This version of the form is not currently in use and is provided for reference only. Download this version of

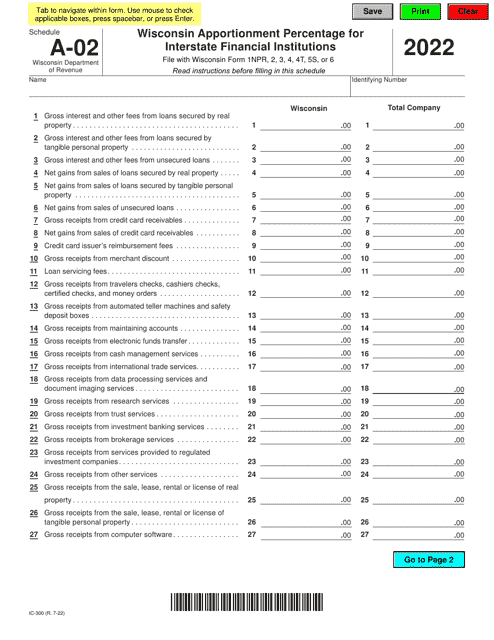

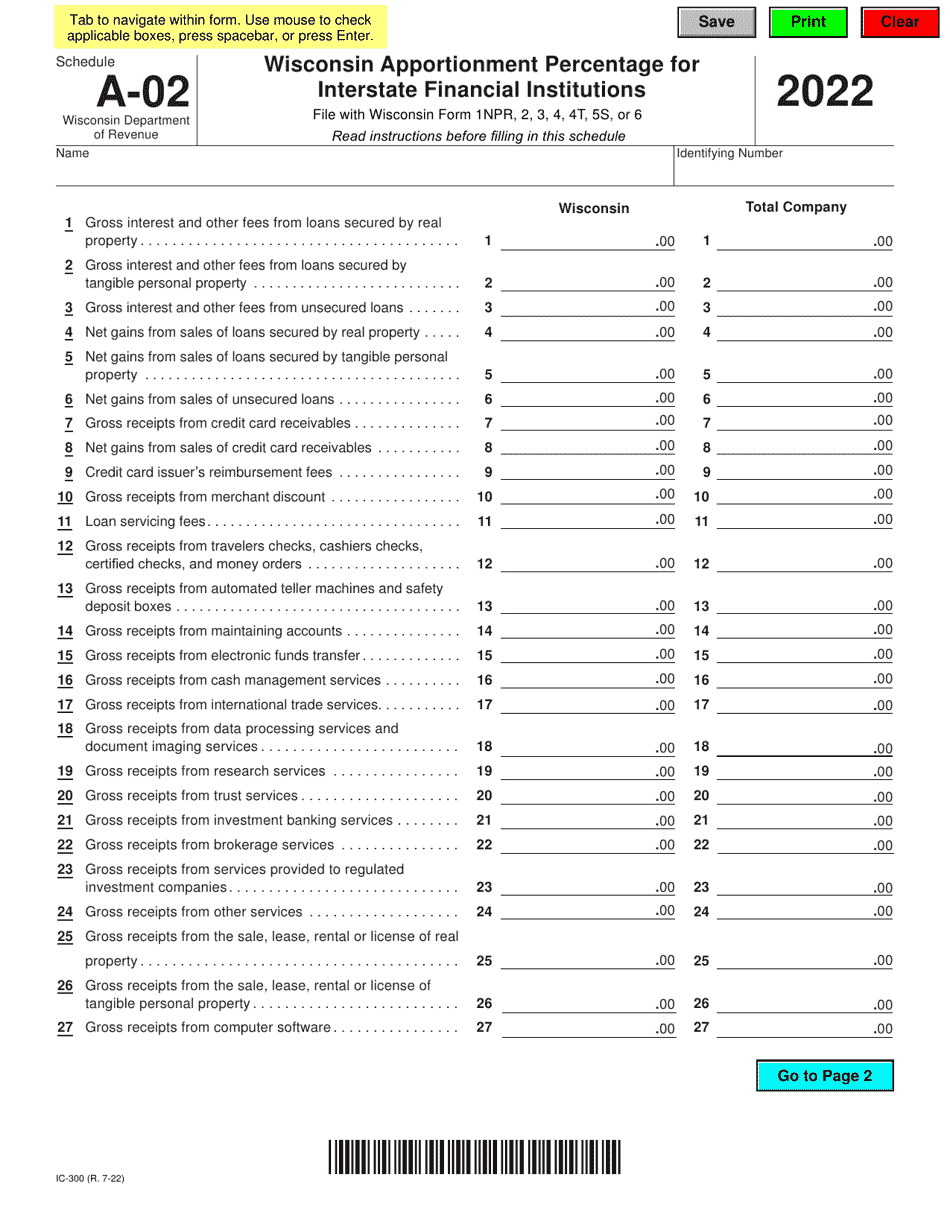

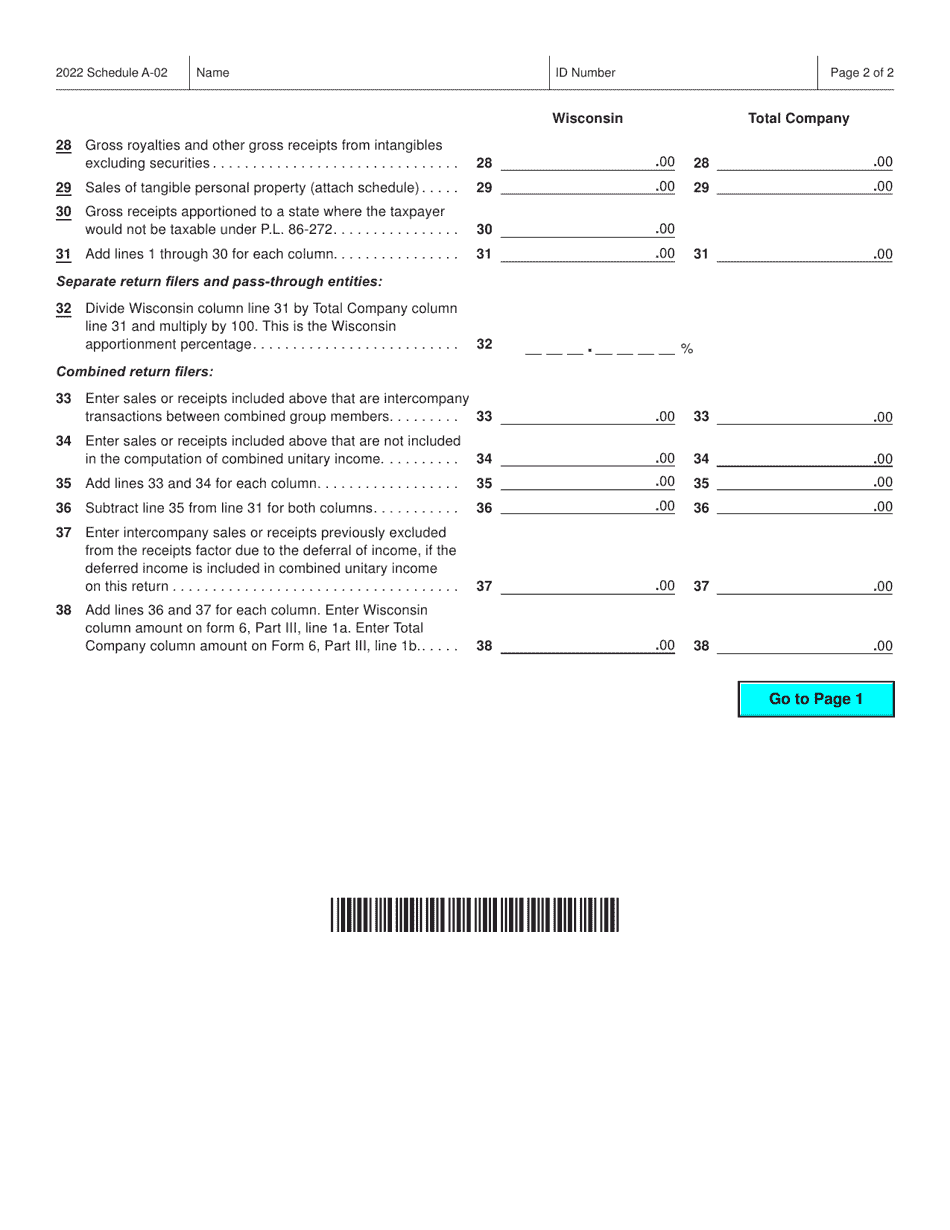

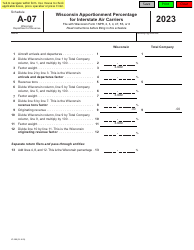

Form IC-300 Schedule A-02

for the current year.

Form IC-300 Schedule A-02 Wisconsin Apportionment Percentage for Interstate Financial Institutions - Wisconsin

What Is Form IC-300 Schedule A-02?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-300 Schedule A-02?

A: Form IC-300 Schedule A-02 is a form used in Wisconsin to calculate the apportionment percentage for interstate financial institutions.

Q: What is the purpose of Form IC-300 Schedule A-02?

A: The purpose of Form IC-300 Schedule A-02 is to determine the portion of a financial institution's income that is apportioned to Wisconsin for tax purposes.

Q: Who needs to file Form IC-300 Schedule A-02?

A: Financial institutions that have interstate operations and are subject to Wisconsin income tax must file Form IC-300 Schedule A-02.

Q: What is the apportionment percentage?

A: The apportionment percentage is the portion of a financial institution's income that is allocated to Wisconsin based on its business activities in the state compared to its activities in other states.

Q: What factors are used to calculate the apportionment percentage?

A: The apportionment percentage is based on factors such as the financial institution's property, payroll, and sales in Wisconsin compared to its property, payroll, and sales in all states.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-300 Schedule A-02 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.