This version of the form is not currently in use and is provided for reference only. Download this version of

Form C (IC-044)

for the current year.

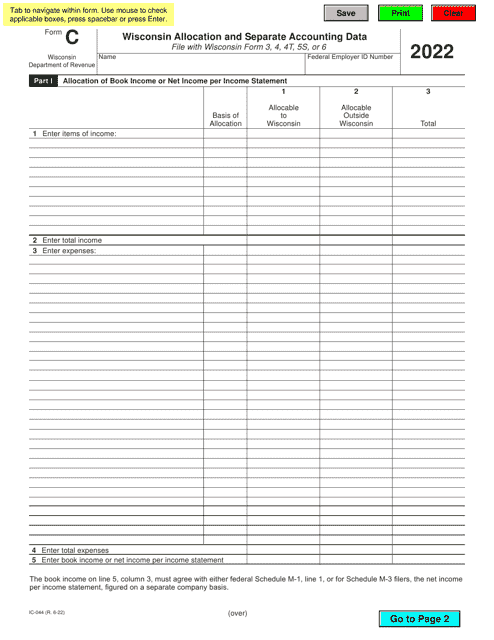

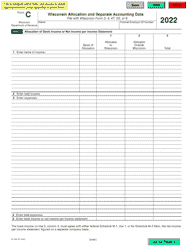

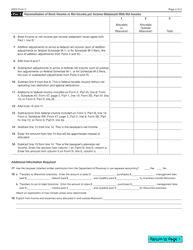

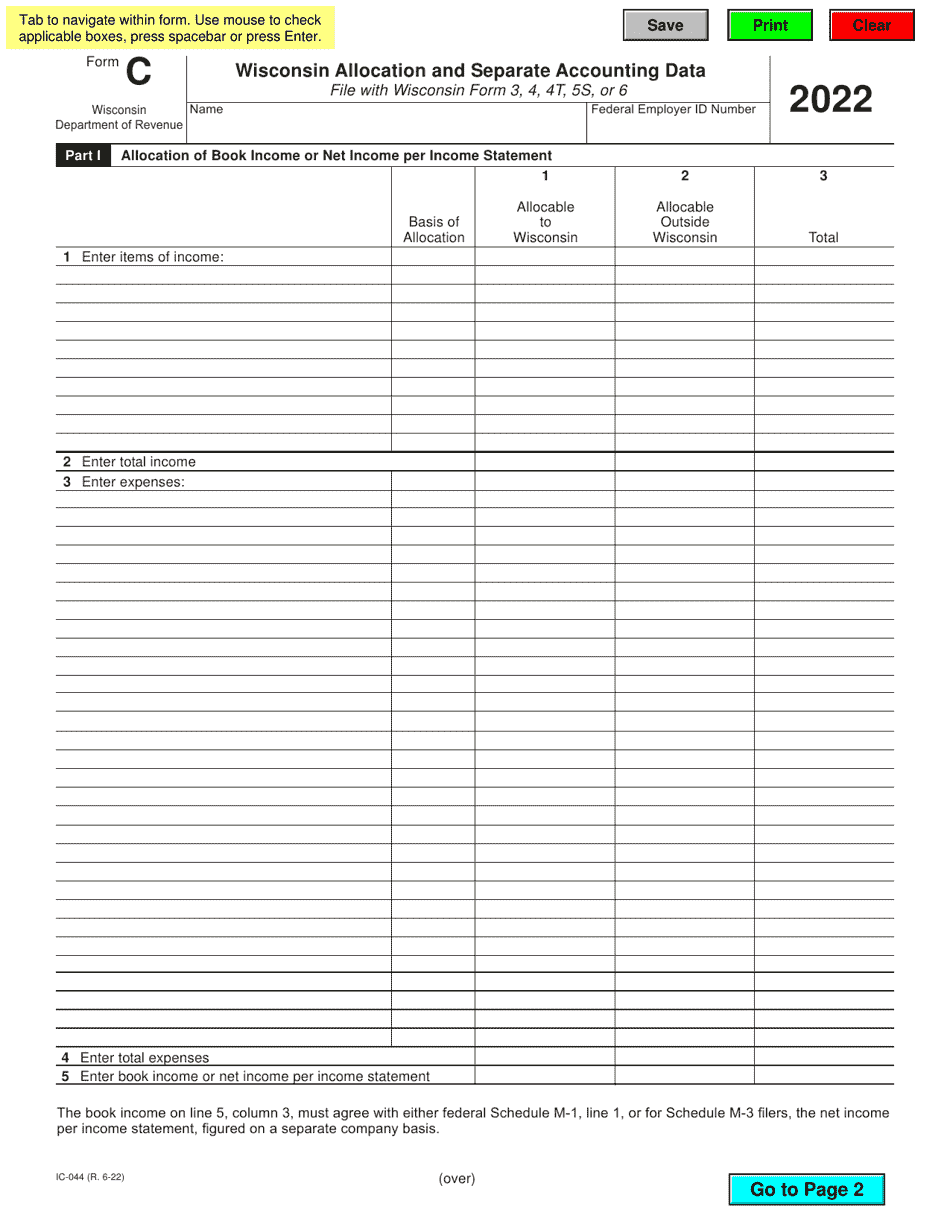

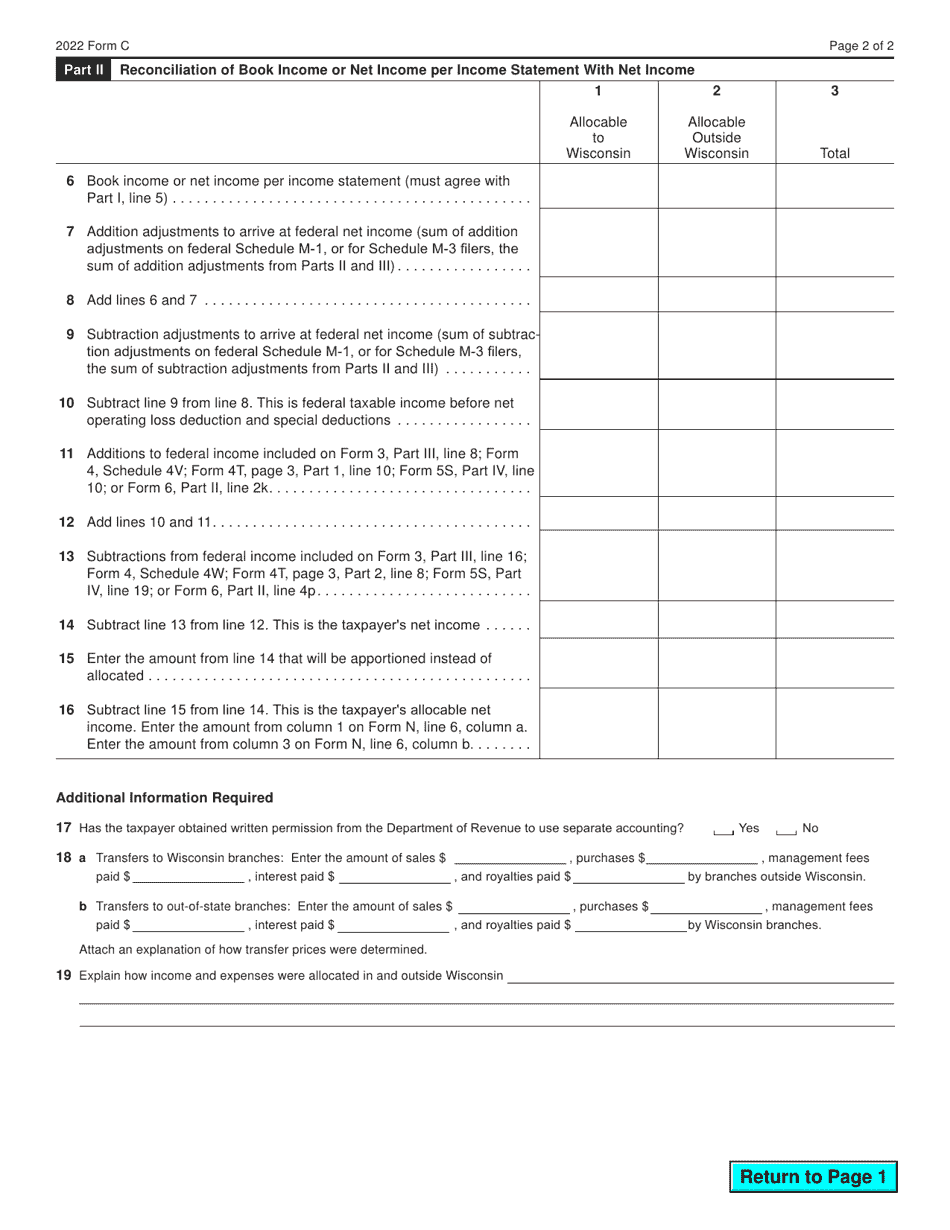

Form C (IC-044) Wisconsin Allocation and Separate Accounting Data - Wisconsin

What Is Form C (IC-044)?

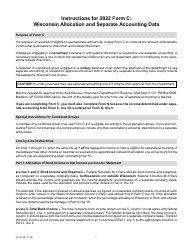

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form C (IC-044)?

A: Form C (IC-044) is the Wisconsin Allocation and Separate Accounting Data form.

Q: What is the purpose of Form C (IC-044)?

A: The purpose of Form C (IC-044) is to report allocation and separate accounting data in Wisconsin.

Q: Who needs to file Form C (IC-044)?

A: Any entity doing business in Wisconsin that has activities both inside and outside the state needs to file Form C (IC-044).

Q: What information is required on Form C (IC-044)?

A: Form C (IC-044) requires information about an entity's sales, property, and payroll in Wisconsin, as well as its total sales, property, and payroll.

Q: When is Form C (IC-044) due?

A: Form C (IC-044) is due on the 15th day of the 4th month following the close of the tax year.

Q: Is there a penalty for late filing of Form C (IC-044)?

A: Yes, there may be a penalty for late filing of Form C (IC-044). It is advisable to file the form on time to avoid penalties.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C (IC-044) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.