This version of the form is not currently in use and is provided for reference only. Download this version of

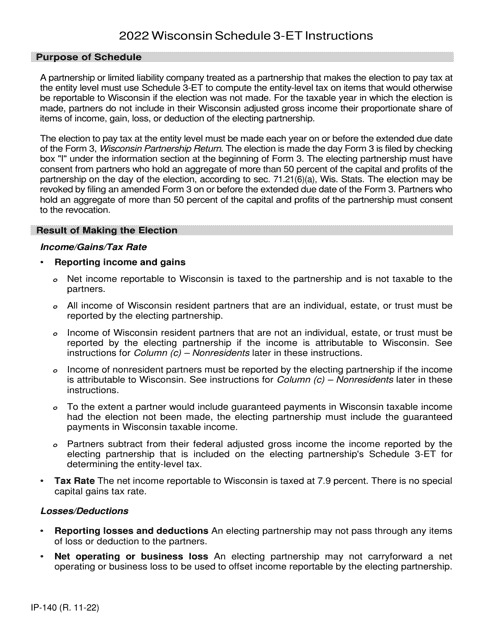

Instructions for Form IP-040 Schedule 3-ET

for the current year.

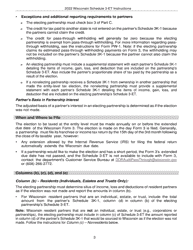

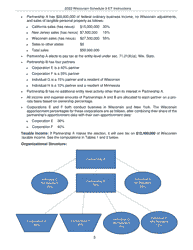

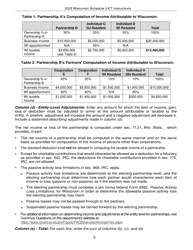

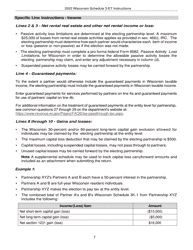

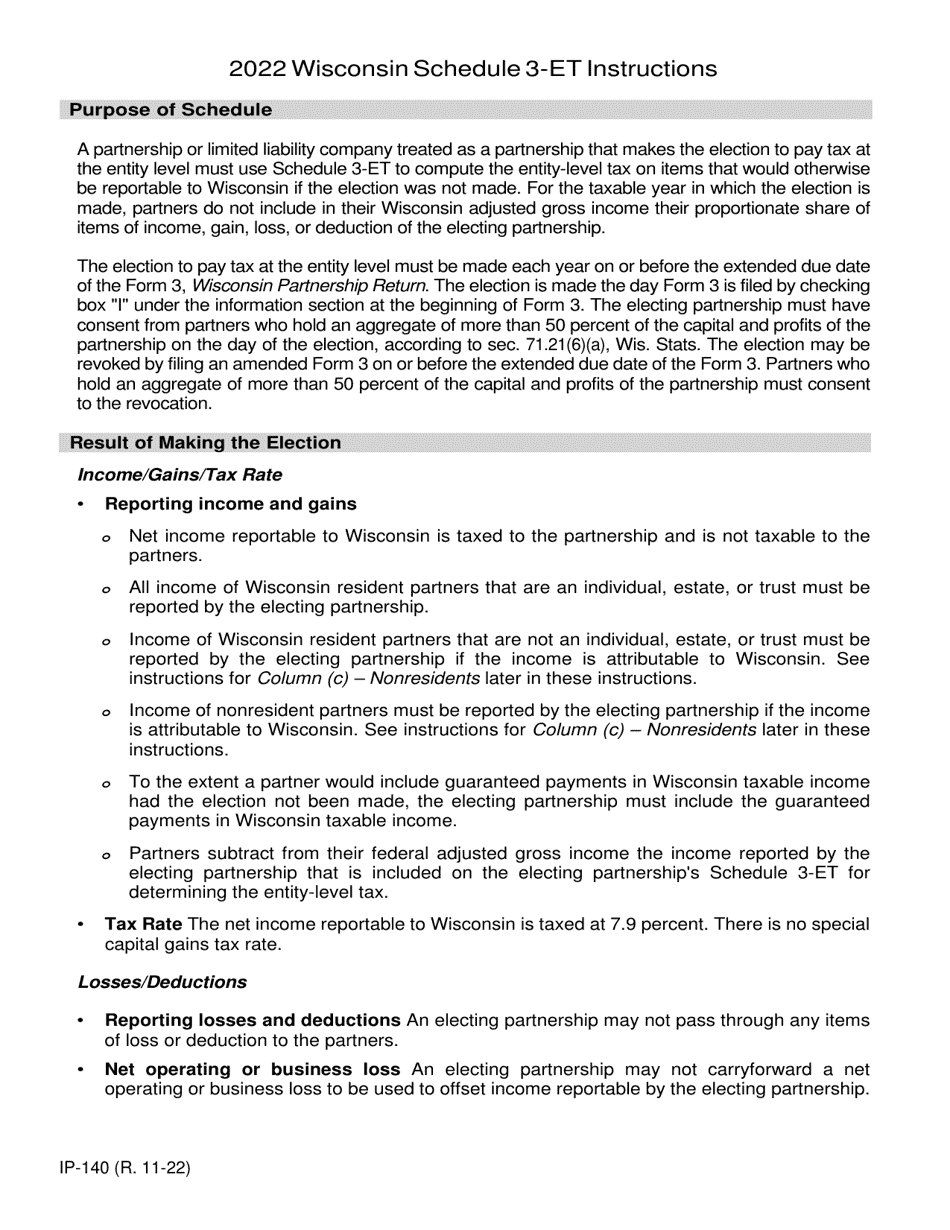

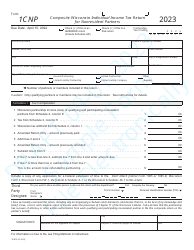

Instructions for Form IP-040 Schedule 3-ET Entity-Level Tax Computation - Wisconsin

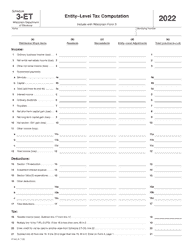

This document contains official instructions for Form IP-040 Schedule 3-ET, Entity-Level Tax Computation - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form IP-040 Schedule 3-ET is available for download through this link.

FAQ

Q: What is Form IP-040 Schedule 3-ET?

A: Form IP-040 Schedule 3-ET is a tax form used to compute the entity-level tax in Wisconsin.

Q: Who needs to fill out Form IP-040 Schedule 3-ET?

A: Any entity subject to entity-level taxation in Wisconsin needs to fill out this form.

Q: What is entity-level tax?

A: Entity-level tax is a tax imposed on an entity, such as a corporation or partnership, rather than on its individual owners.

Q: What is the purpose of Form IP-040 Schedule 3-ET?

A: The purpose of this form is to calculate the entity-level tax owed by the entity.

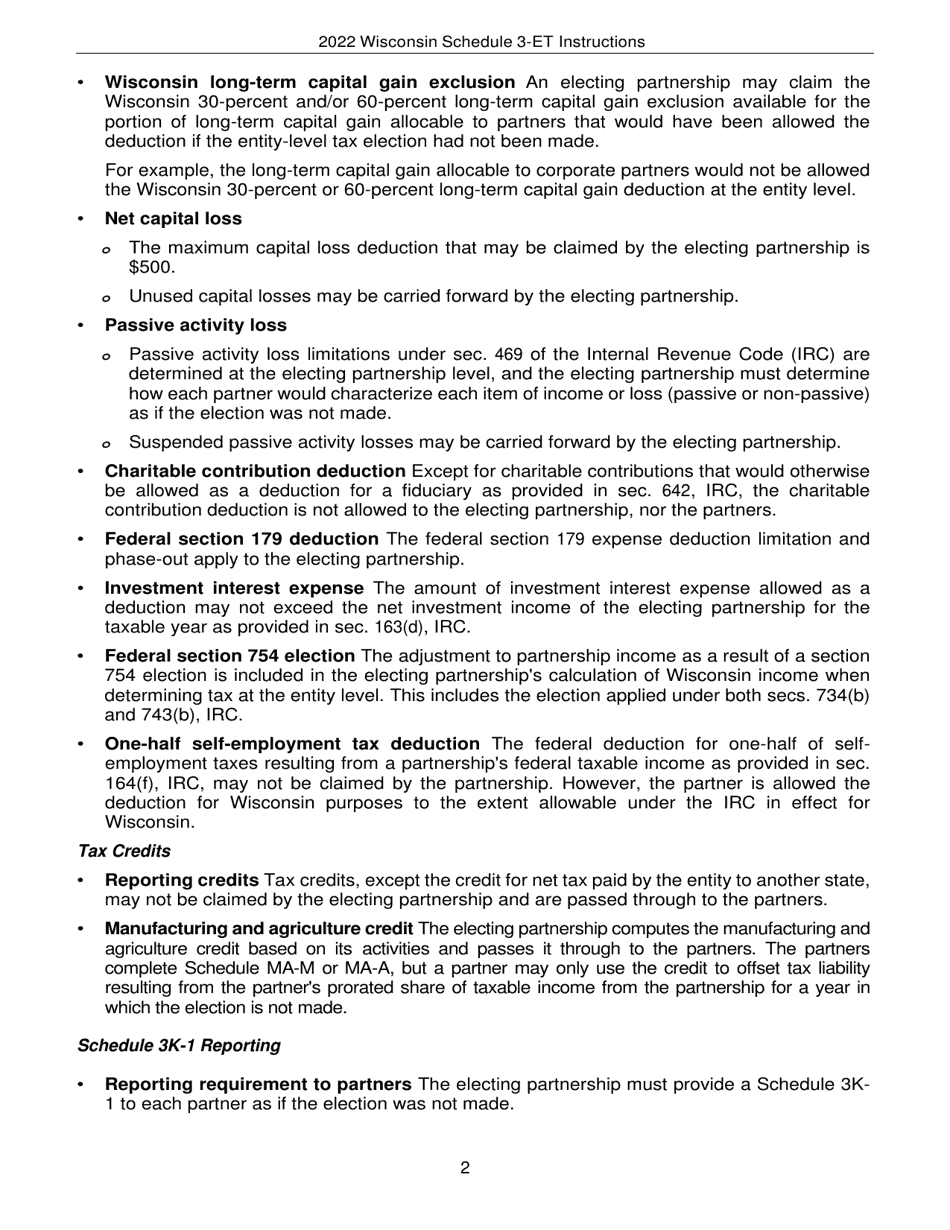

Q: What information do I need to fill out this form?

A: You will need information about your entity's income, deductions, and apportionment factors.

Q: When is the deadline to file Form IP-040 Schedule 3-ET?

A: The deadline to file this form usually aligns with the due date for the entity's annual tax return.

Q: Is there a fee for filing Form IP-040 Schedule 3-ET?

A: There is no fee for filing this form.

Q: Can I e-file Form IP-040 Schedule 3-ET?

A: Yes, you can e-file this form if you choose to do so.

Q: What should I do if I have questions or need assistance with Form IP-040 Schedule 3-ET?

A: You can reach out to the Wisconsin Department of Revenue for assistance with this form.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.