This version of the form is not currently in use and is provided for reference only. Download this version of

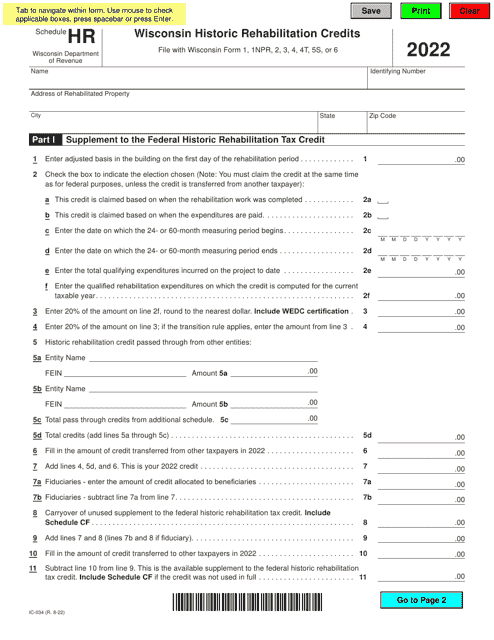

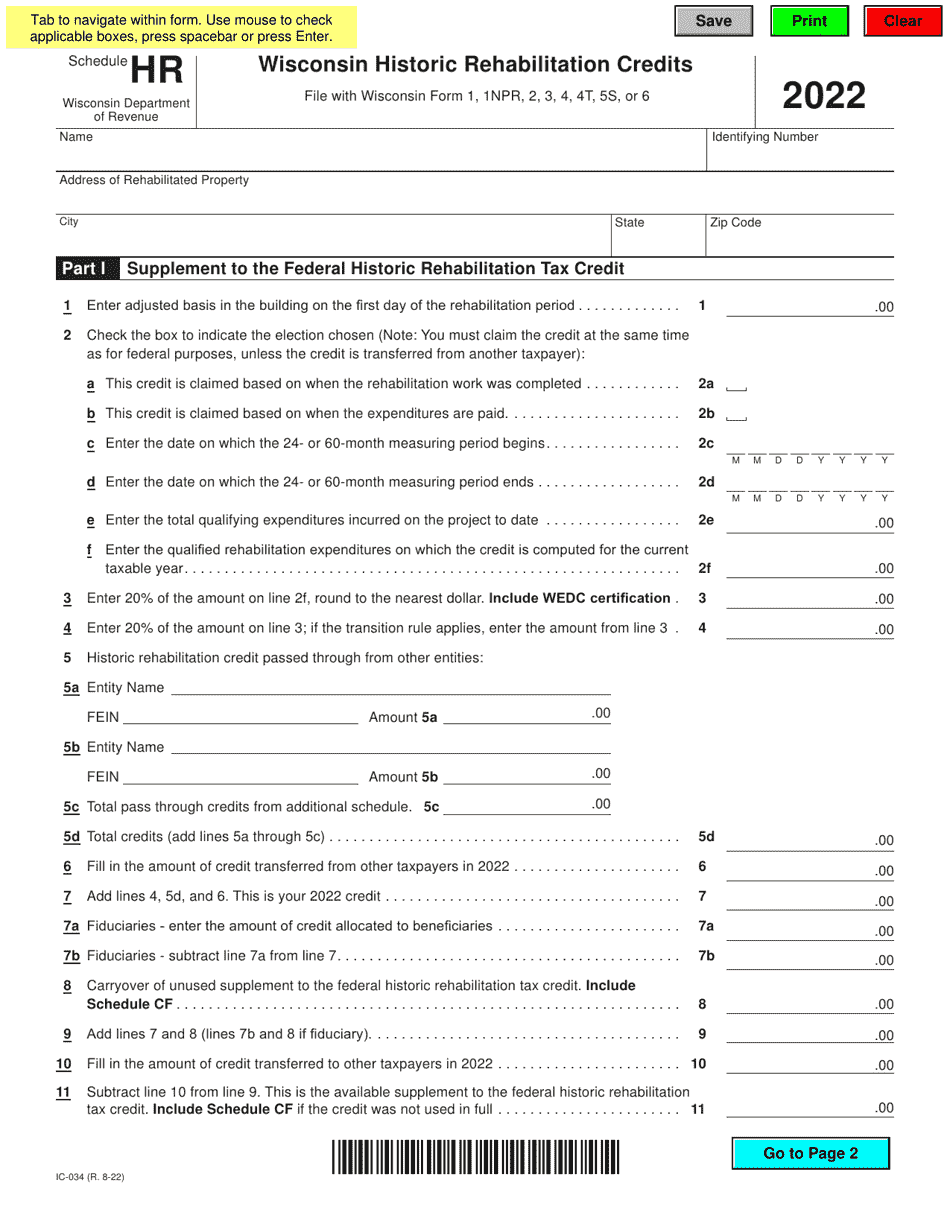

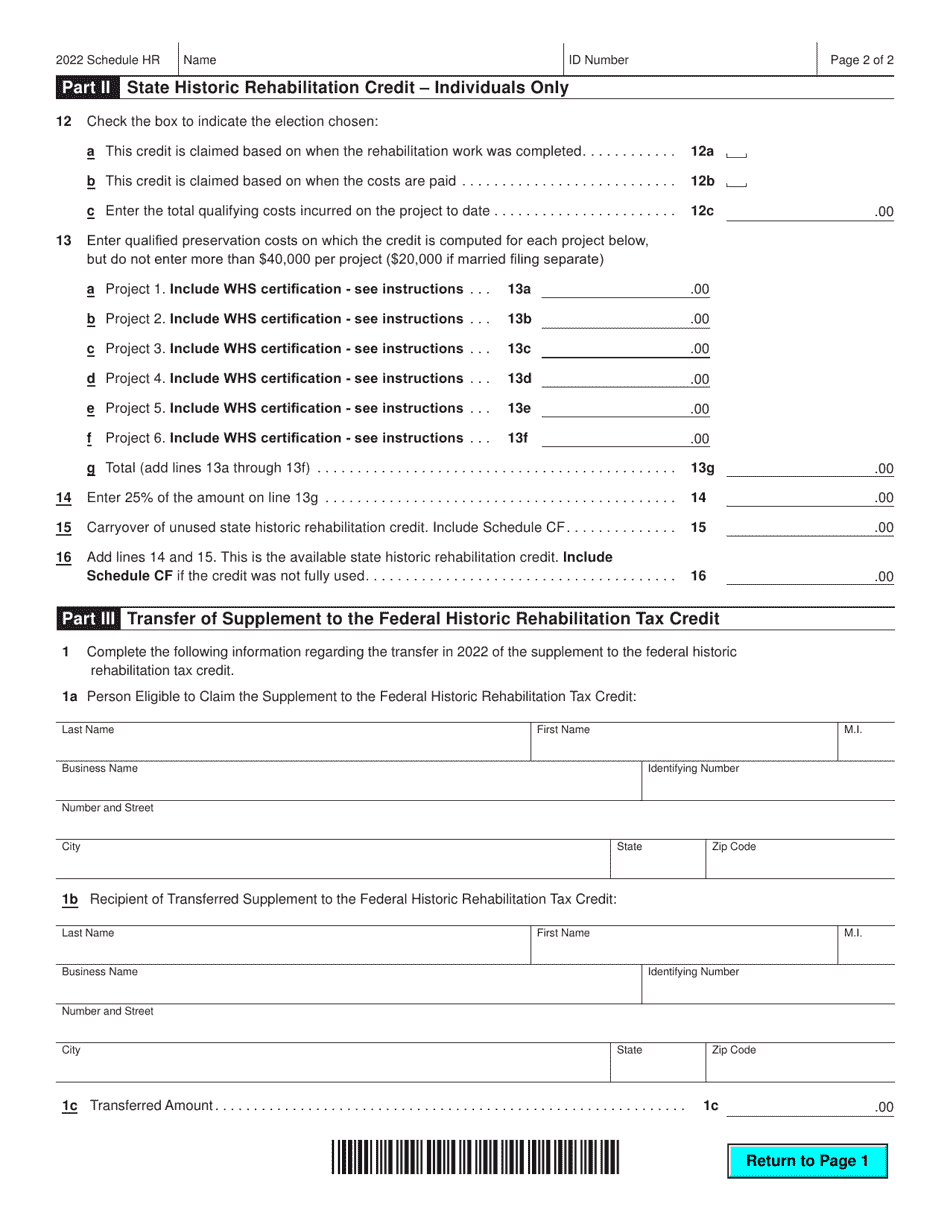

Form IC-034 Schedule HR

for the current year.

Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits - Wisconsin

What Is Form IC-034 Schedule HR?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-034 Schedule HR?

A: Form IC-034 Schedule HR is a schedule that is used to claim Wisconsin Historic Rehabilitation Credits in Wisconsin.

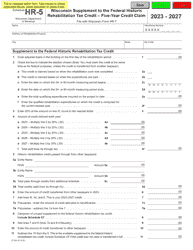

Q: What are Wisconsin Historic Rehabilitation Credits?

A: Wisconsin Historic Rehabilitation Credits are tax credits that incentivize the rehabilitation of historic properties in Wisconsin.

Q: Who can use Form IC-034 Schedule HR?

A: Any individual or entity that is claiming Wisconsin Historic Rehabilitation Credits can use Form IC-034 Schedule HR.

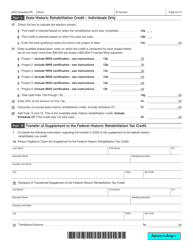

Q: What information is required on Form IC-034 Schedule HR?

A: Form IC-034 Schedule HR requires information about the historic property being rehabilitated, the rehabilitation expenses incurred, and other relevant details.

Q: When is the deadline to file Form IC-034 Schedule HR?

A: The deadline to file Form IC-034 Schedule HR is generally the same as the deadline for filing your Wisconsin state income tax return.

Q: Are there any additional documentation requirements for Form IC-034 Schedule HR?

A: Yes, you may need to include supporting documentation such as receipts, invoices, and other records to substantiate your claims on Form IC-034 Schedule HR.

Q: Can I claim Wisconsin Historic Rehabilitation Credits on my federal tax return?

A: No, Wisconsin Historic Rehabilitation Credits can only be claimed on your Wisconsin state income tax return.

Q: What are the benefits of claiming Wisconsin Historic Rehabilitation Credits?

A: The benefits of claiming Wisconsin Historic Rehabilitation Credits include reducing your state tax liability and incentivizing the preservation of historic properties in Wisconsin.

Q: Can I carry forward unused Wisconsin Historic Rehabilitation Credits?

A: Yes, you can carry forward any unused Wisconsin Historic Rehabilitation Credits for up to 15 years.

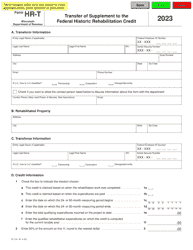

Q: Can I transfer Wisconsin Historic Rehabilitation Credits to another individual or entity?

A: Yes, Wisconsin Historic Rehabilitation Credits can be transferred, but certain restrictions and requirements apply.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-034 Schedule HR by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.