This version of the form is not currently in use and is provided for reference only. Download this version of

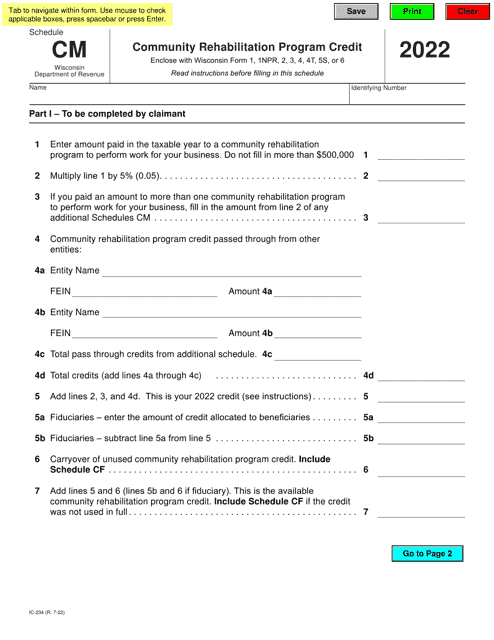

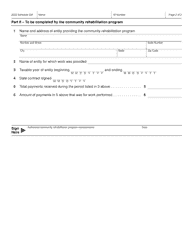

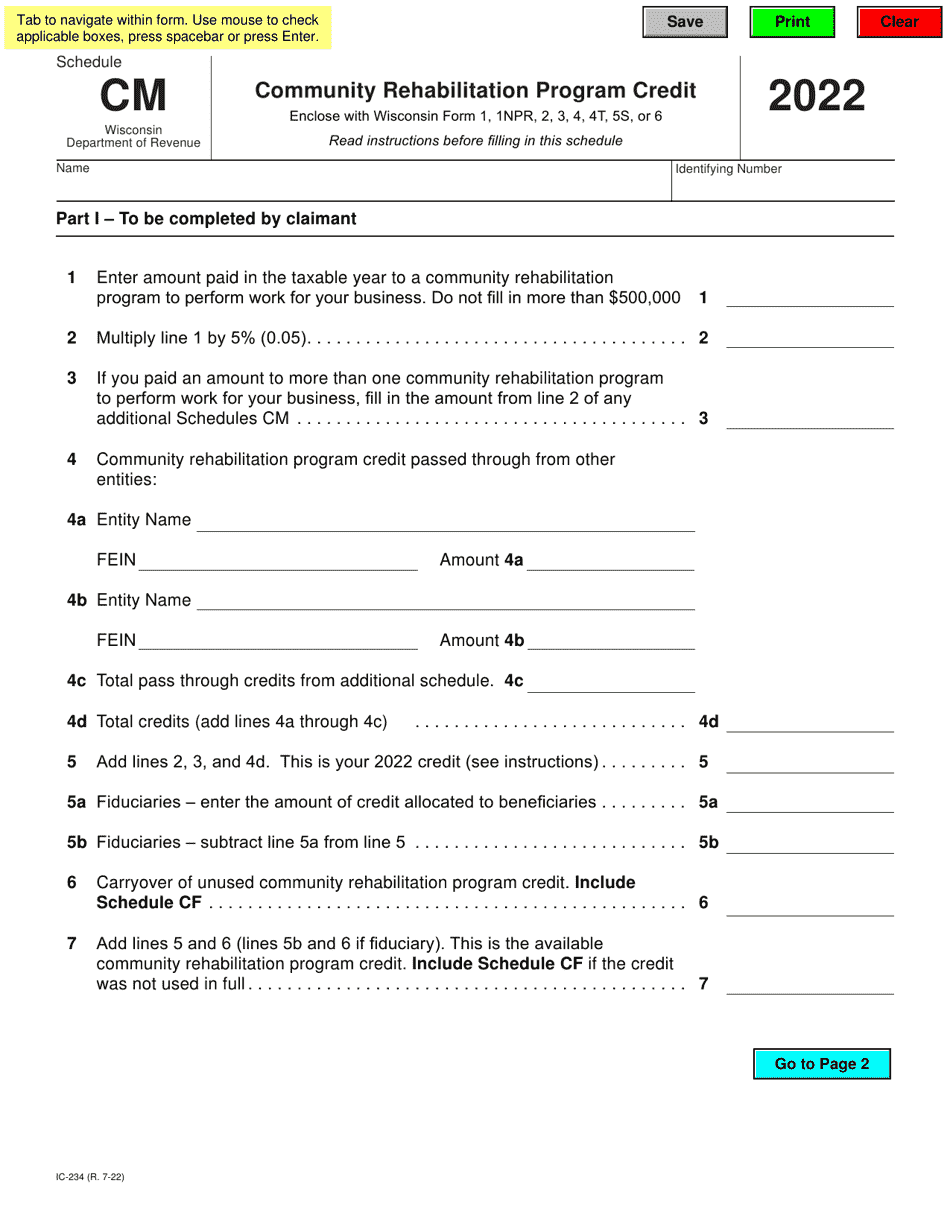

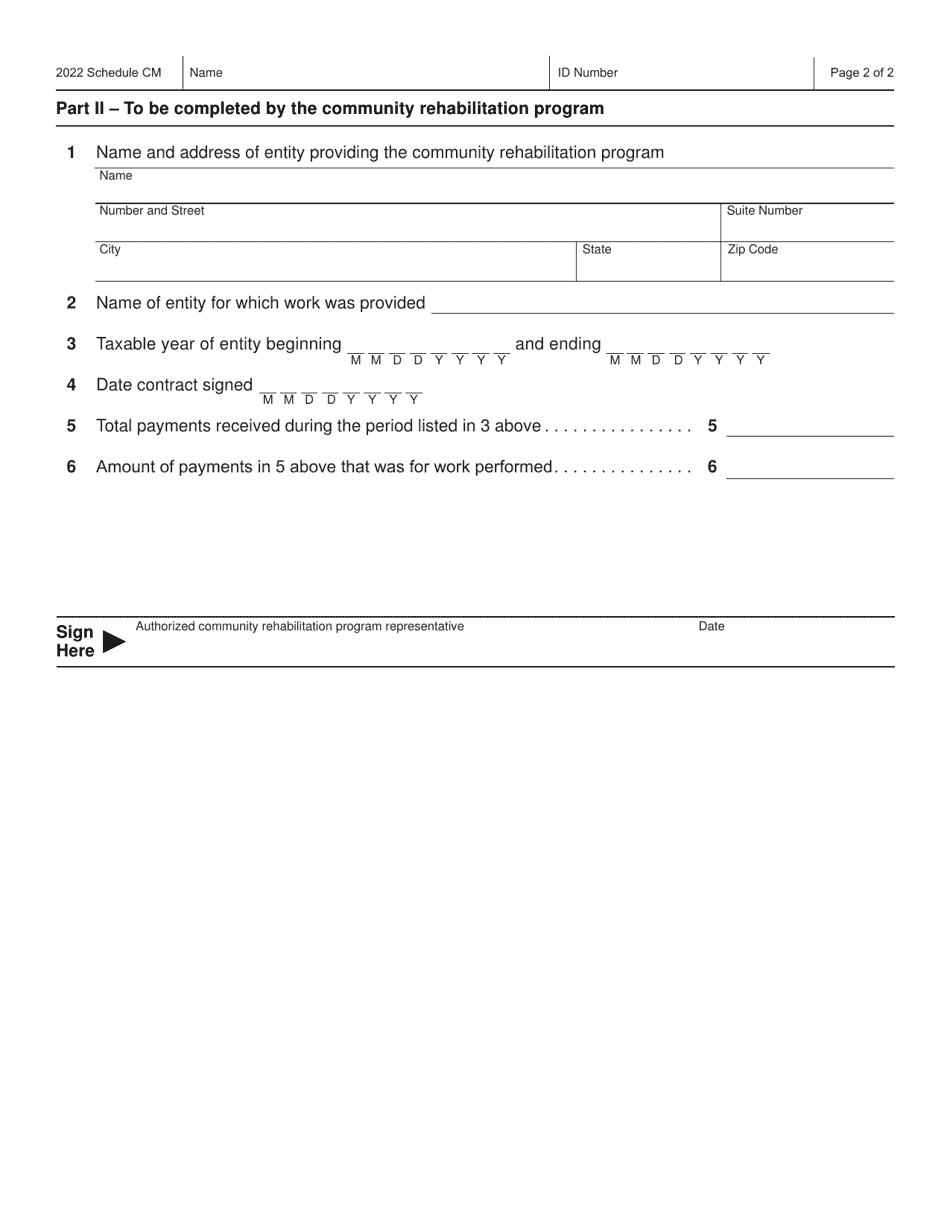

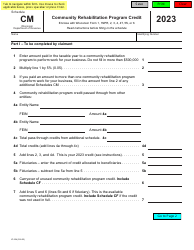

Form IC-234 Schedule CM

for the current year.

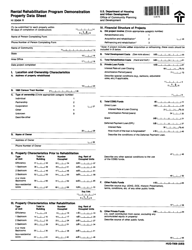

Form IC-234 Schedule CM Community Rehabilitation Program Credit - Wisconsin

What Is Form IC-234 Schedule CM?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-234?

A: Form IC-234 is a schedule used in Wisconsin for the Community Rehabilitation Program Credit.

Q: What is the purpose of Form IC-234?

A: The purpose of Form IC-234 is to claim the Community Rehabilitation Program Credit in Wisconsin.

Q: What is the Community Rehabilitation Program Credit?

A: The Community Rehabilitation Program Credit is a tax credit available in Wisconsin to businesses that participate in the Community Rehabilitation Program.

Q: Who can claim the Community Rehabilitation Program Credit?

A: Businesses that participate in the Community Rehabilitation Program in Wisconsin can claim this credit.

Q: How can a business claim the Community Rehabilitation Program Credit?

A: To claim the Community Rehabilitation Program Credit, businesses must complete Form IC-234 and include it with their Wisconsin tax return.

Q: Are there any requirements to claim the Community Rehabilitation Program Credit?

A: Yes, businesses must meet certain criteria to be eligible for this credit, including being certified as a Community Rehabilitation Program.

Q: Is the Community Rehabilitation Program Credit refundable?

A: No, the Community Rehabilitation Program Credit is not refundable. It can only be used to offset tax liability.

Q: Is there a deadline for claiming the Community Rehabilitation Program Credit?

A: Yes, businesses must file Form IC-234 with their Wisconsin tax return by the due date of the return.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-234 Schedule CM by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.