This version of the form is not currently in use and is provided for reference only. Download this version of

Form PW-U (IC-006)

for the current year.

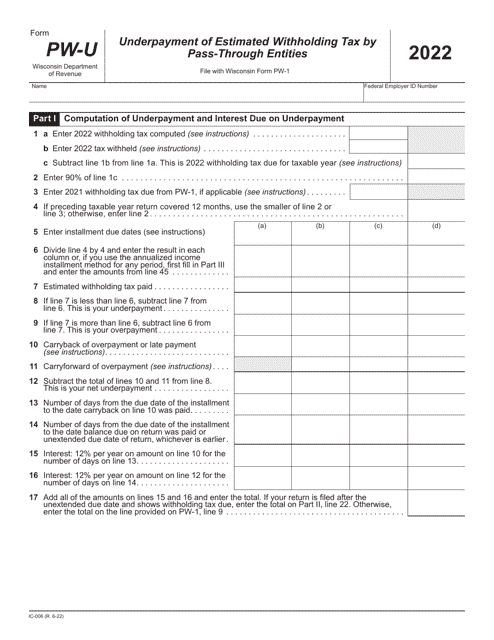

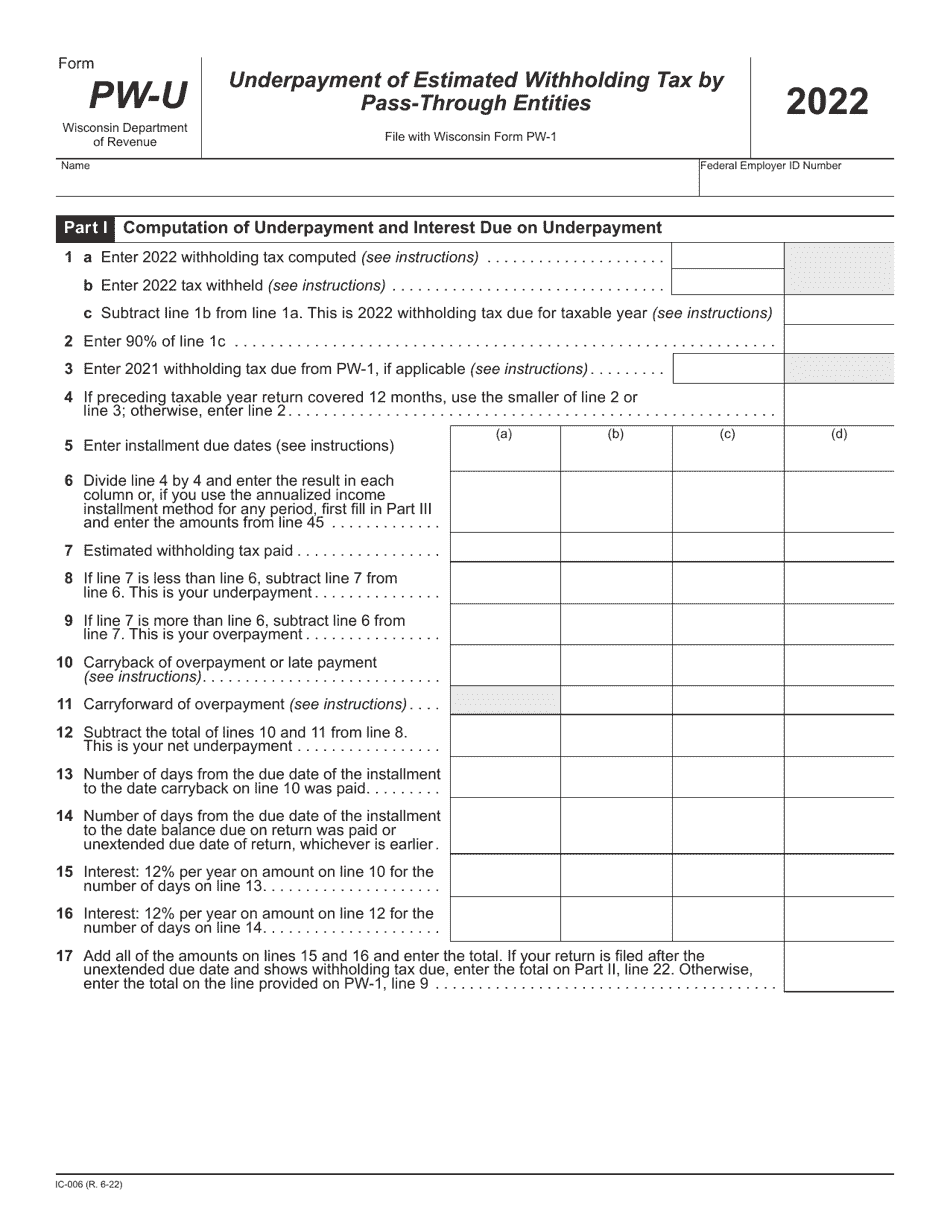

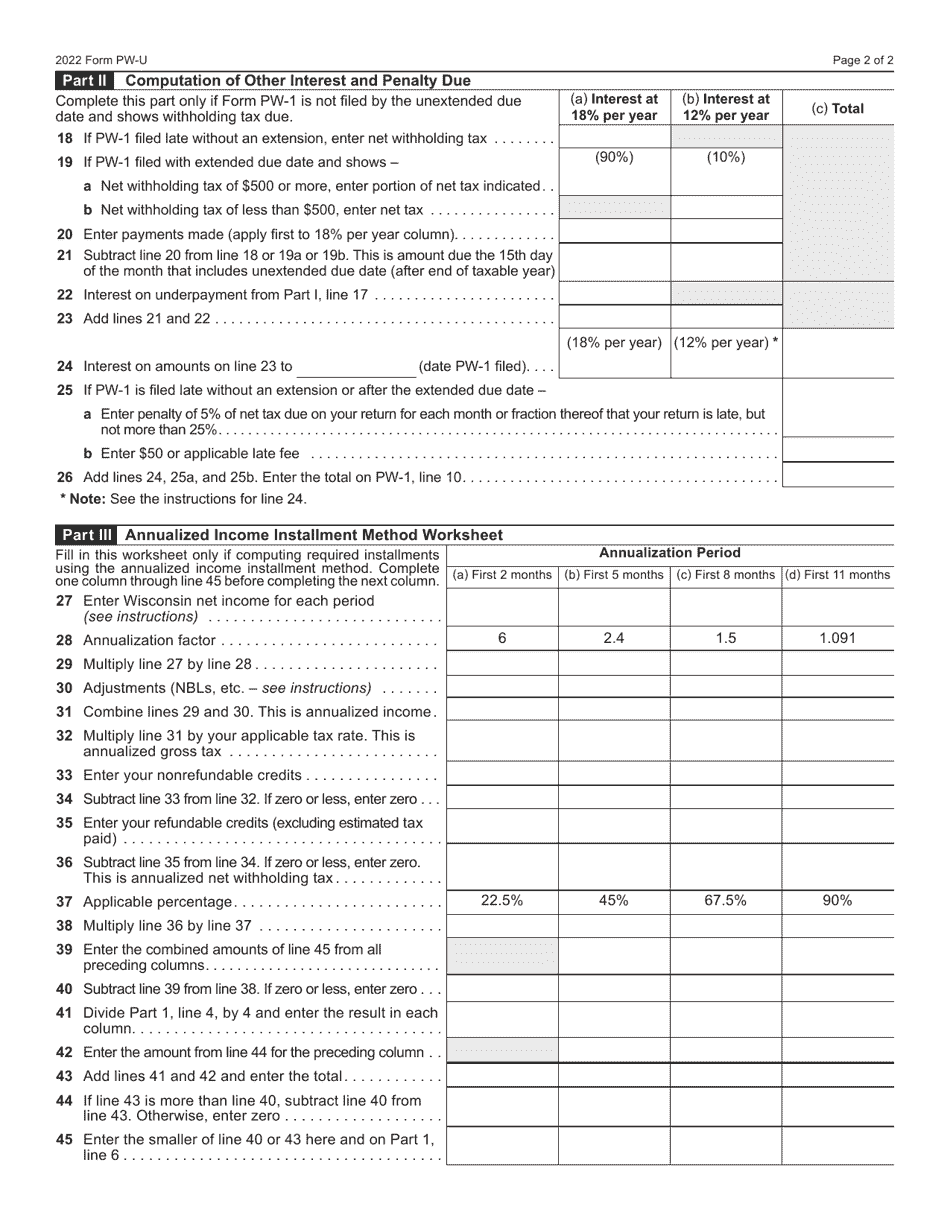

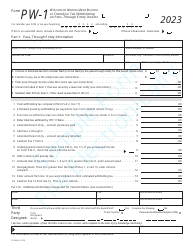

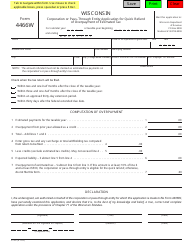

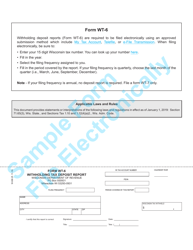

Form PW-U (IC-006) Underpayment of Estimated Withholding Tax by Pass-Through Entities - Wisconsin

What Is Form PW-U (IC-006)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PW-U?

A: Form PW-U is a tax form in Wisconsin used by pass-through entities to report any underpayment of estimated withholding tax.

Q: Who should file Form PW-U?

A: Pass-through entities in Wisconsin who have underpaid their estimated withholding tax should file Form PW-U.

Q: What is the purpose of Form PW-U?

A: The purpose of Form PW-U is to report and pay any underpayment of estimated withholding tax by pass-through entities.

Q: When should Form PW-U be filed?

A: Form PW-U should be filed by pass-through entities in Wisconsin on or before the due date of their annual income tax return.

Q: Is Form PW-U required for individuals?

A: No, Form PW-U is specifically for pass-through entities and not for individuals.

Q: What happens if I don't file Form PW-U?

A: If a pass-through entity fails to file Form PW-U or underpays their estimated withholding tax, they may be subject to penalties and interest.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PW-U (IC-006) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.