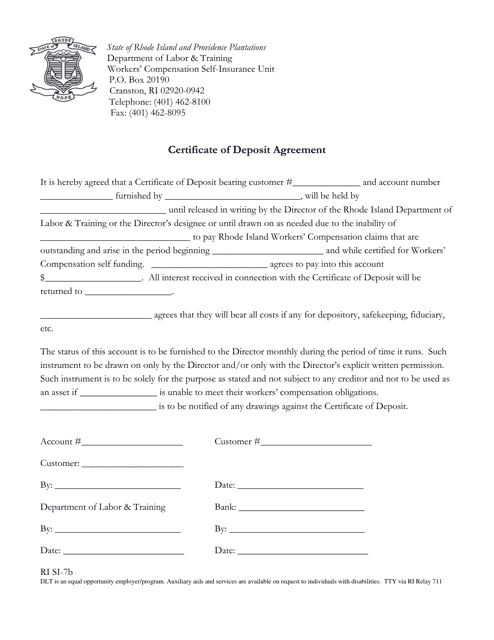

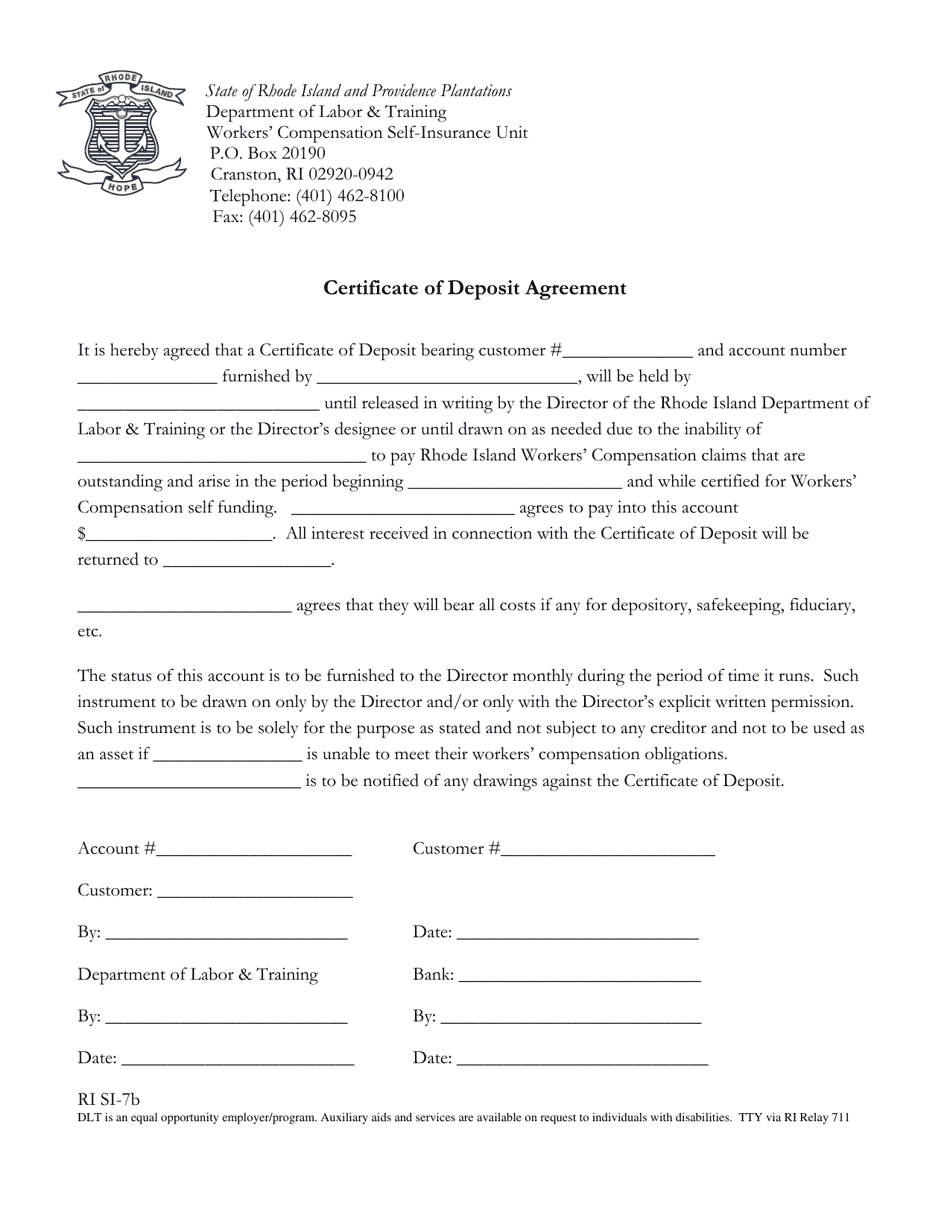

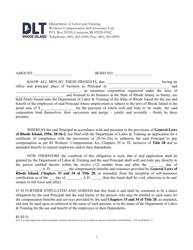

Form RI SI-7B Certificate of Deposit Agreement - Rhode Island

What Is Form RI SI-7B?

This is a legal form that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RI SI-7B Certificate of Deposit Agreement?

A: The RI SI-7B Certificate of Deposit Agreement is a legal document used in Rhode Island to establish the terms and conditions of a certificate of deposit (CD) account.

Q: What is a certificate of deposit (CD)?

A: A certificate of deposit (CD) is a financial product offered by banks and credit unions that typically offers a higher interest rate than a traditional savings account.

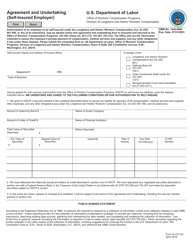

Q: What information is included in the RI SI-7B Certificate of Deposit Agreement?

A: The agreement typically includes details such as the account holder's name, account number, the amount of the deposit, the term (length) of the CD, and the interest rate.

Q: What is the purpose of the RI SI-7B Certificate of Deposit Agreement?

A: The purpose of the agreement is to outline the rights and responsibilities of both the financial institution and the account holder regarding the CD account.

Q: What happens if the account holder withdraws funds from the CD before the maturity date?

A: Withdrawing funds from a CD before the maturity date may result in penalties or a loss of interest.

Q: Is the RI SI-7B Certificate of Deposit Agreement mandatory in Rhode Island?

A: While it is not mandatory, it is recommended to have a written agreement to ensure clarity and avoid disputes regarding the CD account.

Q: Can the terms of the RI SI-7B Certificate of Deposit Agreement be negotiated?

A: The terms of the agreement, such as the interest rate and the length of the CD, may be negotiable depending on the financial institution's policies.

Q: Can the RI SI-7B Certificate of Deposit Agreement be renewed?

A: The agreement may include provisions for automatic renewal of the CD at maturity, or it may require the account holder to take action to renew or close the account.

Q: Can the RI SI-7B Certificate of Deposit Agreement be modified?

A: Any modifications to the agreement would typically require mutual consent and approval from both the financial institution and the account holder.

Q: What should I do if I have questions or concerns about the RI SI-7B Certificate of Deposit Agreement?

A: If you have any questions or concerns, it is recommended to speak directly with a representative from the financial institution that issued the CD.

Form Details:

- The latest edition provided by the Rhode Island Department of Labor and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI SI-7B by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.