This version of the form is not currently in use and is provided for reference only. Download this version of

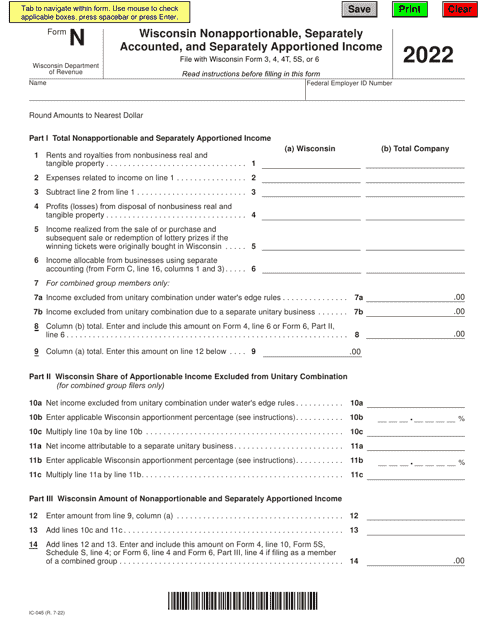

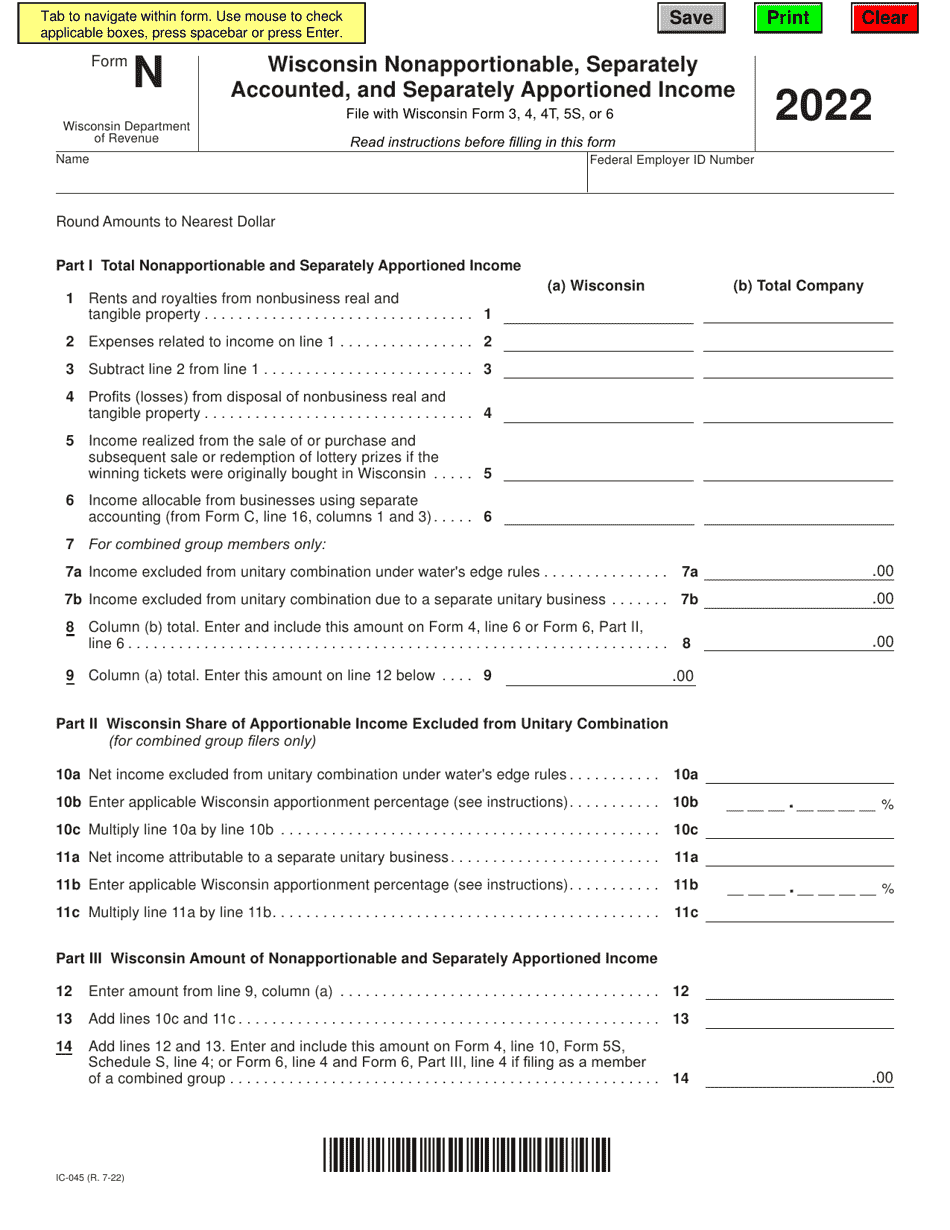

Form N (IC-045)

for the current year.

Form N (IC-045) Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income - Wisconsin

What Is Form N (IC-045)?

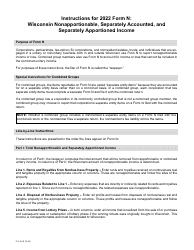

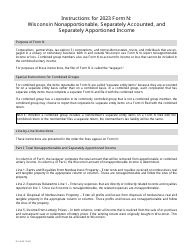

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N (IC-045) Wisconsin?

A: Form N (IC-045) Wisconsin is a tax form used for reporting nonapportionable, separately accounted, and separately apportioned income in the state of Wisconsin.

Q: What is nonapportionable income?

A: Nonapportionable income is income that is only taxable in the state of Wisconsin and is not subject to apportionment.

Q: What is separately accounted income?

A: Separately accounted income is income that is kept separate from other income and is reported separately on Form N (IC-045) Wisconsin.

Q: What is separately apportioned income?

A: Separately apportioned income is income that is apportioned separately from other income based on specific criteria, such as the location of sales or property.

Q: Who needs to file Form N (IC-045) Wisconsin?

A: Taxpayers who have nonapportionable, separately accounted, and/or separately apportioned income in Wisconsin need to file Form N (IC-045) Wisconsin.

Q: What information is required on Form N (IC-045) Wisconsin?

A: Form N (IC-045) Wisconsin requires taxpayers to provide details about the nonapportionable, separately accounted, and/or separately apportioned income, as well as any applicable deductions and credits.

Q: When is Form N (IC-045) Wisconsin due?

A: Form N (IC-045) Wisconsin is usually due on or before the same date as the federal income tax return, which is typically April 15th.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance with the Wisconsin Department of Revenue's tax requirements. It is important to file on time and accurately to avoid any penalties or interest charges.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N (IC-045) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.