This version of the form is not currently in use and is provided for reference only. Download this version of

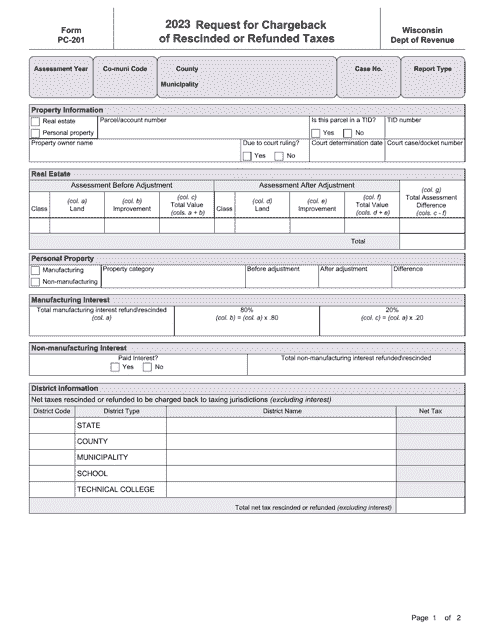

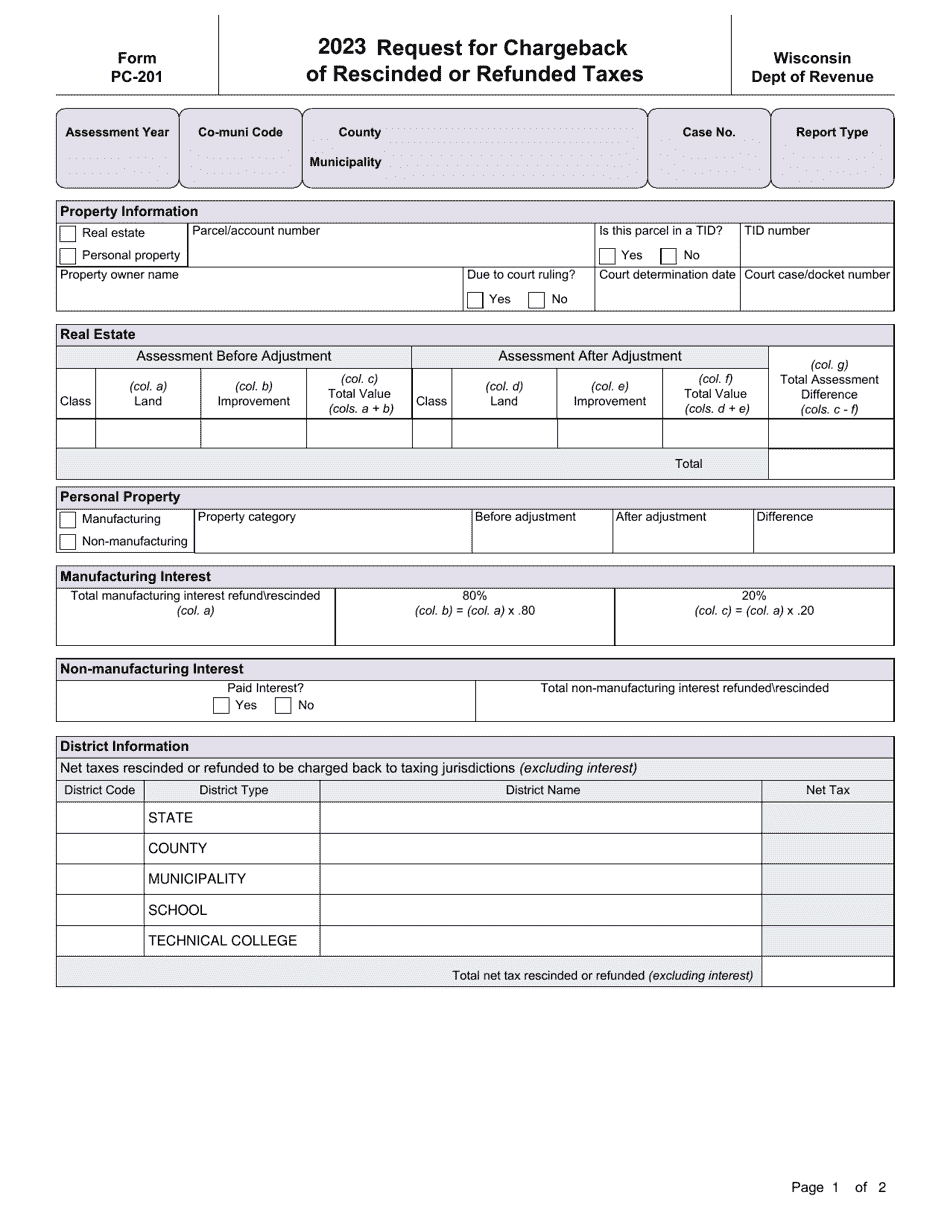

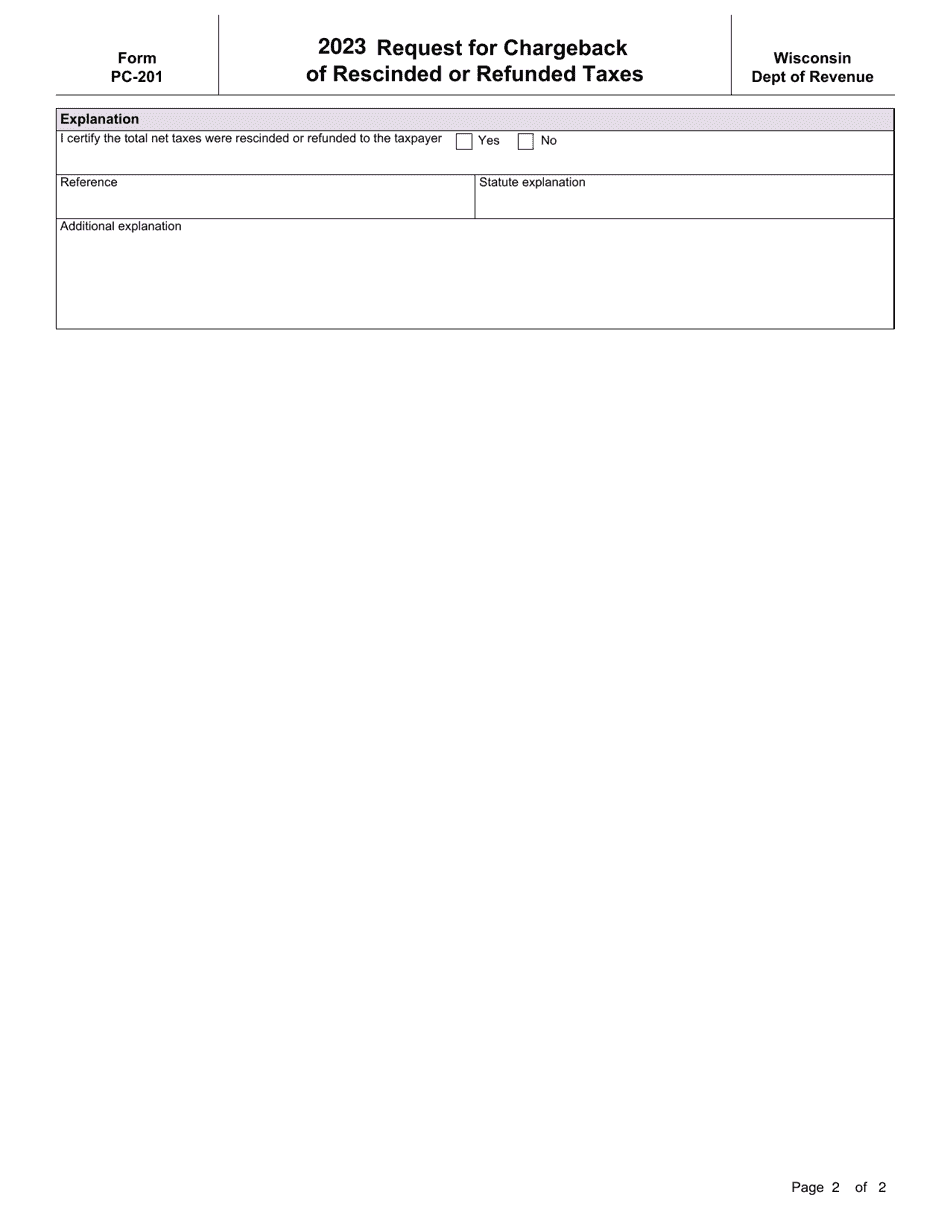

Form PC-201

for the current year.

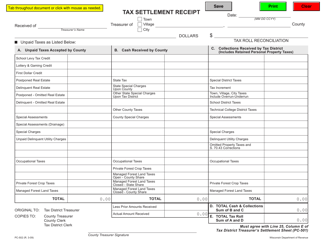

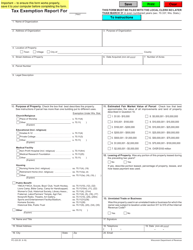

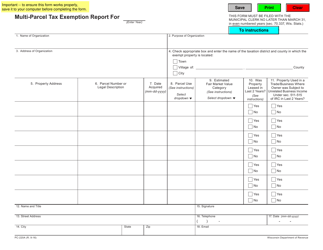

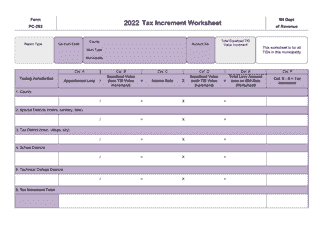

Form PC-201 Request for Chargeback of Rescinded or Refunded Taxes - Wisconsin

What Is Form PC-201?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PC-201?

A: Form PC-201 is a Request for Chargeback of Rescinded or Refunded Taxes in Wisconsin.

Q: What is the purpose of Form PC-201?

A: The purpose of Form PC-201 is to request a chargeback of taxes that have been rescinded or refunded in Wisconsin.

Q: How do I fill out Form PC-201?

A: To fill out Form PC-201, you will need to provide your personal information, details about the rescinded or refunded taxes, and any supporting documents.

Q: Is there a deadline for filing Form PC-201?

A: Yes, there is a deadline for filing Form PC-201. You should submit the form within 4 years from the date the taxes were rescinded or refunded.

Q: Are there any fees for filing Form PC-201?

A: There are no fees for filing Form PC-201.

Q: Who can file Form PC-201?

A: Form PC-201 can be filed by individuals or businesses who have had taxes rescinded or refunded in Wisconsin.

Q: What should I do after filing Form PC-201?

A: After filing Form PC-201, you should keep a copy of the form and any supporting documents for your records.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PC-201 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.