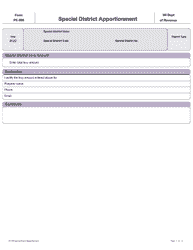

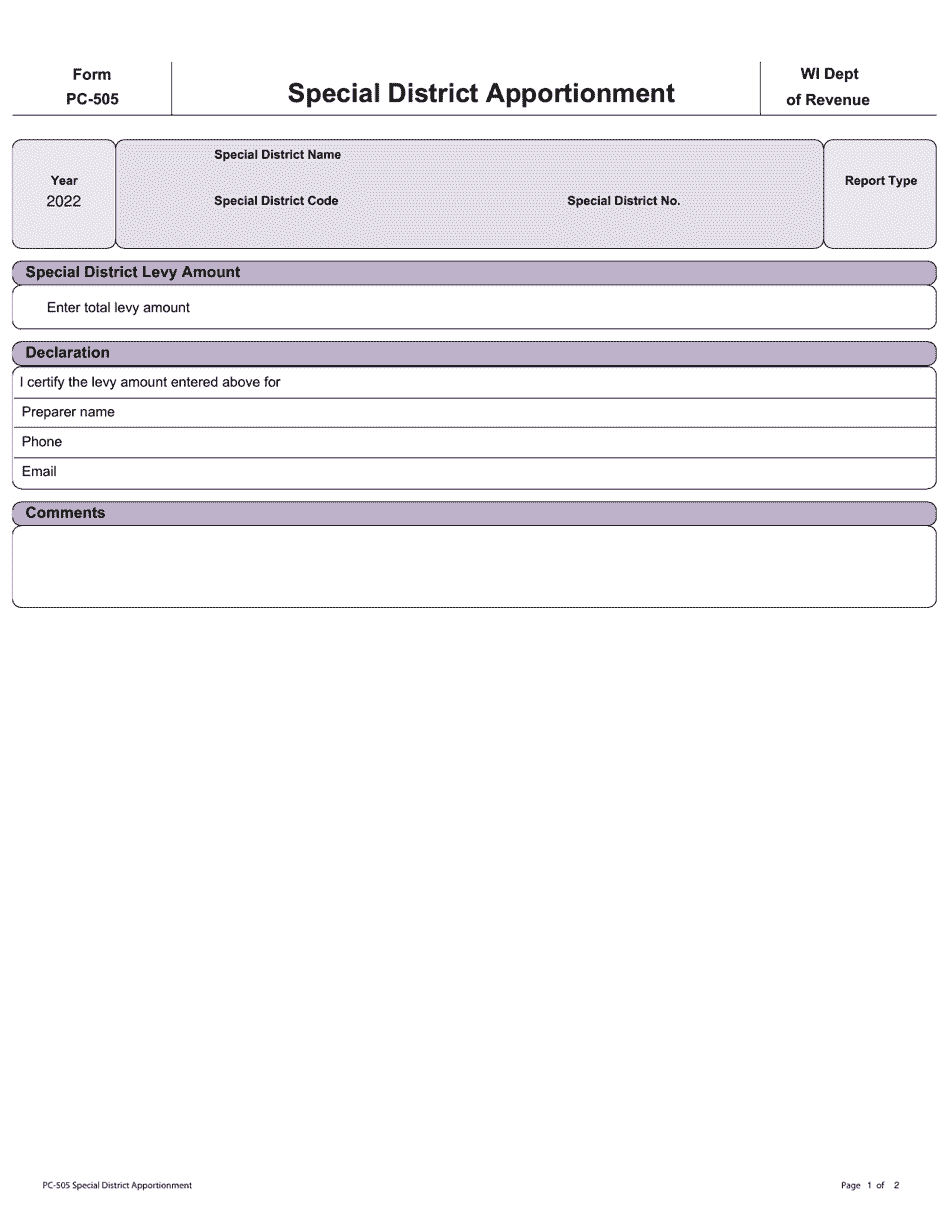

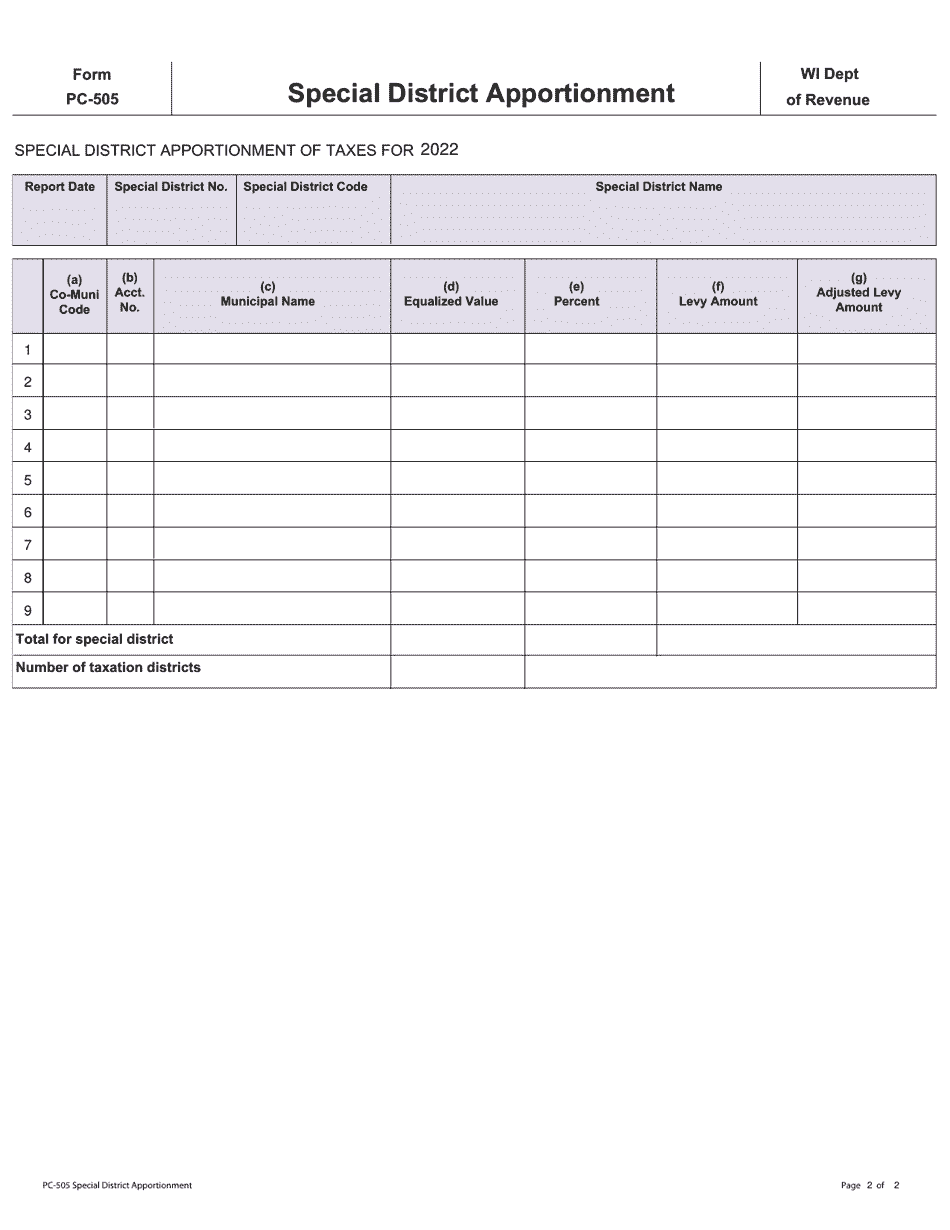

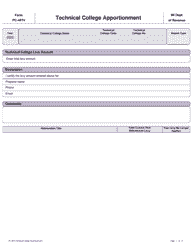

Form PC-505 Special District Apportionment - Wisconsin

What Is Form PC-505?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PC-505?

A: Form PC-505 is the Special District Apportionment form used in Wisconsin.

Q: What is the purpose of Form PC-505?

A: The purpose of Form PC-505 is to calculate and apportion the property tax levy among the special taxing districts in Wisconsin.

Q: Who needs to fill out Form PC-505?

A: Form PC-505 needs to be filled out by the governing body of the special taxing district in Wisconsin.

Q: What information is required on Form PC-505?

A: Form PC-505 requires information such as the name and address of the special taxing district, property valuation data, and proposed tax levy amounts.

Q: When is Form PC-505 due?

A: The due date for Form PC-505 varies by district, but it is generally due in early January of each year.

Q: Are there any filing fees for Form PC-505?

A: There are no filing fees for Form PC-505.

Q: What happens after I submit Form PC-505?

A: After submitting Form PC-505, the Wisconsin Department of Revenue will review the information and determine the property tax rates for each special taxing district.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PC-505 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.