This version of the form is not currently in use and is provided for reference only. Download this version of

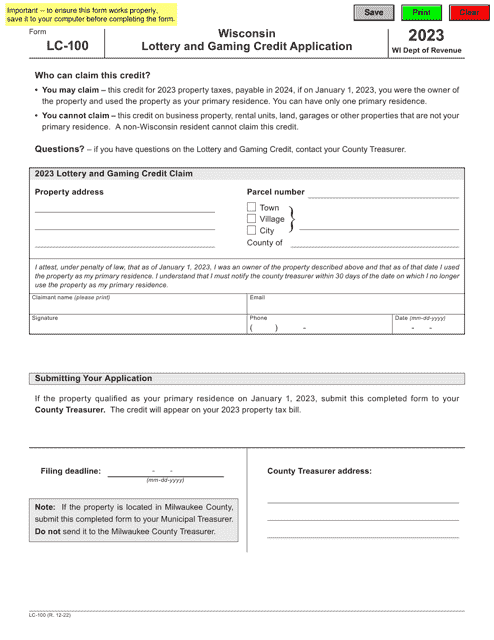

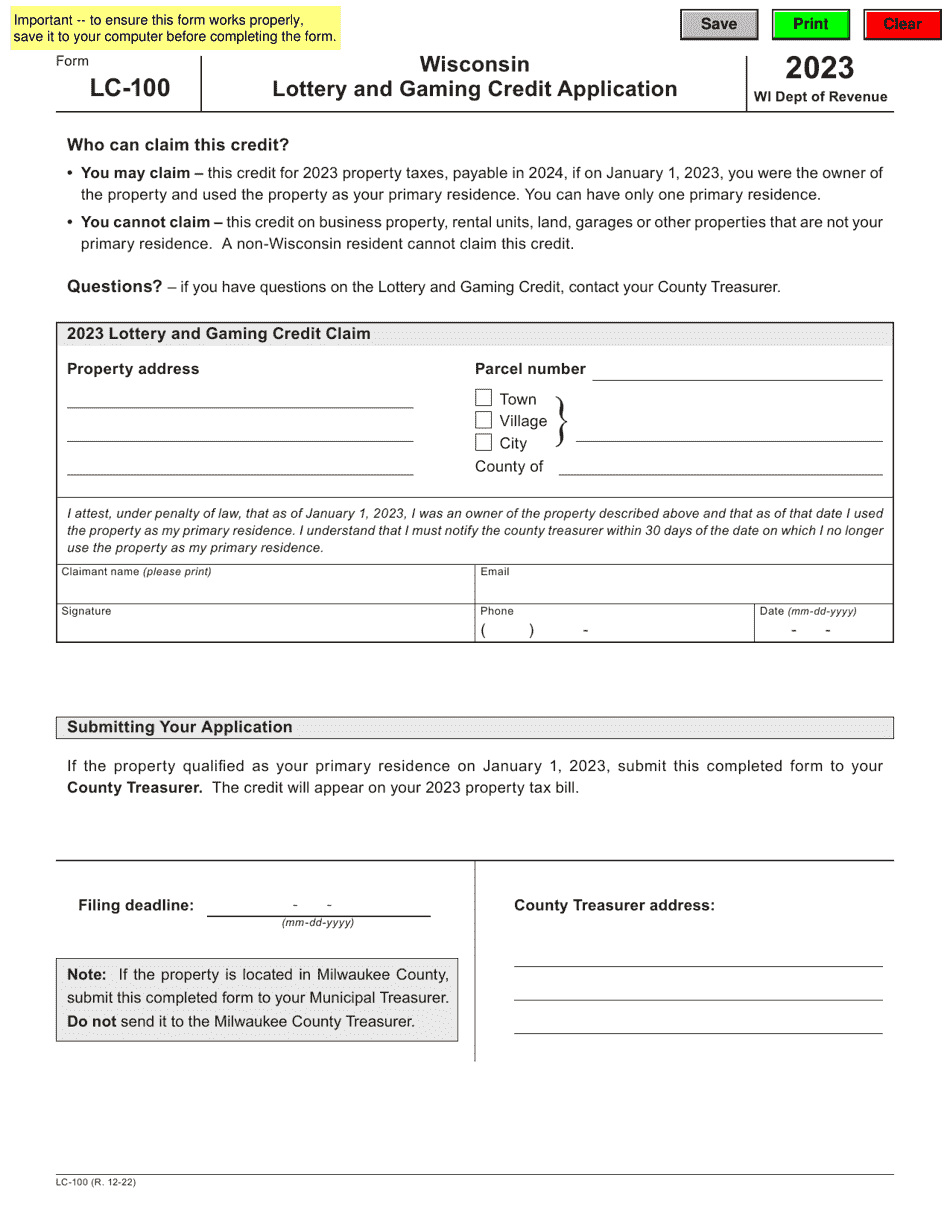

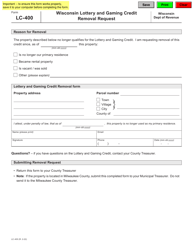

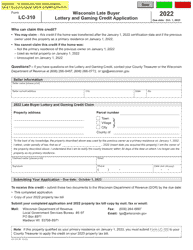

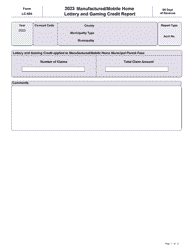

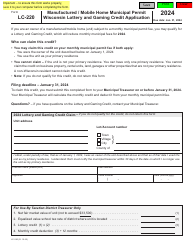

Form LC-100

for the current year.

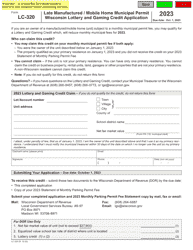

Form LC-100 Lottery and Gaming Credit Application - Wisconsin

What Is Form LC-100?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LC-100?

A: Form LC-100 is the Lottery and Gaming Credit Application in Wisconsin.

Q: What is the purpose of Form LC-100?

A: The purpose of Form LC-100 is to apply for the Lottery and Gaming Credit in Wisconsin.

Q: Who can use Form LC-100?

A: Any Wisconsin resident who meets the eligibility requirements can use Form LC-100 to apply for the Lottery and Gaming Credit.

Q: What is the Lottery and Gaming Credit?

A: The Lottery and Gaming Credit is a tax credit available to qualifying Wisconsin homeowners to offset a portion of their property taxes.

Q: What information do I need to provide on Form LC-100?

A: You will need to provide your personal information, property details, and income information on Form LC-100.

Q: When is the deadline to submit Form LC-100?

A: The deadline to submit Form LC-100 is the same as the deadline for filing your Wisconsin income tax return, which is usually April 15th.

Q: Can I apply for the Lottery and Gaming Credit if I rent my home?

A: No, the Lottery and Gaming Credit is only available to qualifying Wisconsin homeowners.

Q: What supporting documents do I need to include with Form LC-100?

A: You may need to include copies of your property tax bill and income documentation with Form LC-100, depending on your specific situation.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LC-100 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.