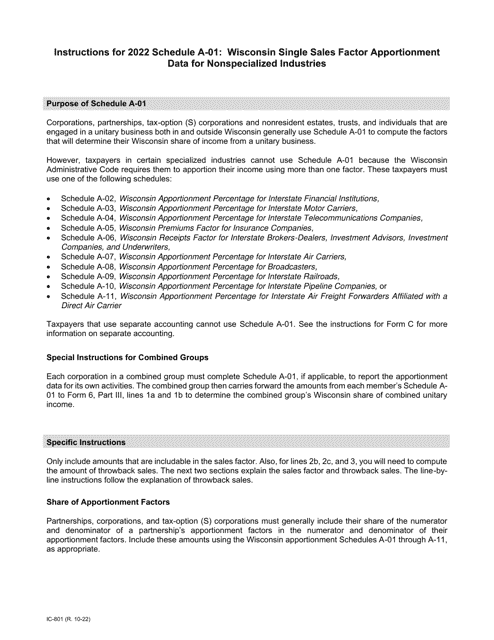

Instructions for Form IC-043 Schedule A-01

for the current year.

Instructions for Form IC-043 Schedule A-01 Wisconsin Single Sales Factor Apportionment Data for Nonspecialized Industries - Wisconsin

This document contains official instructions for Form IC-043 Schedule A-01, Wisconsin Single Sales Factor Apportionment Data for Nonspecialized Industries - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form IC-043 Schedule A-01 is available for download through this link.

FAQ

Q: What is Form IC-043?

A: Form IC-043 is a schedule used to report Wisconsin Single Sales Factor Apportionment Data for Nonspecialized Industries in Wisconsin.

Q: What is the purpose of Form IC-043?

A: The purpose of Form IC-043 is to provide data for the calculation of Wisconsin's Single Sales Factor Apportionment for Nonspecialized Industries.

Q: Who is required to file Form IC-043?

A: Individuals or businesses in non-specialized industries operating in Wisconsin are required to file Form IC-043.

Q: What information is needed to complete Form IC-043?

A: Form IC-043 requires reporting of various sales data, including sales inside and outside of Wisconsin.

Q: When is the deadline for filing Form IC-043?

A: The deadline for filing Form IC-043 is determined by the Wisconsin Department of Revenue and may vary each year.

Q: What are Nonspecialized Industries?

A: Nonspecialized industries refer to businesses that do not fall under specialized industry categories such as manufacturing, broadcasting, or transportation.

Q: Do I need to include Form IC-043 with my Wisconsin tax return?

A: Yes, if you are required to file Form IC-043, you should include it with your Wisconsin tax return.

Q: Are there any penalties for not filing Form IC-043?

A: Failure to file Form IC-043 may result in penalties imposed by the Wisconsin Department of Revenue.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.