This version of the form is not currently in use and is provided for reference only. Download this version of

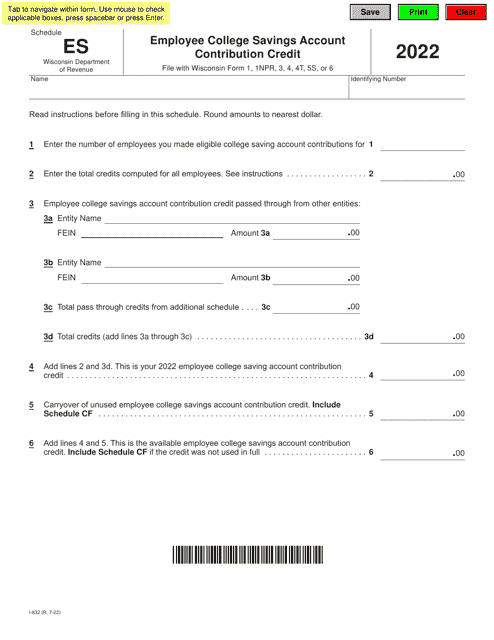

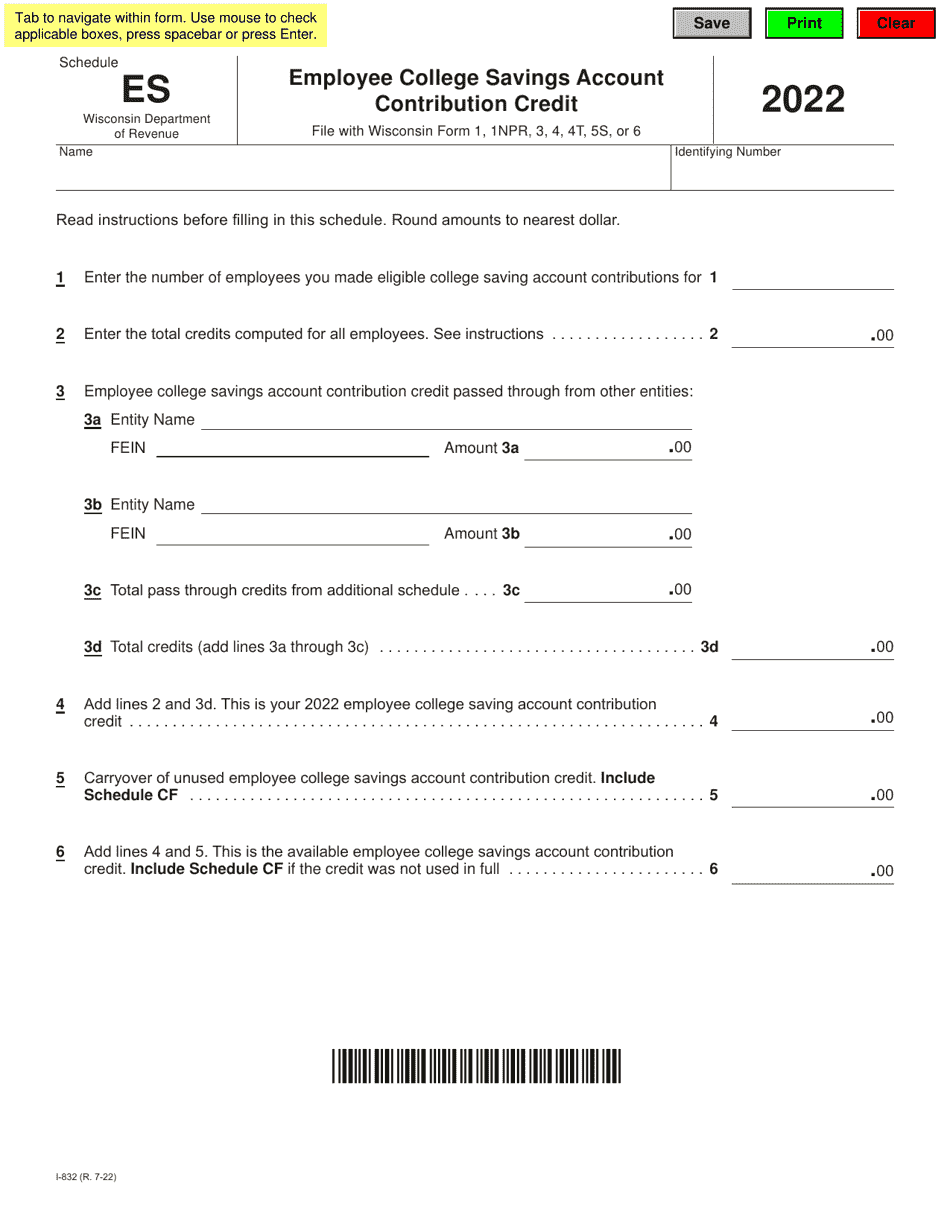

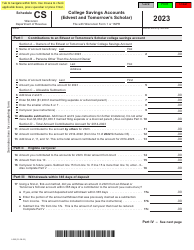

Form I-832 Schedule ES

for the current year.

Form I-832 Schedule ES Employee College Savings Account Contribution Credit - Wisconsin

What Is Form I-832 Schedule ES?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-832 Schedule ES?

A: Form I-832 Schedule ES is a document used for reporting employee college savings account contribution credit in Wisconsin.

Q: What is the Employee College Savings Account Contribution Credit?

A: The Employee College Savings Account Contribution Credit is a tax credit available to eligible individuals in Wisconsin who contribute to a college savings account for themselves or their dependents.

Q: Who can claim the Employee College Savings Account Contribution Credit?

A: Individuals who make contributions to a college savings account in Wisconsin may be eligible to claim the credit.

Q: How do I file Form I-832 Schedule ES?

A: Form I-832 Schedule ES should be filed along with your Wisconsin income tax return.

Q: What information do I need to fill out Form I-832 Schedule ES?

A: You will need information about your college savings account contributions and the amount of credit you are claiming.

Q: When is the deadline to file Form I-832 Schedule ES?

A: The deadline to file Form I-832 Schedule ES is the same as the deadline for your Wisconsin income tax return, typically April 15th.

Q: What is the benefit of claiming the Employee College Savings Account Contribution Credit?

A: Claiming the credit can help reduce your Wisconsin state income tax liability, providing potential savings for your college savings account contributions.

Q: Are there any income limitations for claiming the credit?

A: Yes, there are income limitations for claiming the Employee College Savings Account Contribution Credit in Wisconsin. Consult the instructions for Form I-832 Schedule ES for more information.

Q: Can I claim the credit for contributions made to any college savings account?

A: No, the credit is only available for contributions made to a qualified college savings account in Wisconsin.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-832 Schedule ES by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.