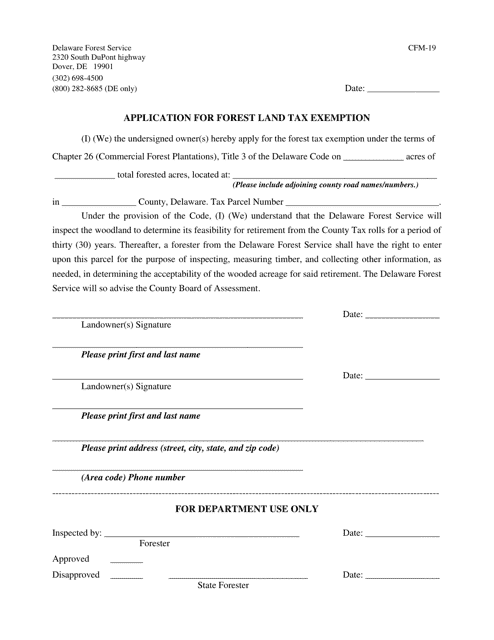

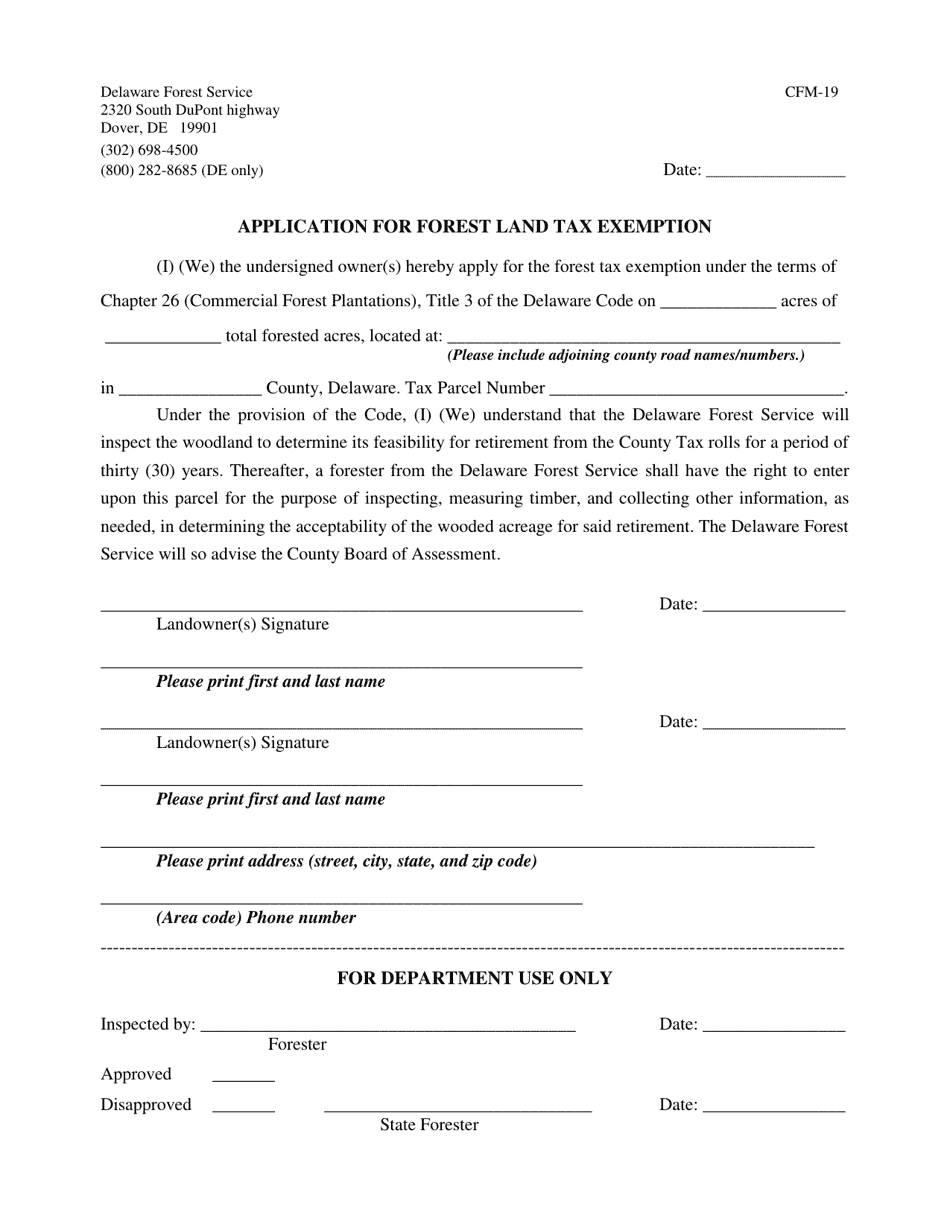

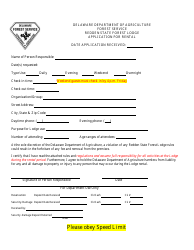

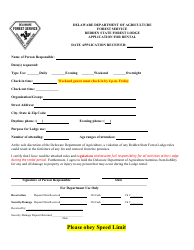

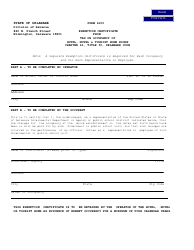

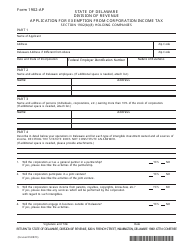

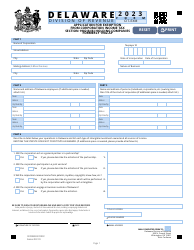

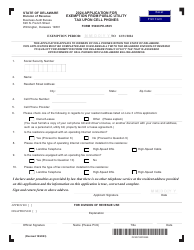

Application for Forest Land Tax Exemption - Delaware

Application for Forest Land Tax Exemption is a legal document that was released by the Delaware Department of Agriculture - a government authority operating within Delaware.

FAQ

Q: What is the Forest Land Tax Exemption in Delaware?

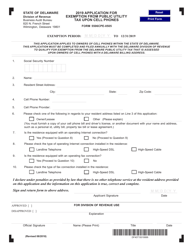

A: The Forest Land Tax Exemption is a program in Delaware that allows eligible landowners to receive a tax exemption on their forested land.

Q: Who is eligible for the Forest Land Tax Exemption in Delaware?

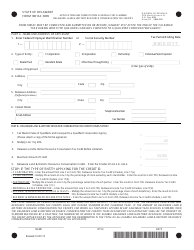

A: Landowners who have a minimum of 10 acres of forested land and meet certain forestry requirements are eligible for the tax exemption.

Q: What are the forestry requirements for the Forest Land Tax Exemption in Delaware?

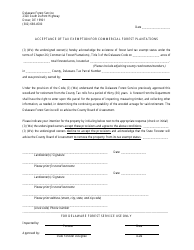

A: To be eligible, landowners must have a forest management plan approved by the Delaware Forest Service and actively manage their forested land.

Q: How do I apply for the Forest Land Tax Exemption in Delaware?

A: To apply, you need to complete and submit the Application for Forest Land Tax Exemption to your local tax assessor's office.

Q: What are the benefits of the Forest Land Tax Exemption in Delaware?

A: The tax exemption can significantly reduce property taxes for eligible landowners and promote sustainable forest management.

Q: Are there any deadlines for applying for the Forest Land Tax Exemption in Delaware?

A: Yes, the application deadline is October 1st of each year.

Q: Can I still use my forested land for recreational purposes if I receive the Forest Land Tax Exemption?

A: Yes, you can still use your land for recreational activities such as hunting, hiking, and wildlife viewing, as long as you meet the forestry requirements.

Q: What happens if I sell my forested land after receiving the Forest Land Tax Exemption?

A: If you sell your land, the new owner will need to reapply for the tax exemption if they meet the eligibility criteria.

Form Details:

- The latest edition currently provided by the Delaware Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Agriculture.