This version of the form is not currently in use and is provided for reference only. Download this version of

Form SL-202M

for the current year.

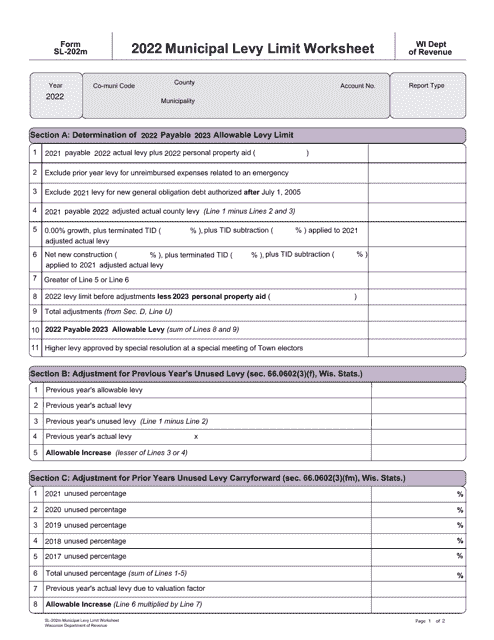

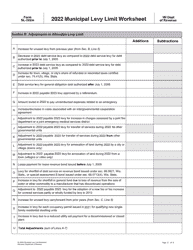

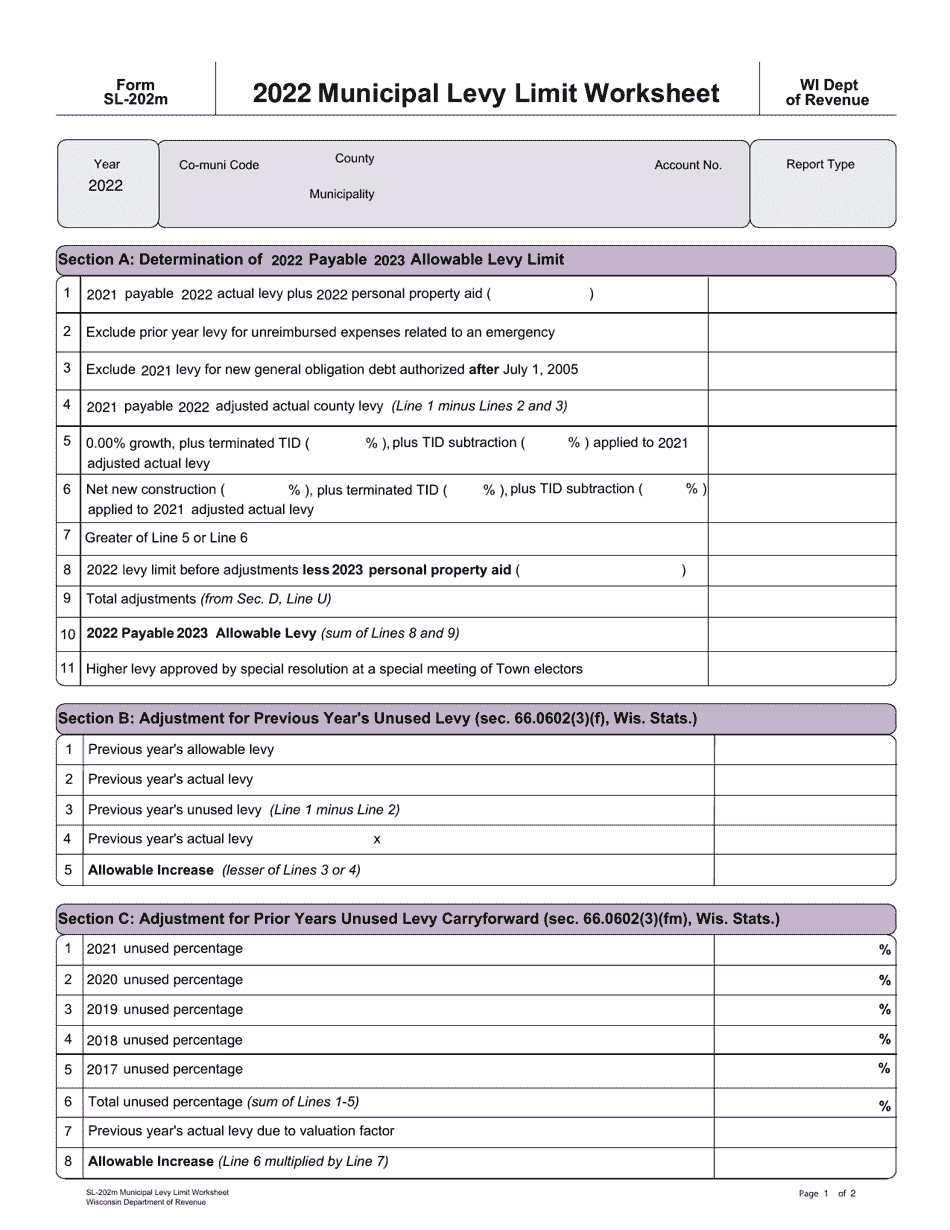

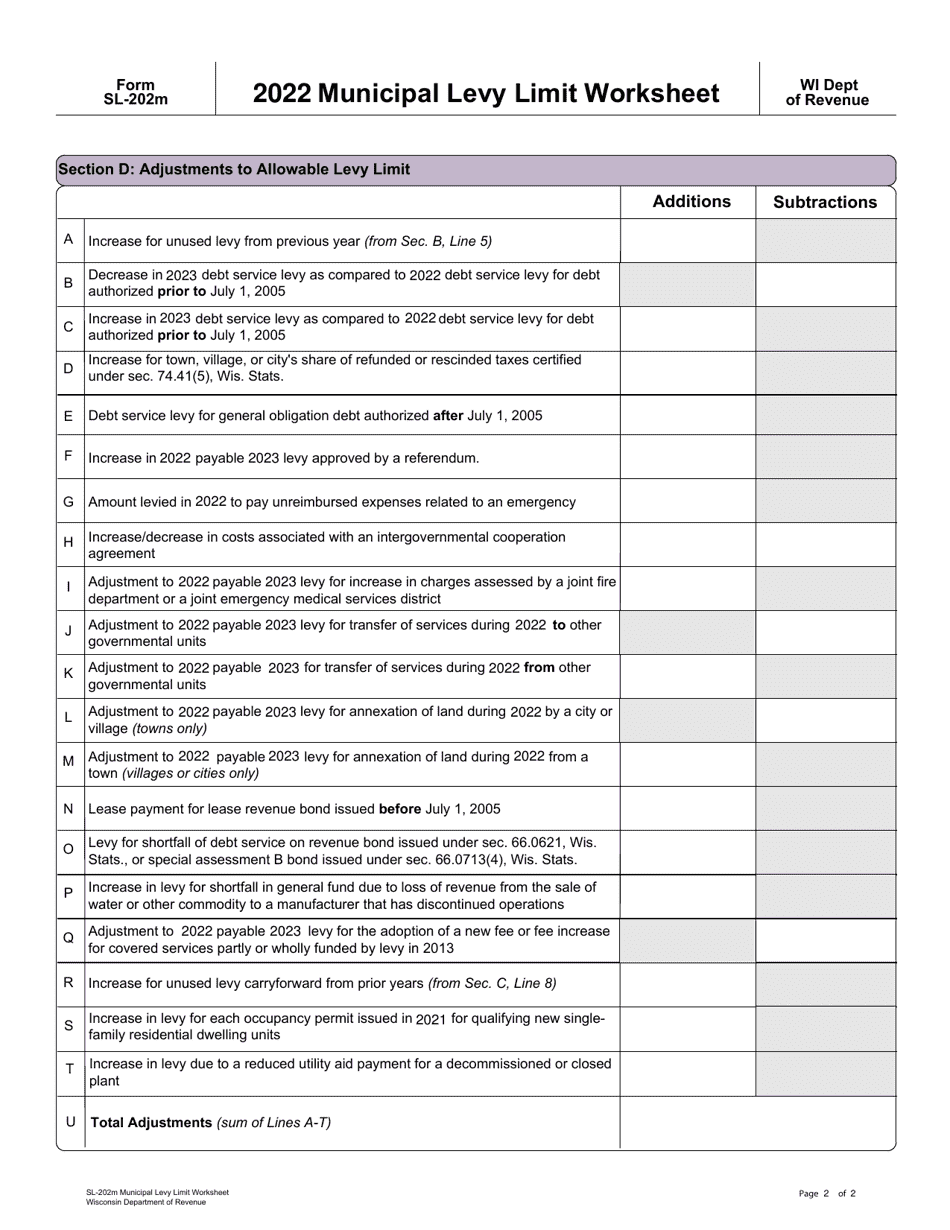

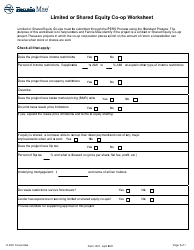

Form SL-202M Municipal Levy Limit Worksheet - Wisconsin

What Is Form SL-202M?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SL-202M?

A: Form SL-202M is the Municipal Levy Limit Worksheet for Wisconsin.

Q: Why is Form SL-202M used?

A: Form SL-202M is used to calculate and determine the levy limit for municipalities in Wisconsin.

Q: Who needs to fill out Form SL-202M?

A: Municipalities in Wisconsin are required to fill out Form SL-202M.

Q: What information is required on Form SL-202M?

A: Form SL-202M requires information such as the municipality's total equalized valuation, prior year maximum allowable levy, and adjustments.

Q: When is Form SL-202M due?

A: Form SL-202M is generally due by November 1st each year.

Q: Are there any penalties for not filing Form SL-202M?

A: Failure to file Form SL-202M may result in loss of shared revenue or other penalties.

Q: Is there a fee to file Form SL-202M?

A: There is no fee to file Form SL-202M.

Q: Can Form SL-202M be amended if I made a mistake?

A: Yes, Form SL-202M can be amended if there are mistakes or changes that need to be made.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SL-202M by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.